The Australian reporting season for August has concluded, and it was a mixed season, to say the least. Volatility remained a hallmark throughout; strong results were rewarded, but poor results were punished—often more than the beats were rewarded. This dynamic put downgrades in focus, as brokers revised outlooks downwards, reflecting a more cautious stance on future growth. This shift has been driven by cautious management outlooks, with concerns about inflation, interest rates, and overall economic uncertainty.

Key Challenges Facing Companies

Headwinds were prevalent, and companies grappled with rising costs. This put a large focus on cost management and operational efficiency, especially in the resources sector, where companies faced big pressure of rising costs and falling commodity prices. Giants like BHP and Rio Tinto fared better than their smaller counterparts, largely due to their ability to maintain lower costs through economies of scale.

Dividend Growth: A Mixed Bag

Dividend growth remains a crucial metric for many investors, signalling a company’s health and potential. Rio Tinto left its dividend intact, while BHP opted to cut its dividend to focus on growth. Overall, it was a positive period for dividends, offering some optimism where guidance may have been lacking. Woolworths and JB Hi-Fi both paid special dividends, increasing their yield for the year.

ASX 2024 Net Annual Dividends Yields

- Rio Tinto – 6.23%

- CSL – 1.26%

- JB Hi-Fi – 4.02%

- Woolworths – 4.02%

- Telstra – 4.59%

- BHP – 6.03%

- Fortescue Metals – 12.15%

A Cautious Outlook

Guidance was one of the disappointments of the season, with only a handful of companies beating expectations and raising guidance for FY2025. This conservative outlook has fuelled concerns about limited earnings growth moving forward, suggesting the possibility of further downgrades as companies brace for a more challenging economic environment.

Retailers Remain Resilient

Retailers once again showed resilience, with standout performances from companies like JB Hi-Fi and Temple and Webster. Despite pessimistic consumer confidence, these retailers provided earnings beats and raised guidance for FY2025, with JB Hi-Fi’s July update showing year-over-year sales growth across all areas of the business. This strong consumer spending has come despite interest rates being at their highest level in a decade.

Top Performers

Several companies stood out for their resilience and strong performance:

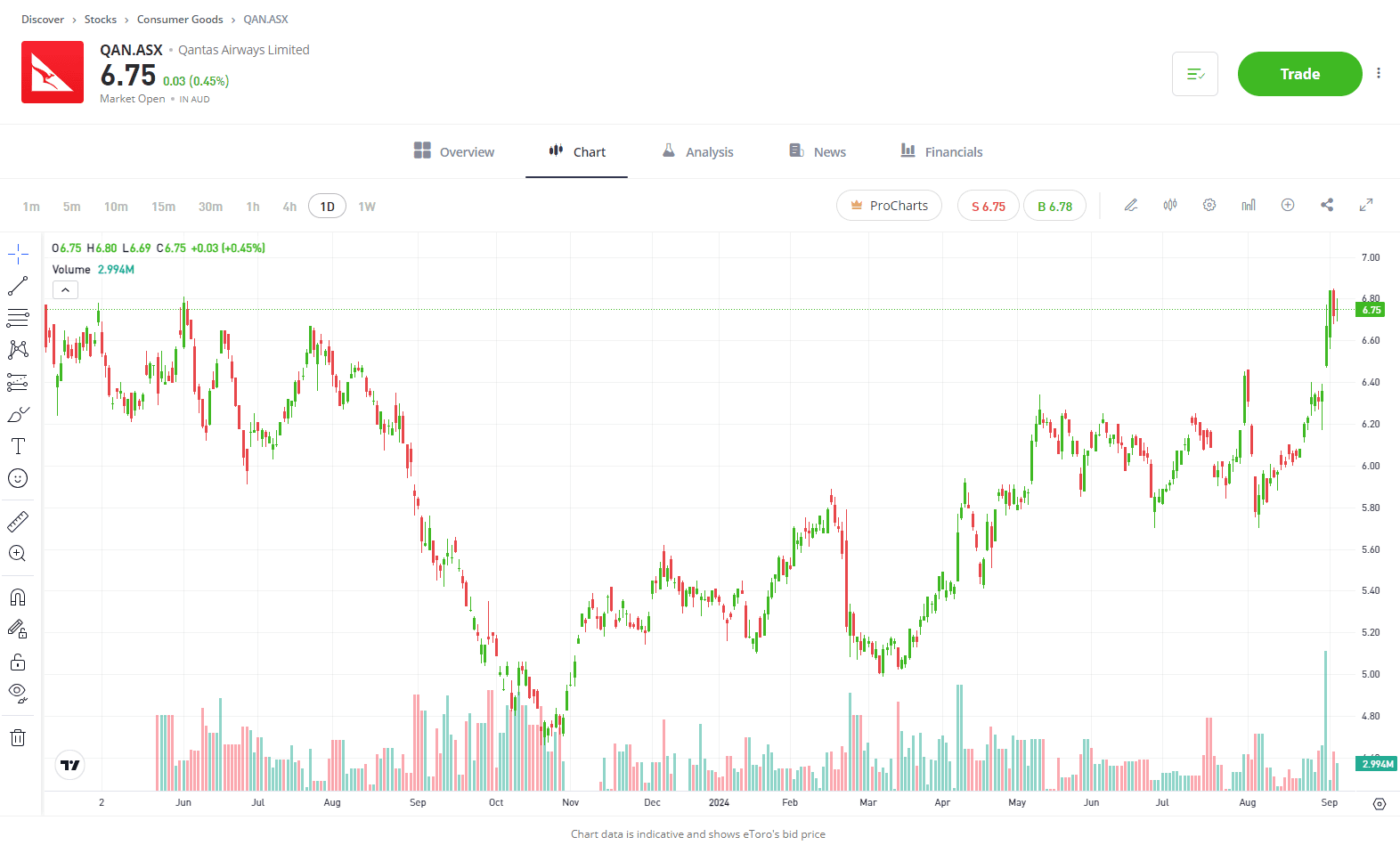

- Qantas: Showed resilience despite falling profits. New CEO Vanessa Hudson faces the challenge of turning the airline around, but early signs are positive, particularly with increased capital expenditure on customer-focused incentives.

