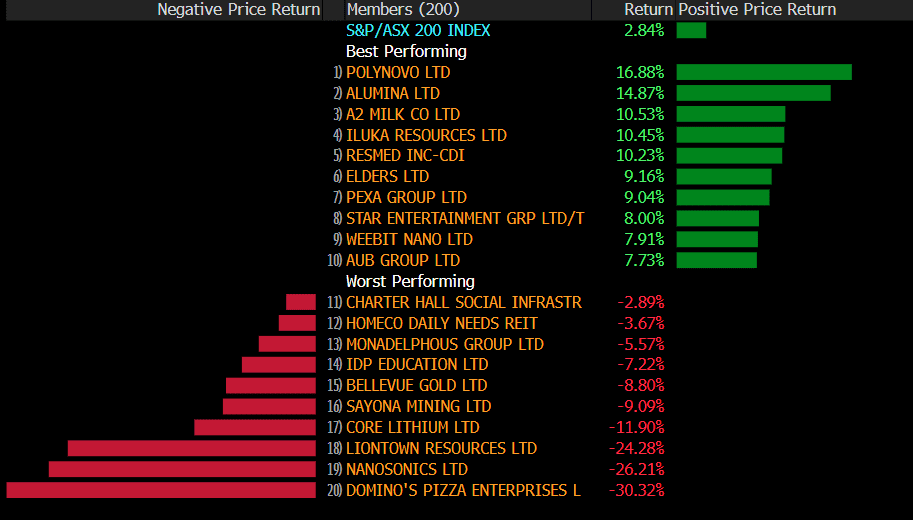

It was a stellar week for the ASX200, gaining 2.8%, with all sectors finishing in the green. The healthcare index led, thanks to gains from PolyNovo (PNV) and ResMed (RMD), closely followed by the materials sector.

US markets were mixed for the week but still finished in the green. GDP came in higher than expected at 3.3%, whilst US PCE also came in below expectations, and tech earnings came through thick and fast, with Netflix (NFLX) delivering a huge 13.1 million new subscribers in Q4. For more on Netflix Earnings, check out the latest episode of Market Bites:

3 things that happened last week:

- ResMed Delivers in Q2

ResMed’s Q2 earnings last week showed last year’s dramatic sell-off was overdone, with double-digit revenue growth across its key revenue segments and solid profitability.

2023 proved to be a challenging year for ResMed with the development of GLP-1 drugs that many felt would threaten demand for its devices – specifically its sleep apnea treatment devices. However, much of GLP-1’s impact on the healthcare sector has been overstated, and that’s evident in today’s results. These drugs may still be a concern in the future, but they have plenty of hurdles to get through before we can say they will materially impact ResMed’s business.

Heading into the result, the focus was on margins that had been challenged over the last 12 months, but ResMed quashed investor concerns, delivering better-than-expected gross margins. This is exactly what investors hoped to see and will give shares the next leg higher after its already strong start to the year.

ResMed is a fundamentally quality business, and these Q2 results show it should be a stock for investors to watch throughout 2024.

