It was another week of gains for the Aussie Market, with the ASX200 climbing 1.6% last week. Energy stocks led the charge, with the sector gaining 5%, and mining stocks ended a three-week losing streak to finish 2.6% higher. Despite gains on the local market, US shares came under pressure, with the S&P500 down 3.4%, and the Nasdaq fell by 5.7%.

3 things that happened last week:

1. RBA Rate Decision

The Reserve Bank of Australia lifted interest rates by 25bps for the second consecutive month, taking the cash rate to 2.85%. The dovish hike from the RBA helped boost markets last week after a 50bps hike was on the cards, given the hotter-than-expected inflation reading a few weeks earlier. However, a 50bps move would have meant a shift back to larger hikes again, a move that the RBA clearly didn’t want to take. Despite the smaller hikes, the RBA expects to increase interest rates further over the period ahead. The Reserve Bank is closely monitoring the global economy, household spending and wages, on top of the housing market that has seen a significant decline in recent months.

2. Federal Reserve Rate Decision

Last Wednesday, the Federal Reserve lifted interest rates by another 75bps, a hike the markets had been pricing in for weeks. The move continued the most aggressive pace of monetary policy tightening since the early 1980s. There was, however, a slight shift from the Fed, who said they were willing to be flexible and will take into account the cumulative tightening of monetary policy. Jerome Powell later said that a slowdown is coming but quickly added that it was too premature to talk about a pause. Even if the Fed slows down rate hikes, rates will likely stay high for some time until inflation comes down significantly.

3. A winner and loser last week from the S&P/ASX200

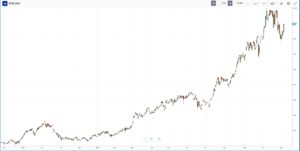

The top performer from the ASX in 2022 had another stellar week, with Whitehaven Coal gaining another 10% last week. The coal price has been on a tear this year after the geopolitical tensions between Russia and Ukraine, and Whitehaven continues to reap the rewards.

It was a pretty torrid week for Dominos as their shares tumbled by 13%. The pizza chain operator saw shares tumble after a disappointing trading update from its annual general meeting. The update showed sales were down 1.8% so far in 2022 and expects earnings to be further impacted by soaring inflation.

3 things to watch for the week ahead:

1. Speech from RBA Deputy Governor Michele Bullock – Are rates higher for longer?

After last week’s second consecutive 25bps rate hike, investors will be keen to hear from RBA deputy governor Michele Bullock this week. Last week, the RBA once again reiterated that “the size and timing of future interest rate increases will continue to be determined by the incoming data”. After the red-hot inflation reading late in October, a 50bps move would have been on the table for the RBA, so it will be interesting to hear if the deputy governor gives us any insight on the board’s decision to stick with a 25bps move. Will her tone also be hawkish? Although the RBA was the first global central bank to pivot, they have recently insinuated that rates will stay higher for longer and wouldn’t be afraid to increase the size of hikes if inflation doesn’t begin to ease. Clearly, the RBA feels it can afford to be patient in waiting for inflation to slow, with ideally only a soft landing rather than a recession for the economy, a luxury other economies don’t have. The key risk with this approach from the RBA is if inflation remains more entrenched in the economy than they have anticipated.

2. US CPI – Sticky Core Inflation is a headache for the Fed

After last week’s 75bps move from the Federal Reserve and Jerome Powell’s comments suggesting it was too premature to talk about a pause, this week’s US Inflation reading will be the market event to watch. Many will want to see the Federal Reserve step down its rate hikes to 50bps in December and begin to pause in the first half of 2023, but inflation is not falling as quickly as the Fed would like. If inflation does come in hot this week, markets will further price in another 75bps move from the Fed in December, which will likely have a significant impact on markets. The Fed has also expressed concern about inflation becoming entrenched, so taking its foot off the gas may be a risk they are unwilling to take right now. Although headline inflation is ‘expected’ to fall again, the market will be focusing on core inflation, which has given Jerome Powell and the committee a headache due to its stickiness, rising again last month to 6.6%, the highest reading so far in 2022.

3. CBA Household Spending Data – Rates rise again, so are consumers spending?

The CommBank Household Spending Intentions Index looks at the payments data from Australia’s largest bank and gives us an insight into the everyday consumer and their current spending habits. Consumer confidence surveys continue to show that Australians are more pessimistic about the economy than they have been in years, but on the other hand, these same consumers continue to spend, with retail sales increasing for the ninth consecutive month, up 0.6% from August. As the RBA continues to raise interest rates, we can expect household spending to slow as demand cools. The key question will be whether the RBA’s rate hikes are already having the desired effect on the average household. Last month’s reading showed a decline in the index for the first time since April, but with the holiday season just around the corner, homes may continue to spend into the end of 2022. This would likely be when households really start to feel the squeeze of cost-of-living pressures and the increase in mortgage payments.

*All data accurate as of 06/11/2022. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.