As we gear up for another eventful week in the markets, the spotlight is on Australia’s January unemployment figures and the Aussie share market reporting season. Investors are poised for a week brimming with insights. Let’s dive into the three key highlights and potential implications for this week.

Australian Unemployment

All eyes will be on Thursday’s announcement of Australia’s January unemployment rate, after December’s higher-than-expected rise to 3.9%. December’s uptick was perceived as a sign that the labour market could be loosening up, with job advertisement figures dipping, and population growth remaining robust, suggesting that we might see a further rise in unemployment this week.

Strong employment growth counterbalanced December’s unemployment rate, a positive takeaway for the RBA, considering they’d also been handed favourable inflation data and relatively soft retail sales figures in the weeks leading up to Christmas. This week’s cash rate decision further suggests that the RBA’s hikes are being left behind in 2023; however, it’s likely to be one of the last major central banks to introduce rate cuts this year.

Investors must remember that despite global expectations of a rate cut by the US Federal Reserve by March, a similar move from the RBA is not likely to be swift. But, as Taylor Swift would say, ‘Shake it off’ and keep an eye on the economic trends. As we approach the release of January’s unemployment data, investors should keep a close eye on the evolving labour market conditions and the potential impacts on monetary policy.

CSL’s Half-Year Results

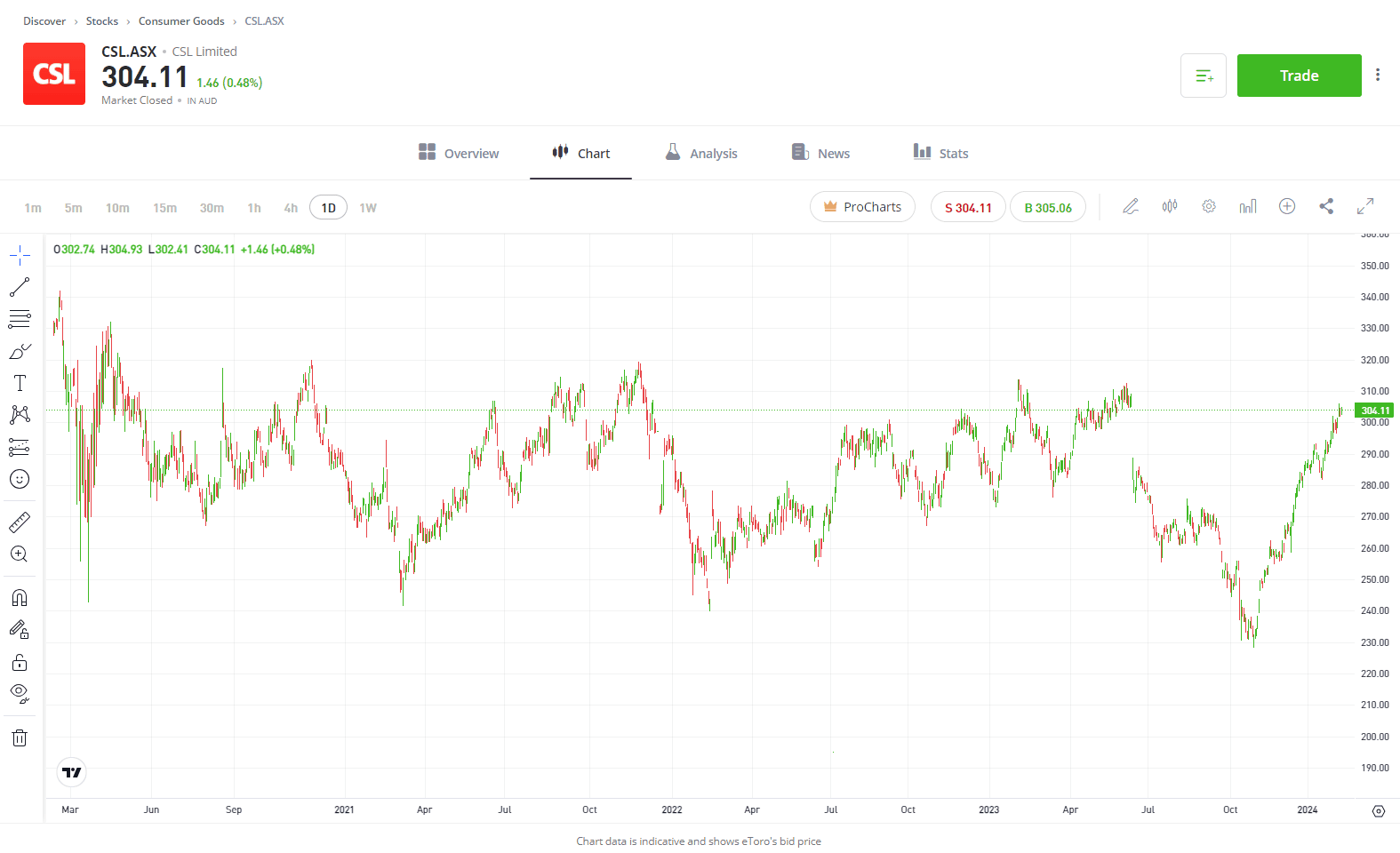

Healthcare may have been an underperformer on the ASX last year, but with an economic slowdown looming, prudent investors are keeping an eye on the sector, with CSL’s FY24 half-year results being a focal point for this week.

While CSL’s shares have risen 30% since its low in October, the company’s share price faced a decline last week following news of a UK investigation into alleged anti-competitive behaviour from CSL Vifor. If found guilty, CSL faces potential fines and reputational damage, which may impact the company’s FY24 results.

