Australian stocks rallied last week, breaking a two-week losing streak as the local market rode the coattails of the S&P500’s best week of the year, gaining almost 6%.

With the Federal Reserve taking a dovish stance, keeping rates on hold for a second consecutive month, markets now believe the US central bank is done raising interest rates, supported by jobs data last Friday. This helped stocks bounce back from oversold levels, with every US sector finishing in the green.

The earnings calendar also slows down this week, with more than 400 of the 500 companies in the S&P 500 already reporting. Two standouts for this week include, Disney (DIS), and Uber Technologies (UBER).

3 things that happened last week:

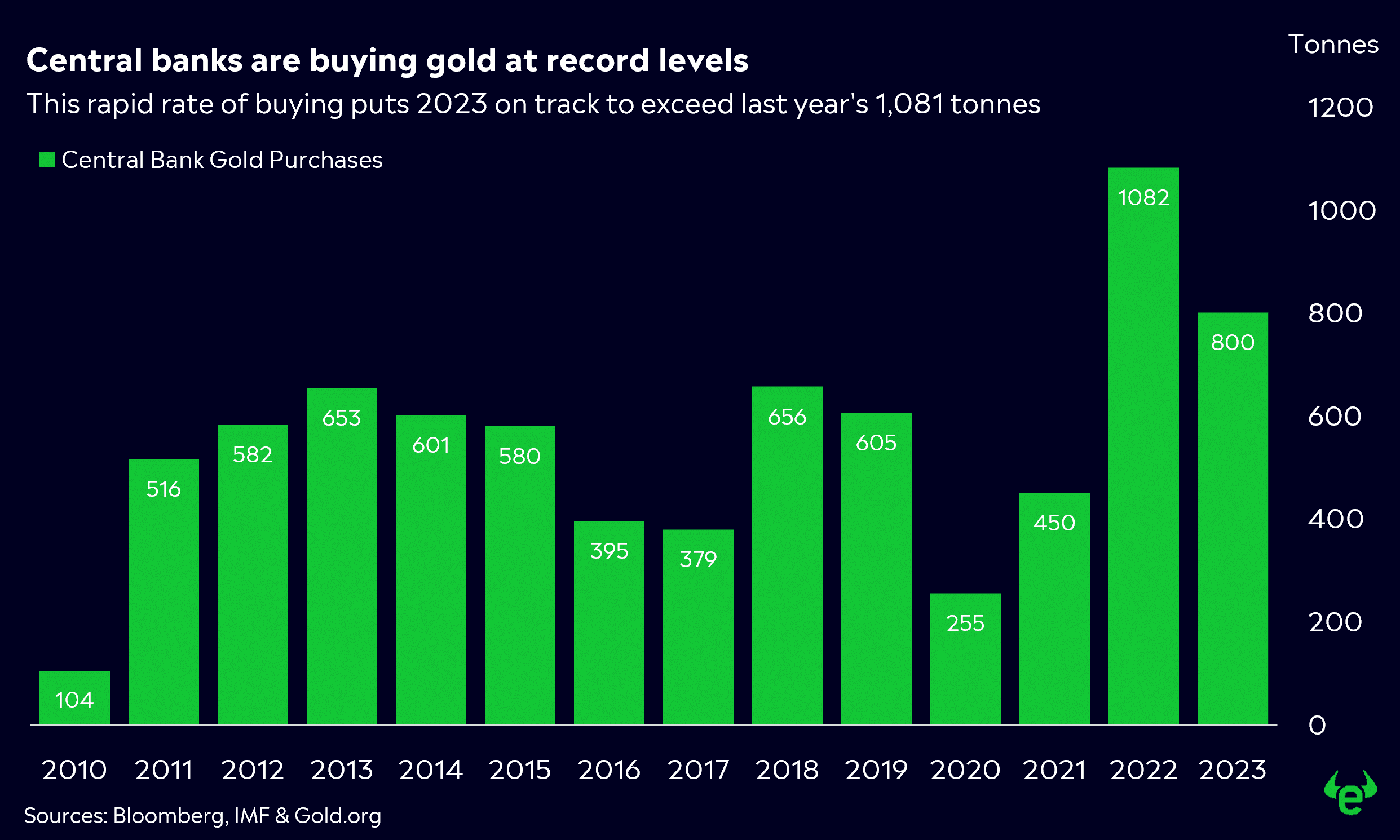

1. Gold tips above $2000 an ounce as Central Banks buy at record levels

In the first nine months of the year, Central Banks have bought 800 tonnes of gold, putting them on track to surpass 2022’s record year of 1081 tonnes. The buying has been led by China, buying over 20% of those 800 tonnes.

