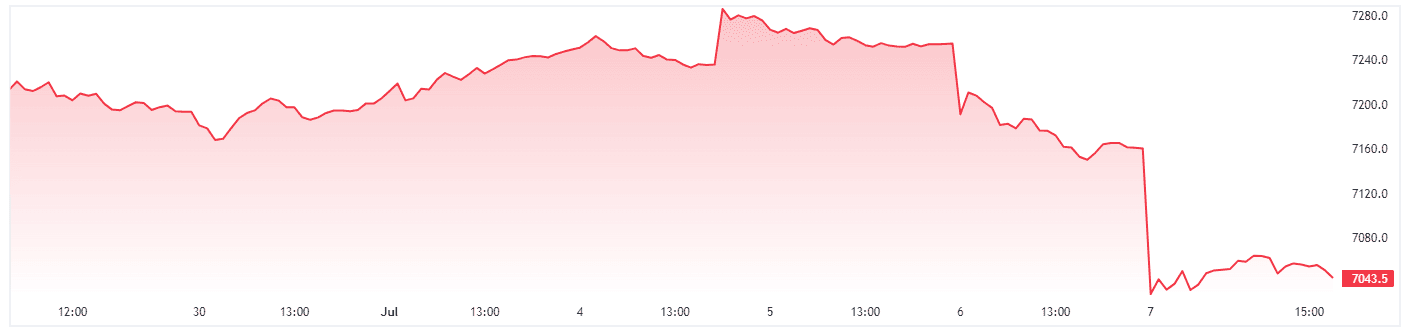

It was a poor end to the week for the ASX200 on Friday, with just eight stocks finishing in the green as the index fell by 1.7%. This capped off a dismal week for the local market with its biggest weekly loss since September. The negative week follows the RBA’s decision to keep rates on hold last week, which offered some optimism to investors, but global economic data has sparked fears of rates going higher, triggering risk-off sentiment.

There was good news from China last week with what looks to be the end of its regulatory crackdown on tech that has wiped billions of dollars from companies’ market value. Alibaba (BABA) shares on Wall Street jumped 8% on Friday following the news. The market has reacted well to the news as it now takes away the overhang for these tech names in China that has caused huge amounts of uncertainty for a prolonged period. Alibaba flirted with the idea of spinning off and publicly listing segments of its business early this year, but this could set the scene for Ant Group to restart growth and line up another crack at an IPO.

3 things that happened last week:

1. RBA keeps rates on pause again

The Reserve Bank of Australia kept rates on hold last week as they look to assess the state of the local economy. The key takeaway for investors is that the Reserve Bank still likely has at least another hike in the tank before the year’s end. The board were pleased with the progress of the monthly CPI reading, but reaffirmed that inflation is still too high. The quarterly CPI reading later this month will hold the key to what’s next for the RBA. Other factors still play a significant role, though, such as the red-hot labour market – a longstanding concern for Philip Lowe. Participation is at record highs, unemployment is near multi-decade lows, and strong wages are becoming a real worry for the Governor. The decision today points towards the economy weakening and the RBA’s clear worry over tipping Australia into a recession, with the board reiterating that the path to a soft landing is narrow.

2. Tesla delivers record quarterly vehicles, earnings in focus

If being the richest man on the planet wasn’t enough for Elon Musk, a record quarter of vehicle deliveries should make Elon a happy man. Tesla (TSLA) delivered 466k vehicles in the 2nd quarter, showing that the price cuts implemented at the start of the year are paying dividends. These numbers will give investors plenty of optimism heading into earnings later this month, but margins will be on watch with volumes higher. Consensus is for Automotive Gross Margins to come in at 20%, which is the golden number. A number below that could put the stock under some pressure after more than a 120% gain so far this year.

We cover Tesla’s delivery numbers in the latest Digest and Invest Podcast Episode. Listen below to get all the details!

3. A winner and loser last week from the S&P/ASX200

In a poor week for the local market, Lynas Rare Earths (LYC) jumped 3.5%. China’s export ban on two crucial metals led investors to believe there may be an opportunity for Lynas to produce Gallium and Germanium in the future following the crackdown.

AMP Limited (AMP) shares fell 11.5%, the worst performer on the ASX200 last week. More uncertainty from its court proceedings saw investors offload the stock.

ASX200 Weekly Chart – Past performance is not an indication of future results.

3 things to watch for the week ahead:

1. Speech from RBA Governor Philip Lowe – A hawk or dove?

The Reserve Bank of Australia left rates on hold last week, stating uncertainty surrounding the economic outlook and allowing time to assess the state of the economy after raising rates by 4% in a short period of time. Next week (Wed 12th July), we hear from RBA Governor Philip Lowe, who should give further insights as to why the board left rates at 4.1% and what may be ahead. The speech comes at a key time for investors but also for Governor Lowe, with his current role up for grabs. Treasurer Jim Chalmers will make a decision on the role of Governor before the end of July with a shortlist of names already on his desk. The focus of the speech, though, will be on the stance of Phillip Lowe and if he will sustain his hawkish bias or give any hints that the end of the RBA’s tightening cycle is nigh. He’s unlikely to offer too much to investors, but they may take some comfort in the latest pause as a sign that the board are beginning to wind down the aggressive stance they have taken this year.

2. US Inflation – Another step closer to the Fed’s target?

US CPI has made significant progress so far in 2023, enough for the Federal Reserve to pause its hiking cycle last month but not quite enough to satisfy the Fed and signal the end of rate hikes in the US. Headline inflation could see another notable decline this week (Wed 12th July), with current estimates showing a fall to 3.2% from 4% the previous month, thanks mainly to falling energy costs. The thorn in Jerome Powell’s side is sticky core inflation, which has remained elevated and looks set to stay at 5%, reaffirming another hike at the end of the month. If inflation, especially core, shows signs of sticking around, alongside a red-hot labour market in the US and consumer spending that is resiliently plodding along, then it may mean rates may keep rising and stay higher for longer than markets are currently pricing.

3. Chinese Inflation – Data likely to show the need for further easing

China’s economic recovery is faltering, with economic data not showing any clear signs of improvement and, if anything, screaming for the government to ramp up measures to support growth. The Chinese Yuan dropped to a seven-month low last week after services growth softened more than expected, with consumers scaling back spending amid an uncertain backdrop. This week (Mon 10th July) sees another essential data point with monthly inflation. Another disappointing reading on inflation this week would be a strong signal for the People’s Bank of China (PBOC) to roll out stimulus. CPI inflation is expected to stall with current market expectations of inflation staying at 0.2%, putting further pressure on the PBOC to loosen policy further after cutting rates in June. The expectation, however, is for measures to be drip fed rather than flooded, which could mean China’s economic strife continues.

*All data accurate as of 10/07/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.