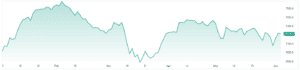

Australian shares look set to start the week on the front foot following a strong rally from Wall Street on Friday and investor optimism that China will roll out stimulus measures to support the economy. The ASX200 is clinging on to its gains so far in 2023 after falling again last week, with financials weighing on the index.

US markets continued their strong performance, with the Nasdaq extending its YTD gains to 33%. Investors were given plenty of good news, with more headway on the debt ceiling and a stronger May jobs report, easing recession fears and again lowering expectations of another Fed hike. US CPI will be the next focal point before the Fed’s rate decision on June 14th, and a stronger reading there could put a hike firmly back on the table.

Energy stocks will be on watch for the local market today after OPEC+ cut output by 1 million barrels per day. Struggling oil prices from weak demand motivated the cut, driven by China’s slowing recovery and the cartel’s clear aim to keep oil prices above USD$70.

3 things that happened last week:

1. Australian Inflation stays stubborn

The RBA’s job isn’t getting any easier, with monthly inflation last week jumping to 6.8% from 6.3% in March and above expectations of 6.4%. The data showed that inflation locally is stubborn, and another hike from the RBA next week seems to very much be on the table. This isn’t a number the RBA and Philip Lowe wanted to see after better news from other data points throughout May. The challenge of delivering a soft landing for the economy is only getting harder. Fighting inflation is no easy task and central banks around the world still have a tough battle on their hands.

2. Debt Ceiling Crisis, is it ending?

The US debt ceiling crisis, which has been the talk of the markets over the last few weeks, seems set to be resolved this week. The deal is to suspend the $31.4 trillion US debt ceiling for two years in return for government spending caps for two years. The ceiling was hit in January 2023 and has now been suspended until January 2025, after the November 2024 Presidential election. However, there are still some risks for investors, with the deal still needing to get over a few hurdles, such as being approved by US Congress. The deal, though, does come with consequences for the US economy. It will see around $100 billion a year of less government spending in 2024 and 2025 whilst taking a big chunk out of the expected US GDP growth rate of 0.8% next year.

3. A winner and loser last week from the S&P/ASX200

Despite a down week for the ASX, Northern Star Resources (NST) came out as a top performer climbing by 7.84% last week.

Sayona Mining shares had a tough week falling by 11.9%. The lithium miner announced it raised $200 million at 18 cents per new share, which was less than the 19 cents shares were trading at before the announcement.

3 things to watch for the week ahead:

1. RBA Rate Decision

Hotter-than-expected inflation data last week has tipped rate hike expectations on its head, with markets now pricing in at least one more hike from the RBA by August. The chance of that hike being handed down this week (Jun. 6th) has grown, with Governor Lowe continuing his hawkish stance that he will do what is necessary to return inflation to the 2-3% target. Before the inflation print, the RBA got data they would have liked, and investors’ expectations for a pause jumped. Retail Sales for April were flat, the May employment print was softer than expected, wage growth also showed signs of easing and business conditions pointed to weaker conditions. But, the inflation reading of 6.8%, jumping from 6.3% in March, puts a hike very much on the table. However, with most of the data points showing signs of easing, the RBA may keep rates on hold to assess data for another month, in the aim that inflation does begin to move in the right direction. Market pricing also believes that the RBA will keep rates on hold, with an 80% chance of a pause. The RBA has raised the cash rate to 3.85% over the past year to take the cash rate to a decade high of 3.85% and investors should expect that they aren’t done yet. This may pressure the local market, with investors not expecting this aggressiveness from the RBA.

2. GDP year-over-year

If the RBA rate decision wasn’t enough for investors this week, Gross Domestic Product (GDP) for Q1 is released on June 7th, and growth could face some significant headwinds. Expectations are for year-over-year growth of 2.7% and quarter-over-quarter growth of 0.4%. Consumption is a key part of GDP, accounting for roughly 60%, meaning that slowing retail sales will weigh on growth locally as rate hikes from the RBA see consumers cutting back. Net exports may also weigh on the growth reading, with a decline in the quarter whilst volatile commodity prices will add to the uncertainty. Migration growth will be a focus of this reading given that it has helped drive Australia’s GDP for over a decade, and with Australia’s population set to grow by 2% this year, this could be the key to Australia avoiding a recession. The RBA expects GDP growth to slow this year as higher interest rates force consumers to tighten their belts.

3. China’s slump could continue to weigh on local equities

To add fuel to the fire of a more hawkish RBA, China’s recovery losing steam may weigh on the local market. Last week’s disappointing manufacturing data has stoked investor fears of weakening demand from the world’s biggest buyer of raw materials, which has weighed on commodity prices this year. The local materials sector has felt the full force of a recovery that has been more consumer-focused rather than manufacturing, with ASX’s second biggest sector the third worst performing in 2023. That weakness may continue as concerns grow over the expectation that China’s commodity demand could remain in decline. The Hang Seng index is the standout laggard of major global indices this year, down by more than 7%. The key will be economic support in the form of stimulus that may help to support further downside risks. More key data is handed down from China this week with inflation and balance of trade, which should give investors more insight into the economy. Some positivity did flow into Chinese equities on Friday over a potential stimulus package which will also be on watch this week.

*All data accurate as of 05/06/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.