Global stocks couldn’t be stopped last week, with the S&P500 marking its best weekly performance of 2024 climbing by more than 2%. The bull run from US stocks picked up steam again after the Fed’s updated dot plot stuck to three interest rate cuts this year after many expected it to be slashed to just two.

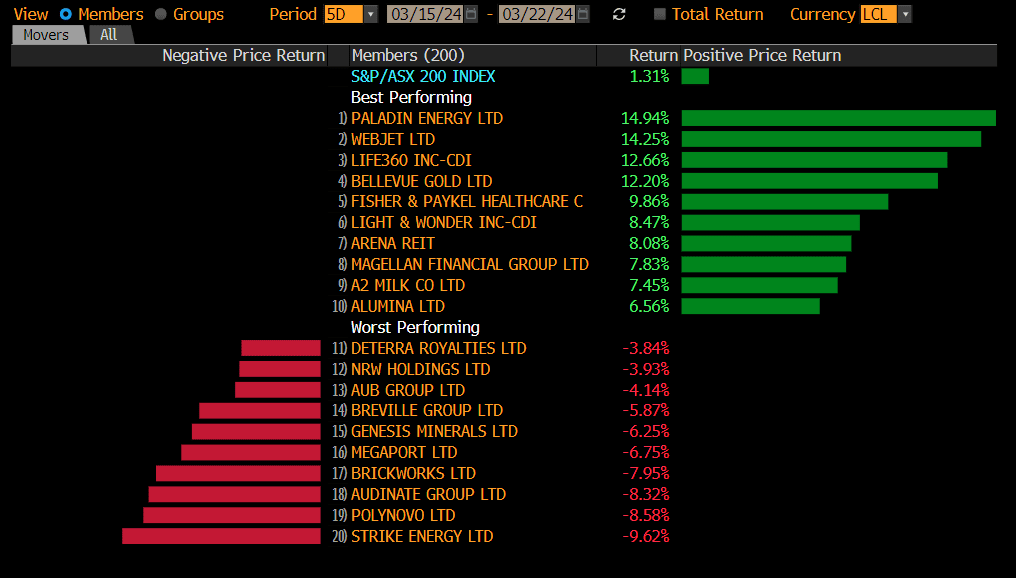

The strong tailwind from US markets helped lift the ASX200 for the week, rising by more than 1.3%, with Materials and Real Estate leading the way.

3 things that happened last week:

- RBA, Fed hold whilst BOJ raises rates for first time since 2007

The Reserve Bank of Australia kept its cash rate unchanged at 4.35% last week as its case to hike rates any further continues to diminish. Instead, the focus firmly shifts to the date of the first rate cut. Last week’s decision has pushed back expectations for the timing of the first cut, with markets looking to August for the first cut, but the June meeting is still ‘live’.

The Federal Reserve also left it’s cash rate unchanged last week, but markets still expect to see three cuts from the Central Bank this year. Chair Jerome Powell pointed to the two inflation prints in January and February to explain the decision to hold rates steady, adding that it will be a bumpy ride. He also added that the central bank doesn’t want to cut prematurely and risk a flare-up of inflation.

The BOJ arguably stole the limelight of Central Banks last week, raising rates for the first time since 2007. The central bank set a new policy rate range of between 0% and 0.1%, shifting from a -0.1% short-term interest rate. The big change comes as inflation has gradually returned to the country and Japanese companies have agreed to large wage hikes, boosting expectations that bigger paychecks will make households more willing to spend money.

- Reddit enjoys stellar debut

Social media site Reddit enjoyed a great start to life as a publicly listed company, jumping 48.4% on the first day of trading. We’ve found that investors typically prefer to invest in stocks they know and are familiar with, and Reddit was Australia’s fourth most visited website in February, above huge names such as Amazon and Netflix, so it’s no surprise to see so much interest from investors.

