It was a solid week for the ASX200 last week, climbing by 1.72%, with Real Estate leading the charge up by more than 3.5%. The performance was driven by the RBA’s decision to keep rates on hold, with investors growing optimistic that Michele Bullock and her team are done hiking rates.

On the macro front, Australia’s economy grew just 0.2% over the September quarter and 2.1% over the year. In China, consumer prices fell further, dropping by 0.5%, underscoring the need for more support to aid the economic recovery.

Overseas, the S&P500 continued its mammoth run closing higher for the sixth straight week. Markets were inspired on Friday, with the drop in the unemployment rate to 3.7% and rising payrolls, leading investors to believe the economy is on its way to a soft landing.

Gold prices continued to move higher, hitting a new high last week of over USD$2,1000. Meanwhile, bitcoin also couldn’t be stopped, hitting USD$44,000, taking its YTD gains to over 160%.

3 things that happened last week:

- RBA presses pause again

The RBA passed on some festive joy to households last week by keeping the cash rate unchanged at 4.35%. Michele Bullock has opted for a hawkish stance since taking the helm in September and reaffirmed that rhetoric in weeks gone by, but last week’s statement doesn’t necessarily reflect that stance. For now, the market may view last month’s hike as insurance as today’s pause and statement signal good news for the end of this cycle. However, the board has continued to reiterate their data dependency. That means if incoming data, particularly inflation, comes in hotter than expected, the RBA will have a big decision to make in February. The RBA will also have its eyes focused on Q4 inflation data at the end of January, which is their preferred measure, given the monthly CPI indicator doesn’t provide all the answers.

- Will the ASX bring the Christmas cheer this year?

