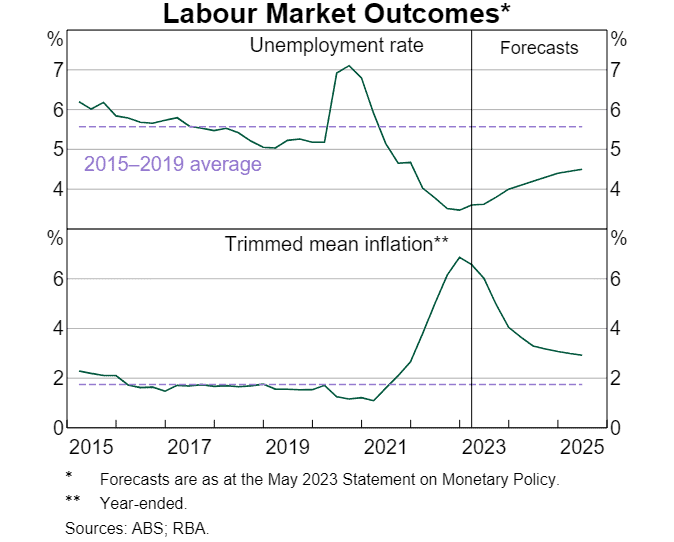

Australia’s unemployment rate rose more than expected in November to 3.9%, which will likely raise investor expectations further that the Reserve Bank of Australia is done hiking interest rates. The good news was employment also saw strong growth, a balance the RBA would have wanted to see.

The data suggests Australia’s labour market is loosening up. With job advertisements falling and strong population growth, both the easing of the labour market and a rise in the unemployment rate are likely to continue into 2024.

This is the final Christmas Present for the RBA after being handed down better-than-expected inflation data and softer-than-expected retail sales in recent weeks. This is also translating into a great December for investors, with the ASX200 up almost 4% already this month.

The pickup in unemployment, though, isn’t surprising, with job advertisements continuing to fall. According to data from Seek, job advertisements fell by 5% in October and sat 19.9% lower year-on-year. Falling job ads mean less demand for hiring as we head into the new year, which is a firm sign that we may see the unemployment rate continue to rise in 2024.

Australia’s unemployment rate was 3.7% in October, with strong employment growth. This continued tightness has affected wages throughout 2023, and it was evident in the wage price index released for the September quarter, rising by 1.3% – the fastest quarterly rise on record. However, in her most recent statement, Michele Bullock pointed to a peak in wages, so this is clearly becoming less of a worry for the central bank.

Despite markets pricing the US Federal Reserve to cut rates by March, investors locally should not expect the same from the RBA anytime soon. Although we may have seen the final hike from the RBA with data moving in the right direction, it may still be one of the last major central banks to cut rates in 2024.

Why is Australia’s unemployment rate important?

The unemployment rate reflects the health of the labour market and, by extension, the broader economy. A lower unemployment rate generally indicates a healthier economy with more job opportunities, increased consumer spending, and higher aggregate demand.

Employment and income levels are directly linked. When more people are employed, there’s an increase in disposable income, which typically leads to higher consumer spending. As consumer spending is a significant driver of economic growth, a low unemployment rate can stimulate economic activity.

Certain sectors are particularly sensitive to employment figures. For example, consumer discretionary companies, such as retail and hospitality, can be heavily influenced by employment rates, as consumer spending is directly tied to employment levels.

The Reserve Bank of Australia (RBA) uses the unemployment rate as a key indicator in their factors when formulating monetary policy. Low unemployment may signal upward pressure on wages, which could lead to inflationary pressures. In response, central banks might adjust interest rates to manage inflation while supporting employment.

What does Australia’s unemployment mean as an investor?

Rising unemployment often signals economic challenges, potentially indicating a slowdown or contraction in the economy. It might suggest reduced consumer spending, lower business investment, and a general lack of confidence in the market. However, in this scenario, it’s good news for investors. This is because it gives the RBA more headroom to cut interest rates, which should be good news for heavy sectors such as real estate and possibly even consumer discretionary. More broadly, rate cuts have often led to a positive impact on equity markets as investors seek higher returns compared to low-yielding fixed-income assets.

Policymakers aim to strike a balance where unemployment is low enough to encourage job creation and consumer spending but not so low as to create inflationary pressures. Achieving this balance often involves a combination of fiscal policies, monetary policies, and structural reforms aimed at supporting job creation, economic growth, and stability.

The RBA’s target unemployment rate is 4.5% by late 2024 which would be below where the rate was pre-pandemic. This is the rate that the RBA believes will allow the economy to be closer to a sustainable balance point.

*All data accurate as of 15/12/2023. Data Sources: Bloomberg, ABS, RBA and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.