It was a torrid week for global stocks as a hawkish tone from the Fed dialled back rate expectations, whilst rising geopolitical tensions saw risk-off sentiment prevail. The ASX200 and S&P500 had their worst trading weeks in over a year, falling by 2.84% and 3.1%, respectively.

A disappointing quarterly report from Dutch semiconductor equipment maker ASML weighed on chip stocks and the broader technology sectors in Australia and the US. Last week, the three biggest losers on the S&P500 were Super Micro Computer (-20.5%), Tesla (-14%), and Nvidia (-13.6%).

It’s a big week ahead with a wealth of Australian Economic data, including quarterly and monthly inflation updates as well as export and import data. In the US, the Fed’s preferred measure of inflation, US PCE, is handed down on Friday, whilst earnings season moves up a gear as four of the Magnificent Seven report earnings.

3 things that happened last week:

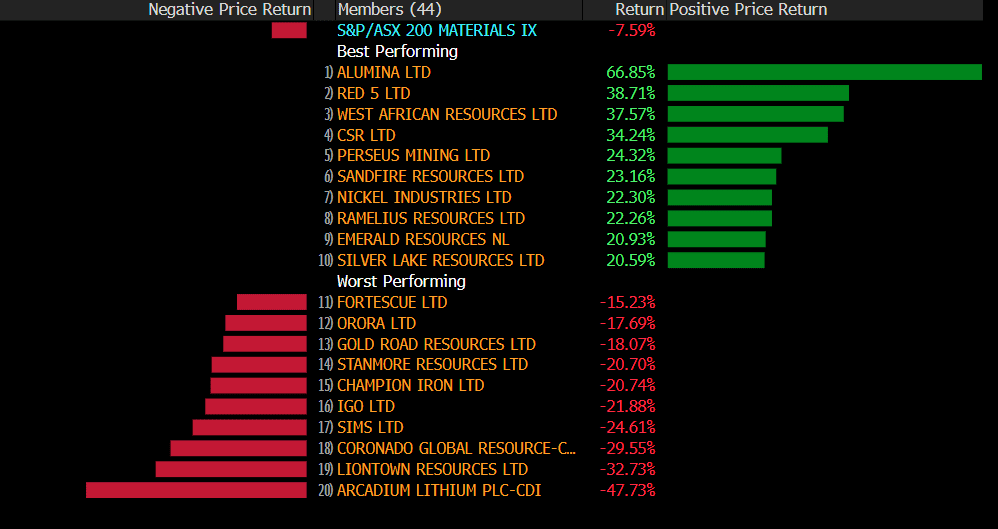

- Australian miners continue to lag

The Australian materials sector remains the biggest drag on the ASX200 this year, with the sector down more than 7%. The fall comes despite the recent rally in gold and copper prices, weighed down instead by the fall in iron ore prices which have fallen by 17% this year as China’s real estate sector slump continues, dampening steel demand.

The good news is that Iron Ore prices may have found a bottom, rebounding from their lows in recent weeks. Recent data from China shows that the road to recovery will continue to be bumpy, and that, therefore, clouds the outlook for major miners. Both BHP and Rio Tinto reported production updates last week and both looked to deflect from the weakness in Iron Ore by trying to focus investors attention on their mining in Copper and Lithium. This offered some optimism, but investors will want to see more stimulus from China before turning bullish on these stocks.

