The ASX200 had a great week last week, jumping by 1.31% and hitting a new record high on Friday. The gains were led by rate-sensitive sectors financials, real estate, and healthcare, as the expectation of rate cuts continues to grow. Investors will now be eying the 8000-point target for the ASX200 ahead of the RBA’s second rate decision of the year next week.

In the US, investors took profits from US tech shares, which have been the driver of gains to start the year. That saw the Nasdaq slip by 1.2%, while the S&P500 fell 0.9% for the week.

3 things that happened last week:

- Bitcoin hits a new record high

Last week, bitcoin hit a new record high of $69,900, bringing its year-to-date gains to over 50%. We’re seeing huge interest in Bitcoin ETFs, which are garnering substantial trading volumes and billions of dollars of inflows. The world’s largest crypto asset has yet to break through the allusive $70,000 as investors continue to take profit with the asset at all-time highs after a long crypto winter. However, with the bitcoin halving still to come, rate cuts in the middle of the year, continued inflows into ETFs, as well as returning retail interest, it is very possible that we could see the peak of the bull market somewhere in the six figures.

- Record highs for global markets bring risk, but new highs beget new highs

Last week, US stocks, Australian stocks, gold, and bitcoin reached record highs. Investor sentiment is high, and valuations are being stretched, leaving the potential for a short-term correction. We would see any ‘breather’ in markets as healthy, giving the S&P500 is running at an annualised return of over 40% to start the year. But, when the S&P500 has reached an all time high in a new year, it has historically been followed by an average 1 year performance of +15% and has been positive over 90% of the time. This speaks to markets continuing the trend unless they see a significant change in fundamentals. We see fundamentals continuing to drive the market this year from an improving earnings cycle and upcoming interest rate cuts.

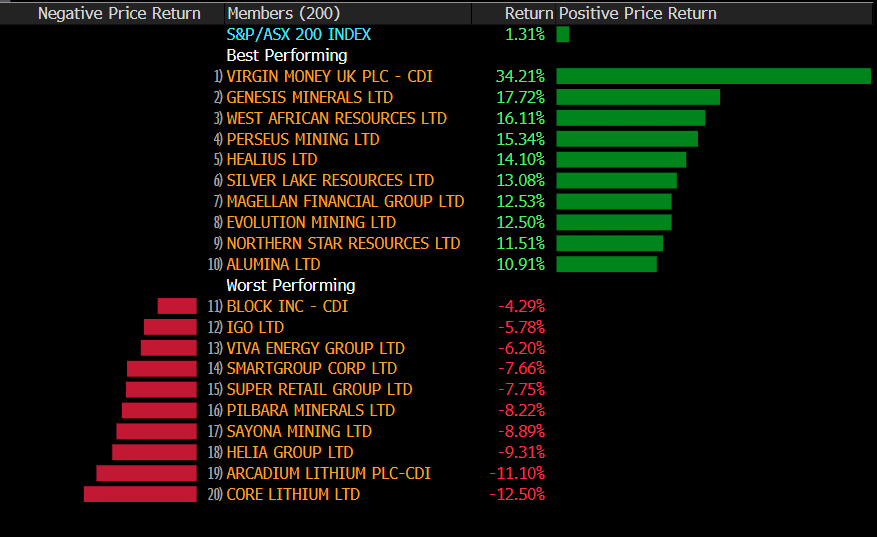

- A winner and loser last week from the S&P/ASX200

Virgin Money took the limelight last week, rising by +34.2% as UK bank Nationwide Building Society reached a preliminary agreement to buy Virgin. This would likely see the ASX-listed business consolidated to the FTSE.

It was another torrid week for Core Lithium, dropping by -12.5% following the announcement from Albemarle that it planned to sell USD$1.75 billion in shares in a public offering.

3 things to watch for the week ahead:

1. US Inflation

As we approach the March 12 release of the US February CPI data, markets are on edge, anticipating another possible surge in inflation figures. This data proceeds the much-awaited March 20 U.S. Federal Reserve meeting and these numbers could set the tone for the Fed’s monetary policy decisions. Inflation trends have been quite volatile, peaking mid-2022 before dipping, and now potentially on the rise again. Should recent data be indicative, we may see annual rates hovering near – or surpassing – 3%, diverging from the Fed’s 2% target.

The Fed has hinted at interest rate cuts in response to falling inflation, but the magnitude of these cuts will likely be influenced by the course inflation takes. If estimates for February’s CPI data hold, markets may be left questioning the need for significant rate reductions in 2024. Yet the Fed maintains a cautiously positive outlook, aiming to guide inflation back to the 2% target as it continues to keep a close eye on the services sector and housing costs trends, both essential factors in the broader inflation narrative.

2. NAB Business Confidence

NAB’s monthly business survey for February, which will be released this Tuesday, is set to provide an indication of how ongoing price pressures and inflation continue to affect business confidence. December and January’s data saw confidence increase from November’s 6 point fall to -9 index points, a promising sign for investors that this week’s data will reflect an ongoing rise in business confidence as inflation begins to ease, with rate cuts predicted to begin in June.

This is another key data point that the RBA will be watching ahead of its next rate decision. Rate cut expectations have been toned down since the start of the year, but markets still expect to see three cuts this year, meaning this week’s data point is another crucial piece of the puzzle.

3. China Retail Sales

China’s February retail sales data, set to release on March 18, will once again bring the nation’s concerning consumer spending trends to the forefront of investors’ minds. Declining property values continue to significantly impact consumer sentiment, despite the government’s efforts to stimulate the property market. This, coupled with the threat of pay cuts and job losses, has forced many consumers to favour saving over spending.

UBS projections suggest a potential drop in retail sales growth, with 2024 estimates indicating a rise of 5.5%, a notable reduction from the 6.5% growth experienced last year. As consumers turn towards discounted goods in these uncertain economic times, policymakers must take more decisive actions and improve their policy stance to avoid worsening declining consumer confidence and hindering spending.

*All data accurate as of 11/03/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.