Australian stocks capped off a solid week, gaining 0.7% last week, led by real estate and technology stocks. That positivity looks set to continue to start the week, with futures pointing to a positive open. Following updates from Woolworths and Coles that disappointed investors, the consumer staples sector was the worst performer. US Stocks jumped on Friday following jobs and wages data that pointed to signs of a weakening labour market. That lifted expectations for the Federal Reserve to start cutting rates by September.

Over the weekend, Warren Buffet’s Berkshire Hathaway reported their cash pile had grown to record levels at USD$188.89 billion. It follows operating profits rising by 39% YoY to $11.22 billion, led by a 185% increase in insurance underwriting earnings. Berkshire also trimmed its Apple stake by 13%, a setback for Tim Cook and Co. following better-than-expected earnings last week. With so much cash on the table, where will Warren put his cash next?

3 things that happened last week:

- Apple results better than feared

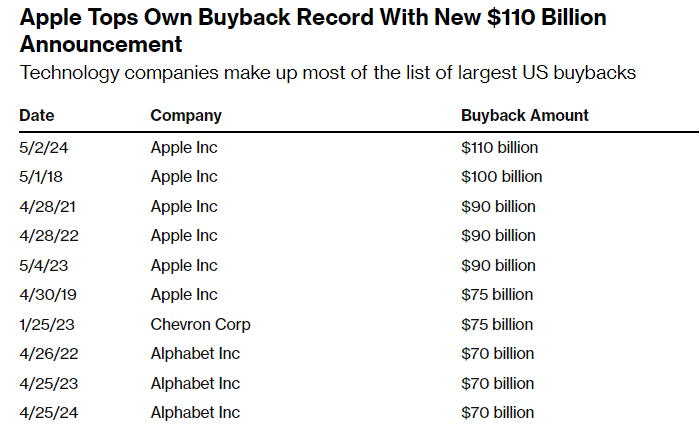

Apple showed resilience last week, beating revenue and profit expectations while hiking its dividend and announcing an eyewatering $110 billion share buyback. Many investors had begun to question if Apple still has what it takes to deliver the top growth they have become accustomed to over the years, but Tim Cook turned on the charm today and offered relief to investors.

Sales in China were better than feared, still falling by 8%, but less than the 11% expected. The region will remain an ongoing headwind for Apple, with the economy sluggish and competition heating up. Total revenue guidance for Q3 came in the low single digits, not setting the world alight but pointing to some stabilisation in sales.

It’s crucial for investors to remember that the business has over 2 billion installed devices worldwide, which is the biggest of any company globally and remains a massive tailwind. This is where its services business remains key, and it proved to be a bright spot during the quarter, delivering 14% growth with $24 billion in revenue year-over-year.

- Amazon’s cloud growth continues

Amazon beat earnings expectations last week, with its cloud unit posting its strongest sales growth in a year. As AI continues to be embraced, AWS is at the forefront of capitalising on the tidal wave of spending we’re seeing across the globe. This has helped lift operating income by more than 200% in the quarter, aided by CEO Andy Jassy’s cost-cutting in the last 12-18 months, which improved margins as the e-commerce giant became more efficient.

Amazon’s eCommerce business, with its US$54.6 billion in sales, continues to solidify the company’s status as a consumer favourite. While this segment may not be the primary driver of Amazon’s profitability, it remains a crucial component and a clear catalyst for revenue growth. The prime business, in particular, stands as a formidable force in this regard.

The downside was that we didn’t see a dividend announced despite its growing cash pile. But, investors shouldn’t be disappointed. Instead, the business is focusing on reinvesting back into the business, with a huge push to build more data centres and support growth opportunities, which is a long-term win if they can use the capital in the right way.

- A winner and loser last week from the S&P/ASX200

Boss Energy was the winner last week, gaining 21.2%. It follows a move by the Biden Administration to ban imports of Russian Uranium, which will likely see Uranium prices move higher.

Bapcor shares had a terrible week, falling by -19.3%. In a strange turn of events, new CEO Paul Dumbrell decided against joining the company a day before he was due to start. The company also announced forecasted weaker-than-expected earnings.

3 things to watch for the week ahead:

- RBA Rate Decision

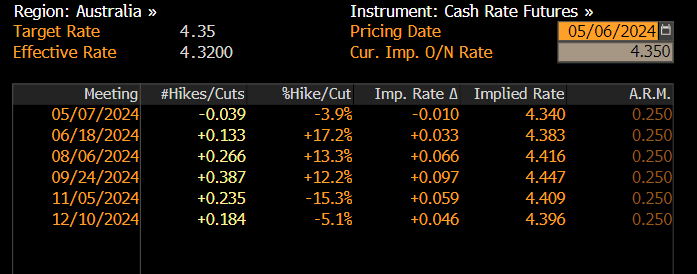

As the May 7th RBA rate decision looms, recent inflation figures from both the US and Australia have sparked a shift in rate cut expectations. Australia’s inflation rate slowing less than expected in the March quarter has ignited speculation that the RBA’s first potential rate cut may be pushed back to mid-2025, with markets even pricing in the potential for another hike. That does seem far-fetched, but not entirely out of the question.

So, although we may not get another hike, despite market expectations, rates are likely to stay higher-for-longer given the recent data, news that many Australians will be frustrated to hear. Looking ahead to this week, the RBA is set to stay on hold again, leaving the cash rate at 4.35%. However, the focus will be on commentary and language. We saw the RBA shift slightly away from its tightening bias in March, but a more hawkish tone from Governor Michele Bullock might be on the cards this week.

- Big Bank Earnings

Investors are eagerly awaiting this week’s financial results for three of Australia’s four biggest banks: Westpac, ANZ, and CBA. Consensus forecasts remain cautiously optimistic about stable earnings. This follows NAB’s half-yearly results, which reflected an increasingly challenging landscape. Despite the challenges, NAB lifted its interim dividend to 84 cents per share and initiated a $1.5 billion share buyback, showcasing the potential resilience of the sector.

Macquarie Group’s FY24 results this week were similarly challenging due to decreased income and sectoral struggles; the company recorded a 32% drop in net profit to $3.52 billion. Nevertheless, Macquarie’s final dividend of $3.85 per share exceeded the market prediction of $3.50. As three of the Big Four unveil their results this week, future focus will likely fall on their strategic tactics to control costs and enhance margins in a fiercely competitive lending environment.

Given the weighting of the financial sector to the ASX200, their results this week will remain a key driver of the local market.

- Goodman Group Q3 Operational Update

The AI boom has captivated markets globally as companies such as Nvidia begin to make billions of dollars from the technology revolution. But, as investors look locally, they are greeted with a small basket of stocks from the tech sector. However, Goodman Group is a business that stands out in the AI revolution as Australia’s largest industrial real estate manager. AI spending isn’t slowing down, with both Amazon and Meta being very open in recent weeks that they intend to re-open their wallets after cutting down capital expenditure in recent years to spend big on AI. Thanks to this demand, global requirements continue to grow for Data Centers, and that helped lift Goodman Group’s operating profit 28% in the first six months of the fiscal year, and the group expect solid growth in the second half of the year, with AI demand in full swing.

Although we won’t get cold, hard numbers from Goodman this week, we will be able to see insights into demand for their properties, which will help give investors a better understanding of what to expect for the full-year result. Nvidia is the name-making money front and centre, but companies like Goodman Group are definitely the background winners of AI.

*All data accurate as of 06/05/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.