The sell-off in US stocks intensified last week as a weak jobs report fueled fears that the Fed has left rates too high, for too long. This has lifted the potential for a 50bps cut in September. The sell-off on Friday will be felt in Australia today, with AUS200 futures pointing to a pretty steep fall at the open. It wasn’t all bad news last week, as utilities and real estate companies had big weeks as a rotation into dividend-paying sectors played out, two sectors to focus on locally this week.

For the week, the S&P500 and Dow Jones both fell -2.1%, while the Nasdaq 100 fell 3%, taking it into correction territory, down 10% from its peak.

A big week ahead ensues in Australia as reporting season gets underway and the RBA announces its latest rate decision. Although we expect the RBA to stay on hold this week, a rate hike will undoubtedly have been heavily discussed.

3 things that happened last week:

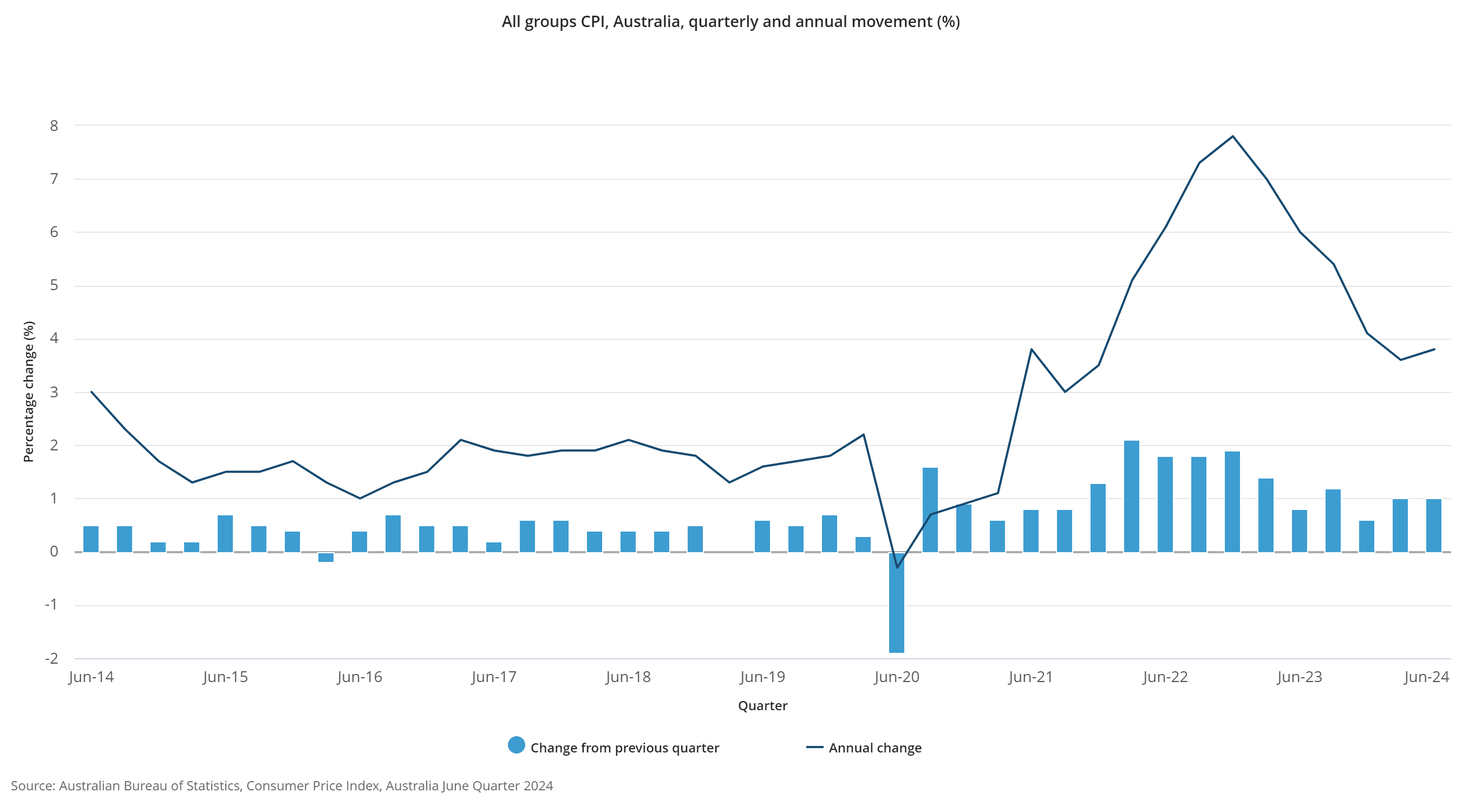

- Australian inflation takes rate hike off the table

There was a collective sigh of relief from the RBA at Martin Place last week, with inflation likely giving the board the freedom to leave rates on hold. There was no smoking gun last week’s data that calls for another hike. Inflation for Q2 came in at 3.8% which was in line with expectations. This was the most critical data point the RBA had received all year, and it came in better than feared. After two hotter-than-expected monthly readings in April and May, there was a real possibility that last week’s inflation reading could come in above expectations, forcing the RBA’s hand. Instead, I think this inflation reading draws