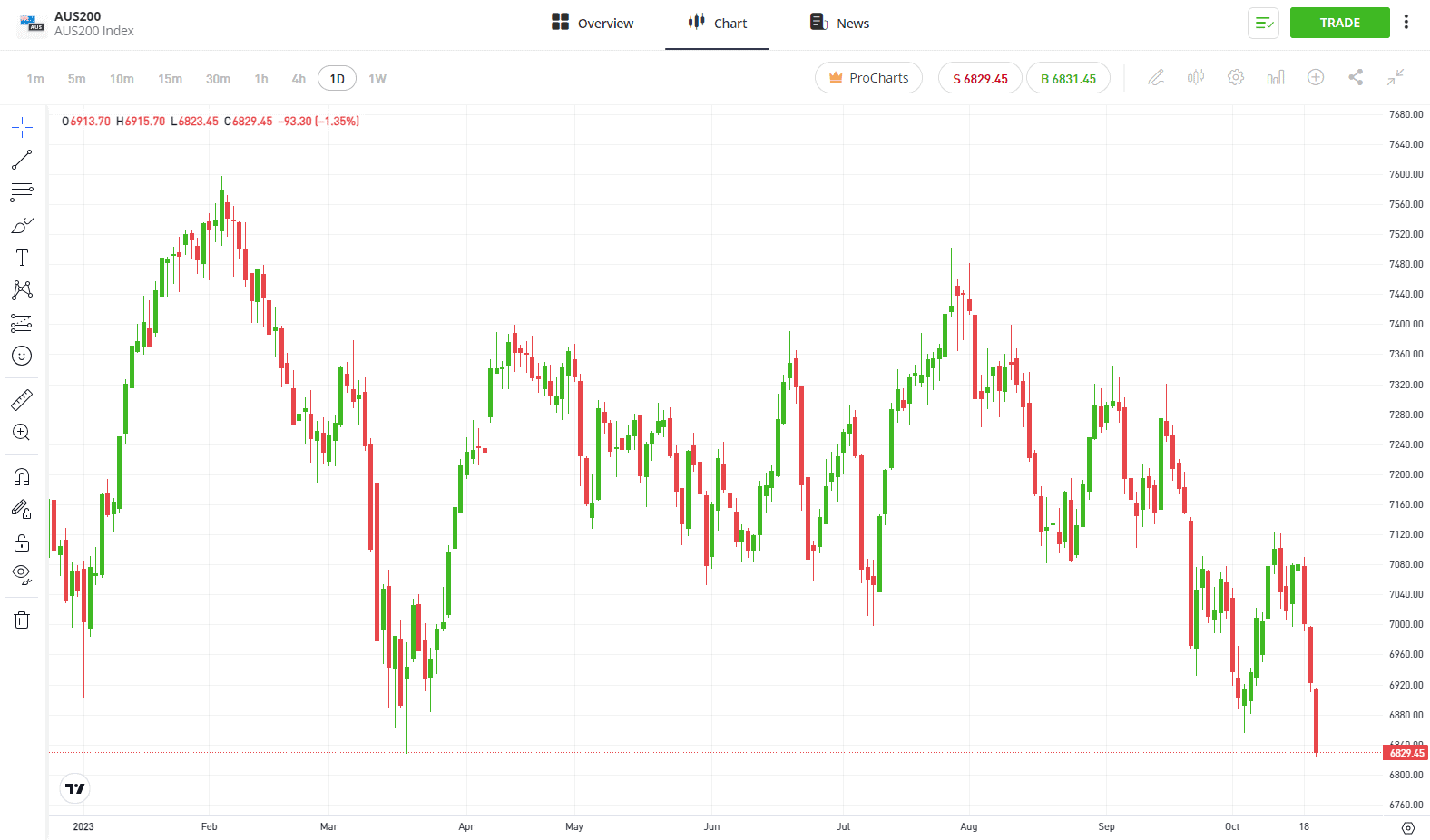

It was a sea of red across global markets last week, as geopolitical tensions and rising yields dampened sentiment. The ASX200 lost 2.13% for the week, with energy the only sector finishing in the green. The local market also digested minutes from the RBA’s latest policy meeting, which were taken as hawkish by most, while Australian unemployment fell to 3.6% from 3.7% in August. The S&P500 closed out the week with four straight daily losses, ending the week down 2.4% while tech felt the full force of the sell-off with the Nasdaq Composite closing down 3.2%.

