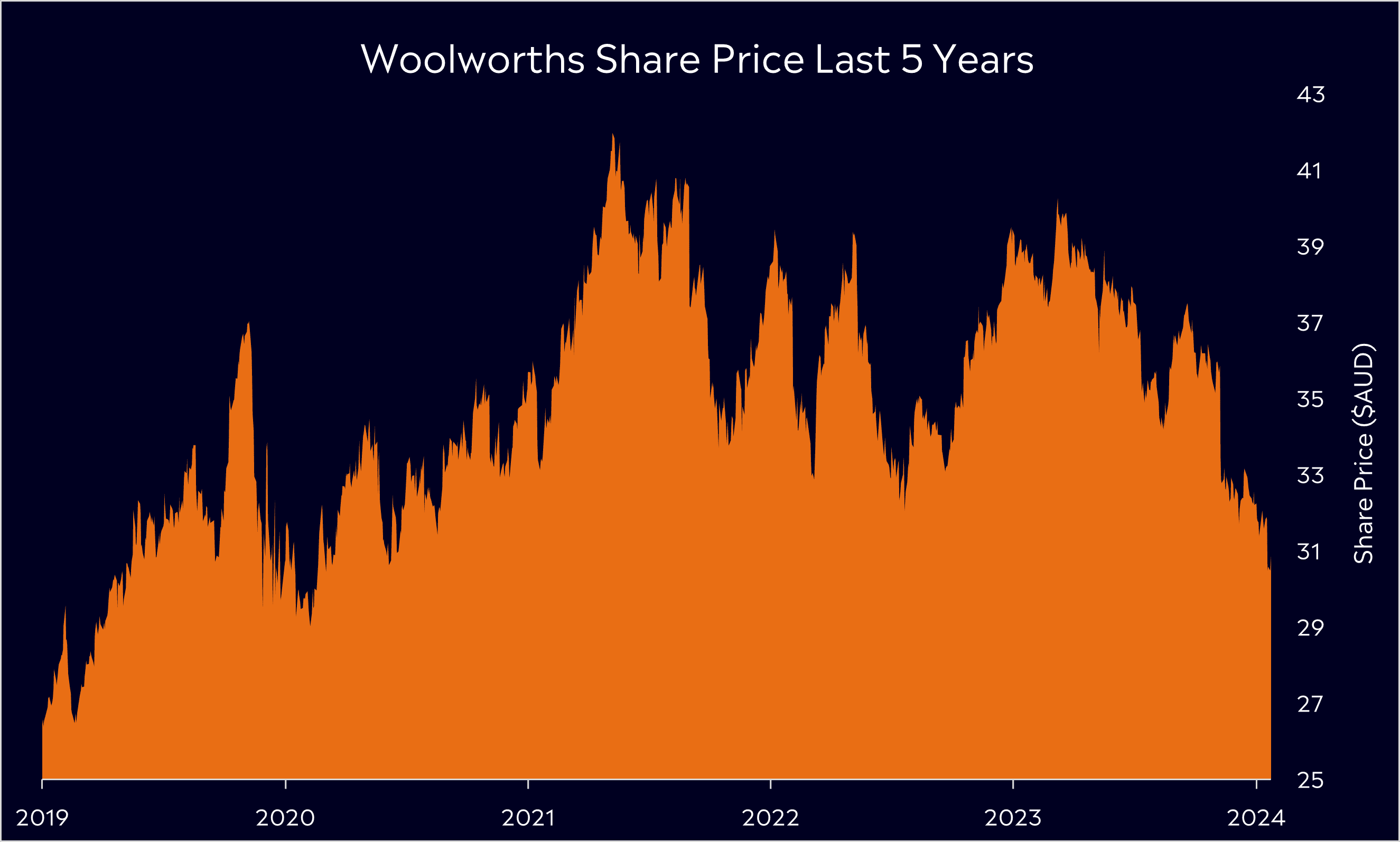

Woolworths (WOW) is a household name to most Australians, and in the last 12 months, the business has been thrown into the limelight, facing heightened political and media scrutiny. This, combined with slower sales to start the year, has sent shares to a four-year low. Is this a good time to invest in Australia’s largest supermarket chain, or will challenges hinder its growth? Let’s find out.