- Tesla goes into reverse

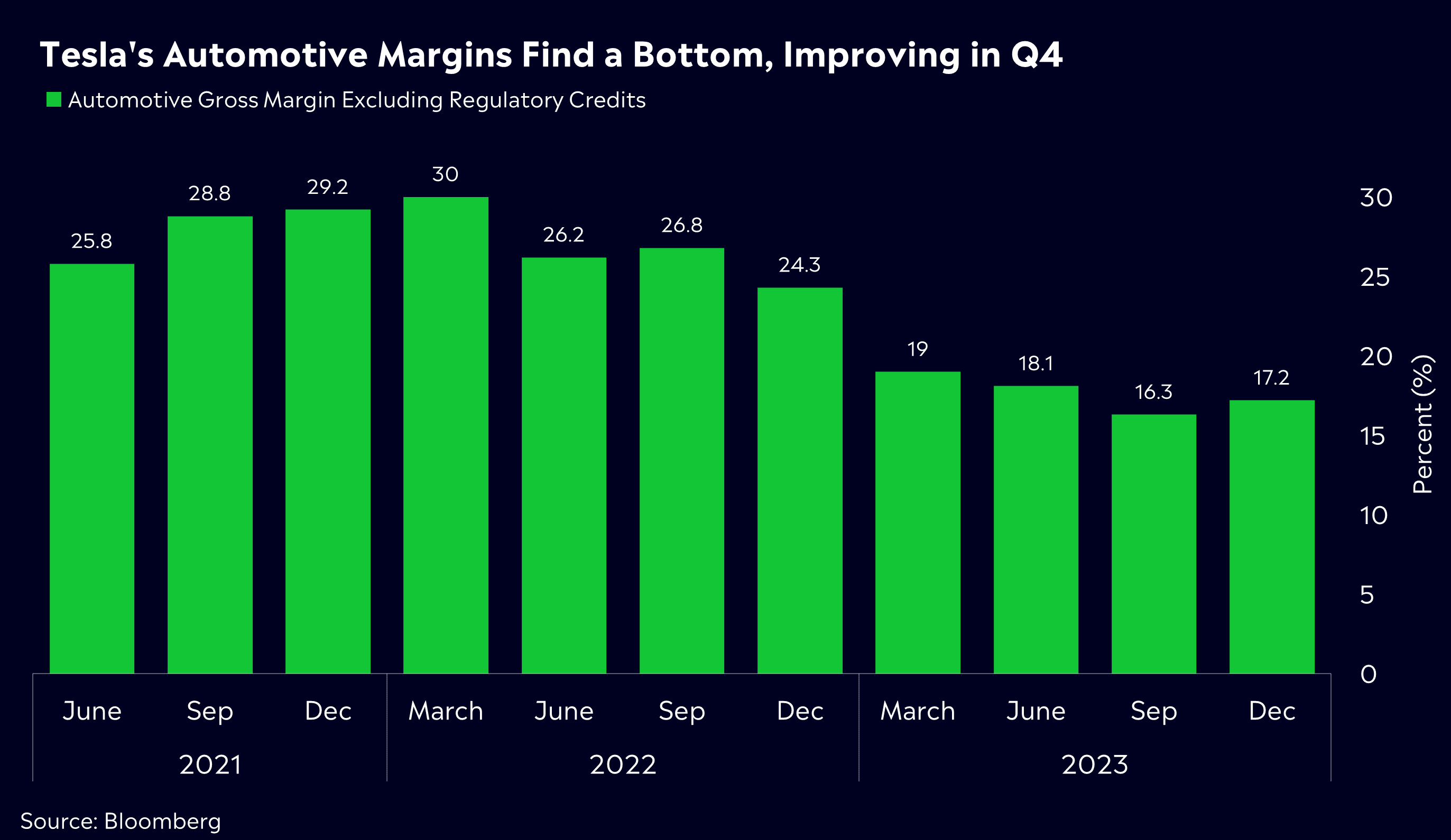

It was a miss across most key metrics for Tesla (TSLA). Earnings, revenue and gross margins came up short in Q4 and a warning that sales may be notably lower this year won’t help investor sentiment.

These results follow a poor start to the year, with Tesla’s shares down more than 15%, making it one of the worst performers on the S&P500 in 2024 amid concerns over waning demand for EVs. We can expect Tesla shares to be on the back foot over the days ahead with USD$194 the key level for investors to watch – its Q4 low. A break below that level could see further downside pressure for the retail investors’ favourite, especially after losing its EV crown to BYD earlier this year.

The positive note was automotive gross margins, rising from 16.3% last quarter to 17.2%. Investors will be monitoring how margins hold up this year, with Tesla set to unveil its new ‘discounted’ model. However, long-term investors still have plenty of catalysts to be optimistic about with battery costs falling, the prospect for long-term EV demand trends, Tesla’s AI investments, and developments in its solar business.

- A winner and loser last week from the S&P/ASX200

Just like ResMed, PolyNovo also delivered a solid trading update, which sent shares 17% higher for the week, and it’s easy to see why. Revenue grew by 65%, and the company reported an EBITDA of $3.6 million in the first half of the year.

It was a rough week for Domino’s Pizza (DMP), with shares falling by more than 30%. The company issued a profit warning and said work would need to be done for volumes to grow in the second half of the year.

