The ASX200 finished higher on Friday after a wild week for markets. Despite gains on Friday, the index still finished 2% lower for the week. US stocks also rebounded, with the S&P500 only finishing down 0.04% last week. Last week’s volatility highlighted the importance of diversification in an investment portfolio.

It’s a busy week ahead with AU reporting season moving into full swing. US earnings continue to roll through, with huge retailers, Walmart and Home Depot reporting alongside Alibaba. On the macro front, Australian unemployment and US inflation data are the key data points for the week.

3 things that happened last week:

- Markets rocked by volatility

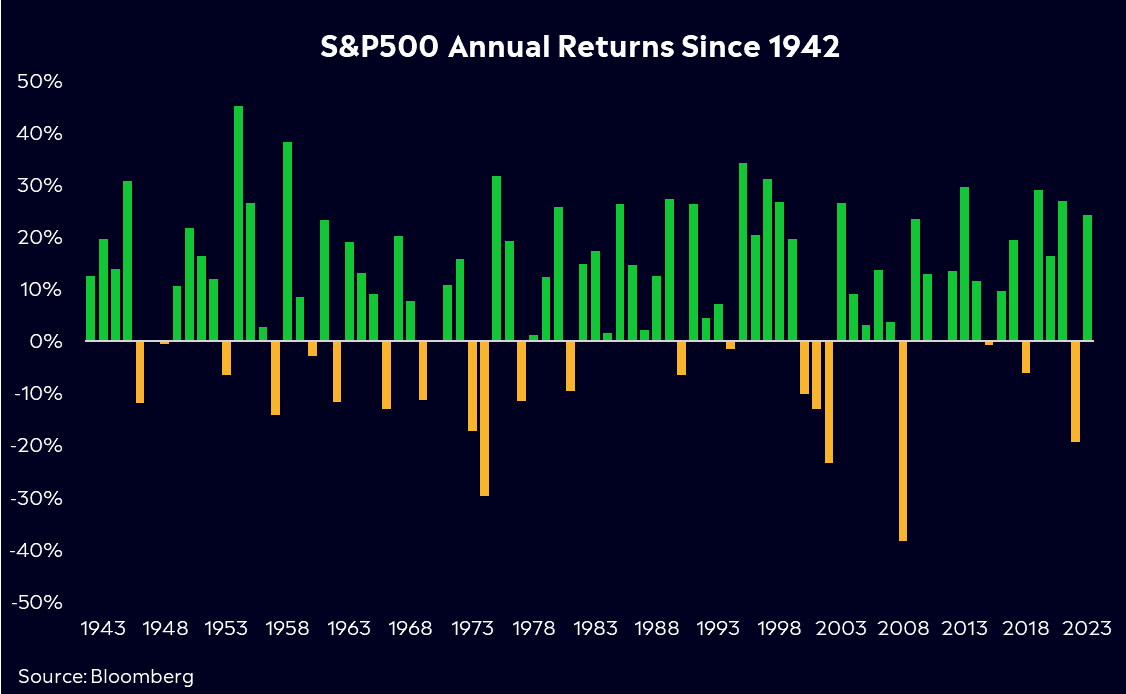

Last week, markets were rocked by a bout of volatility as recession fears grew and the Yen carry trade came unstuck. For more on what happened last week, click here for the full explainer. After one of the worst days in global markets since the pandemic, it’s fair to say investors are going to feel uneasy. However, it’s important to zoom out. Yesterday’s fall for the Nasdaq, S&P500, and ASX on a 5-year chart is merely a blip. Pullbacks are uncomfortable for investors, but they happen and are simply the price of entry into the stock market. Sell-offs of this magnitude highlight the importance of not timing the market and using a simple strategy such as dollar cost averaging. In our view, this bull market isn’t finished yet. If we look to the US, solid earnings growth is a reason to be positive. With most of the S&P 500 reporting, earnings are up 11.5% annually, the fastest since late 2021, and revenues have grown for 15 straight quarters. Strong economic growth also supports optimism. US GDP grew by 2.8% in the second quarter, continuing a trend of over 2% growth in seven of the last eight quarters.