Reddit’s IPO comes at a time when digital advertising spend has started to bounce back, as seen in recent earnings from the likes of Google and Meta. US stocks are also trading at record levels, with tech leading the charge and investor sentiment also high, making it a great time for a tech IPO. This year, almost US$8.7 billion has been raised via IPOs on US exchanges, an increase of about 150% from this point last year. This climb shows there is a clear demand from investors to buy into newly listed public companies.

- A winner and loser last week from the S&P/ASX200

Paladin Energy was the winner of last week, rising by 15%. Uranium stocks continue to enjoy their time in the sun as prices pick up from the lows in 2023, with the radioactive metal hitting US$88.50 a pound last week.

It was the tale of two energy stocks last week, but Strike Energy disappointed falling by as much as 9.6% last week. The stock is the worst performer on the ASX200 this year, down by more than 50%.

3 things to watch for the week ahead:

- Australian Monthly CPI

This week, the RBA will receive a crucial data point when monthly inflation is handed down. After last week’s labor report saw Australia’s unemployment rate drop to 3.7%, February’s inflation data, which is set to be released this Wednesday, will give the Reserve Bank a better indication of future rate decisions. While forecasts indicate inflation may remain steady at 3.4% for a third consecutive month, a hotter-than-expected print could potentially push back expectations for when Australians can see the first rate cut of 2024. But, for now, the recent inflation data we’ve received has shown that price pressures are easing, and that will be exactly what the RBA wants to see again this week.

Rate cuts are coming this year and the market now sees an 80% chance the RBA will cut rates in August. However, the higher-for-longer take from the board can’t be ignored by investors. The RBA doesn’t meet again until May, so there will be plenty of data for the board to digest before that time. Inflation remains the most important number in markets right now, locally and overseas. Central banks’ fight against inflation isn’t an easy one and clearly remains a worry. But, as rate cuts near closer, investors are looking at the rotation to come as we get nearer rate cuts, moving away from the US dollar and tech into cheaper and more cyclical assets

- Consumer Confidence

In light of February’s Consumer Sentiment index, we’re observing an upward trajectory that’s quite encouraging. Last month’s 6.2% rise to an 86 index score, the highest in almost two years, suggests consumers are responding positively to easing inflation and signals that rate cuts aren’t too far away. Given this trend, it’s reasonable to anticipate a similar trend in March, considering the monthly CPI for January saw consumer prices rise 3.4 per cent, going against economists’ expectations of a slight increase from December.

Australian consumers have continued to show resilience in the last 12 months, and that was evident through reporting season, with retailers reporting ‘better-than-feared’ results. The good news for Australian consumers is that January’s CPI figures show a continual decline in annual inflation since the peak of 7.2 per cent in December 2022. However, the market is pushing back on the number of rate cuts this year, in early February, the market was expecting more than two cuts, which has since been pushed to under two cuts, with markets embracing the potential ‘higher-for-longer’ stance from the RBA.