3 things that happened last week:

1. Netflix delivers whilst Tesla disappoints

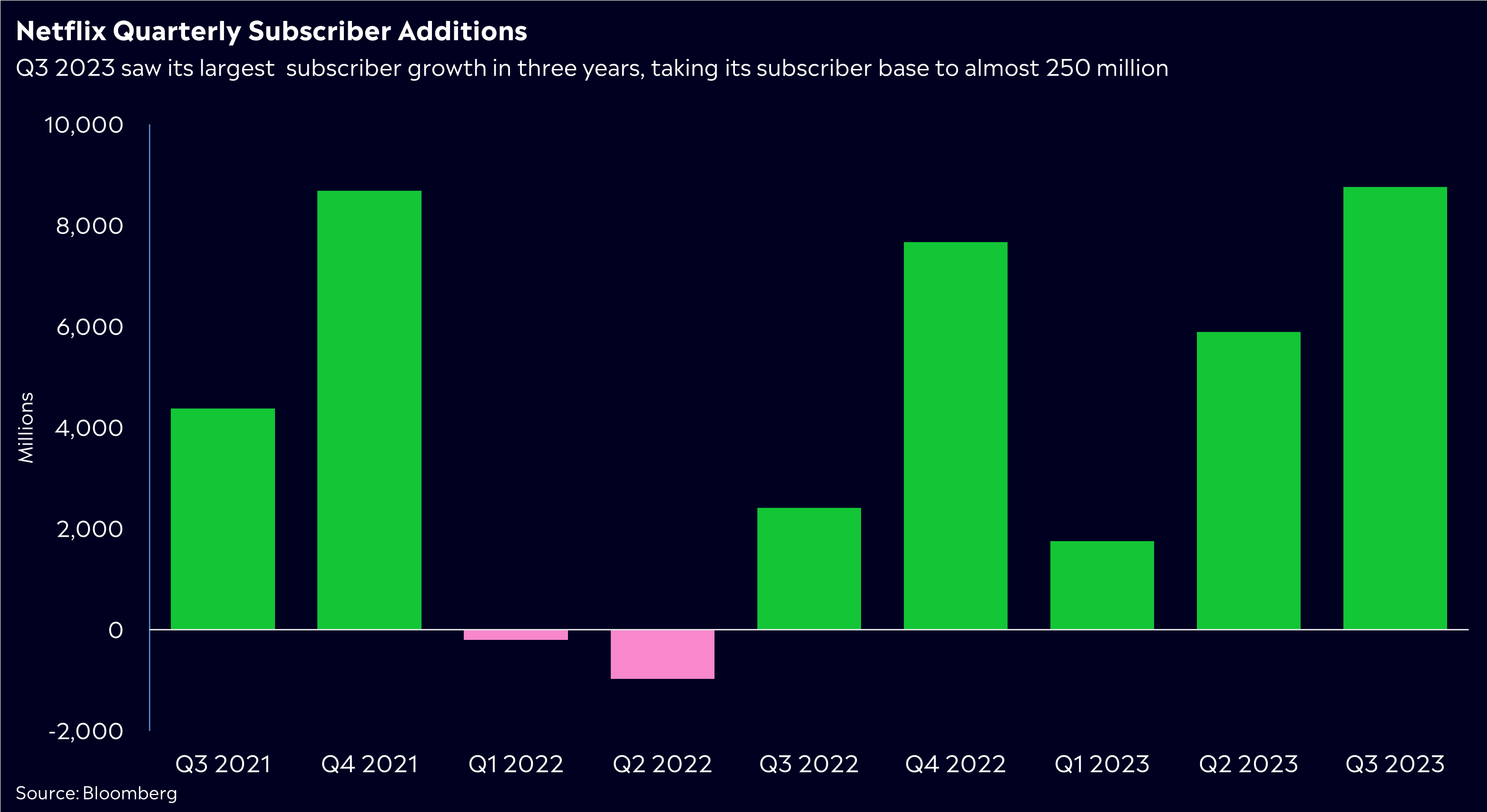

The two big tech names to kick off earnings season had broadly different results last week. Netflix (NFLX) added 8.76 million new paid subscribers for the quarter, easily topping estimates of 6.2 million and taking its subscriber base to almost 250 million. Those new subscribers are well and truly aiding Netflix’s top and bottom line, with earnings, revenue, margins, and free cash flow all beating analyst estimates for the quarter. A significant jump in free-cash flow saw Netflix flex its financial muscle with a $2.5 billion buy-back in Q3. But, for Tesla (TSLA) it was a different story. Margin struggles continue to be the centre piece of the Tesla story right now, and they missed estimates once again. Tesla’s operating margin fell to 7.6% in the quarter, falling from a recent high of 19.21% in Q1 2022, whilst automotive gross margins ex-regulatory credits for the quarter were 16.3%. It got worse on the conference call as CEO Elon Musk tried to rein in expectations on the Cybertruck. He went on to warn that “there will be enormous challenges in reaching volume production with the Cybertruck, and then in making a Cybertruck cash flow positive.”