- While shares reached record highs in 2023, Woolworths shares have fallen over 20% in the last 12 months, trading at the lowest levels since the pandemic.

- Challenges remain in place, from ongoing ACCC investigations to increasing competition. However, these risks seem to have been priced in by investors.

- Sales have started the year slowly, but growth in e-commerce as well as its dominant market share, means analysts like it. The average price target from analysts via Bloomberg signals a 10% upside from current levels alongside its 3.5% dividend yield.

View Woolworths

The basics

Founded in 1924, and known to many as ‘The Fresh Food People’, Woolworths now operates over 1,400 stores, employs over 100,000 people and serves a massive 24 million customers a week. That’s almost the whole of Australia’s population flooding through their stores each week. In 2023, it was Australia’s largest company by revenue, raking in over AUD$64 billion in sales.

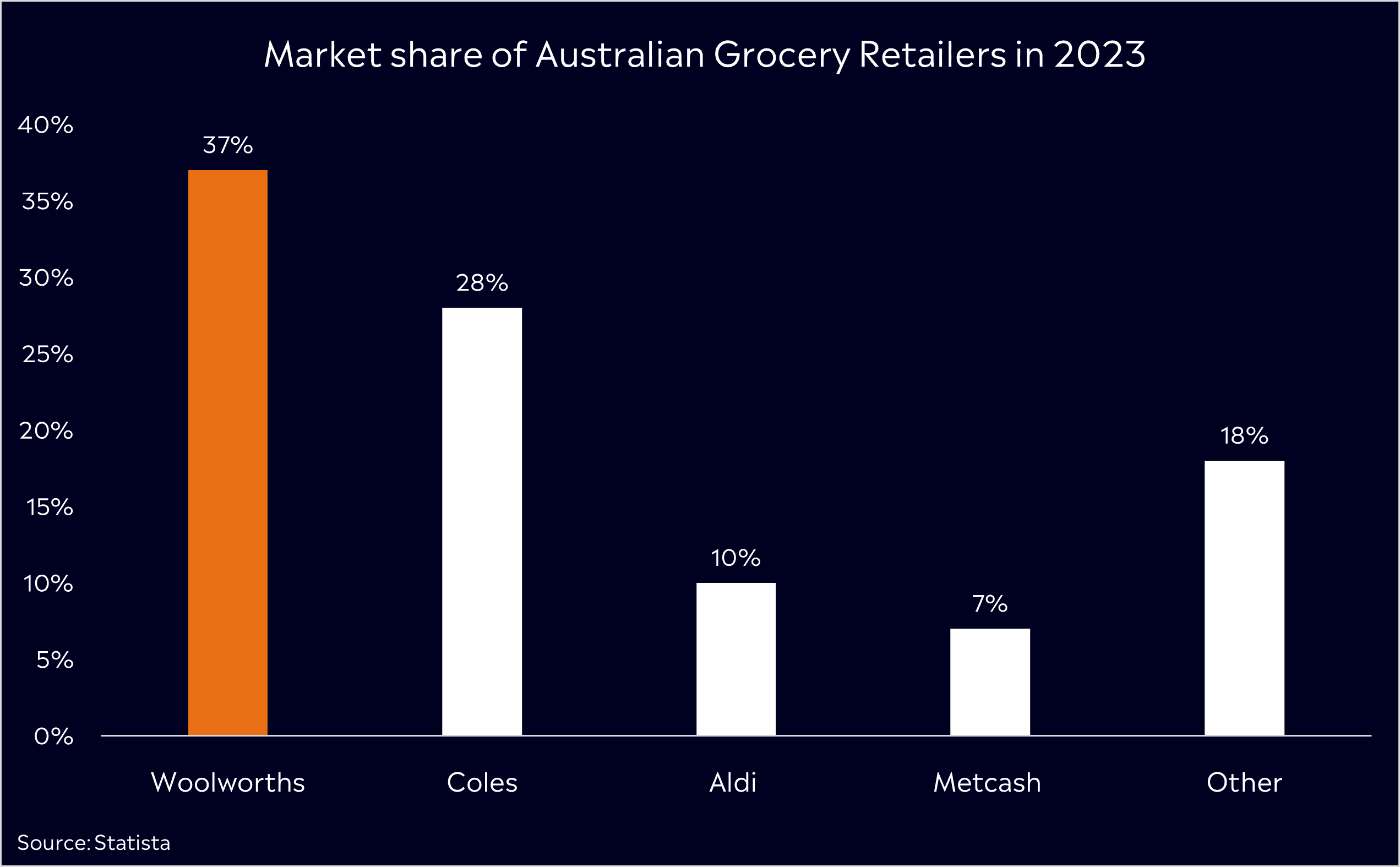

Woolworths has four main segments: Australian Food, New Zealand Food, Australian B2B, and Big W. Australian Food is the largest of the four, contributing over 80% of total revenue, and this remains Woolworths’ crown jewel, with the brand accounting for 37% share of Australian Supermarkets.

Competitor Diagnosis

For decades, Woolworths has dominated the Australian supermarket sector, with Coles (COL) as its primary competitor. But, the expansion of Aldi and Costco (COST) in Australia has seen the stiffest competition for these two giants in years, forcing Woolworths to remain price-competitive.

Despite that, Woolworths grew its market share in 2023, driven by investment in e-commerce, through WooliesX. It saw 23% sales growth in Fiscal Year Q3 2024 as customers became more active and delivery times improved. Woolworths has established itself as a digital leader with 9.7 million reward members and weekly traffic to its digital platforms growing by 18% year-over-year in Q3, serving as an excellent base for growth over the years ahead.

Online shopping and delivery services provide the differential for Woolworths to Aldi and Costco, who are looking to steal market share by targeting cost-conscious shoppers. Coles also remains a significant threat, posting stronger food sales than Woolworths in Q3.

Financial Health Check

