Moving into a new apartment means furniture shopping—and if you’re like me, that starts with a click, not a trip. That’s where Temple & Webster comes in, Australia’s go-to online retailer for furniture and homewares. From sofas to décor, they’ve got it all, minus the brick-and-mortar stores. But how does this e-commerce retailer stack up as an investment? Well, they’ve delivered massive returns for shareholders in the last five years, but can that continue? Let’s find out.

- Temple & Webster’s asset-light e-commerce model has enabled strong growth, while recent AI integrations are boosting efficiency.

- The business has grown its active customer base to a record 1 million in FY 2024, with Temple & Webster targeting $1 billion in sales within the next five years.

- Temple & Webster has 10 buy ratings, 3 holds, and no sells, with an average price target of AUD$13.01, indicating a potential 14.3% upside.

View Temple & Webster

The Basics

I recently moved into a new apartment, and as you do, I’ve been on the hunt for some new furniture. Given that it’s 2024, most of that shopping started online, and almost every search brought me to Temple and Webster. They’re Australia’s largest online retailer specialising in furniture and homewares, providing customers with everything from sofas to décor, all delivered straight to your door.

Their business model revolves entirely around e-commerce, which has given them an edge in the rapidly growing online shopping industry. They are entirely online and have zero brick-and-mortar stores. Temple & Webster avoids the high costs associated with physical stores by focusing on digital retail, allowing them to invest more in technology, customer experience, and competitive pricing. Importantly, they have a great mix of affordable and higher-end products, appealing to a broad demographic.