This move elevates China’s gold holdings in its massive $3 trillion FX reserves to over 4%. This colossal rate of buying, alongside growing demand for gold as a safe-haven asset, has pushed gold prices above $2,000, taking its gain to more than 9% for the year. It’s now shining as one of the top-performing commodities in 2023.

Rising gold prices have meant good news for Gold Miners. The ASX200‘s top 5 performers in October were all Gold miners, each boasting gains of over 15%. This was a stark contrast to the broader market in October, which saw the ASX down by 3.8%, its worst month of the year.

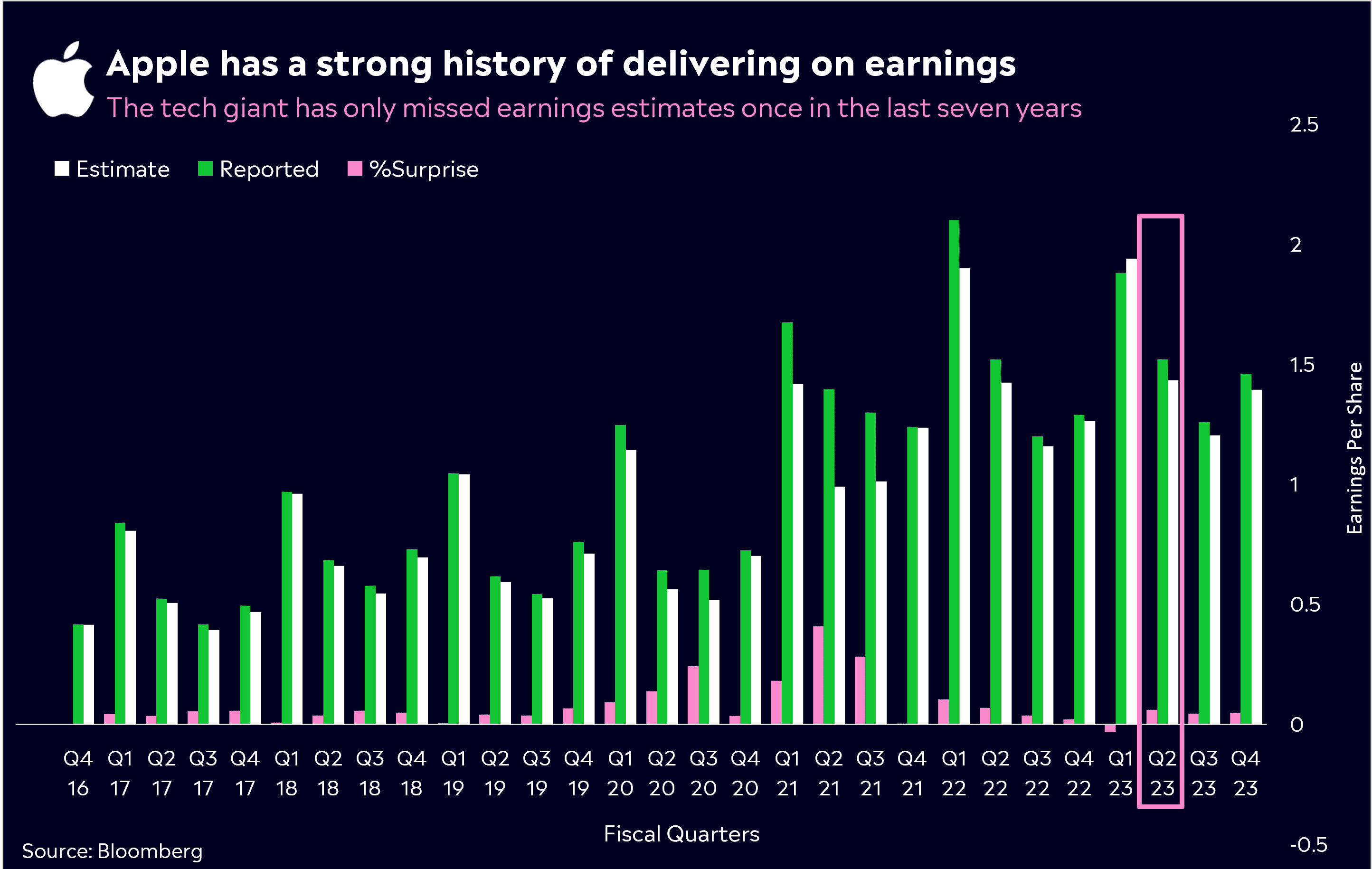

2. Apple earnings beat expectations, but revenue slows

Apple (APPL) beat earnings estimates last week – but revenue declined year-over-year for the fourth consecutive quarter.

