It was a torrid week for global stock markets last week, with the ASX200 ending with its largest loss of 2023, down 2.6%, while the S&P500 fell by 2.1% for its third straight week of declines. The ASX200 materials sector saw its biggest fall in 5 months following China’s economic woes.

It’s a big week ahead for investors with a vast amount of earnings from the ASX, a focus on China’s recovery, on top of highly anticipated earnings from Nvidia (NVDA), and Jerome Powell’s speech at Jackson Hole.

3 things that happened last week:

1. CSL and Telstra Earnings

It was a mixed bag of results last week for CSL (CSL) and Telstra (TLS), with CSL arguably coming away better off. It’s been a challenging start for CSL’s new CEO Dr Paul McKenzie, with shares dropping by 13% in the last six months as he attempts to fill the big shoes left by his predecessor, Paul Perreault. However, he handed down a solid set of full-year results despite the downgrade last quarter, with revenue growth up 31% year-over-year to USD$13.31 billion and underlying profit jumped 10% to USD$2.61 billion. For Telstra, strength in its mobile division was the key driver of earnings, with product income up 8.3% to A$10.3 billion and net income jumping 14% year-over-year to A$1.93 billion. However, the market was disappointed that its infrastructure division would be retained rather than sold, which weighed on shares.

2. Bitcoin drops as SpaceX sells

Bitcoin sold off sharply last week following news that Elon Musk’s SpaceX had written off and sold some of their US$373 million of bitcoin. Whenever you have a big name in the industry selling bitcoin (BTC), especially someone as influential as Elon Musk, it will put the price under pressure. Arguably, Elon Musk has one of the most influential voices in the world and when he makes moves in crypto, the market moves accordingly. If we also consider some of the weaknesses we’ve seen across global markets – particularly risk assets – over the last few weeks with the expectation that rates will likely stay higher for longer, it was a recipe for a pullback. Bitcoin has struggled for a leg higher in the last month, trading in a tight range of between $29k and $30k with little ‘good news’ to push the asset higher, which has only exuberated this sell-off. With limited catalysts to push bitcoin higher in the short term, a fall below 25k could put bears in charge, and if the rout in global risk assets continues, bitcoin could face further downside.

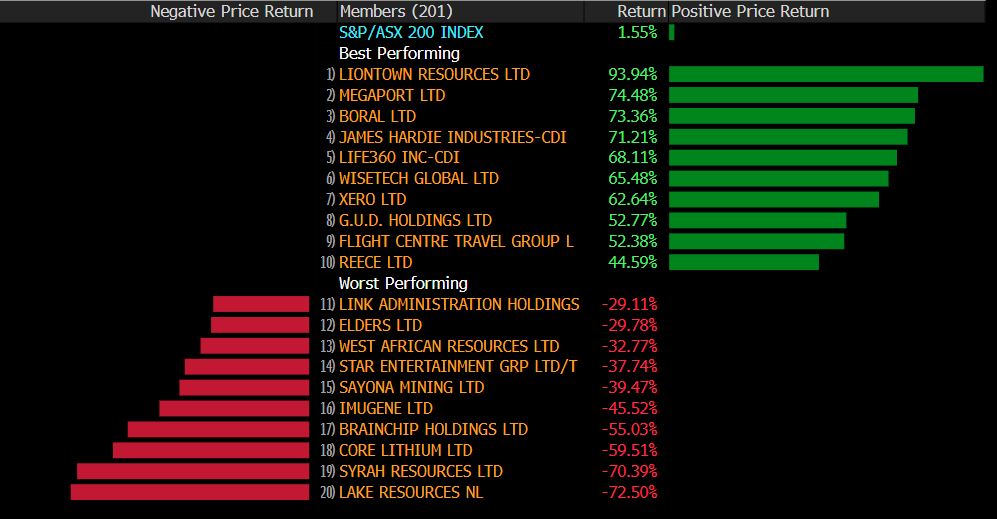

3. A winner and loser last week from the S&P/ASX200

carsales.com (CAR) raced ahead last week, with shares rising by 13.4% after an impressive set of full-year results saw net income climb to AU$646 million, more than 300% growth for the full year, in a record full-year result.

