- Only 9 per cent react to market volatility by selling off their investments

- The majority (55 per cent) of Australian retail investors hold investments for years

- Concern over the Australian economy subsides, but investors see the state of the global economy as the biggest risk to their investments

- Australia overtakes the US as local investors’ favourite stock market for long-term returns

Tuesday, 8th of April 2025 – Australian retail investors adhere to long-term strategies to navigate market volatility, but are cautious about the state of the global economy, according to the latest quarterly Retail Investor Beat from trading and investing platform eToro. The study, which surveyed 1,000 retail investors in Australia, revealed that more than half of the respondents (60 per cent) stay the course and maintain their existing investment strategy during volatile times, while only 14 per cent opt to rebalance their portfolios. 11 per cent see market volatility as an opportunity to buy more investments, and only a small fraction (9 per cent) react by selling off their investments.

The majority of retail investors are in it for the long run. 55 per cent hold their positions for years, and a further 11 per cent for decades. 18 per cent hold assets for months, while only a small proportion of retail investors stay invested in them for weeks (6 per cent) or days (2 per cent). The study also found that retail investors’ confidence hasn’t wavered. A majority (52 per cent) believe they are on track to achieve their investment goals, with long-term investors (>10 years) the most likely to be on track at 65 per cent.

Commenting on the data, eToro Market Analyst Josh Gilbert, said: “After a golden few years, retail investors are being put to the test this year with uncertainty sweeping through markets. But our data shows that they are in it for the long haul. Rather than panic-selling, everyday investors are staying the course and gone are the days of dismissing retail as reactive or short-sighted. What we’re seeing now is a more educated, more disciplined investor base, confident enough to navigate turbulence without abandoning long-term goals.”

Worries surge for the global economy but fade for Australia

Concern about the state of the global economy has shot up, with one in three Australian retail investors (32 per cent) naming it the biggest external risk to their investments. This is a 60 per cent jump from Q4 2024. Conversely, local retail investors are much less concerned about the state of the Australian economy, with only 1 per cent thinking it’s the biggest external threat to their investments, compared to 19 per cent in Q4 2024. Meanwhile, one in five Australian retail investors (20 per cent) remain concerned about inflation’s risk to their investments.

Table 1: Australian retail investors on what poses the biggest external risk to their investments