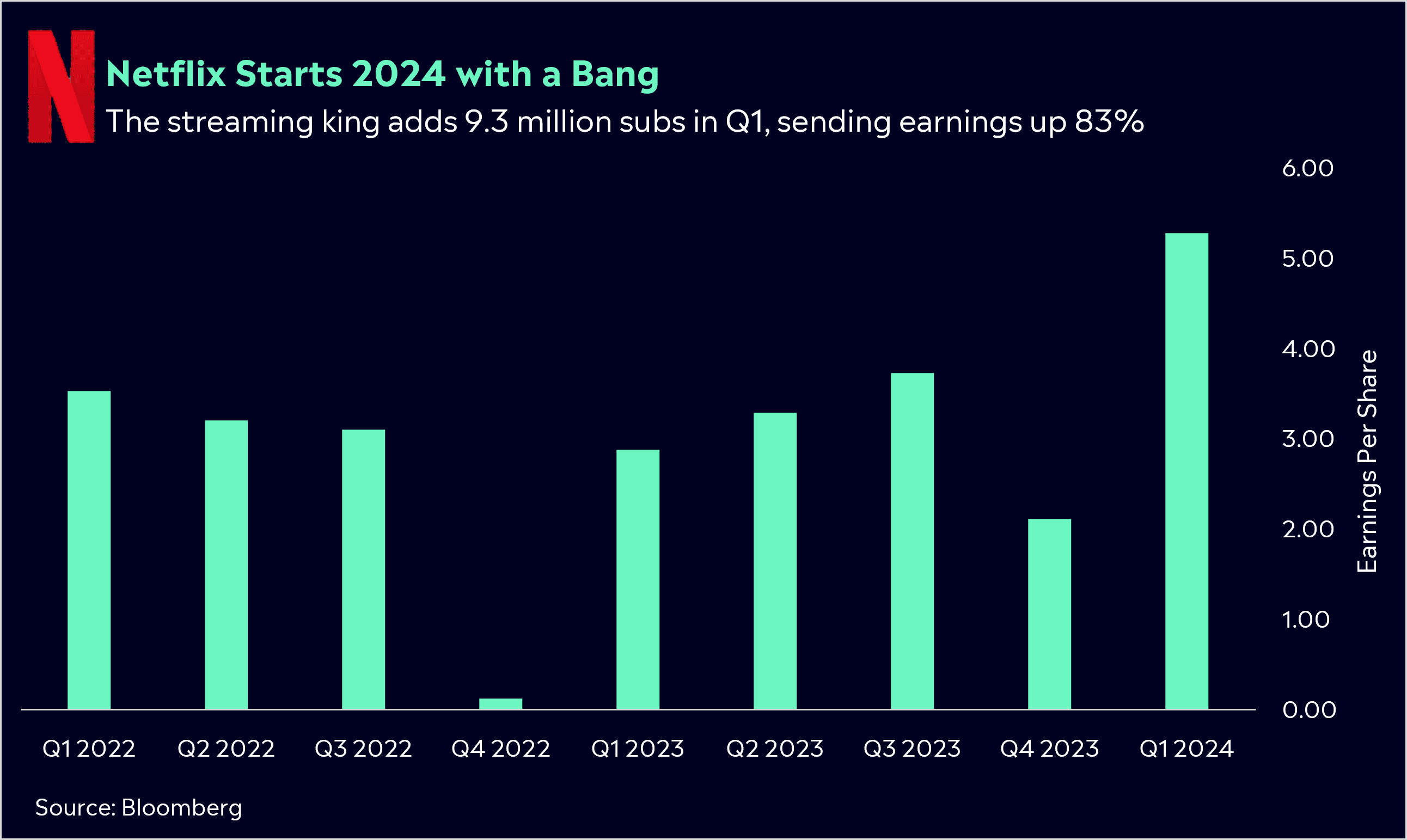

- Netflix beats but disappoints the street

Netflix justified its rally this year, beating expectations across all key metrics as the business continues to grow at the fastest pace since the pandemic.

The streaming giant added 9.33 million new subscribers, delivering its best subscriber growth since 2020 and nearly doubling analyst estimates. Its crackdown on password sharing is undoubtedly bearing fruit, and its strong content slate is enticing users. Importantly, those new subscribers are well and truly aiding Netflix’s top and bottom line, with earnings growing by more than 80% in the quarter.

The downside to the report was that its Q2 revenue forecast came in slightly weaker than expected, signalling that subscriber growth might be lower next quarter. Netflix also said it would stop reporting quarterly subscriber numbers from next year, a move that disappointed investors who see it as a key metric each quarter.

- A winner and loser last week from the S&P/ASX200

Telix Pharmaceuticals was the winner of a bad week, jumping by +5.3%. The healthcare stock moved higher following the release of its quarterly results, showing revenue jumped by 18% year over year.

It was another bad week for Star Entertainment as shares fell by -16.8%. It follows the company facing a second inquiry in less than a year. Regulators are currently deciding whether star is suitable to hold a casino license in NSW, which could have huge implications for shares.

