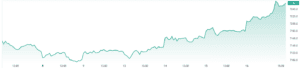

Australian shares snapped a three-week losing streak last week to finish the week up 1.8% for its biggest gain since March. The ASX200 has been on the back foot recently, with investors thrown off course by the RBA’s hawkishness after the index had a tearing start to the year. Markets shrugged off stronger-than-expected jobs data, with investors already pricing in further hikes from the RBA. The heavily weighted financial sector, which has been the worst-performing sector in 2023, gave the index a much-needed boost, jumping by more than 3% for the week.

3 things that happened last week:

1. Federal Reserve pauses biggest hiking cycle in decades

The Federal Reserve gave no surprises last week, pausing its hiking cycle after ten consecutive hikes. But, Jerome Powell gave investors a reality check with hawkish comments that signalled more hikes and no rate cuts this year. This aggressive stance may not have been exactly what investors were hoping for, given the weaker-than-expected CPI reading earlier in the week, but it points to the Fed sticking to its mandate of getting inflation back to target. The worry from here is rates staying higher for longer, which could weigh on growth, and put the economy under pressure. But, investors are calling the Fed’s bluff on its hawkish stance, and they believe inflation is falling rapidly, which points to the end of the hiking cycle on the horizon.

2. World’s biggest asset manager files for bitcoin ETF

Crypto assets have struggled in the second quarter after a blazing start to the year, faced by regulatory headwinds that are clouding the sector, with bitcoin falling by 5%. However, the news on Friday that the world’s largest asset manager, Blackrock, has filed for a bitcoin ETF is a massive win for bitcoin, helping to move the asset back above $26,000. There has been plenty of noise around a bitcoin ETF for years, so investors shouldn’t get too ahead of themselves. But when it comes to ETFs, Blackrock (BLK) knows a thing or two, with 575 accepted applications and one denial. A bitcoin ETF provides the opportunity for trillions of dollars of institutional investment to flow into the asset, which it has lacked over the years, as well as a wave of new retail investment. This could be the key to helping bitcoin reach new highs.

3. A winner and loser last week from the S&P/ASX200

The best-performing stock on the ASX in 2023 was once again the top performer last week as Liontown Resources (LTR) gained 12.5%, hitting a new record high. Optimism continues to grow that another offer will be received from fellow miner Albemarle (ALB).

It was a tough week for medical giant CSL (CSL), with shares falling by 9%, its worst week since 2020. The company downgraded its profit guidance for the 2023 financial year citing FX headwinds.

3 things to watch for the week ahead:

1. RBA Meeting Minutes – Are more hikes justified?

The RBA ‘surprised’ markets again at the start of June by hiking Australia’s cash rate to 4.1% after a stronger than expected inflation reading. Given the RBA’s unexpected hawkishness this year, the ASX200 has come under pressure, with investors being left wrong-footed after expecting rate cuts by the end of 2023. This week’s meeting minutes should provide investors with further insight into the board’s decision to raise the cash rate when most economists felt the cash rate should stay on hold. The key takeaway from the rate decision was that the door is still open for more hikes if required, and interest rates may still have further to go as the RBA pointed towards upside risks to inflation. Their hawkish tone, though, may have been matched last week with the stronger-than-expected jobs data, which will spark fears of further wage increases and prolonged inflation.

2. Will China continue to cut rates?

Last week, China ramped up its efforts to help boost the economy as its property market continues to weaken and business investment slumps. The People’s Bank of China (PBOC) cut rates on its seven-day reverse purchase rate and medium-term lending facility. Both cuts followed data that showed further signs of weakening economic activity, with industrial output slowing to 3.5% from 5.6% in April, and retail sales grew by 12.7% but below expectations. The cuts, alongside the weak data, point towards a further reduction in lending rates this week. This will be good news for Chinese stocks, which climbed last week after the cut and local stocks exposed to China, such as BHP (BHP), Fortescue Metals (FMG) and Rio Tinto (RIO). Although more cuts are on the horizon, policymakers still have plenty to do in order to shift this recovery into 1st gear, particularly direct support to the property sector.

3. Can AI help productivity and boost the economy?

There are only two ways to grow economies – more people (demographics) or more output per person (productivity). Despite tech advances over the years, productivity has been stagnant or grown slowly, and in Australia, this has been flagged by the RBA as a key concern in recent months when handing down their interest rate hikes. An AI-powered boost in productivity would be important for economies. It’s also good for markets, with eToro’s latest Retail Investor Beat demonstrating that 58% of Australians are looking to maintain or increase their investment in sectors that stand to benefit from AI.

This AI tech boom is not without a potential downside, however.

Undoubtedly, AI will disrupt industries, and companies will reduce headcounts if they feel they are more efficient with AI. The good news is, like any industrial breakthrough, new industries and jobs will be created, which will open up plenty of opportunities. After all, most job types today did not exist fifty years ago – and inversely, you wouldn’t find new job openings for lift operators, signallers or lamp lighters on a careers website. These far-reaching industrial changes can be vital long-term, but the transition can cause tension as businesses and employees move quickly to adapt.

*All data accurate as of 19/06/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.