The ASX200 finished in the red last week after the RBA resumed its hiking cycle and raised the cash rate to 4.35%. Energy was the biggest loser of the week as crude oil lost ground, falling below AU$80 a barrel. US stocks continued their strong run, with the magnificent-seven doing what they do best – in particular; Microsoft hit a new record high, and Nvidia made gains for eight straight sessions.

China’s economy will remain in focus this week, with a wealth of economic data on the calendar following its fall back into deflation last week. Unemployment, retail sales and industrial production will all be in focus, as well as Joe Biden’s meeting with Xi Jinping. Alibaba and Tencent also hand down earnings. In positive signs for a recovery in the Chinese consumer, both Alibaba and JD.com said they saw strong sales from Singles Day, with JD saying sales volumes were at record highs.

Bitcoin and crypto continued their ascents over the weekend, with bitcoin tipping over $37,000, making it four weeks of gains for the largest crypto asset. A lot of optimism is coming from the growing expectation that a bitcoin spot ETF is on the way. This opens the door to institutional funds that have so far sat on the sidelines, and that investment simply can’t be underestimated. The ETF expectation is the top of a growing list of catalysts, which gives the current rally further legs. The Federal Reserve looks to have finished its hiking cycle, with rate cuts on the horizon as early as May or June, and March’s always-important ‘halving’ is set to tighten supply further.

3 things that happened last week:

1. RBA restarts hiking cycle

The RBA restarted its hiking cycle last week as the Central Bank looks to reign in inflation after keeping rates on hold for four straight months.

After 400bps of hikes, the board felt that inflation still wasn’t on the trajectory that they would have hoped. Alongside the trifecta of sticky underlying inflation, hotter-than-expected retail sales, and unemployment remaining near record lows, the increase in overseas migration, putting pressure on inflation and swelling house prices, were the finishing touches.

The recent sell-off in the ASX200 represents the expectation that rates had further to go. However, there was a key takeaway for investors. The shift in language from ‘some further tightening of monetary policy’ to ‘whether further tightening of monetary policy’ could be taken as dovish and may signal that the board feels this is a final ‘insurance’ hike in this cycle. This makes incoming data points heading into year-end all that more critical.

2. China falls back into deflation

China’s economic recovery hit another hurdle last week, with the economy slipping back into deflation as CPI fell 0.2% year-over-year.

The recent stimulus measures being rolled out are a step in the right direction but are clearly not doing enough to lift demand, giving policymakers another headache.

A drop in food prices – particularly pork prices, had a significant impact on the overall reading, but broader consumer goods also showed declines.

I believe we have seen the worst for the Chinese economy in this current cycle, but its recovery will take time to move into full swing. These challenges may be something investors simply have to accept in the months ahead as it won’t be all one way. China has committed to ensuring it doesn’t see a further growth slowdown, so more support from Beijing in the form of additional stimulus measures may be on the cards.

3. A winner and loser last week from the S&P/ASX200

James Hardie stole the show on the local market last week after reporting Q2 earnings. The building materials company reported a jump in profit to US$178.9 million.

