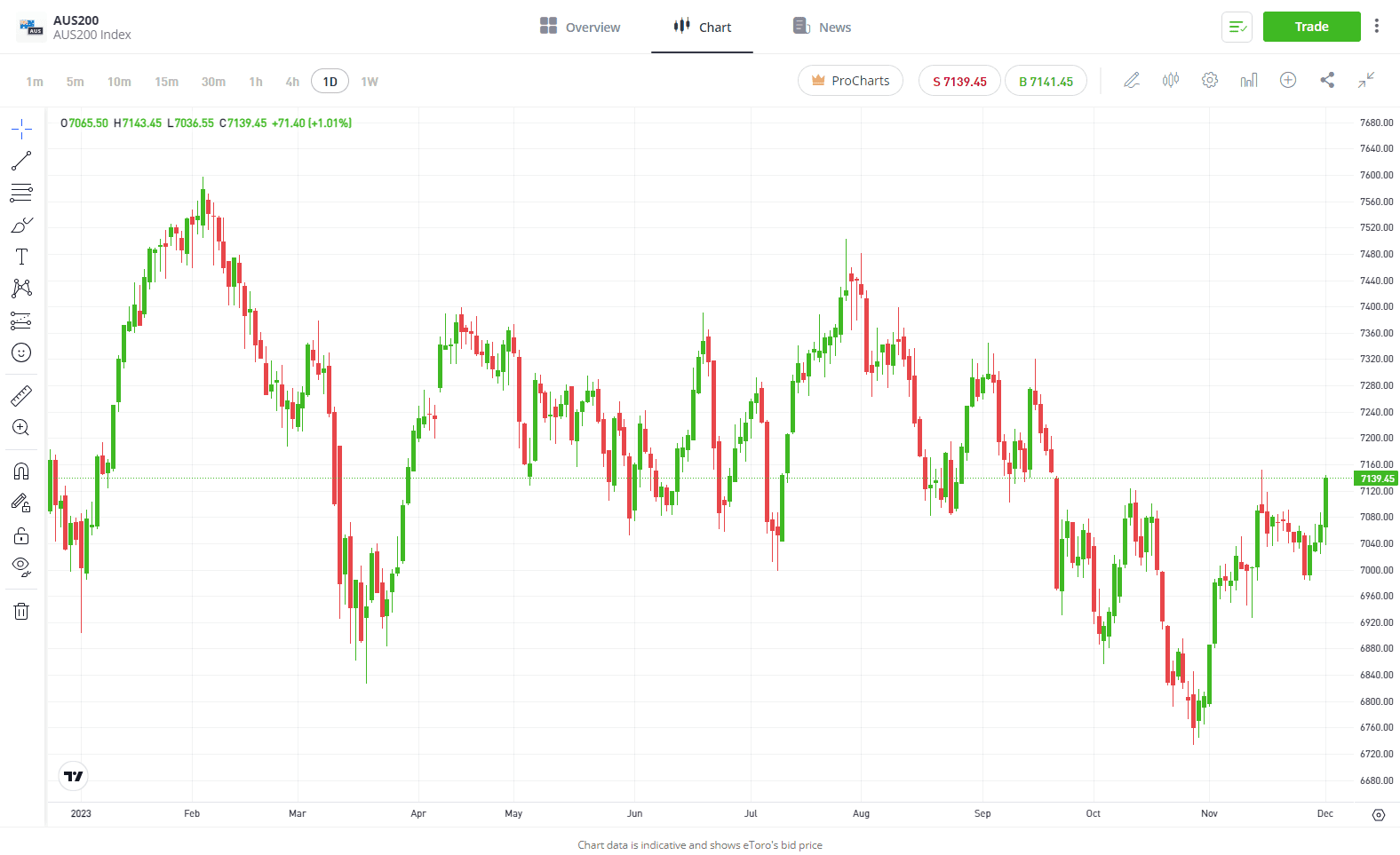

It was green for the ASX200 last week, with 7 of 11 sectors gaining as inflation eased and retail aisles showed signs of slowing. The winning week capped off a strong November for the local market, gaining 4.5%, its best month since January.

