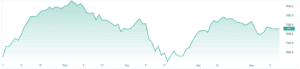

The ASX200 gained 0.5% for the week, with lithium stocks leading the charge. Despite the strong performance of lithium names, the materials sector still finished negative dropping 0.49%, whilst the tech sector soared, jumping almost 3%.

Overseas, US stocks were mixed, with the Nasdaq adding 0.4% while the S&P500 slipped 0.3%. Financial stocks fell once again as concerns over regional banks continued. The debt ceiling also spooked investors, with the potential for a default as soon as early June edging closer.

3 things that happened last week:

1. Australian Budget posts first surplus in 15 years

Investors will be breathing a sigh of relief after last week’s budget, with no major shocks that should materialistically feed inflation or make the Reserve Bank’s job to cool inflation any harder. Inflation is set to come down to 3.25%, which should deliver real wage growth by 2024, helping to ease consumer pressure, opening the door to rate cuts and seeing capital flow back into financial markets. There are short-term headwinds with global economic fears but long-term investors will find value in quality companies that are likely to benefit from strong population growth, China’s economic re-opening and the easing of rates by year-end.

2. US Inflation falls for 10th straight month

US Headline Inflation fell to 4.9% last week for its 10th consecutive decline. Shelter prices which make up a third of the index, fell for the first time in two years, a big positive. In other parts of the basket, food, energy, and used car prices all decelerated. Core inflation also eased to 5.5% from 5.6%, making this a good result for the equity bulls. This inflation progress is key to keeping a data-dependent Fed on pause at 5% when they meet again in June. This print also helps to increase the possibility of the Fed cutting interest rates later in the year.

3. A winner and loser last week from the S&P/ASX200

Allkem (AKE) shares soared by 21.7% after announcing an agreement to merge with lithium giant Livent Corp (LTHM). The company expects the transaction to close by the end of 2023.

Despite a strong week for tech, Block (SQ) fell by 7.5% last week. The drop comes after payments rival PayPal (PYPL) lowered its operating-margin outlook, which sent shares tumbling by 17.7% last week.

3 things to watch for the week ahead:

1. Xero Fiscal Year 2023 Full Year Results

It’s been an impressive start to 2023 for Xero (XRO) shareholders, with shares climbing by more than 30% as investors added tech back to their portfolios with the view of the RBA cutting rates by year-end. Despite this positive start to the year, Xero’s share price remains below its peak of $155 during the 2020-2021 tech boom. The upcoming full-year results announcement holds significant importance for investors, as they hope it will help reignite the shares and push them towards previous highs.

There have been some big changes at Xero in the last year, with Sukhinder Singh Cassidy assuming the role of CEO. She has outlined a strategy to reduce operating costs and drive profitability, which will be the focal point of the upcoming full-year results, particularly after earnings missed expectations in its half-year results and its net loss widened. But, the market believes that the new CEO’s focus on profitability will pay off, expecting to report a net profit of $3 million for the full year-with revenues climbing by 28%.

A strong result will be needed to help sustain Xero’s excellent performance this year and reinforce investor confidence.

2. RBA Meeting Minutes

Following the RBA’s unexpected rate hike in May, investors are eagerly awaiting the release of the RBA meeting minutes this week, hoping to gain a better understanding of the central bank’s decision. At the start of May, the Reserve Bank lifted Australia’s cash rate by another 25bps to 3.85% after the market had priced in a 90% chance of a pause, saying that inflation was too high.

The key concern for investors is whether the RBA will maintain its hawkish stance. If the board continues to signal the possibility of ‘further tightening to monetary policy’, it may lead to market weakness since the market is now pricing in rate cuts by October. However, any shift in language to hint that the end of the rate hikes could be in sight will be well received by the market.

But, the RBA will walk a fine line between outlining that previous tightenings will begin to have their effect whilst still signalling that inflation is still too high. If the RBA gives an inch, the market will take a mile.

3. Tencent and Alibaba announce quarterly earnings

With Chinese Tech equities having a tough few months, investors will be looking towards the Chinese reporting season for boost that is well needed. This week, Tencent (0700) and Alibaba (BABA) will hand down quarterly earnings and expectations are low. Earnings estimates for the Hang Seng remain near record lows, Alibaba’s sales growth is set to come in under 3%, and Tencent will still report single-digit growth, a stark contrast from the years of 20%+ revenue growth.

If US earnings can tell us anything, it’s that low expectations can often lead to upside surprises, which would be positive for investor sentiment. Despite plenty of optimism from the re-opening in China, consumers are still reluctant to spend with worries over an uncertain economic outlook, and that hasn’t lived up to expectations that stocks priced in at the start of the year.

Although it may be another challenging quarter for Chinese Tech, both Alibaba and Tencent’s attractive valuations may present long-term opportunities for contrarian investors.

*All data accurate as of 08/05/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.