This is an unprecedented slowdown for the world’s biggest company, and Apple investors aren’t accustomed to slowdowns. It comes as the company witnesses a sharp decline in Mac sales, down 34%, whilst demand in China remains sluggish.

Not only are Chinese consumers not spending at the pace Apple would like, but competition in the region from Huawei – which recently launched the very successful new ‘Mate’ phone – is dampening appetite for the iPhone.

Apple is navigating a difficult period, but don’t expect this trend to last for long. What’s important is the tech powerhouse is delivering on its two key segments; iPhone and Services, which will guide it through this blip.

Services revenue was the standout, showing 16% growth. This segment of the business is a huge part of Apple’s future growth, with high margins and an eye-watering one billion paying subscribers.

Apple has taken a few punches, but it certainly won’t be getting a ten-count anytime soon.

3. A winner and loser last week from the S&P/ASX200

Block (SQ2) shares rallied 28% last week on better-than-expected earnings and strong Q4 guidance. It was a much-needed surge for Block shares after a dismal year.

It was a tough week for Origin Energy (ORG), falling by -8.6%, the worst performer on the ASX200. The sell-off follows growing concerns that its potential takeover from the Brookfield-led consortium of investors may fail to come to fruition.

For more on the markets from last week, see the latest episode of Market Bites:

3 things to watch for the week ahead:

1. RBA Rate Decision – Tuesday

Melbourne Cup day often involves photo finishes, but markets will see another close call on Tuesday when the RBA meets.

After the trifecta of sticky underlying inflation, hotter-than-expected retail sales, and unemployment remaining near record lows, there’s a strong chance the RBA will hike rates again when they meet on cup day.

Markets are backing a 53% chance the Reserve Bank will raise rates by 25bps. At this point, a hike before year-end seems pretty much nailed on, so the question is now whether we see more than one hike. Elsewhere, Central Banks like the Federal Reserve are winding down their tightening cycles, leaving Australia the odd one out – something that hasn’t escaped the attention of International Monetary Fund economists currently visiting Australia.

The global financial body has added to the pressure for the RBA to hike, but not without also pointing the finger at state and Federal Governments, insisting more needs to be done on a policy level to complement the impact of rate hikes.

2. Chinese Inflation – Thursday

Thursday sees China’s monthly consumer price index reading, which is predicted to come in lower than forecast following three months of low readings.

China’s struggling economy has likely bottomed out – and while better news may be on the horizon, PMI data last week showed that it will be a rocky road to recovery.

Recent policy support in the form of additional sovereign debt and raising the budget deficit ratio is a step in the right direction, but it’s not a quick fix and will take time to pay off.

With the positive impact of policy stimulus, a broad increase in demand will take time to build momentum, meaning inflation will continue to hover near ‘deflation territory’. Expectations for this week’s reading are for an increase to 0.2%.

3. Xero Half-Year Results – Thursday

In 2023, Xero (XRO) lifted its subscriber count by 14% to 3.74 million. However, its net loss widened for the year, disappointing some investors. Against a difficult backdrop and mounting investor pressure, new CEO Sukhinder Singh Cassidy has promised to drive operational efficiency to help grow profitability for the NZ-based powerhouse.

Given Cassidy’s commitment, expectations will be high heading into Xero’s H1 results this Thursday. There will be little margin for error as well, given shares have climbed by 58% in 2023 and investors will be expecting additional decent returns.

These earnings will be the first for the company without the involvement of founder and former CEO Rob Drury. Drury retired from the board after the company’s annual meeting in August, closing out close to two decades with the company. Despite this, Drury has committed to continuing to support Cassidy and with Xero’s subscriber base still growing across the globe, the future looks bright for Xero.

*All data accurate as of 06/11//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.