It was a positive week for the ASX200, with the index gaining by 0.18%, led by technology and consumer discretionary shares. Healthcare was the worst performer, dropping by almost 5%, dragged down by heavyweight CSL, whose half-yearly results didn’t excite investors.

In the US, hotter-than-expected CPI data dampened expectations on Fed rate cuts, with markets pushing back on a March cut further. This saw US stocks slip for the week, breaking five weeks of gains with the S&P 500 closing down 0.4% and the Nasdaq sliding 1.3%.

3 things that happened last week:

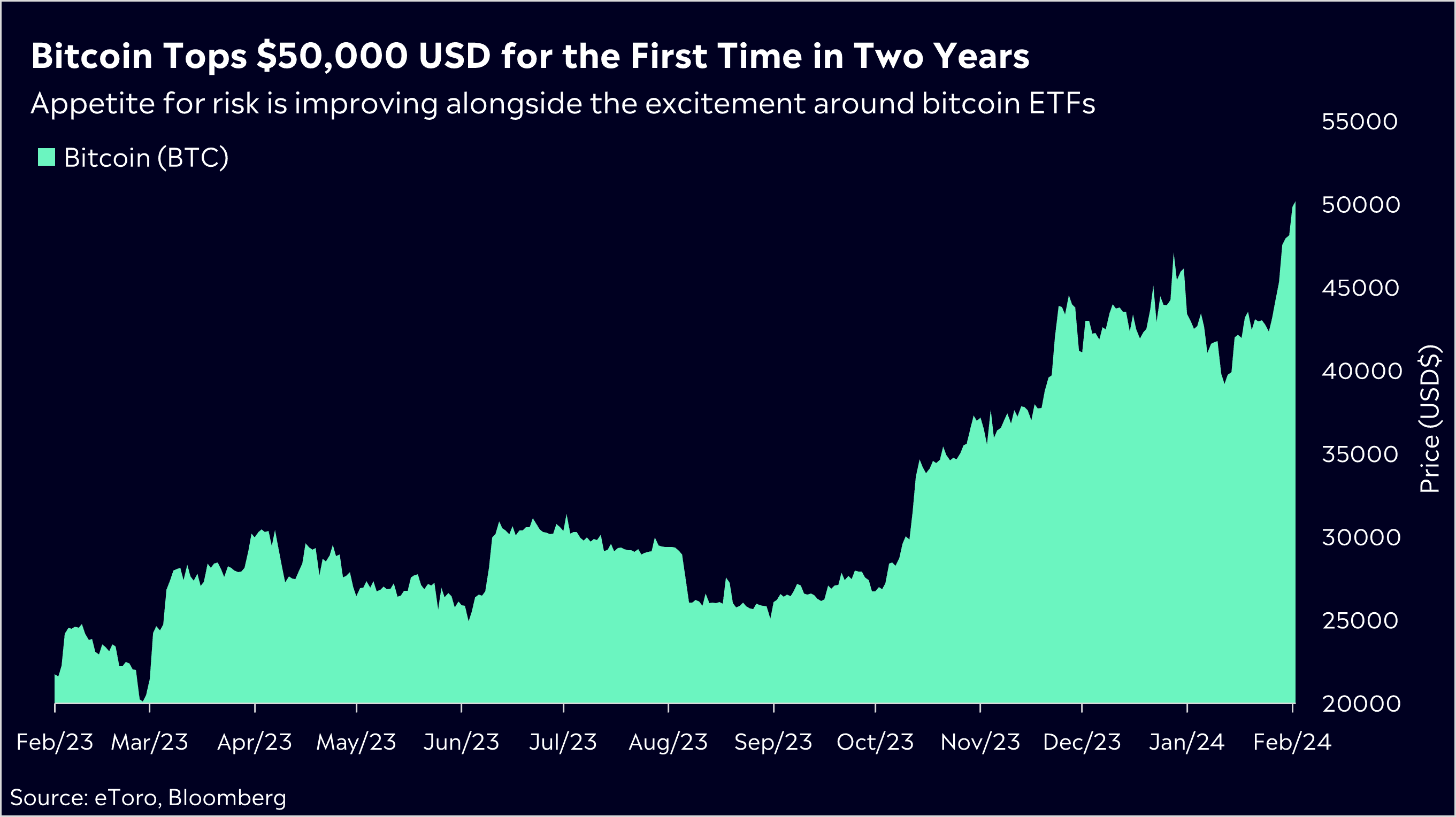

1. Bitcoin Tops 50k for the First Time in Two Years

In what has been a remarkable turnaround since the lows in 2022, the world’s largest crypto asset topped $50,000 last week, and its price tripled in that time as the appetite for risk improves alongside the excitement around bitcoin ETFs.

