Australian shares finished slightly higher last week, up 0.15%. Rate-sensitive sectors led the way, with Real Estate, Healthcare, and Consumer Discretionary among the winners. That followed the rotation trade in the US, where investors trimmed positions from the winners of the year, such as tech, into laggards, such as small caps, on the view the Fed will cut rates multiple times in 2024.

Crowdstrike shares caught the headlines on Friday, following more than 12%, following the major IT outage that sent ripples worldwide in an event never seen on this scale before.

The news the world will digest today is Joe Biden’s decision to abandon his reelection bid after weeks of pressure from Democrats to drop out. US President Biden, who is now 81, will serve out his term but has endorsed Vice President Kamala Harris to replace him as the Democratic nominee. The ‘Trump Trade’ has already picked up steam this morning, with gold gaining on the expectation of a weaker dollar.

3 things that happened last week:

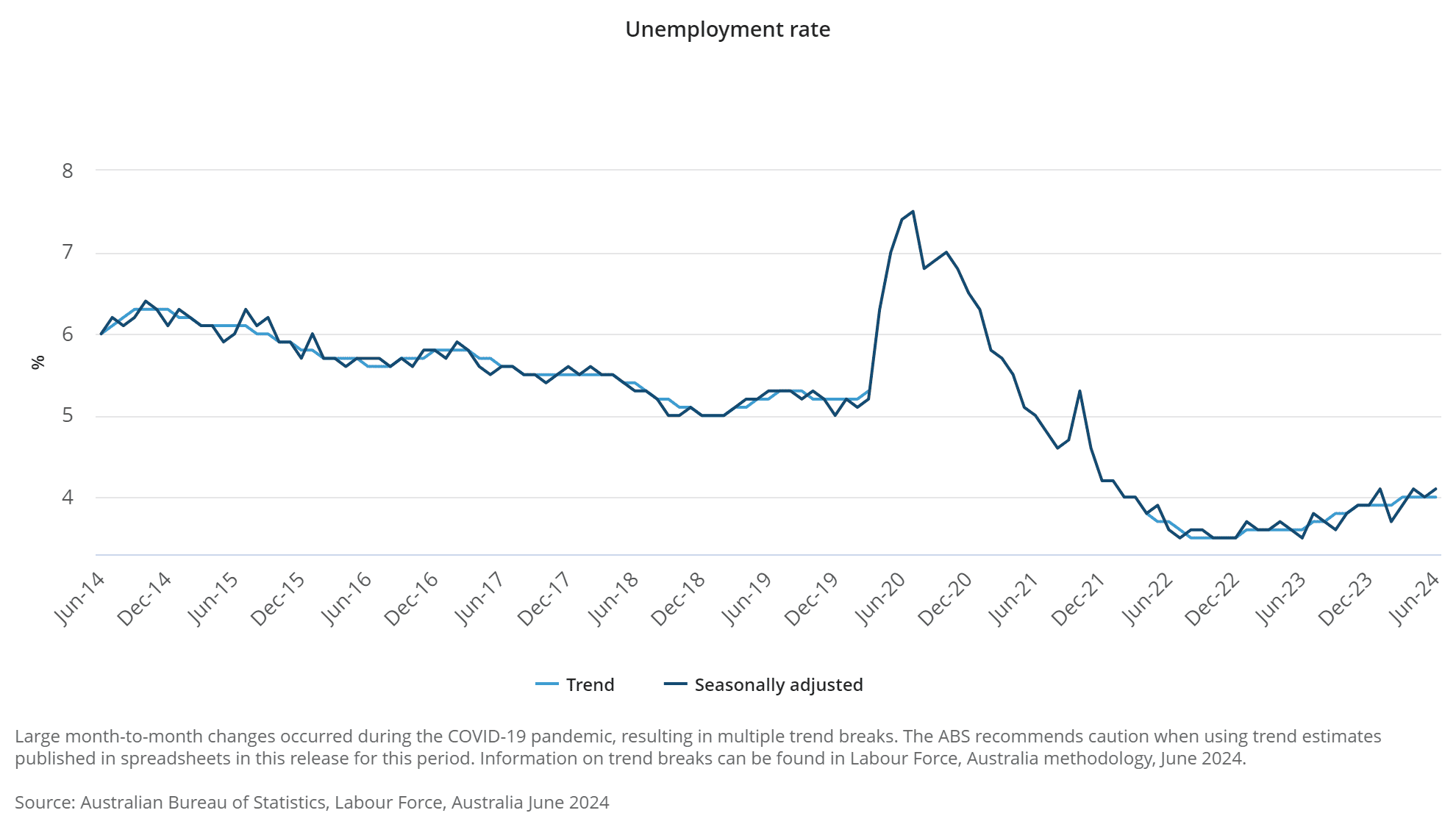

- Unemployment rises, but jobs jump

Last week’s employment report in Australia was mixed. The unemployment rate inched up to 4.1% in June from 4.0% in May, while the economy added 50,000 full-time roles, well above the 30,000 markets had anticipated. The report split economists on whether this would drive the RBA towards another hike or instead leave rates on hold. For now, markets see rates staying where they are, which would seem to be a smart choice from the RBA, with the labour market clearly showing signs of easing. The big focus now shifts to the Q2 CPI release next week, which will likely be the deciding factor for the Reserve Bank.

