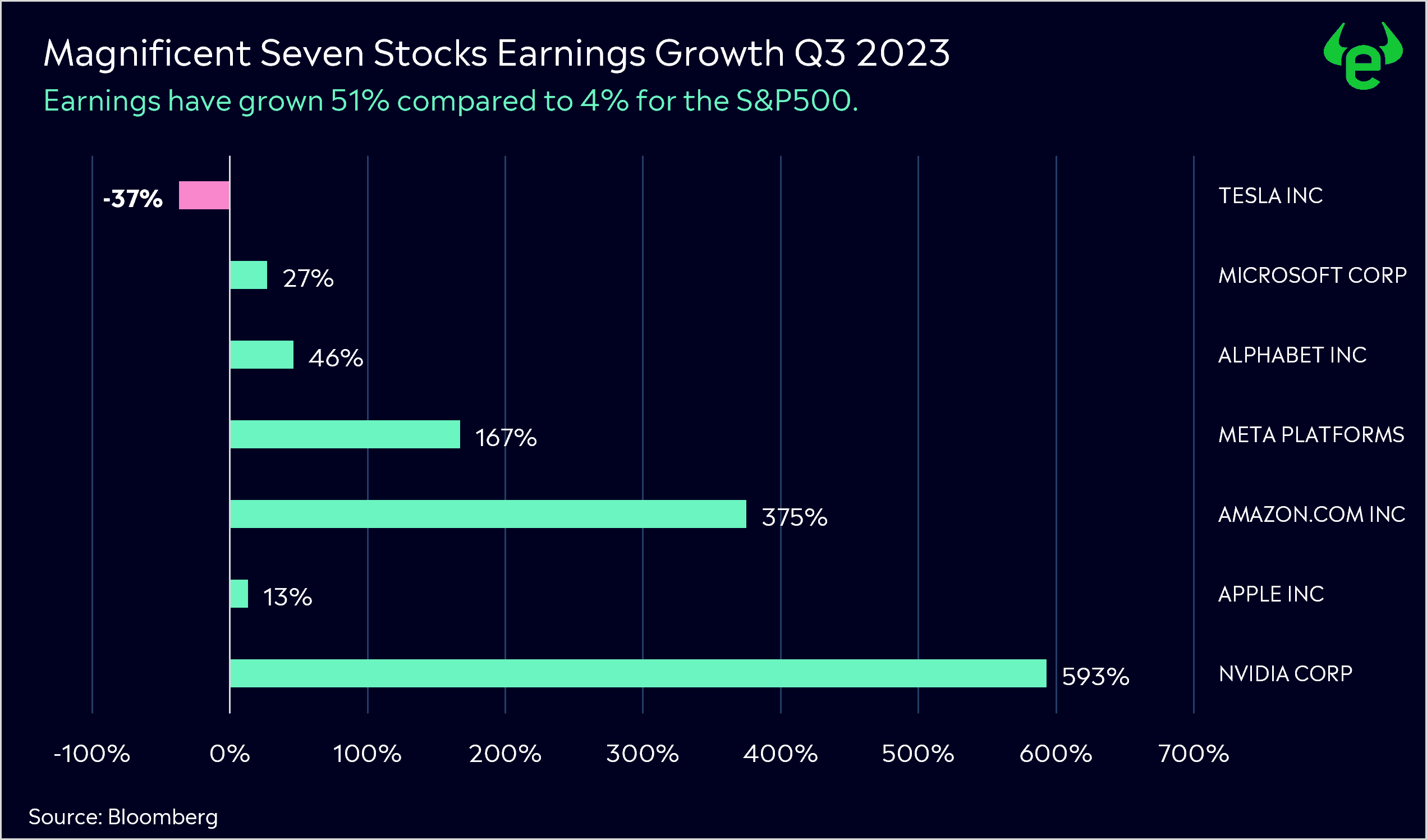

There was simply no margin for error heading into Nvidia’s (NVDA) Q3 earnings, with shares gaining more than 240% before reporting and expectations sky-high, but Nvidia delivered.

It was another blowout quarter for the world’s most valuable chip maker, topping expectations across the board. Revenue grew by 200% year over year, whilst earnings jumped a massive 593%. When you’re expected to be great, you need to be exemplary, and that’s what Nvidia keeps doing.

AI Fueling Revenue Surge

Nvidia’s data center division, the standout performer in its operations, recorded a staggering $14.5 billion in revenue, marking a remarkable 279% increase from the previous year from the same period a year earlier. Simultaneously, the company’s personal computer unit has rebounded from an industry-wide slowdown, boasting an 81% revenue surge to $2.86 billion.

Nvidia’s powerful processors provide the capacity to power, develop and implement Artificial Intelligence (AI), including the highly popular ChatGPT, which has fueled unprecedented demand, underpinning the company’s soaring revenue.

Guidance and China Caution

Importantly, guidance for the fourth quarter was also stellar at US$20 billion, well ahead of estimates of $17.2 billion. However, Nvidia did warn that they expect sales in China to decline significantly in Q4, coming from the US curbs on exports to China. This follows the US government’s revised export regulations in October, aimed at tightening restrictions.

However, Nvidia acknowledged that these changes may not immediately impact its sales owing to robust demand elsewhere. Yet, complying with the requirements has spurred the company to innovate. Nvidia is actively developing new chips designed to circumvent export restrictions, slated for release in the upcoming months.

Investor Sentiment

The robust guidance, however, should overshadow this cautionary note, indicating that there is no end in sight for the AI boom just yet. But, this warning from Nvidia was enough for shares to sell off, dropping by 2% the day after the result. This won’t worry investors too much, though given it’s coming off the back of a record 10-day winning streak, hitting a new all-time high of $505 in the process. Shares have retraced to $478 as of 29/11.

Jensen Huang and the team at Nvidia are hitting home run after home run for investors right now. AI isn’t just Wall Street hype but, clearly, a revolutionary technology that is making Nvidia serious money.

*Sources: eToro and Bloomberg

*Past performance is not an indication of future results.

Invest in Nvidia

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.