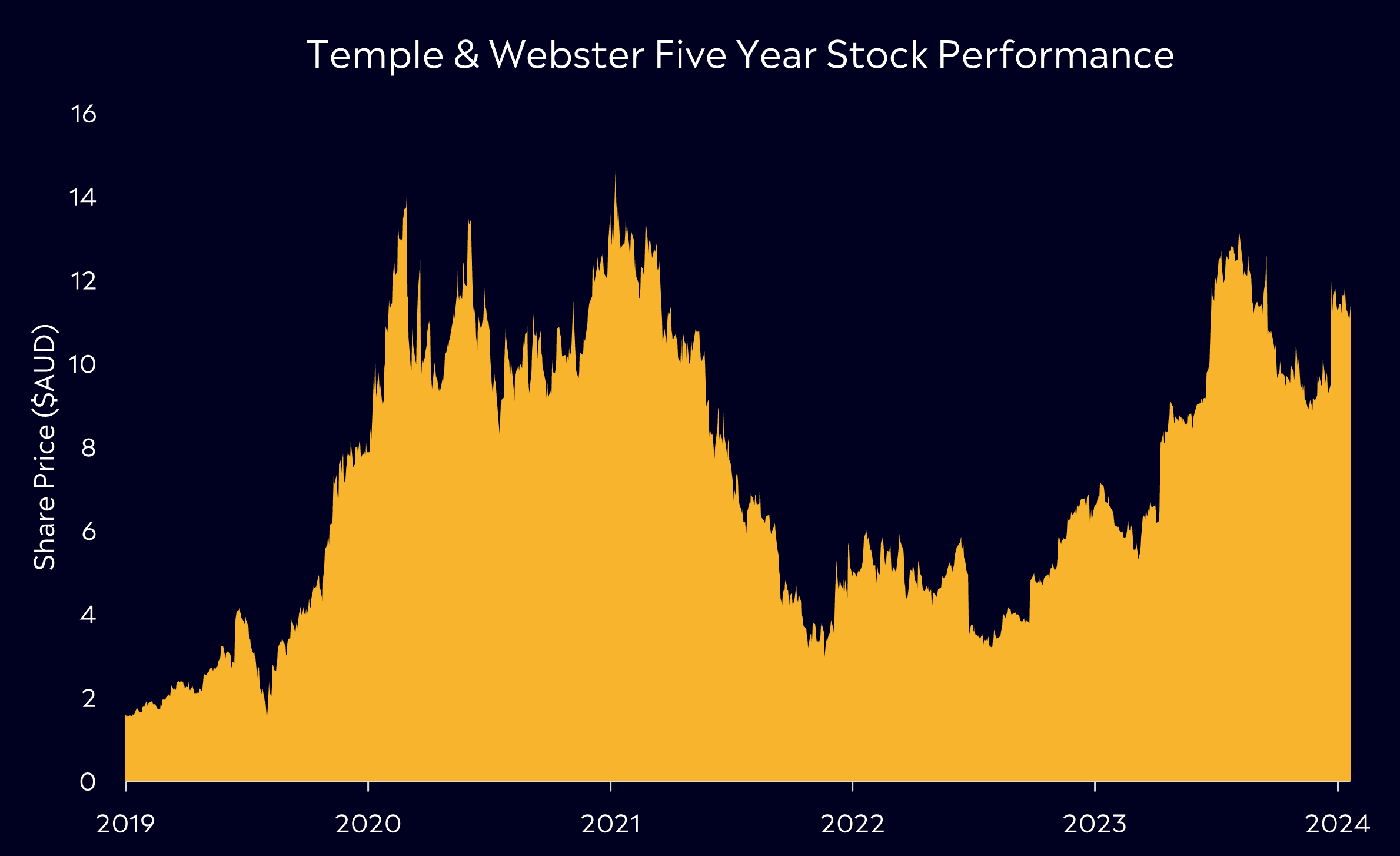

The company has seen impressive growth in recent years, benefiting from the e-commerce boom. Since 2020, Temple & Webster’s revenue has grown over 180%. They have over 200,000 products on their website through a drop-shipping model while also providing a private label range of products. The business has an ambitious target of reaching AUD$1 billion in annual sales within the next five years, which would require seeing its revenue double. In the last five years, shares have jumped by more than 550%, representing its solid growth, with active customers growing to a record 1 million in FY2024. However, shares have still yet to reach their record high from 2021 at $14.71.

Fun Fact: CEO Mark Coulter has been with Temple and Webster for almost 14 years, and insiders own more than 12% of the company, signalling confidence in the firm’s future prospects.

Competitor Diagnosis

The real win for Temple & Webster is that the Australian furniture market is seeing a continued migration to online platforms as consumers seek convenience, broader selections, and competitive pricing. Without expensive stores and sales networks to support, it can generally offer products at comparable prices its offline and omnichannel peers find difficult to match.

However, Temple & Webster faces plenty of competition in the furniture and homeware space in Australia. Arguably, none is bigger than IKEA. They’re a global giant known for their flat-pack furniture and huge brick-and-mortar stores, quite the opposite of Temple & Webster. IKEA, though, has been ramping up its online presence and will continue to be a formidable competitor.

Other competitors include retail giant Harvey Norman, a staple in Australian retail. Fantastic Furniture, known for its value-driven offerings, and Freedom Furniture, which is stepping up its investment in e-commerce. This could pressure Temple & Webster, particularly in the premium furniture segment.

Temple & Webster continues to benefit from its head start in the e-commerce space. Still, the battle for market share will intensify as competitors invest more in their digital offerings. However, they also have the most extensive online product range in Australia, which means that as we see more consumers looking to buy furniture online, there’s a very good chance they will end up on the Temple & Webster website, just like me.

Financial Health Check

Temple & Webster continues to grow its market share in Australia, but it has plenty of room to grow further. In Fiscal Year 2024, its market share of the total furniture & homewares market is now 2.3%, up 31% year on year. They run a profitable asset-light business model, with FY24 EBITDA at AUD$13.1 million and profit is set to grow dramatically over the next couple of years.

That asset-light business model has helped its balance sheet. The business finished the year with AUD$116 million in cash and no debt, allowing Temple & Webster to enter into an AUD$30 million on-market buyback. Its balance sheet also allows the business to continue investing in logistics, customer experience, and technology while benefiting from the economies of scale.

