- Global cocoa price up 250% vs last Easter and nearly three times higher (191%) than in 2022

- Aussies are paying up to 50 cents more for their favourite chocolate treats this year

- Price of snacks and confectionary items in Australia has gone up almost 17 per cent since the end of 2021

Sydney, 25 March, 2024 – The chocolate charge is higher this Easter, with global cocoa prices nearly three times higher than they were at Easter 2022. The price of snacks and confectionary items is also up by almost 7 per cent in Australia, according to analysis from trading and investing platform eToro.

In Australia, popular chocolate brands like Cadbury and Ferrero Rocher have seen notable price increases since this time last year. In March 2023, a Cadbury dairy milk chocolate block cost $5.50, with the same block currently costing $6.00 at full price. Ferrero Rocher easter eggs have also had a 50 cent price increase since last year, costing $7.50 in March 2023 and $8.00 at their current full price.*

Recent CPI data reflects these price rises, with December 2023 reporting a 6.8 per cent and 16.8 per cent increase in the price of snacks and confectionary items in Australia compared to December 2022 and 2021, respectively.

Table 1 – Australian Quarterly CPI data on Snacks and Confectionary

| Quarterly CPI Data | |

| Date | Snacks and Confectionary |

| 31/12/2023 | 122.2 |

| 30/09/2023 | 119.6 |

| 30/06/2023 | 120.3 |

| 31/03/2023 | 119.1 |

| 31/12/2022 | 114.4 |

| 30/09/2022 | 111.5 |

| 30/06/2022 | 107.8 |

| 31/03/2022 | 107.7 |

| 31/12/2021 | 104.6 |

* CPI measures the average change over time in the prices paid by consumers for goods and services.

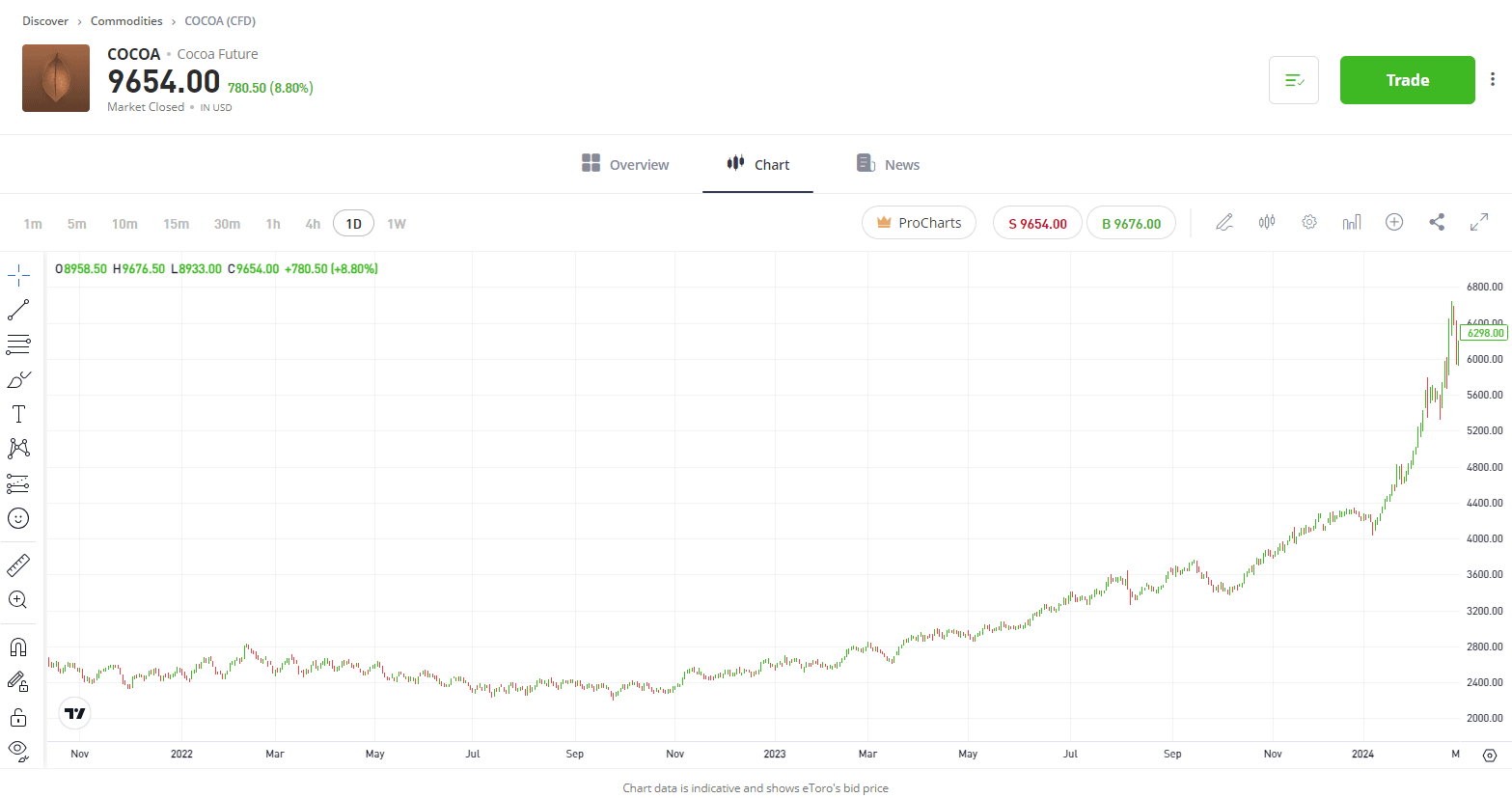

Cocoa prices have been on a steep upward trajectory for almost two years as key cocoa-producing countries have been hit by damaging El Niño-driven weather conditions. Prices recently hit a record high of $7,263.95 per tonne. El Niño is a climate phenomenon that leads to drier weather in some of the key cocoa-growing regions, notably West Africa, and its impact on crop yields has been significant.

This represents a price increase of more than 159% since Easter 2023 and 191% from Easter 2022. The surge in cocoa’s price is unsurprisingly impacting chocolate makers and food retailers, who are passing on the higher costs to consumers.

Josh Gilbert, Market Analyst at eToro, said: “Globally, consumers will be feeling the pinch when it comes to buying easter treats this year, and Aussies are no exception. The cocoa market has been on a tear in recent times, with a notable increase of over 10% within a single week earlier this year. This surge will inevitably impact the pocket of the average consumer, particularly as we approach festive periods like Easter. On top of this, retailers grapple with escalating costs related to transportation, labour, and packaging, which are expected to be shouldered by consumers.

As it stands, the elevated chocolate prices are poised to become the norm. This is due to the need for producers and retailers to replenish their stocks at these higher rates. Meanwhile, the next cocoa harvest is slated for October, and it typically takes up to five years for new production to yield results.”

Trade Cocoa

Disclaimer:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.