It was another challenging week for Core Lithium (CXO), with shares falling by 28%, taking total losses for the year to 60%. Shares sold off following a $100 million institutional placement at $0.40 per share, which represented a 26% discount to where shares were trading.

ASX200 Member Ranked Returns Year to Date. Source: Bloomberg

3 things to watch for the week ahead:

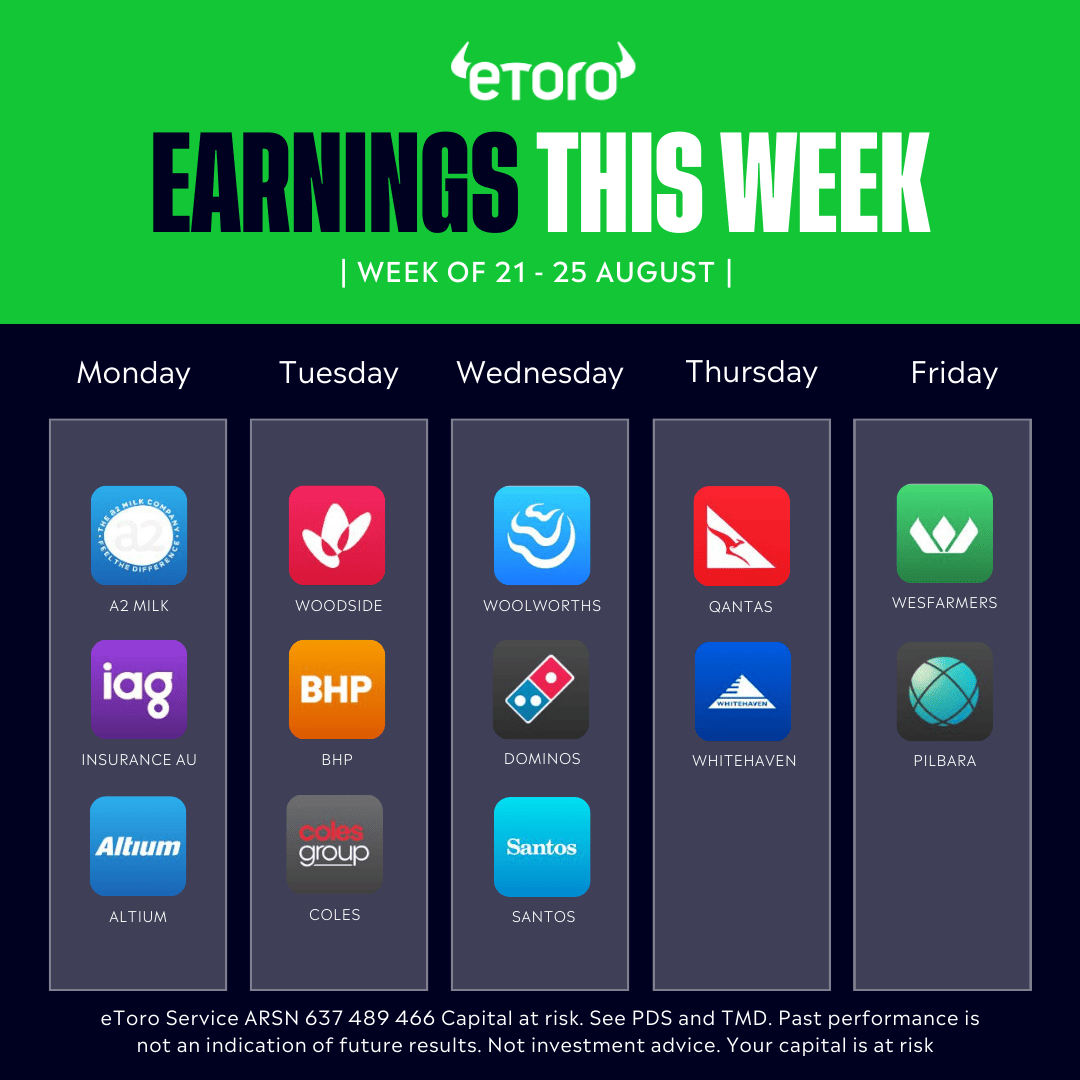

- Reporting season’s biggest week

It’s the biggest week on the reporting season calendar this week, with over 40% of ASX200 listed companies reporting results. Some of the standout names include BHP (BHP), Qantas (QAN), Coles (COL), Woolworths (WOW), Wesfarmers (WES) and Pilbara Minerals (PLS). It’s been a mixed reporting season, but Commonwealth Bank (CBA) has been the standout name so far with record profits. Despite some positive results, the local market recorded its largest decline in 11 months last week as China’s economic troubles persist and investors digest higher-for-longer rates. Investors’ worries over China will be front and centre this week when BHP reports its full-year results. Falling commodity prices will weigh on the results, with the market anticipating a significant decline of 40% in earnings and a 16% decline in revenue. Any signals from the mining giant of further weakness from China will weigh on shares. On a more positive note, Qantas looks set to post record profits as travel remains in the sweet spot of strong demand and low supply. Revenue is set to rise to A$19.6 billion, whilst underlying profit is expected at A$2.45 billion. With record profits, investors should watch out for the return of its dividend – or at least an increase in its recent buyback scheme.

2. Nvidia Earnings – The AI Boom

Nvidia, AKA the poster boy of AI, reports its Q2 earnings this week in which investors will be hoping to see AI hype translate into revenue after promising a huge quarter. Earlier in the year, Nvidia shocked Wall Street and offered what was arguably one of the most bullish revenue forecasts markets had seen from a company of this magnitude. Nvidia forecasted Q2 revenue of US$11 billion, well ahead of analyst estimates of US$7.15 billion, with CEO Jensen Huang citing ‘unprecedented demand’ for its advanced chips required to train and power AI services. In this AI boom, Nvidia is selling the