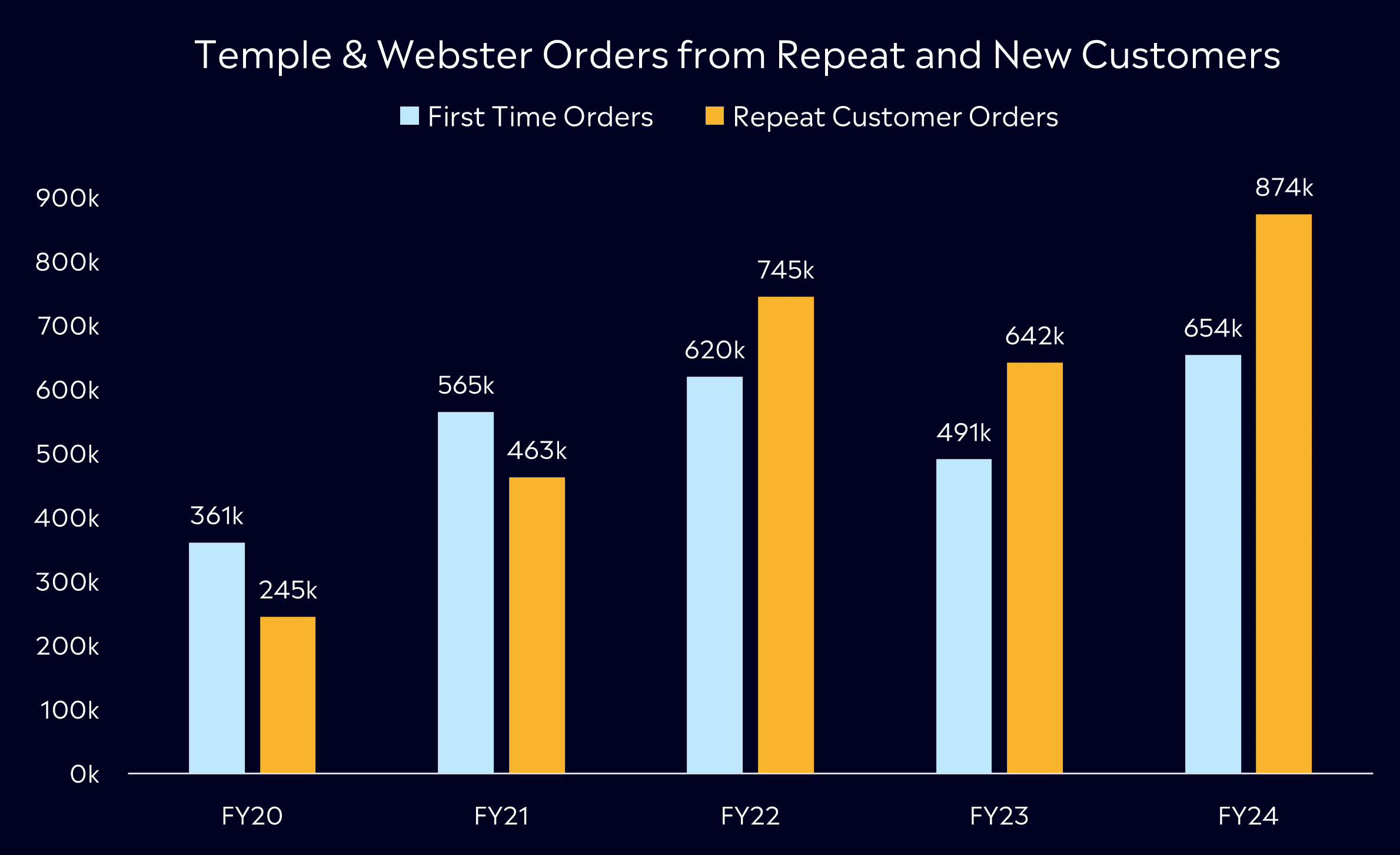

Like most businesses in 2024, Temple & Webster has looked to harness the power of AI. 40% of customer support interactions are now handled by AI, resulting in AUD$4 million in annualised savings. Temple & Webster’s growth is not only coming from attracting more customers but also from growing its repeat customer orders. Their focus on digital innovation, data-driven marketing, and streamlined logistics have helped them maintain a strong position in the market. Their cash flow remains healthy, and they continue to invest in their online platform, positioning them well for future growth.

Buy, Hold or Sell?

Temple & Webster’s growth trajectory since 2020 has been impressive, with its share price reflecting this significant progress. However, it hasn’t been entirely smooth sailing. As the chart above highlights, the business faced challenges in 2023, with first-time and repeat orders declining due to supply constraints and a shift in consumer spending. Moving forward, risks like supply chain pressures, rising competition, and a slowdown in retail spending could pose challenges for the company. While its growth has been remarkable, the journey hasn’t been without hurdles.

That said, analysts remain optimistic about Temple & Webster’s future. According to Bloomberg’s Analyst Recommendations, the company has 10 buy ratings, 3 holds, and no sells, with an average price target of AUD$13.01, indicating a potential 14.3% upside.

Temple & Webster has firmly established itself in the booming e-commerce sector, and its robust revenue growth is a testament to that. With a strong balance sheet and ambitious growth targets, the company is well-positioned to continue its upward trajectory—though investors should remain mindful of the risks. Given its track record, Temple & Webster remains a business to watch closely.

View Temple & Webster

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.