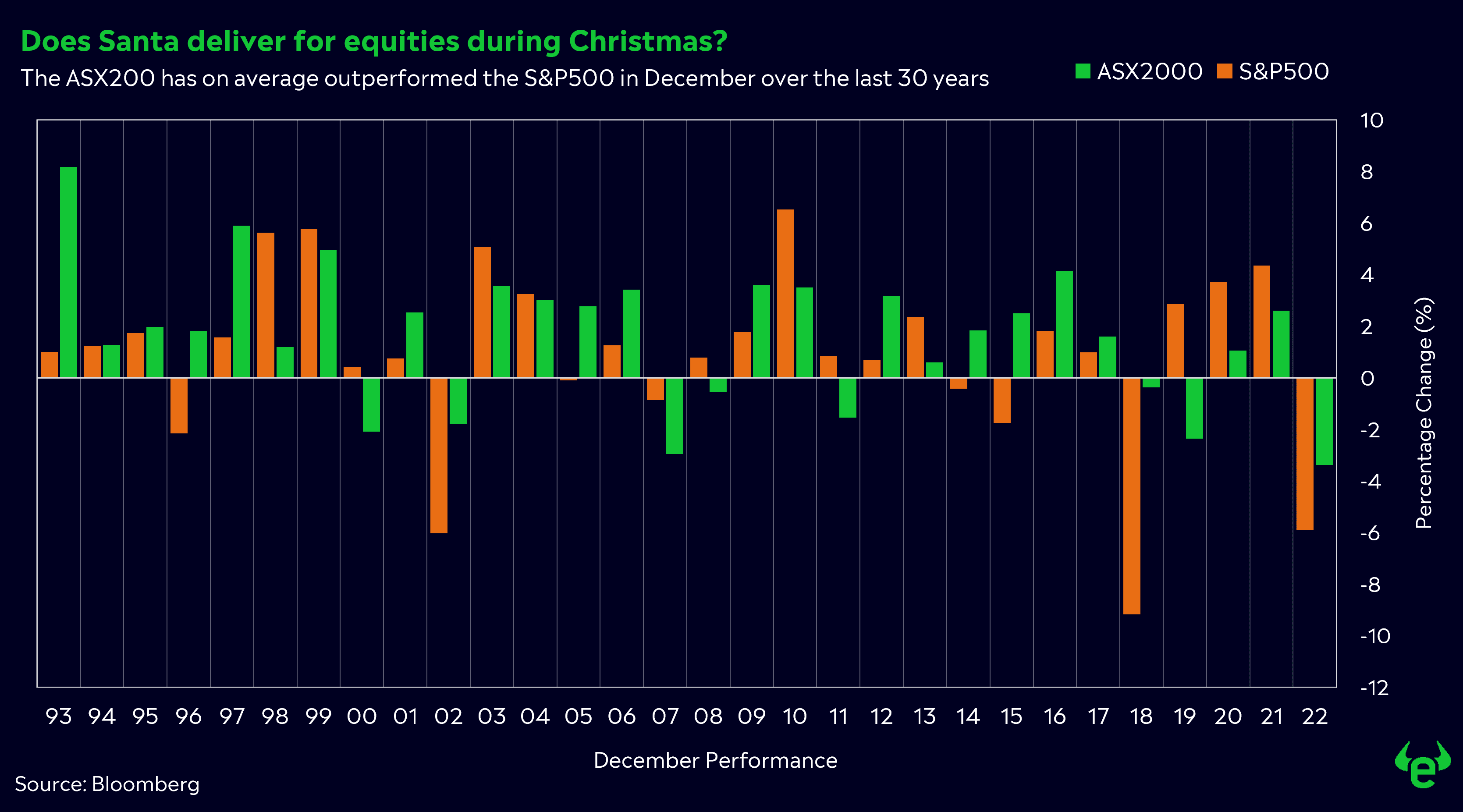

There’s been much speculation that Santa came early for stocks this year, with huge returns in November, with the ASX200 having its best month since January returning 4.5% and the S&P500 jumping by a huge 8.9%! The good news for investors is that Santa usually delivers for equities over December. The ASX200 has returned an average of 1.6% over the last 30 years, outperforming the S&P500’s average of 0.93%. The ASX could do with some festive joy in December, given its weak return in 2023 of just 2.2%, compared to the S&P500’s massive 18.5%.

- A winner and loser last week from the S&P/ASX200

Chalice Mining (CHN) enjoyed the top spot for the ASX last week, rising by 22.2%. The massive week follows approvals for its exploration project in Perth.

Despite gold continuing to move higher last week, Evolution Mining (EVN) fell -10.9% on the back of a discounted capital raise.

3 things to watch for the week ahead:

1. RBA Bullock Speech

On Tuesday, we will hear from the RBA’s Michelle Bullock in what is likely to be one of the last times we hear from the Governor in 2023. Given the current 2024 outlook, this will be a key speech for investors to watch.

The RBA’s decision to keep rates on hold last week was no surprise, but the accompanying dovish statement was, with comments pointing towards progress on inflation and a peak in wage growth.

This was a contrast to what we had heard from Michele Bullock just weeks prior, with hawkish rhetoric pointing towards risks on the inflation front. It will be interesting to see what side of the fence she sits on this week, as any dovish tones will undoubtedly excite the market and lift expectations that we have seen the end of the RBA’s hiking cycle.

With the next RBA rate call scheduled for the start of February, there will be plenty of speculation on the next rate call either way, given there’ll be plenty of economic data trickling in post-Christmas.

2. Unemployment Rate

Data points in recent weeks have moved in the right direction for the RBA, but employment is one key area that continues to show resilience.

The unemployment rate was 3.7% in October, with strong employment growth. This continued tightness has affected wages throughout 2023, and it was evident in the wage price index released for the September quarter, rising by 1.3% – the fastest quarterly rise on record.

In a sign of what might be ahead for the unemployment rate, job advertisements fell by 5% in October and sat at 19.9% lower year-on-year, according to data from Seek. Falling job ads mean less demand for hiring as we head into the new year, which is a firm sign that we may see the unemployment rate rise this week. This, in turn, will further stoke the belief that the RBA’s current hiking cycle is at its end as we head into the new year.

3. Fed Interest Rate Decision

This Thursday’s US Federal Rate Decision may be something of a nothing event, with it widely expected the Federal Reserve will keep rates on hold at 5.25% to 5.5%.

If this does wind up being the case, this would then shift the focus towards the Fed’s statement and Chair Jerome Powell’s Press Conference.

Markets believe we have seen the end of the Fed’s hiking campaign, with pricing for rate cuts as early as March next year. Although the Federal Reserve has softened its language in recent months regarding further hikes, Jerome Powell has done his best to push back on the expectation of cuts in the first half of 2024. Before the decision this week, the Fed will receive the latest CPI release and if we see further progress on inflation, Jerome Powell will then have the undesirable duty of keeping markets in check.

*All data accurate as of 11/12//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.