- Pro Medicus: Exceeded expectations with solid profit margins and expanding market reach, especially in the US.

- WiseTech Global: Reinforced its position in the global freight forwarding market with strong revenue growth and major client acquisitions like Nippon Express.

Underperformers

Some companies had a tough reporting season:

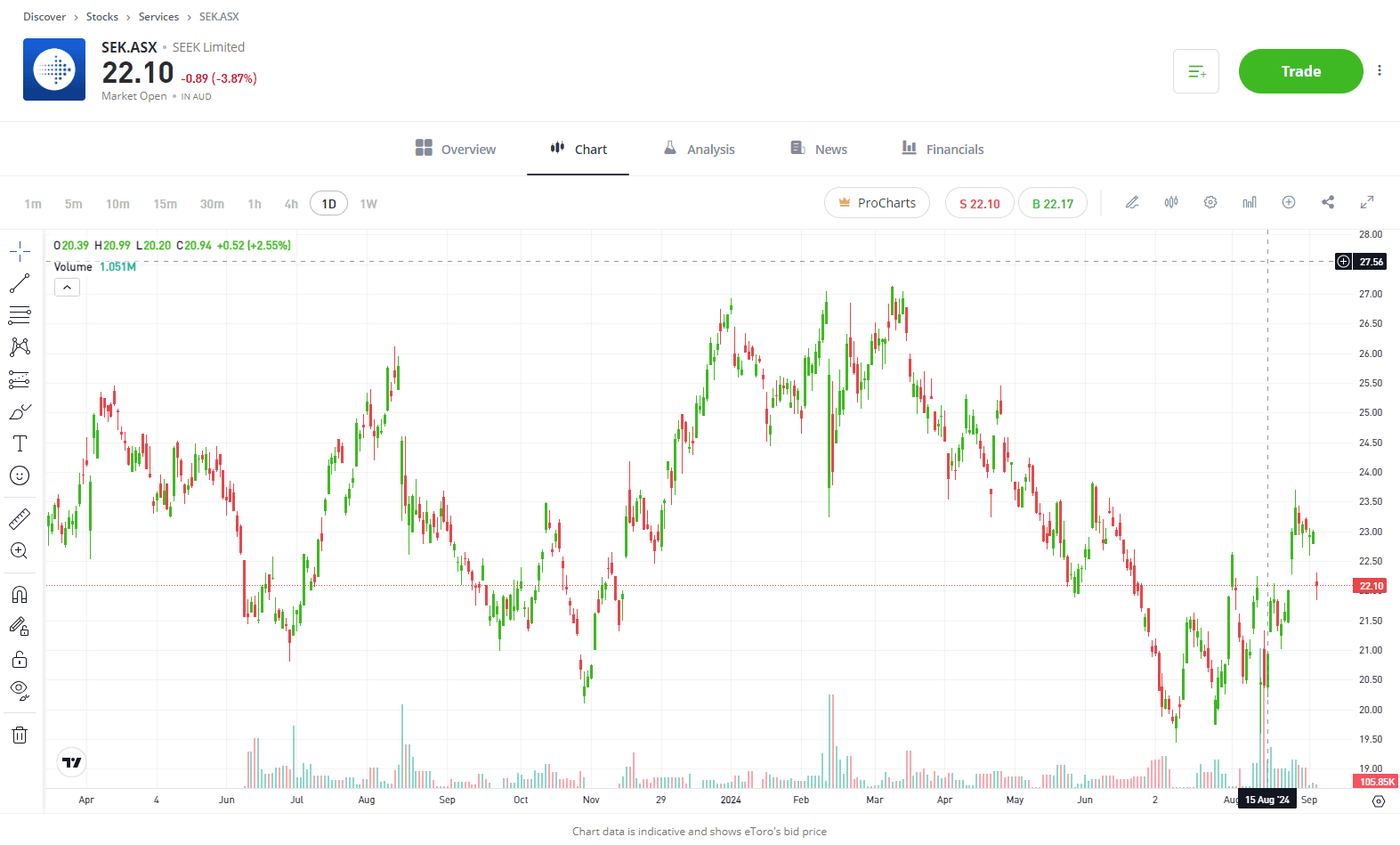

- SEEK: Suffered a 25% earnings downgrade, struggling both domestically and in Asia, with earnings per share now lower than they were a decade ago.

- Audinate: Faced a bleak outlook for FY25 after a slowdown following a period of strong demand.

- Johns Lyng Group: The worst performer on the ASX200 during August, falling by more than 30% after missing market expectations.

What Lies Ahead?

The August reporting season reflected the complexities of the current economic environment, where cautious outlooks prevailed. As companies navigate these challenges, the market will continue to focus on quality, operational efficiency, and strategic growth. The months ahead will be crucial as businesses adapt to the shifting economic landscape.

Explore ASX Shares

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD. The content that will be discussed is intended for information and educational purposes only and should not be considered financial product advice or any recommendation. General advice only.