Shareholders were pleased with the healthcare giant’s FY23 results, where revenue growth went up 31% year-over-year to USD$13.31 billion, and the company’s FY24 guidance continued to hold firm. CSL’s projected underlying profit range of USD$2.9 billion to USD$3 billion for FY24 has provided reassurance to investors eagerly anticipating the company’s half-year results. They are keen to ascertain whether CSL has sustained its course toward recovery following the turbulence its share price experienced in 2023.

Explore CSL.ASX

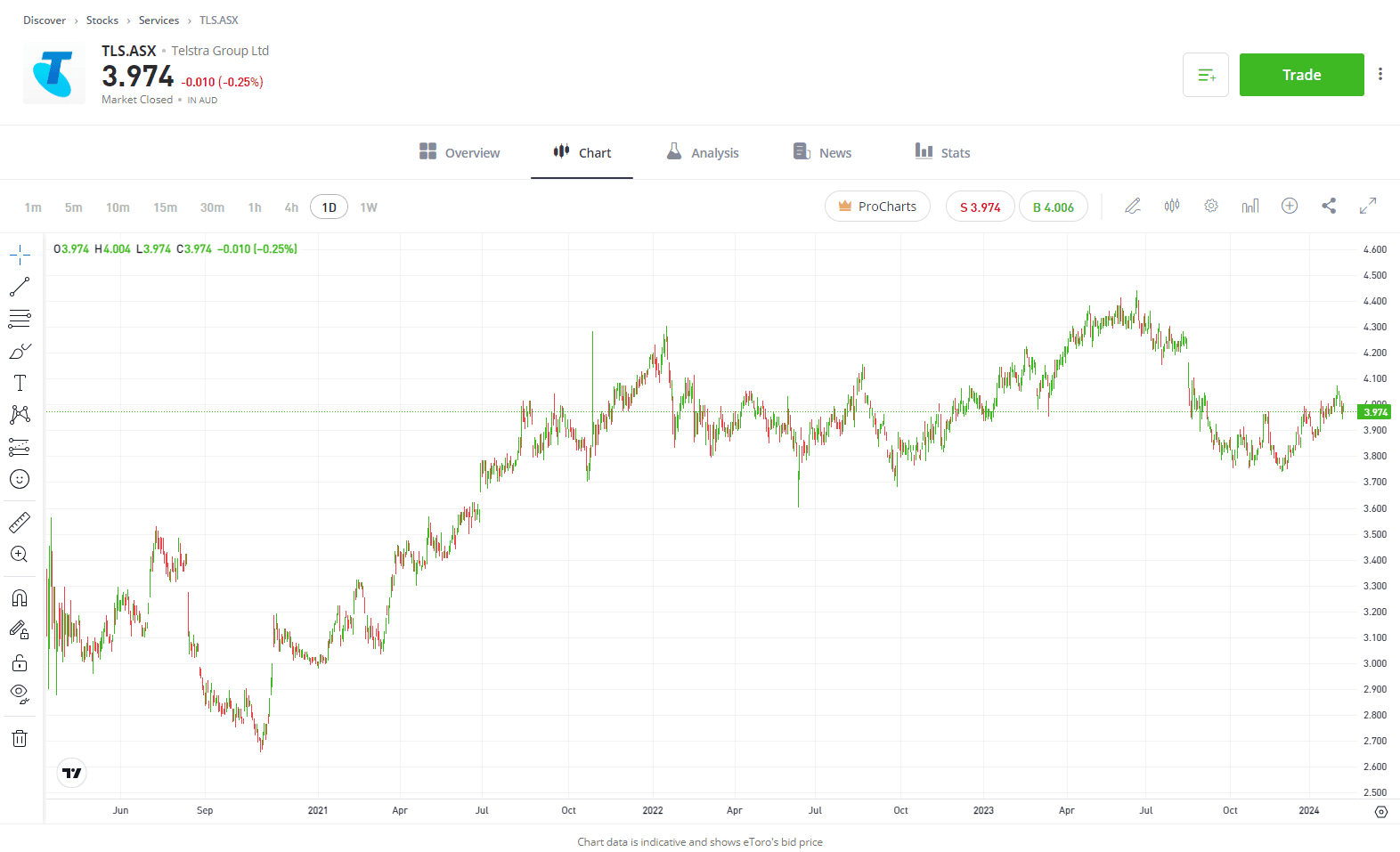

Telstra’s Half-Year Results

It’s been a lacklustre couple of years for Telstra, with shares falling by around 2% in that time, despite a 14% jump in profitability last year. This week’s half-year results will be a key insight as to how cost-cutting has aided the businesses bottom line. The good news is that Telstra’s profits look set to continue growing. In August, the business forecasted EBITDA of A$8.2 billion to A$8.4 billion in FY24, well ahead of FY23’s A$7.86 billion.

Telstra’s move in November to secure a significant portion of mid-band 5G allocation will undeniably have ripple effects on its FY24 half-year results. The key will be how effectively this spectrum purchase is leveraged to increase market dominance, particularly as 5G continues to become the new standard. Investors will be eager to see how this step influences its half-year results, and whether this gamble pays off in terms of customer acquisition and retention. With this move, Telstra seems to be aiming for a larger slice of the digital economy.

Interest rates and their potential impact on Telstra shares have also been a hot topic of late, with the possibility of rate cuts later in the year signifying that Telstra could become a more attractive proposition for yield-seeking investors as cash loosens up.

Explore Telstra.ASX

Stay up to date with eToro’s earnings calendar and know when your companies report.

*All data accurate as of 12/02//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.