- Netflix Earnings

Netflix impressed last week with better-than-expected earnings, as its ad-supported memberships rose 34%. Advertising remains a key part of Netflix’s business, recently adding sports in a bid to drive advertisers to the platform, with the crackdown on password sharing having the desired effect. Revenue jumped 17% to USD$9.6 billion, as Netflix added 8.05 million new subscribers in Q2, well above the 4.87 million analysts had expected. Netflix’s growth has transpired while most of its rivals have slowed down, struggling to attract consumers and drive new content. Either way, these results show that Netflix is still the streaming king for now.

- A winner and loser last week from the S&P/ASX200

James Hardie shares were on a tear last week, gaining 9.6%. The company received a bullish upgrade from Macquarie, sending shares higher.

On the other side of the market, Lifestyle Communities saw their shares fall -24.3% last week. It follows concerns over fees from residents and reports of unethical practices.

3 things to watch for the week ahead:

1. US PCE Inflation (Friday)

While sticky inflation continues to be an issue globally, figures from the US continue to affirm that the nation is creeping closer to rate cuts than we are down under.

Globally, many markets are cutting or getting closer to rate cuts, a completely different trend to what we have here in Australia. Positive downward pressure on inflation in the US has created good economic conditions in the months leading up to the election.

PCE, or ‘Personal Consumption Expenditures’, differs from Core CPI in that it measures goods and services exclusively consumed by individuals, providing crucial detail around consumer spending behavior. While the broader CPI reading, released earlier in every month, is generally the element that will grab the most headlines, PCE is really the key to the Fed’s decision making process when it comes to individual spending and the economy.

A low PCE figure this Friday will signal that the Fed is effectively in the clear to commence its easing cycle, with a September rate cut looking highly likely. A repeat of last month’s 0.1% CPE figure will be good news for Jerome Powell and would likely see markets pricing in three rate cuts in 2024, barring any disastrous circumstances in August. Of course, with the economy a central focus in the election race and last week’s highly turbulent political atmosphere, nothing is out of the question just yet.

2. ETH ETFs – could potentially go live this week

A whopping ten Ethereum ETFs are slated to go live in the US this week, following SEC approval. Most notably, the Grayscale Ethereum Mini Trust and the ProShares Ethereum ETF are tentatively set to go live on Tuesday.

Broadly speaking, crypto ETF approval is a huge boon for the asset class as it signals institutional acceptance and provides greater investor accessibility.

Bitcoin’s ETF launch proved hugely beneficial for the asset and despite some turbulence earlier this year, it has helped BTC move from strength-to-strength.

Ether could do with a boost, frankly. The 2022 Ethereum merge failed to inspire market hype despite a highly-publicised rollout and the asset did not experience much volatility in either direction for quite a while. ETH has performed well so far in 2024, but still is yet to surpass it’s November 2021 highs.

Ethereum is still lagging behind bitcoin in performance terms over the last 12 months, and the launch of these ETFs may be the catalyst to see the asset outperform. However, it may take some time. The bitcoin ETFs launched in January of this year, but a new high wasn’t recorded until March. We could expect to see the same with ethereum as investors digest the launch, and institutions get to grips with the new offerings.

Either way, the runway ahead for crypto assets looks positive with this launch, another sign of strong demand and Federal Reserve rate cuts within sight. The news this morning of Joe Biden stepping down as the Democrat Nominee is also pushing crypto assets higher with the view that a Trump reelection is growing more likely. This will likely cause some volatility throughout the week, but if markets continue to view Trump as the front-runner, then crypto assets will move higher.

3. Tesla and Alphabet Earnings

Q2 earnings reports continue in full swing his week as tech giants Tesla and Alphabet report their earnings on July 23. After falling short of revenue estimates for Q1, Tesla has had a few positive weeks thanks to investor optimism around Q2’s better-than-expected vehicle delivery numbers, with shares up 70% in the last three months, leaving little margin for error this week.

Last month, Tesla shareholders showed strong support for Elon Musk by approving his $56 billion pay package. However, Musk’s announcement of plans to donate $45m a month to a political action committee supporting Former President Trump, alongside recent headlines surrounding the company’s controversial cybertruck, may cast a shadow on earnings forecasts for Q2.

Tesla continues to be the most held stock on the eToro platform in Australia despite underwhelming Q1 results. Therefore this week’s results are a must-watch for investors. AI will once again be front and centre, with Elon Musk a pioneer of the AI revolution. Margins, cyber truck production, robotaxi and guidance will all be key focal points.

Alphabet, which significantly surpassed earnings estimates for Q1, is expected to continue this positive streak, with the company rumoured to acquire cybersecurity startup Wiz and ramp up its presence in the AI market through Google DeepMind. Alphabet is no stranger to the benefits of sustained AI hype, with shares up 27% in 2024.

Although not miles ahead in the AI race, Alphabet’s work in AI advancement including Project Astra, AI model Veo and improvements to its Gemini Pro 1.5 model are promising signs for investors that the company is committed to progress and maintaining competition with the Magnificent Seven. Google Cloud will likely be the focus, but investors should also have one eye on advertising revenue for any signs of weakness that could derail the stocks run this year.

*All data accurate as of 22/07/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.