It’s been a challenging 12 months for many Australians. Not only are we still reeling from a years-long pandemic, but there’s been rapid inflation and an ongoing cost-of-living crisis. So it’s no wonder millions of Aussies are nervous about the first Tuesday of every month: when the Reserve Bank of Australia (RBA) decides whether or not to raise the cash rate.

After consecutive months of rate increases, the RBA left rates untouched in July and August, but that doesn’t mean the pain is over. With interest-rate decisions rippling through Australian households and industries, the RBA can have a significant influence on the Australian Securities Exchange (ASX). Here’s what the central bank’s decisions mean for our stock market and ASX shares.

What does the Reserve Bank of Australia do?

The Reserve Bank of Australia is the nation’s central bank, and its decisions are made public through one key figure – Governor Philip Lowe until 18 September 2023, when Michele Bullock will take over. The RBA’s responsibilities are broad and significant, covering a wide range of economic areas.

The purpose of the central bank is to ensure the stability and ongoing prosperity of the Australian economy. One of its most important tools is dictating the cash rate, which acts as a benchmark interest rate and influences borrowing costs and lending rates.

What is the RBA’s cash rate history?

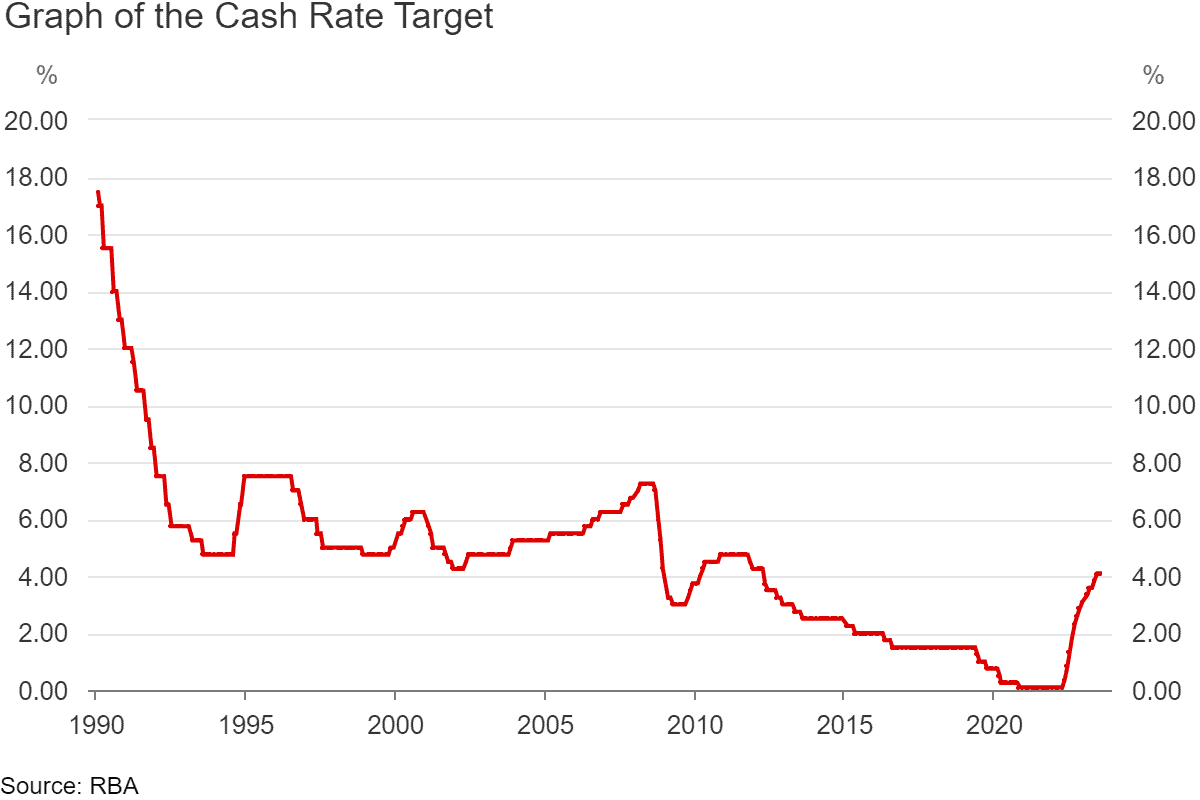

Until May 2022, Australians enjoyed a long period of historically low interest rates, with the cash rate target sitting at 0.10% from November 2020. This was primarily due to efforts to stimulate economic growth during the height of the COVID-19 pandemic. But in the months since May 2022, the RBA has hit Aussies with a series of sharp interest rate hikes, culminating in a total of 12 rate increases in the past 15 months.

While the RBA cash rate has held the cash rate steady at 4.10% since its last rise in June, this pause has investors, businesses and homeowners wondering whether we should expect interest rates to decline moving forward or potentially keep rising if inflation and jobless figures can’t get to where they need to be.

Will the RBA increase interest rates again?

Despite Governor Lowe saying the worst is over for interest rate increases, the question on many investors’ lips is whether the series of back-to-back RBA rate hikes will have a negative impact on their portfolios moving forward. Indeed, many are still worried that the central bank is not finished with rate rises.

The decision to increase interest rates always involves a delicate balancing act between supporting economic growth and managing inflation. While the RBA’s recent decision to hold rates steady for a second consecutive month suggests a positive near-term, future decisions will depend on various factors – and we may still be some months away from rates decreasing.

What does it mean for ASX shares if interest rates remain steady or are reduced?

The reality is that interest rates can – and do – affect the stock market. The relationship between the RBA’s cash rate decisions and the ASX is, therefore, quite intertwined. When interest rates rise, borrowing costs increase, potentially impacting consumer spending and corporate borrowing. This, in turn, might lead to stock price fluctuations as investors recalibrate their expectations for a particular company’s performance.

Conversely, if the RBA cash rate remains steady or is reduced, it can stimulate economic activity. Lower borrowing costs can encourage consumer spending, boost business investment and typically lead to greater corporate profits. This positive sentiment might drive investor confidence and contribute to stock price surges.

It’s important to remember that the relationship between interest rates and the stock market is multifaceted. A wide array of factors influences stock prices – not just interest rates. From corporate earnings, market sentiment and geopolitical developments to technological advancements, these should all be factored into your research before you make a trading decision.

As an investor, getting to grips with the RBA-ASX relationship can help you better understand the potential shifts in market sentiment due to the central bank’s decisions. While the RBA’s influence is undeniable, your personal investment choices should be backed by a comprehensive strategy considering the full spectrum of influences on stock price movements. As with all your investment decisions, ensure they align with your financial goals and overall risk appetite.

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.