There is so much for investors to be positive about right now, with plenty of catalysts suggesting this rally has further legs. We’ve got four or five cuts lined up from the Federal Reserve in 2024, the fourth bitcoin halving that will enhance the asset’s scarcity, and further inflows to bitcoin ETFs after already seeing billions of dollars flow in just weeks after launching.

The ETFs have been a success, no matter how you look at it. Seeing this much capital flow into this asset and the trading volumes shows why the market longed for its approval. This is just the tip of the iceberg for ETF flows, and we’ll likely continue to see robust inflows in 2024, which is why bitcoin looks solid.

2. Telstra Half-Year Results Disappoint

It was a lacklustre half-year report from Telstra, with revenue and total income both growing by around 1% and a slightly disappointing outlook for full-year EBITDA.

The good news is that Vicki Brady’s efficiency mode continues to pay off, with net income climbing by 11% year-over-year. This is a solid achievement for the business, given they’re still being able to invest significantly in digital infrastructure across Australia. Cost discipline has been the focus for shareholders in recent years, and when executed well, will continue to be applauded by investors.

Investors would have hoped for a slightly better result on its mobile product income, which missed estimates, following service outages from rival Optus and, therefore, a clear opportunity for Telstra to acquire new customers.

3. A winner and loser last week from the S&P/ASX200

It was a better week for lithium shares last week, and Sayona Mining came out on top, climbing by 41%. Despite a strong week, shares are still down more than 20% for the year.

Strike Energy was the worst performer on the ASX200 last week, falling 31%. It follows a disappointing update from the company showing issues with well-testing activities.

3 things to watch for the week ahead:

1. Nvidia Earnings

It’s easy to see why Nvidia is branded as magnificent, with a five-year return of over 1500%. In that time, Nvidia has become a Wall Street darling that continues to reward investors, taking full advantage of the AI revolution. Last week, the artificial intelligence computing company claimed another feather in its cap, taking the title of the third largest company on the S&P500. Within the last year, Jensen Huang and his team at Nvidia have grown its earnings by 500%, a remarkable feat that’s even more remarkable given Wall Street expects that growth to continue.

This week, consensus has Nvidia reporting earnings of USD$4.56 with revenue of USD$20.26 billion. If the last three results are anything to go by, we could even expect numbers much higher than that.

Investors will be watching its data centre business, which has driven growth thanks to AI, but the main focus will be on guidance. Shareholders will want to hear that sales aren’t slowing down and that the AI boom is not just a flash in the pan. With such outsized gains in less-than-optimal conditions, anything but perfect will put shares on the back foot.

2. Pilbara Minerals Half-Year Results

If you take a look at the worst performers on the ASX200 this year, it’s filled with miners – mainly lithium miners. It’s been a torrid few years for the price of lithium as it continues to freefall, weighing heavily on local miners that enjoyed a strong 2022 during peak prices for the asset. While the pricing environment has softened for the time being, investors should not lose sight of the significant demand for lithium, with EV growth still high at around 30% this year.

The Australian investor favourite in lithium, Pilbara Minerals, reports this week, and shares have held up reasonably well compared to other names. That’s because it has a better balance sheet than most to get it through this lithium winter, allowing it to continue expanding and growing production. Income will fall significantly, but that is to be expected, so investors should instead focus on commentary around production. Ultimately, Pilbara is at the whim of the lithium price, but the business looks the best positioned to navigate this challenging period.

3. Australian Quarterly Wage Index

Michele Bullock and the RBA have continued to see data move in the right direction, with unemployment last week lifting more than expected, showing the labour market is loosening. Rising unemployment will be a significant reason for the RBA to cut rates, with market pricing looking to as early as June for the first cut.

This week, the board receive another key data point from the Quarterly Wage Index. With capacity in Australia’s job market growing, wages should not see too much pressure to the upside from here, given that we will likely see the unemployment rate grow during 2024, all of which is good news for inflation. The Wage Price index is expected to lift to 1% QoQ and to 4.1% year-over-year this week.

*All data accurate as of 19/02/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.