3 things to watch for the week ahead:

- All eyes on inflation

The RBA’s first-rate decision of the year is fast approaching and given the Federal Government’s 11th-hour redux of the long-promised Stage Three tax cuts, the dreaded topic of inflation is firmly back on the agenda for the year ahead.

There has been a powerfully optimistic tone from markets in the last couple of months, with the presumption that rate cuts are all but guaranteed in 2024, and recent unemployment data has backed up the view that the RBA has finished its hiking cycle. However, inflation is the data point the RBA are most focused on Wednesday’s reading will be key ahead of the February rate decision.

Following November and October results that showed inflation was slowing at a faster rate than expected, a range of shifting conditions, the inevitable Christmas consumer rush and a rapidly changing outlook for 2024 may mean the needle is closer to market CPI estimates this time around. A better-than-expected result this week will only see rate cut expectations brought forward, and that will likely be met with optimism from local stocks.

- Earnings blitz

This week is an absolute earnings bonanza, with five of the Magnificent Seven posting results, alongside aerospace titan Boeing (BA).

With record highs the talk of Wall Street, a huge week of tech earnings will be front and centre with solid results likely needed to keep indices at record levels. Tech shares have led performance so far in 2024, picking up where it left off in 2023 with investors not ready to give up on last year’s winners.

AI will likely take centre stage once again for big tech, with investors wanting to see how this revolutionary technology is positively affecting bottom lines, with use cases continuing to grow for consumers and enterprises. Investors will want to hear more from Apple (APPL) and Amazon (AMZN) around AI, who have been slightly slower to announce their AI plans compared to the Magnificent Seven stocks, with both looking to play catch up this year.

Efficiency was the theme for big tech in 2023, which continued in the fourth quarter with further cost-cutting and a focus on driving revenue. Big tech continues to move from strength to strength, and it’s not hard to see why investors want to own these stocks. Apple may be the name that stands out this week after its underperformance in the last 12 months, and losing its place as the world’s most valuable stock on the back of concerns of weaker iPhone demand. But, the launch of its new Vision Pro has plenty of potential and may excite investors this week, either way, Tim Cook and his team need a good earnings call.

Boeing – and, really, the air travel industry as a whole – has been facing intense scrutiny following widely reported maintenance and manufacturing failures. Boeing CEO Dave Calhoun has just met with lawmakers in Washington amidst seemingly escalating incidents as analysts point to a drive for profitability leading to a drop in quality control at the company.

These headline events haven’t rattled investors, however, and the company’s share price has continued to experience a relatively steady recovery since it took a hit in the pandemic. However, these upcoming earnings, coupled with the potential of costly repercussions from authorities globally, could be just the thing shareholders are dreading.

- Supermarket stress

Prime Minister Anthony Albanese’s announcement today that the ACCC will be conducting a 12-month price inquiry into supermarkets’ alleged anti-consumer conduct may not be surprising to many, especially given The Greens already announced its senate inquiry into price gouging in December.

This is likely good news for the average Aussie struggling at the checkout. According to eToro data, families in Australia are facing up to a 32 per cent increase in the cost of a BBQ this year. eToro analysed a popular supermarket’s prices and found that a typical Aussie barbecue meal of meat and prawn skewers alongside burgers, sausages and salad will cost at least $81.89 for a family of four*. In January 2023, the same meal was estimated to cost a total of $62.26.

According to eToro data, the cost of living is truly weighing on Aussies. When asked about the impact it’s having on their life, Aussies were most likely to say it’s denting their savings (45 per cent) and spending habits (29 per cent). 1 in 2 Aussies (50 per cent) are now limiting dining out, eating at home instead.

Since the start of the year, Woolworths’ (WOW) share price has taken more than a few blows, specifically following the announcement it would not be selling Australia Day products. Ongoing negative publicity from the impending ACCC investigation is unlikely to do wonders for market sentiment. Similarly, Coles Group (COL) shares have underperformed since the year kicked off.

Recommended changes by the ACCC could also result in the supermarkets incurring additional costs to implement these changes, affecting profit margins and consequently influencing share prices. While the price inquiry is far from over, the announcement of the ACCC’s involvement may be enough to make some investors wary.

*All data accurate as of 29/01//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.