The ASX200 fell by 1% last week, despite the RBA keeping rates on hold as they begin to close the door on the extended hiking cycle. The US credit rating downgrade last week tipped markets into negative territory, with the S&P500 falling by more than 2%. This was not helped by market giant Apple, with its shares falling by 5% on Friday after reporting a third consecutive quarter of negative revenue growth.

In the US, earnings season continues with Palantir (PLTR), Disney (DIS), and United Parcel Service (UPS). Of the 84% of companies from the S&P500 to report so far, 79% have reported earnings above estimates – above the five-year average of 77%. The earnings decline, for now, is ‘better-than-feared’ with a -5.2% decline in earnings against the -7.5% decline the market had anticipated. The good news is that this is the trough of the slowdown, with the market expecting earnings growth in the second half of 2023.

For more on US earnings, listen to Market Bites on Digest and Invest.

3 things that happened last week:

- The Reserve Bank stays on pause

The Reserve Bank of Australia left the cash rate unchanged last week at 4.1%. The decision was highly anticipated, with markets pricing in a pause, but economists believed the Reserve Bank would hike with the labour market so tight. With two consecutive pauses, it seems the RBA might have finished its hiking cycle. The case for keeping rates on hold was influenced by lower-than-expected inflation, declining retail sales, and Governor Lowe’s bid to engineer a soft landing. I think investors can take the decision and the statement as dovish with a bias for leaving rates on hold unless there is a notable shift in data. For investors, it means that the peak of interest rates might just be here, which will likely see the ASX200 extend its recent gains.