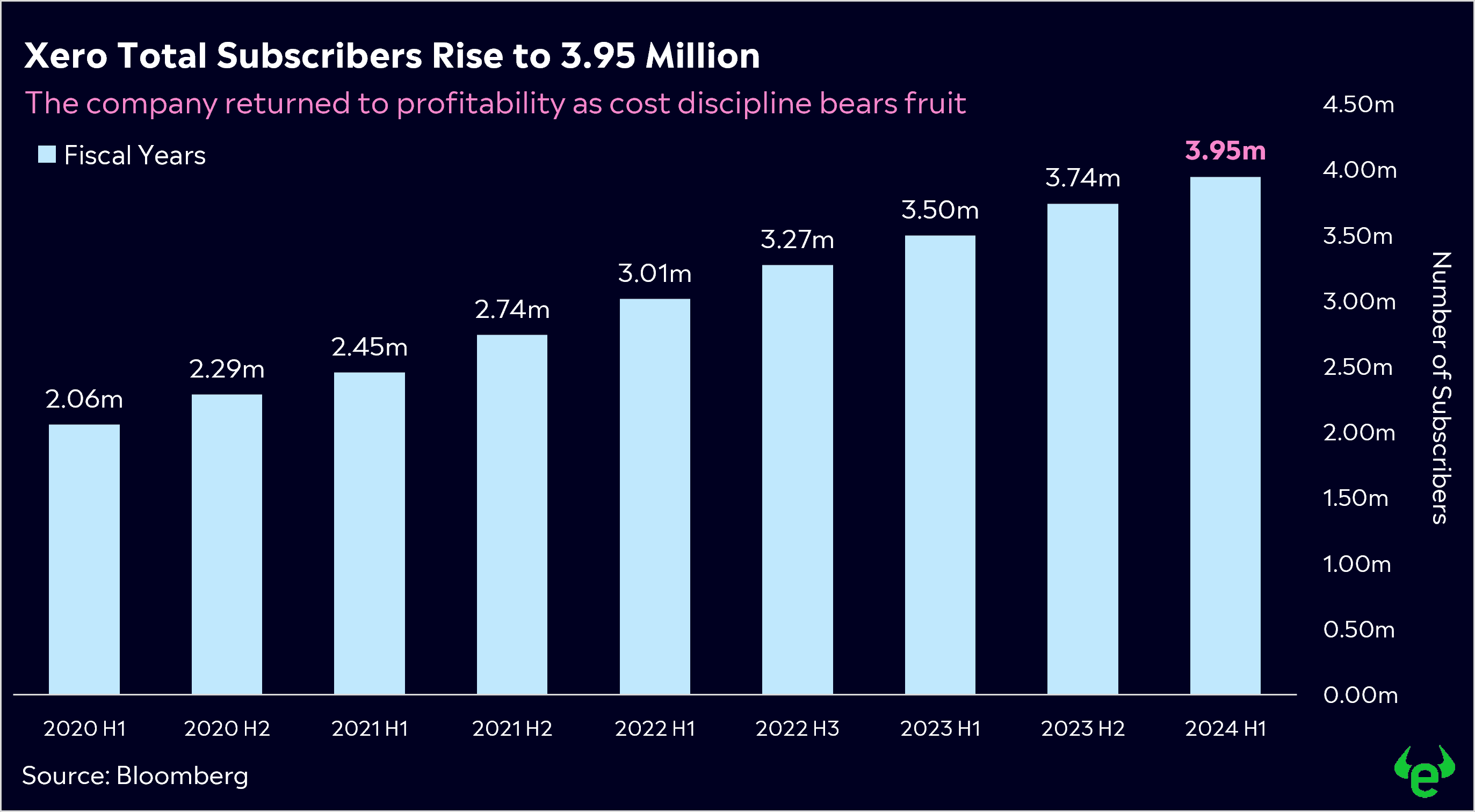

Unfortunately for Xero, the market didn’t like its 1H result. Despite returning to profitability, revenue, net income and subscriber numbers both missed expectations.

3 things to watch for the week ahead:

1. AU Unemployment

After last week’s rate rise, incoming economic data holds the key to whether last Tuesday was the last hike in the RBA’s current tightening cycle. This week sees the first set of that data with employment figures. Employment looks set to remain robust, with unemployment figures lingering near record lows and net employment additions expected to be solid.

The RBA will know that increasing unemployment is on the horizon, with the full extent of current economic conditions yet to be truly felt by the economy. Migration is high, and data from Seek last week showed job adverts are falling. Market forecasts for unemployment month-on-month have remained fairly accurate, and while November’s reading is unlikely to be the first time we see a sharp increase in the unemployment figures, it’s hard to see levels remaining low far into 2024. With that being the case, it’s unlikely the Reserve Bank will feel the need to tighten policy any further from here.

2. AU Consumer Confidence

This week’s reading of consumer confidence is unlikely to indicate that consumers are feeling any more positive following another rate rise from the Reserve Bank and hotter-than-expected inflation. This latest move from the RBA will undoubtedly put pressure on households, especially as savings continue to evaporate just ahead of an expensive time of year.

With many Australian households feeling the pinch, pressure is mounting on the Federal Labor Government to reconsider its plan to introduce stage three tax cuts. One of the party’s key election promises, the planned cuts to tax for high-income earners would likely cause a boost to retail sales and consumer confidence while doing little to ease the pressure felt by mortgage holders and renters – many of whom will inevitably feel the unwanted sting of this last week’s rate rise, right before Christmas.

3. Alibaba and Tencent Earnings

It’s been a pretty miserable year for these two tech giants, with broader tech shares globally seeing huge gains while these Chinese-based companies continue to underwhelm.

China’s struggling economy has weighed on these companies despite the relaxation of regulations from Chinese Authorities. The good news for investors is that both these stocks have depressed valuations, making them attractive for contrarian investors.

Alibaba’s future may be looking brighter, however, with recent news from CEO Eddie Wu indicating the company aspires to become an open tech platform and provide infrastructure for AI innovation and transformation in thousands of industries.

Tencent also has some positives on the horizon, with the company recently announcing it will be globally launching TanLIVE, its climate community platform, at the upcoming 2023 United Nations Climate Change Conference. The platform is designed to connect and empower organisations working towards carbon neutrality.

Alongside lower valuations, earnings expectations are rising. A strong set of results this week, alongside solid forecasts, could be the tailwind these tech giants need to get a leg up in this market.

To keep up to date with financial markets, check out Digest and Invest by eToro for all the latest news:

*All data accurate as of 13/11//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.