In Woolworths’ most recent financial update in February, the retail giant reported revenue of AUD$34.6 billion (4.4% up year-over-year) with EBITDA of AUD$3.08 billion (8% up year-over-year). The biggest challenge remains the wafer-thin margins, with Woolworths’ after-tax profit margin at 2.7%. The good news is, bad news has been baked into the share price, with shares now trading at AUD$30.76, well below their 5-year average of AUD$34.72.

Looking forward, estimates are for earnings of AUD$1.42 for the full year 2024, set to be reported in August, giving the company a price-to-earnings ratio of 21. Given the quality of Woolworths’ business with its growth in e-commerce, dominance in market share and EBITDA growing in single digits, it seems fairly valued.

Amongst all of this, Woolworths is facing a PR nightmare with ongoing investigations from the ACCC (Australian Competition & Consumer Commission) and the recent announcement of CEO Brad Banducci’s departure. After Banducci has spent eight years in charge, this is a big shift for Woolworths. However, this feels like a timely pivot, and it may prove to be prudent. Amanda Bardwell is a great fit to take over the helm at Woolworths, having run two highly successful segments of the business in WooliesX and Loyalty.

Buy, Hold or Sell?

Investors’ confidence in Woolworths has undoubtedly been dented over the last 12 months, and that’s represented in the weakness we’re seeing across shares. However, the last time shares saw a fall of 20% or more, back between 2015 and 2016, shares soared by 120% over the next five years.

According to Bloomberg’s Analyst Recommendations, Woolworths has 5 Buys, 8 Holds and 4 Sells. The average price target across those recommendations is $34.05, representing over 10% upside from current levels. Goldman Sachs has the highest rating at AUD$39.90, whilst Morningstar has the lowest at AUD$27.50.

Investors should also remember that Woolworths also offers an attractive dividend, set to reward investors with a fully-franked 3.5% yield for FY2024, projected to grow to 3.7% for FY2025.

The next few months will remain challenging for Woolworths, but many investors will see recent weakness as an opportunity to own a high-quality and defensive business at an attractive valuation.

View Woolworths

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.