- Amazon delivers, while Apple disappoints

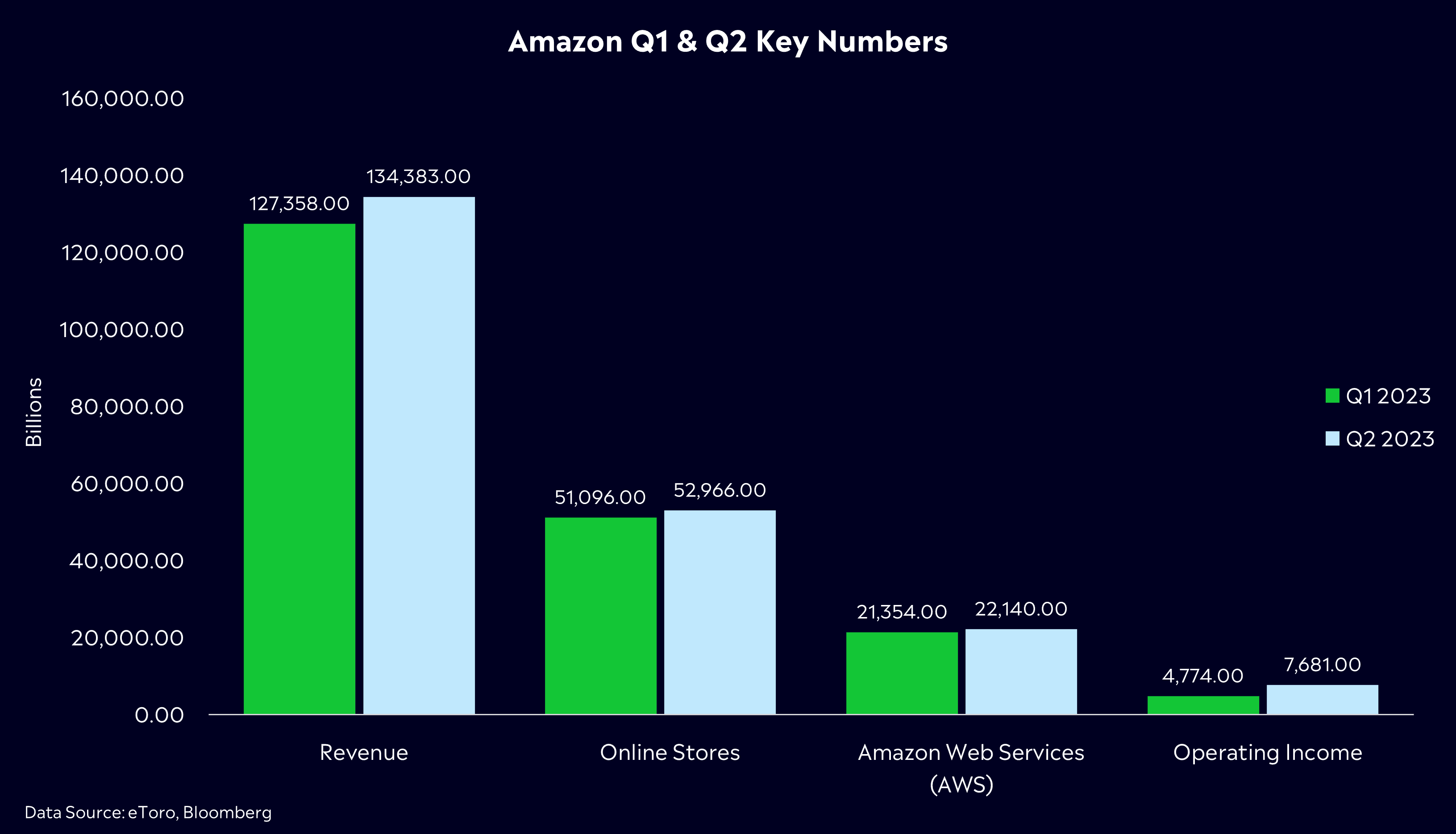

Last week, earnings rolled through, with the last of the big names reporting. Amazon (AMZN) delivered and Apple (APPL) disappointed. Apple’s revenue declined for the third consecutive quarter with lower-than-expected iPhone sales. Apple is clearly facing challenges in a difficult macro environment, but the upcoming release of the new iPhone next month couldn’t come at a better time for Tim Cook and his team. For Amazon, it was a solid beat across the board. The heartbeat of Amazon’s profitability right now is AWS, and the good news is growth stabilised. Revenue surpassed Wall Street forecasts, with 12% growth year-over-year. Online sales also showed signs of a recovery, with revenue growth of 4%, after two previous quarters of declines. Importantly, Amazon’s cost-cutting is paying off. Operating expenses were up 7.5% for the quarter, its slowest rate since 2012, whilst operating income more than doubled year-over-year to $7.7 billion.

Past performance is not an indication of future results.

- A winner and loser last week from the S&P/ASX200

TPG Telecom (TPG) stole the limelight last week, with shares climbing by 8.8%. It comes after Vocus Group made a bid to acquire TPG’s Enterprise, Government and Wholesale assets for $6.3 billion.

It was less good news for ResMed Inc (RMD), with shares falling by 8.3% last week. The healthcare giant missed market expectations on its FY23 results and gross margins contracted.

Past performance is not an indication of future results.

3 things to watch for the week ahead:

1. Reporting Season – Low expectations

The ASX200 has risen for the last two months, aided by the Reserve Bank of Australia seemingly winding down its tightening cycle as inflation falls and the expectation that the US can avoid a recession. Reporting season will be the next catalyst to tallying three months of gains for the local market, but given the low expectations, there are downside risks. Looking ahead to this week, some of the more prominent names start to roll through, with ASX200 giant Commonwealth Bank (CBA) reporting alongside Computershare (CPU), Newcrest Mining (NCM), AGL Energy (AGL) and REA Group (REA), to name a few. AGL Energy will be a name to watch this week after revising its FY23 and FY24 guidance last month. Although the good news is already likely baked in, keep an eye out for an upside to EBITDA and especially on guidance for FY24. For Commonwealth Bank, record earnings in its half-year results weren’t enough to stop shares from falling after warnings of a peak in net interest margins and slowing loan growth. That will be the focus this time around, and investors will be hoping for some optimism, with shares down 8% in the last six months. The good news is that low expectations can sometimes leave room for upside surprises.