2. Bitcoin surges above 30k

Amongst the sell-off in global assets, bitcoin (BTC) continued to defy critics, trading above $30,000 over the weekend as the expectation of an acceptance of a spot ETF grows. The asset has now gained 80% YTD, making it the best-performing asset class. Investor sentiment has been depressed, but our recent global retail investor survey shows investors are bullish on crypto of all assets for the fourth quarter, with 15% saying crypto would be the asset they’d be buying in Q4. This supports our view of a strong road ahead for bitcoin with a long list of catalysts, from the acceptance of a spot ETF, March’s always-important ‘halving’, the new global banking and US corporate accounting regulations making it easier to own crypto, as well as the potential to soon see the first central bank holding bitcoin in reserves.

3. A winner and loser last week from the S&P/ASX200

Weebit Nano enjoyed its best week of the year up 26%. The semiconductor company announced a commercial agreement with South Korean foundry, DB HiTek. The news was well received by investors given DB HiTek’s extensive customer base.

It was a torrid week for Liontown Resources (LTR) falling by -32% and losing its place amongst the ASX200’s top performers for 2023. It’s proposed takeover with Albemarle (ALB) collapsed and the company announced an emergency funding round at $1.80 which represented a 35% discount when it was announced.

3 things to watch for the week ahead:

1. US tech earnings (Microsoft, Alphabet, Meta)

This week is set to be one of the biggest weeks on the US quarterly earnings calendar with Microsoft (MSFT), Alphabet (GOOG) and Meta (META) posting results.

A big focus for both Microsoft and Google will be artificial intelligence. Amid growing pressure on those in the AI field to turn presence into profit, investors will want to hear from management that AI hype can translate into growing revenue and earnings. Despite AI effectively being the trend of 2023, big tech is still struggling to convert market enthusiasm and broad adoption into viable revenue streams.

Meta will also be in the AI conversation with the launch of its AI assistant glasses, so outlook there will be key as well. Of course, Meta’s foray into virtual and augmented reality with Horizon Worlds has largely fallen far short of expectations, so the pressure is on for Zuckerberg to produce a ‘must have’ piece of hardware this financial year. Time will tell whether AI is the key to reversing some of the negative consumer sentiment the company endured across 2023. Margin improvement has been key for Meta since cutting costs early, which has helped shares surge by 200% YTD, so further margin growth will be in the limelight.

Importantly, tech earnings need to deliver. Valuations are high and the expectation from investors will be that earnings are recovering and margins are improving for the tech world’s heaviest hitters.

2. Australian inflation and RBA Speeches

It’ll be a big week for the RBA; not only do we hear from Governor Bullock, but the Q3 CPI reading will likely guide the Governor on whether the RBA will raise rates again before year’s end.

This week’s published minutes from October’s rates meeting were construed as hawkish by investors, and the market is now pricing in one more hike in this cycle despite the Reserve Bank keeping rates on hold for four consecutive months.

Then, we have the crucial CPI figures this week. These will be imperative to market direction and the RBA’s next move. Q3’s CPI reading is forecast to be 5.1%, a drop from 6% last quarter.

There are some fears over the jump in fuel prices due to global turmoil impacting the RBA’s reading – a valid concern. To add to that concern, the bubbling geopolitical tensions overseas will only add to fears over stubborn oil prices. Regardless, anything under 5% could be the magic number for the RBA and would be a number that may justify keeping rates on hold in November.

3. US GDP

Retail sales rose again this week, showing that US consumers are still spending even while inflation bites down. The figures set the scene for the US GDP reading on Thursday, which is also likely to indicate further resilience in the US economy and that resilience has taken most investors by surprise this year.

Despite difficult conditions, the US economy is frankly still some distance from a recession, with the Q3 GDP reading set to see growth of 4.1%, the fastest quarterly growth since the end of 2021. A US recession would have global ramifications, so strong growth for the world’s largest economy is good news.

Consumer spending continues to be driven by a tight labor market, with the economy creating 336,000 jobs in September. However, headwinds are mounting for consumers, many of whom rely on debt to fund purchases. Higher borrowing costs as the U.S. central bank tackles inflation have also pushed credit card delinquencies to an 11-year high. These conditions are serious enough to be a concern before the end of the year, but aren’t likely to be reflected in this week’s data.

*All data accurate as of 22/10/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.