- RBA leaves rates on hold, again

Last week, the RBA left rates on hold for its sixth straight meeting. There were question marks recently surrounding another hike, however, the RBA’s case to hike has slowly wilted away recently. Unemployment rose, GDP data in Q1 was weak, and inflation was almost in line with the board’s projections. Markets are pricing in a full cut by the end of this year. For now, that seems slightly optimistic, but not entirely out of the question. Michele Bullock has reiterated that the board isn’t ruling anything ‘in or out’. That’s a key message that has been retained and shows that the board is still worried about the upside to inflation, making this a hawkish hold. For now, there will be no hikes or cuts either, but rates will remain restrictive. The worst seems to be behind for the RBA; they’ve cleared that final hurdle, but there is still ground to cover, and it’s going to be a photo finish.

- A winner and loser last week from the S&P/ASX200

There were limited winners on the ASX last week, but AMP Ltd (AMP) topped the charts up by more than 8%. It followed a solid full-year report with its Super business reporting a 21.4% increase in underlying profit.

It was a tough week for Audinate Group (AD8), whose shares tumbled by more than 37%. The AV solutions provider beat full-year earnings but offered poor guidance for the next financial year.

3 things to watch for the week ahead:

- US Inflation – Wednesday

After last week’s call by the RBA to keep rates paused prompted a collective sigh of relief across the nation, investors will now be focused on the US, where the latest inflation reading is due to be handed down on Wednesday. Headline inflation is expected at 3% year-over-year, whilst core is expected to fall to 3.2% from 3.3% in June. This is going to be a key data point for markets, especially after last week’s volatility and recession fears.

A US Fed rate cut is still expected in September, thanks to the unemployment rate continuing to rise as expected. Markets are now pricing for 125 bps of cuts from the Fed by the end of January, a significant shift. However, some Federal Reserve officials flagged last week that there was still work to do in cooling inflation. If September’s cut goes ahead as hoped, it’ll stoke hopes of cuts across the rest of the west, given the UK delivered its first cut of the cycle at the start of this month, and some analysts now believe end-of-year rate cut in Australia is creeping back towards becoming a possibility.

- AU Employment – Thursday

Unemployment continues to be a major concern in Australia’s efforts to combat persistent inflation. In June, Australia’s unemployment rate rose to 4.1%, but the RBA will likely still want to see unemployment rise to somewhere between 4.25% and 4.75% before the year’s end in order to reverse this persistent period of inflation. The RBA’s decision last week to leave rates on hold for the sixth consecutive meeting may bring some relief, as another hike was likely to push unemployment much higher than the RBA would have liked. The recent unemployment reading in the US showed there is a fine line between cooling the labour market and sparking serious slowdown concerns.

However, the decision to leave rates on hold may still spark a large jump in Australia’s unemployment rate. In June, the number of job ads on SEEK slipped by 17.1% year to date, while the number of applicants per job ad rose dramatically. It’s continuing to be challenging for Australians to manage a mortgage or find work right now, with Michelle Bullock recently reaffirming that the bank was unlikely to start cutting rates this year coming as a disappointment to many already struggling households.

Based on current projections, there may be even worse conditions ahead before the central bank announced inflation is truly under control.

- AU Reporting season moves into full swing

Australian earnings season moves into its second week with a bumper lineup, including ASX Limited itself posting results. This stack contains some useful measures for Australia’s overall economic health. Seek’s results will provide some small insight into the state of employment in Australia, while JB Hi-Fi’s earnings generally provide a good measure of the retail industry’s on-the-ground performance.

Banking, telecom and energy titans Commonwealth Bank (CBA), CSL (CSL), Telstra (TLS), Origin Energy (ORG) and AGL Energy (AGL) will also be reporting, along with building materials manufacturer James Hardie and more than sixty other companies. As energy costs continue to climb for consumers, it’ll be particularly interesting to see how energy providers’ earnings measure up against each other.

CSL, the biggest healthcare company in Australia by a wide margin, is estimated to report FY24 earnings of US$14.7b. CSL, along with plenty of other healthcare providers, have underperformed in the last three years, but many are expecting to see a return to form as we begin a new financial year. As will be the case across most big names this reporting season, it will need to deliver or else the market will punish shares.

*All data accurate as of 12/08/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.