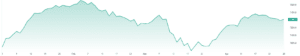

After a shorter week of trading, the ASX200 slipped to a 0.29% loss last week, with the materials sector dragging the index lower. The big news of the week was Australian Quarterly Inflation fell to 7%, slightly higher than market expectations of 6.9%.

Overseas, US markets gained for the week, with the S&P500 up 0.87%, but equity markets were on edge after First Republic Bank (FRC) shares fell by another 49%.

3 things that happened last week:

1. Big Tech delivers solid earnings

It was a great week for big tech last week, with Microsoft (MSFT), Alphabet (GOOG), Meta Platforms (META), and Amazon (AMZN) all delivering better-than-expected earnings. The standout was Microsoft, whose numbers were stellar across the board, with solid cloud growth the standout. A big discussion from all big tech conference calls was AI, one of the leading technology themes in 2023. Microsoft is likely in one of the strongest positions on Wall Street for now, given its investment into OpenAI, which has been so successful this year.

2. Pilbara Minerals production falls

Pilbara Minerals (PLS) had a tough first quarter, with a 9 per cent decline in spodumene production and a 3 per cent drop in shipments. To add insult to injury, Pilbara Minerals’ production costs also grew in the quarter, with labour shortages, inflation and supply chain issues all contributing factors. This was a disappointing result, particularly with the lithium price free falling over the past year, alongside the mining giant’s spodumene sales price falling by 15 per cent. The lithium miner has seen record growth over the last 12 months as the transition to clean energy, particularly electric vehicles, ramps up. However, subsidies are ending after years of support and demand for battery inputs has dropped in the short term. This is a small bump in the road for Pilbara, particularly given China’s re-opening spells positivity, especially in the second half of the year – but falling lithium prices will remain a concern for the immediate future.

3. A winner and loser last week from the S&P/ASX200

Megaport was the leader on the ASX200 last week, gaining by 33% after a strong quarterly update. Goldman Sachs (GS) also reaffirmed its $8.10 price target, giving the tech company another 44% upside.

Mineral Resources (MIN) had a tough week, with the mining company falling by -6.4%. The company slashed its full-year production guidance for its core mining services division, sending shares lower.

3 things to watch for the week ahead:

1. RBA Rate Decision

Aussie eyes will focus on the RBA this week as investors look to see if the central bank will keep rates on hold once again. Quarterly inflation data last week showed inflation has eased from its peak, coming in at 7%. The headline number came in line with expectations, whilst trimmed mean inflation came in below expectations at 6.6%. This reading offered no real surprises from what the RBA already knew after pausing in April, scaling back expectations for another rate hike this week. However, another increase can’t be ruled out, with inflation still way above the RBA’s target rate of 2-3%. One look overseas shows that fighting inflation is no easy task, and that is something the RBA has to consider. But the bottom line is that the central bank put rates on hold to give itself some time to breathe while assessing the state of the economy after its huge tightening cycle. Given that this data didn’t throw up any shocks, the market would be surprised by a hike this week.

2. Federal Reserve Rate Decision

It’s one central bank to the other this week, and the Federal Reserve looks set to hand down one final ‘insurance’ hike. US inflation is still the most important number in markets right now, driving the Fed and recession risks. Although headline inflation fell in March to 5%, the worry was that core inflation jumped to 5.6%, which is why the market is now expecting a 75% chance of another hike this week. Outside of inflation, there are also a few other key indicators that likely means another 25 bps hike is nailed on, with unemployment still low, consumer confidence rising in March and equity markets still gaining this year, with the Nasdaq up more than 17%. Banking issues have helped to do some of the Fed’s job so far this year, with tighter liquidity slowing loan growth and inflation expected to fall faster. Despite expectations for another rate hike, the market is still pricing in at least two rate cuts this year despite Jerome Powell saying there would be none. Rate cuts would spell good news for risk assets, particularly for tech and crypto, in the second half of the year.

3. Apple Earnings

After a strong week of earnings from Big Tech last week, Apple (APPL) investors’ expectations are high, with little to no room for error from the tech behemoth. The worry heading into the report is whether the global slowdown in computing device spending will dampen demand for its Mac computer, which accounts for 10% of Apple’s revenue. However, the focal point is the iPhone, its primary revenue driver. Sales may be boosted by the re-opening of China, a large market for Apple as well as easing supply chain disruptions. Given the current environment, I’d also expect to hear from Apple’s management on fine-tuning operating expenses for the full year to help margins, with its forecast for the next quarter likely to be scrutinised by the street. Revenue is expected to decline by 4.8% year-over-year to $92.6 billion for the quarter, whilst earnings look set to fall by 6%. Apple investors aren’t accustomed to being disappointed on earnings, but they were let down last quarter, so a strong result and a beat will be needed in order to underpin Apple’s 30% gain in 2023.

*All data accurate as of 01/05/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.