a line in the sand. We can now shift the focus away from another hike and instead look towards that first cut, which will improve investor sentiment and be positive for markets. Early market pricing suggests that the first cut could appear as soon as February next year.

- Apple reports as Buffett Sells

It was a mixed week for Apple (APPL) shares despite robust results last week. The tech giant beat on earnings and revenue, but sales in China continued to struggle. Revenue came in at USD$85.78 billion for the quarter, above the USD$84.43 billion Wall Street expected. Berkshire Hathaway (BRK), though, slashed its stake by nearly 50% as part of a second-quarter selling spree that saw Warren Buffett’s cash pile soar to a record USD$276.9 billion. After the Tech sell-off last week, this is bad news at a bad time for Apple investors. However, it’s important to note that Apple is Berkshire’s number one position, almost double the size of its second-largest position, Bank of America. They also trimmed that position by 8.8%, showing a broad range of selling. This will undoubtedly see some investors hitting sell, as when the world’s best investor does, it’s hard not to imagine others will follow suit. But, with the new iPhone 16 just around the corner and its AI features set to see stronger sales, it’s too early to write off Apple just yet.

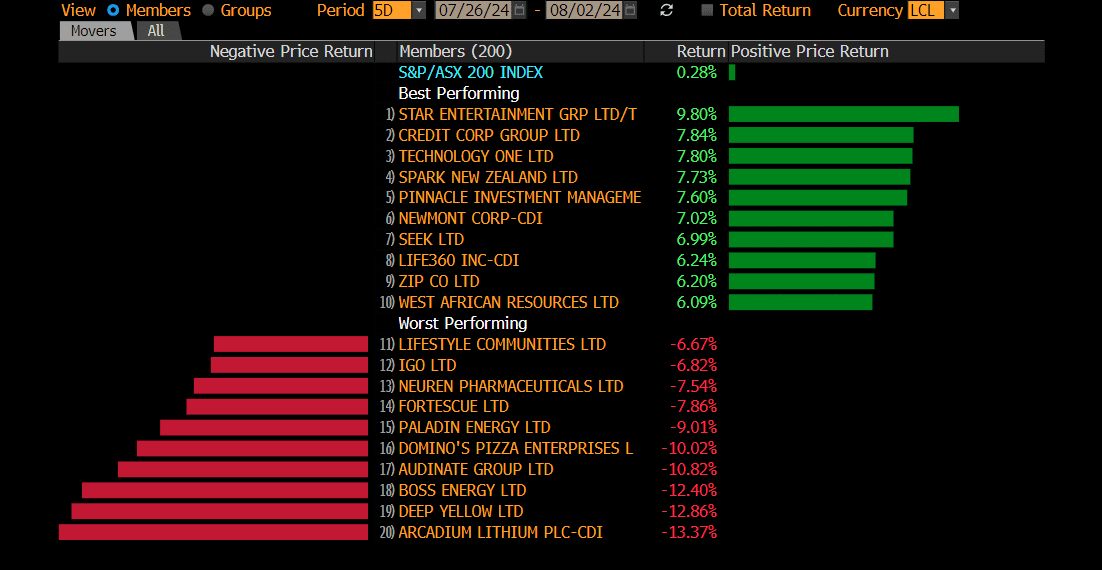

- A winner and loser last week from the S&P/ASX200

Star Entertainment (SGR) shares won in what was a pretty tepid week, gaining +9.8%. It follows several news articles citing potential takeover offers for the struggling entertainment group.