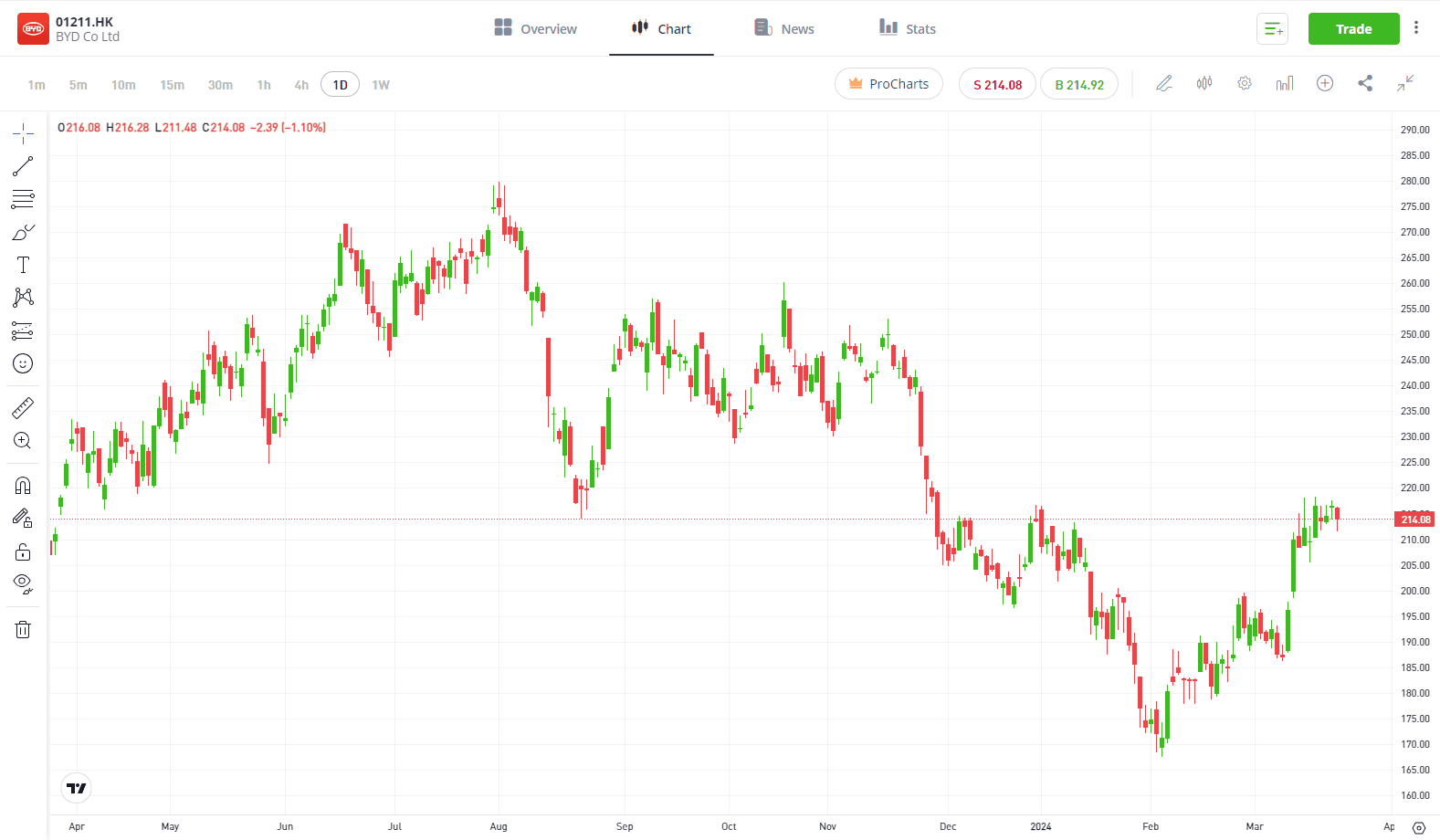

- BYD Earnings

At the start of 2024, BYD overtook Tesla to become the largest electric vehicle company in the world. If you have any small interest in cars, you may have noticed quite a few ‘BYD’s, or ‘Beyond Your Dream’ vehicles popping up across Australia within the last 12 months. That’s because BYD is set to deliver more than 3 million cars for the full year 2023.

With BYD’s earnings announced on March 26, investors are eagerly anticipating the automotive company’s earnings, which BYD expects to have risen by up to 85.6% year-on-year for 2023. However, the company’s preliminary income figures fell short of market expectations, which could create an interesting dynamic around the earnings announcement this week.

The company has shown robust financial prospects, which is a strong driving force behind its share price appreciation. In the larger EV market context, however, BYD is increasingly facing stiff competition from other key players, and the company’s position relative to competitors like Tesla has the potential to impact investor sentiment towards the stock significantly.

The future of the EV market is undoubtedly bright, but it is also highly competitive. Whether BYD can leverage its growth potential to carve out a larger market share remains to be seen. The upcoming earnings report will likely shed more light on this subject, providing key insights into BYD’s strategic direction and financial health.

*All data accurate as of 25/03/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.