| External Risk | Q4 2024 | Q1 2025 |

| State of the global economy (potential recession) | 20% | 32% |

| Inflation | 17% | 20% |

| International conflict | 14% | 15% |

| High interest rates | 12% | 11% |

| Increased/rising taxes | 7% | 7% |

| Rise in national debt | 4% | 6% |

| State of the Australian economy (potential recession) | 19% | 1% |

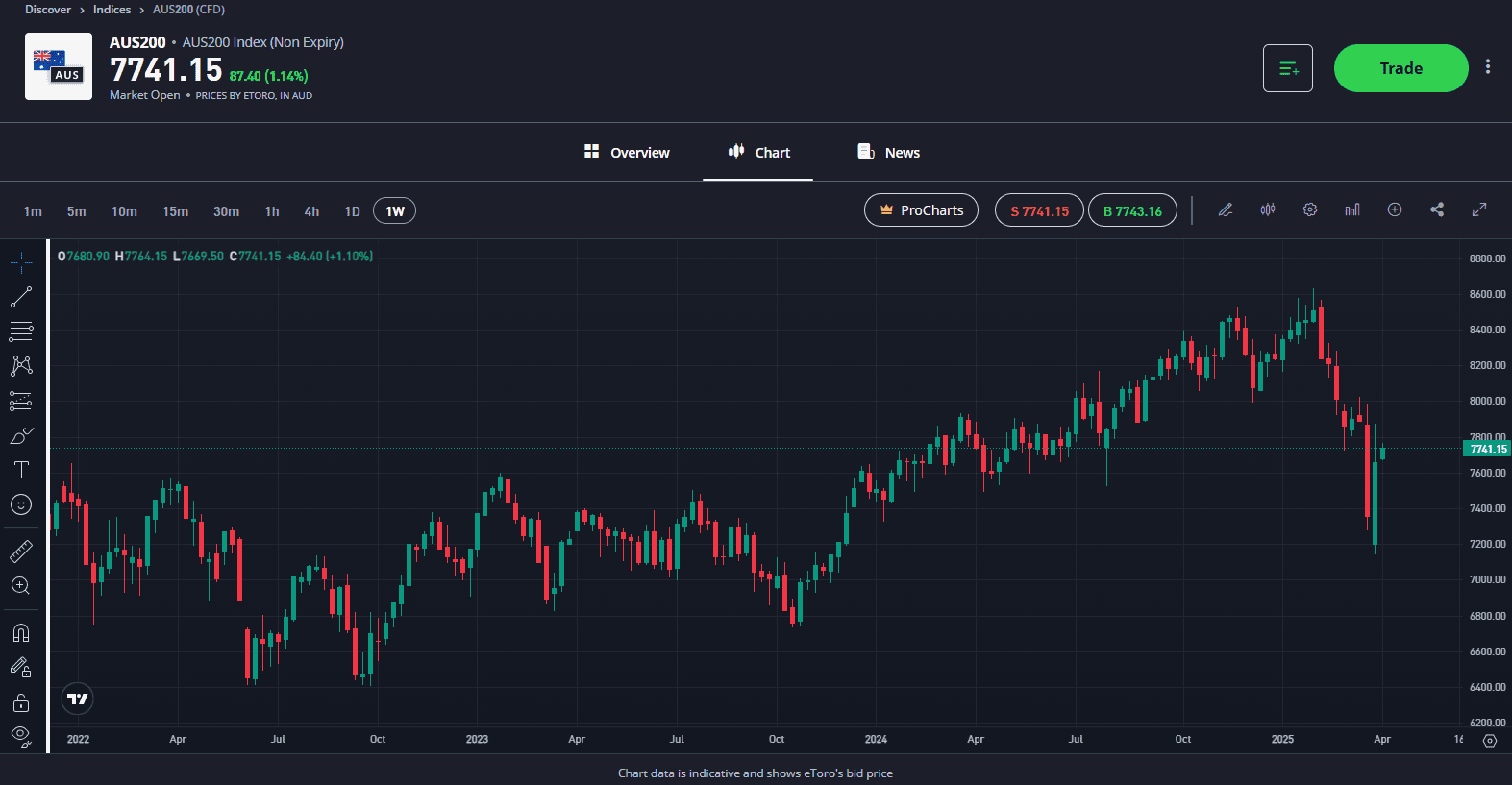

Confidence in ASX rises, but declines for the US

Over one in three retail investors (39 per cent) identify Australia as the region with the strongest long-term return potential, up 30 per cent since Q4 2024. Conversely, those favouring the US market for long-term returns dipped from 40 per cent to 34 per cent since Q4 2024, down 15 per cent. The percentage of retail investors that trust emerging markets for the long run rose from 13 per cent last quarter to 15 per cent, Japan from 12 per cent to 14 per cent, the UK from 5 per cent to 7 per cent, and Europe from 9 per cent to 10 per cent. China also saw a slight increase, rising from 16 per cent to 17 per cent in the first quarter of the year.

Josh Gilbert commented: “The RBA’s angst over uncertainty in the world economy is clearly being matched by retail investors, with global headwinds now the dominant concern. This shift highlights that retail investors are focusing on the bigger picture, from recession risks in the US, to escalating trade tensions and geopolitical instability.

“On the other hand, it’s very interesting to see the lack of concern over the Australian economy, which is a key reason that Aussie investors are confident in the local market.

“The lack of confidence in the US market is likely bringing some optimism to the ASX. However, the knock-on effects of US trade policy via Asian nations, especially China which has been hit with tariffs since early February, could weigh on our export-heavy economy, especially if global demand slows and commodity prices retreat.”

Explore Markets

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. eToro is authorised and regulated by the Financial Conduct Authority in the UK, in Cyprus by the Cyprus Securities and Exchange Commission, by the Australian Securities and Investments Commission in Australia, licensed by the Financial Services Authority in the Seychelles and by the Abu Dhabi Global Market (“ADGM”)’s Financial Services Regulatory Authority (“FSRA”) in the UAE.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.