3 things to watch for the week ahead:

1. Australian Q1 CPI

Given the RBA’s last rate call was in March, this upcoming quarterly CPI reading will be an important one. There has been plenty of data in the meantime to indicate inflation may be gradually coming under control, coupled with last week’s news that the unemployment rate is slowly drifting upwards. A strong confirmation that inflation is approaching its target will see mortgage holders letting out a sigh of relief, as it will affirm a rate cut may be on the table in the second half of 2024.

The RBA have had a tough job of analysing fluctuating figures this year, with a strong spike in jobs at the start of the year and, of all things, Taylor Swift’s world tour skewing March’s CPI reading, but a fairly dull April may now provide more reliable data. In short: this quarterly CPI will be the first powerful indicator for the year. Expectations are for Q1 Headline CPI to rise 3.4% year-over-year, with housing set to be a major contributor as high migration continues to drive rental prices.

Markets currently see a 57% chance the RBA will cut rates in August, and recent fears around the US Fed losing confidence in inflation returning to target, have pushed back rate cuts globally. A rate cut in Q2 looks highly unlikely at this stage, but signs of inflation easing this week could put an early Q3 cut on the table. To add to that, the ASX200 could also do with some optimism after its worst week in over a year last week, so a weaker-than-expected quarterly inflation reading will be a big boost for the local market.

2. Four of the Magnificent Seven Report Earnings

Four of the ‘Magnificent 7’ US big-tech stocks report earnings this week, with only Apple and NVIDIA set to report later on May 2nd and 22nd, respectively.

Tech’s big performers remain crucial drivers for another S&P 500 earnings upside surprise. Importantly, this earnings surprise is needed now more than ever as expectations of a Fed rate cut continue to be pushed back. These seven huge stocks are juggernauts, accounting for 29% of the S&P500 market cap – and look set to grow profits by 37% this quarter. That’s a huge dispersion to the -3% decline expected from the rest of the 493 stocks on the S&P500.

Out of the names reporting next week, Microsoft looks set to continue benefiting from AI Adoption, whilst Meta’s success of late looks set to continue, with earnings expected to grow by 96% for the quarter as digital advertising spending rebounds, and Zuckerberg’s efficiency continues to bear fruit. But, despite that, Tesla will likely be the name investors remain laser focused on. The EV manufacturer is set to be less than magnificent when it reports next week, with earnings set to fall by 40% with deliveries missing the mark and margins contracting on price cuts. Bottom line, Elon Musk needs to produce some magic to turn the ship around. This is one of the biggest earnings calls for Tesla in a long time, and investors need some clarity.

3. Bitcoin Post- Halving, what’s next?

Last week, bitcoin saw its fourth bitcoin halving and this week, investors will be focused on the market’s reaction to the halving, given we’ve seen a sharp sell-off over the past few weeks amid rising geopolitical tensions and a pushback on rate cut expectations.

The ‘Halving’ is an event that, as the name suggests, reduces the reward for successfully mining a block by half. The bitcoin halving occurs every 210,000 blocks that are mined, and with new blocks taking about 10 minutes to be added to the chain, a halving happens roughly every four years. Before last week, the last halving was in May 2020 and the last ever halving will be sometime in the year 2140, by current estimates.

The block reward has now dropped from 6.25 bitcoin to 3.125 bitcoin per block. The annual supply inflation rate has fallen from around 1.70% to 0.84%. When supply falls, and demand is high, prices rise, and historically this has been the case with bitcoin. A look back at the data shows these gains are significant.

The halving is a highly anticipated event in the crypto world because it has generally marked the start of the next bitcoin bull market, with the price surpassing the previous all-time high within six to eight months, and the bull market peak coming 12 to 18 months after the halving. This time is different, though, as it’s the first time we’ve seen the bitcoin price surpass the previous all-time high before the block reward halving has even occurred.

The question now is whether we will see the price rally again to fresh all-time highs or if the price will fall even lower following the halving. What adds another new element to this halving is the introduction of institutional interest which has led the rally in 2024. The halving as it has in other cycles, could be the catalyst to reignite retail interest, which we’ve yet to really see in 2024 when compared to previous cycles. However, don’t be surprised to see a muted reaction in the weeks following the halving, with the larger upswings in the months ahead, which could provide investors with opportunities should we see lower prices in the weeks ahead.

*All data accurate as of 22/04/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.