picks and the shovels – and with so much demand for AI, everyone needs those work tools right now. The growth will come from its Data Centre revenue, which is set to see a 110% jump to US$7.86 billion through the sale of its flagship AI chip, the A100. However, even that number could be blown out of the water with growing demand from businesses such as Tesla (TSLA), Alibaba (BABA), Tencent (0700.HK), Microsoft (MSFT) and even countries such as Saudi Arabia and the UAE. The good news for investors is that if Nvidia can translate AI interest into higher sales, this is just the beginning.

3. China woes weigh on the local market

China unexpectedly cut its one-year medium-term lending facility rate last week by 15 basis points to 2.5%. The rate is a key economic health indicator as it relates to loans to financial institutions, suggesting that policymakers are starting to see concerns in the state of the economy as data continues to weaken. The focus for this week will be if more monetary easing is on the cards – and if they can do so in a way that safeguards the stability of the Yuan. China’s central bank and financial regulators met with bank executives over the weekend in a bid to boost loans to support the recovery. Warning signals flashed again last week with fears mounting in the property sector as the slowdown continues to hurt developers. That was evident on Friday as Evergrande filed for bankruptcy in the US and concerns grew that other large developers would default. The region needs stimulus and the data handed down recently more than supports that. It’s now a case of how far they are willing to let the economy spiral before acting. Unfortunately, Australia will feel the effect of the economic slowdown in the region. China is the world’s largest manufacturer, the second largest economy, and the largest source of global consumption and commodities growth. Its growth weakness this year has been both a symptom of the world’s manufacturing and trade recession and caused by the caution of its own consumers. The materials sector was the worst-performing sector on the ASX last week, and that may be a sign of things to come if China’s economic woes continue.

For more on China, click below to listen to the latest Market Bites episode:

*All data accurate as of 21/08/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.