Miners continue to feature in the worst performer of the week category, and last week, it was Arcadium Lithium (ALTM), falling by -13.3%. This follows ongoing weakness in the lithium price.

3 things to watch for the week ahead:

- AU Reporting Season

The AU reporting season kicks off this week with some significant names. Notably Transurban (TCL), QBE Insurance (QBE), REA Group (REA), Mirvac (MGR) and AMP Limited (AMP).

We’re anticipating a mixed bag of results across that spread of companies. Over the last six months, QBE insurance group has been leaning into embracing AI to improve efficiencies, having found success from a North American trial. Their AI assistant has cut broker submission review times by 65% since rollout and now, the company plans to further leverage gen AI to support underwriting activities within its Australian operations. Widespread AI hype – along with stability elsewhere in the company’s operations, will have investors hoping for some solid results come Friday.

Mirvac’s earnings on Thursday may be a very different story. The stock is down 35% over the last five years, which will be wearing thin on investors – even those used to holding onto property developer stocks for extended periods. Property developers in Australia are still in rough waters, broadly speaking, with inflation and material costs keeping progress sluggish. In fact, there are 40,000 new homes across Australia that developers are yet to commence building and there doesn’t seem to be any significant regulation or initiatives to provide relief on the horizon. For the daring, another round of disappointing earnings may be a clear sign to buy, given the increased optimism that the RBA will not hike interest rates again before year’s end, potentially leading to a more fruitful year for developers in 2025.

- US stock earnings: Disney + Uber

This week, plenty of eyes will be on quarterly earnings reports for US giants Disney (DIS) and Uber (UBER). Disney’s stock plummeted in May after the company fell short of consensus revenue estimates for fiscal Q2. However, its streaming services turned a profit for the first time during this period, and the success of recent blockbuster releases such as Inside Out 2 and Deadpool & Wolverine might offer some financial buoyancy.

The entertainment giant recently laid off 2% of its Television workforce, changes which are part of an effort to adapt to a rapidly evolving media landscape which favours streaming platforms. Disney expects its combined streaming services to be profitable in Q4, with further improvements in profitability to follow. Wall Street anticipates that Disney will report a YoY increase in earnings next week. As such, any deviation from the consensus outlook could cause a notable shift in stock price.

Despite a surprising net loss in Q1, estimates for Uber’s Q2 results anticipate YoY revenue and profit growth. New initiatives, including discounted Uber One subscriptions for college students and an extended partnership with Costco, are expected to potentially boost revenue. It will be interesting to see how these new business sectors contribute to the company’s results.

However, an impending fare cut announcement has left drivers and investors apprehensive. While Uber claims these changes are due to the current economic environment and local market conditions, the timing, which ties in with Australia’s minimum gig work standards that are set to take effect from August 26, has stirred debate, which could reflect in the company’s Q3 earnings report.

- What’s next for CrowdStrike?

Since last month’s faulty product update which caused havoc around the globe, Crowdstrike’s reputation has taken a pretty hefty dent. While most businesses have since recovered from the outage, there will be repercussions for CrowdStrike (CRWD). The brand damage that this will have caused at a critical period for the cyber security space is yet to fully be observed.

Crowdstrike’s valuation also remains lofty, trading at 58x forward earnings, which may be justified by the industry’s growth and the firm’s strong development. That said, analysts are still extremely bullish. The recent weakness has seen some price target downgrades, but its return potential has also increased significantly.

CrowdStrike’s recent earnings report was strong, with revenue rising 33% year-over-year to USD $921 million and full-year guidance upgraded. However, this financial strength might be overshadowed for now. The upcoming quarterly report, due August 27th, will be critical and the next two quarters are going to be tricky. The outage has likely impacted new bookings, with new customers hesitant to sign deals and sales teams focusing on existing business. The challenge now is navigating potential lawsuits, with Delta Air Lines already announcing it is seeking damages.

The positive aspect is CrowdStrike’s quick and transparent response, which should help mitigate some damage and financial impact. Investors might consider a ‘sit and wait’ approach, evaluating the next earnings call. A strong performance could boost the stock, while a weak response may create a potential lower entry point for investors. Much of the bad news might already be priced in, and CEO George Kurtz’s proactive response offers confidence that the growth story remains intact.

*All data accurate as of 05/08/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.