Overseas, the S&P500 and Dow Jones went on to hit their highest levels in more than a year on Friday following Federal Reserve Chairman Jerome Powell’s comments that supported the view that interest rates have peaked.

Origin Energy (ORG) is still catching headlines after its board rejected another offer from the Brookfield Consortium. Brookfield flagged on Friday that it could walk away from its pursuit of Origin entirely should the vote fail again this week.

3 things that happened last week:

- Australian Inflation eases

Australian CPI dropped to 4.9% in October from the previous month’s 5.6%, with the easing of inflation largely attributable to lower petrol prices. While this was good news, given most analysts estimated the CPI figure to be 5.2%, inflation still remains uncomfortably high due to a substantial increase in rental CPI over 2023, widely linked to record-high migration rates. The saving grace for the rental market in October was rental assistance subsidies, which prevented rents from increasing as steeply as they did in September. This follows the trend of global inflation, which shows continued signs of easing.

- Oil drops for two straight months

It was a rocky November for Oil, with WTI Crude and Brent both seeing their second consecutive monthly decline. This is a stark contrast to Oil’s performance in the months prior, soaring in Q3 with WTI Crude trading above $90, its highest level of 2023. Crude prices have fallen by 15% in the last two months, and this recent weakness is being driven by rising US stockpiles and increased supplies from non-OPEC+ countries. Total crude inventories in the US are rising, recently hitting their highest level in three months. The good news for consumers for now is that this should bring some relief at the pump. Households are already under plenty of pressure with interest rates at decade highs, so this will be welcomed news.

- A winner and loser last week from the S&P/ASX200

Iress (IRE) shares won the week gaining +23.7% last week. It comes following an improvement to its profit guidance for the full year, with the company upgrading EBITDA by $10 million.

It was another down week for Core Lithium (CXO) as the miner fell by -18.2%. A downgrade by Citi Bank last week saw shares tumble in what has been a terrible year for lithium miners.

3 things to watch for the week ahead:

- RBA Rate Decision

There was an early Christmas surprise for the RBA last week, with inflation coming in under expectations and retail sales slowing, taking some weight off Michele Bullock to hike rates again.

The RBA still has the potential to be the Grinch this week, should they decide to deliver one final hike to see out 2023. Right now, the likelihood of that is fairly low – but the Governor has maintained a hawkish tone in recent weeks. Specifically, Bullock has spoken about homegrown inflation being more persistent than expected, which will certainly keep markets on edge heading into Tuesday’s decision.

The good news for investors is that overall, markets still see a very low chance of there being a hike this week. However, that doesn’t mean there isn’t the potential for another hike early next year if key data points don’t move in the right direction. Given that a hike is unexpected, the focus is likely to be on the statement following the decision. We’re unlikely to see any lighter tone from the RBA and Michele Bullocks’ hawkish rhetoric may be front and centre once again.

- Australian GDP

This Wednesday marks the release of the quarterly Gross Domestic Product (GDP) rate by the ABS. Markets will be hoping for another set of relatively positive results following September’s data matching the forecast 0.4% rate.

September’s results were welcome news after June produced the weakest result since the COVID-19 Delta lockdown contraction in September 2021. There are some potential impacts to consider ahead of Wednesday’s reading; retail sales have slowed following a relatively quiet October and a seemingly underwhelming Black Friday period, with plenty of households keeping the purse straps tight as supermarket prices continue to climb. Economists broadly will be expecting GDP growth of around 0.4%, which right now, seems more than tenable.

- Chinese Inflation

Last month, China fell into deflation for the second time in 2023 as consumers continue to hold back their spending due to a deepening property crisis in the region. The region’s bad news continues to stack, with weaker-than-expected manufacturing data being handed down last week.

However, bleak outlooks from China aren’t always as bad as they seem, as it often kickstarts chatter around more stimulus measures being rolled out. Recent stimulus measures for the property sector are good news on inflation, given that they should help to reduce the impact on household pressures such as wages and employment and, therefore improve consumption.

That said, the expectation for now is that the region will remain in deflation. The consensus this week is for CPI to come in at -0.2%, reflecting the ongoing struggles and solidifying China as the market disappointment of 2023.

*All data accurate as of 04/12//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.