2. US CPI – Core the key to keeping the Fed on hold

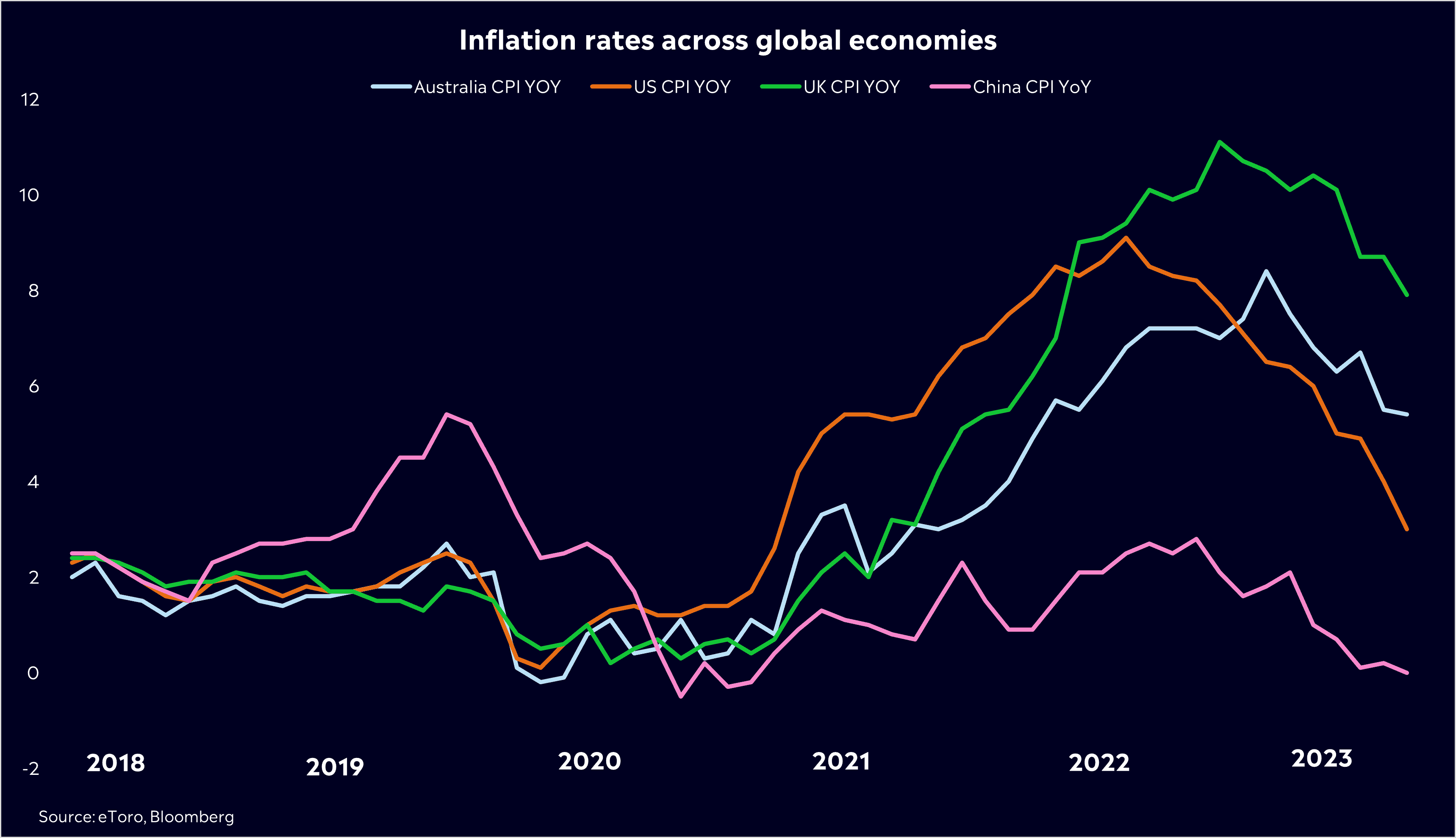

US headline inflation has made significant progress in the last 12 months, falling from a peak of 8.5% to 3% in June, thanks to substantial declines in energy and food prices. This has led markets to believe that the Federal Reserve is done hiking rates, with current pricing showing just a 17.5% chance of a September hike. This week’s CPI reading will be crucial in confirming this and further progress in core inflation will be the golden ticket investors are looking for to draw a line in the sand on the Fed’s hiking cycle. Current Bloomberg estimates are for headline inflation to rise slightly to 3.2% from 3%, while core is declining to 4.7% for 4.8%. The Fed’s preferred measure of inflation has also shown further signs of receding, with June showing the smallest increase in more than two years. There may be some worry about a pickup in headline inflation, given the 15% jump in oil prices over the last three months, but investors may be more focused on any declines in core inflation.

3. Chinese Inflation – Deflation nation

Whilst most of the world is worried about high inflation, the world’s second-biggest economy is dealing with deflation fears. China is expected to experience deflation this week, with a projected CPI reading of -0.4%. Manufacturing activity last month fell for the fourth straight month, and cautious local consumers, anticipating better deals due to falling prices, have slowed down spending, reinforcing deflationary pressures. The reading this week may be what the region needs to heap pressure on Bejing to hand down further measures to reignite growth and boost the economy. Officials have hinted at additional support in recent weeks but with no material action. The worry for investors is that the effect of deflation in the world’s second-largest economy has global repercussions. Close to home, Australian miners could see some hardship if a period of deflation prolongs, given it would drive Chinese demand for raw materials down, amongst other areas such as energy, and even food. Unless more meaningful support is rolled out soon, fear is likely to grow amongst investors that the economy will continue to stagnate.

*All data accurate as of 07/08/2023. Data Source: Bloomberg and eToro

Past performance is not an indication of future results.

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.