- Over half (58 per cent) of Aussie retail investors expect bull market to span 2025, with the majority (59 per cent) backing AI stocks to keep rising

- Aussie investors most confident they have been in a year about their investments and likely to have upped their contributions

- Gen Z stays loyal to the Australian market while other generations bet on the US to outperform

Thursday, 16th January 2025 – Aussie retail investors are optimistic that the current bull market will continue throughout this year, according to the latest quarterly Retail Investor Beat from trading and investing platform eToro.The study, which surveyed 10,000 retail investors across 12 countries, including 1,000 in Australia, found that 58 per cent of Aussie retail investors predict the bull market will persist. Confidence in AI stocks also remains high among Aussie investors, with 47 per cent expecting them to rise gradually in 2025, while 12 per cent expect significant increases.

Australians are the most confident they have been in the past four quarters when it comes to their investments. Investor confidence is now at 79 per cent, up from 72 per cent in Q4 2023 and 75 per cent from Q1 to Q3 2024. As a result, Aussies are also the most likely they’ve been in the past four quarters to have increased the amount they invest, with 31 per cent having added more to their portfolios in the past three months (compared to 23 to 27 per cent from Q4 2023 to Q3 2024).

US stocks stay on the menu, but Gen Z favours the home market

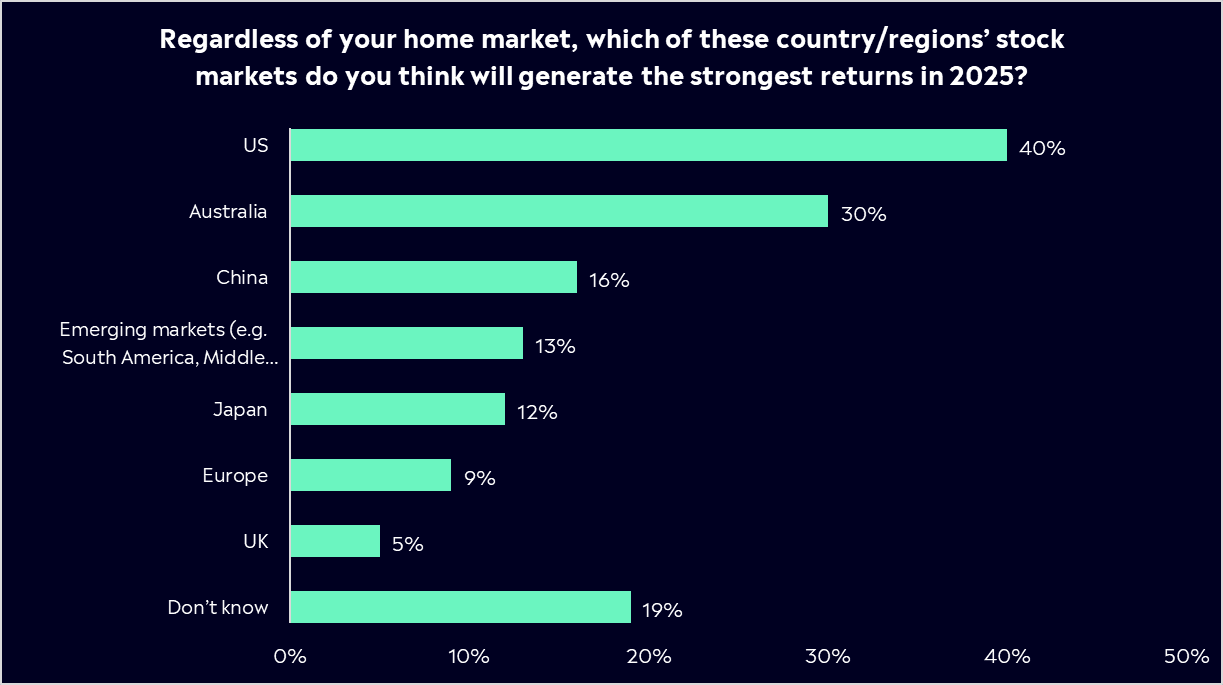

After the S&P 500 soared over 20 per cent for the second year in a row, Aussies are still tipping the US to outperform local darlings in 2025. 40 per cent of Aussie retail investors believe the US stock market will generate the strongest returns in 2025, while only 30 per cent think the local market will do the same.

However, Australia’s youngest investors – Gen Z, are more confident in the local market. 42 per cent think the Australian stock market will generate the strongest returns this year, with only 28 per cent believing the same for the US stock market. Gen Z is also the only generation that is the most confident in the Australian stock market overall, with every other generation favouring the US stock market.

Commenting on the data, eToro analyst Josh Gilbert said: “Aussie retail investors remain highly optimistic about the market outlook for 2025, and that’s not surprising following the solid end to 2024 and the strength being seen across the AU and US economies. But what is surprising is to see Gen Z investors focusing on homegrown stocks rather than looking to Wall Street with its high-flying technology stocks.

“This is clearly a sign of a younger cohort of investors sticking to what they know, with companies they understand. It’s not often the ASX 200 stands taller than the S&P 500 but with rate cuts imminent and a Chinese economy that could be primed for recovery, it’s fair to see why Gen Zs are feeling confident on the local market.”

Table 1: Australian Retail Investors’ opinion on which stock market will generate the strongest returns in 2025

US election sparks strategic shifts

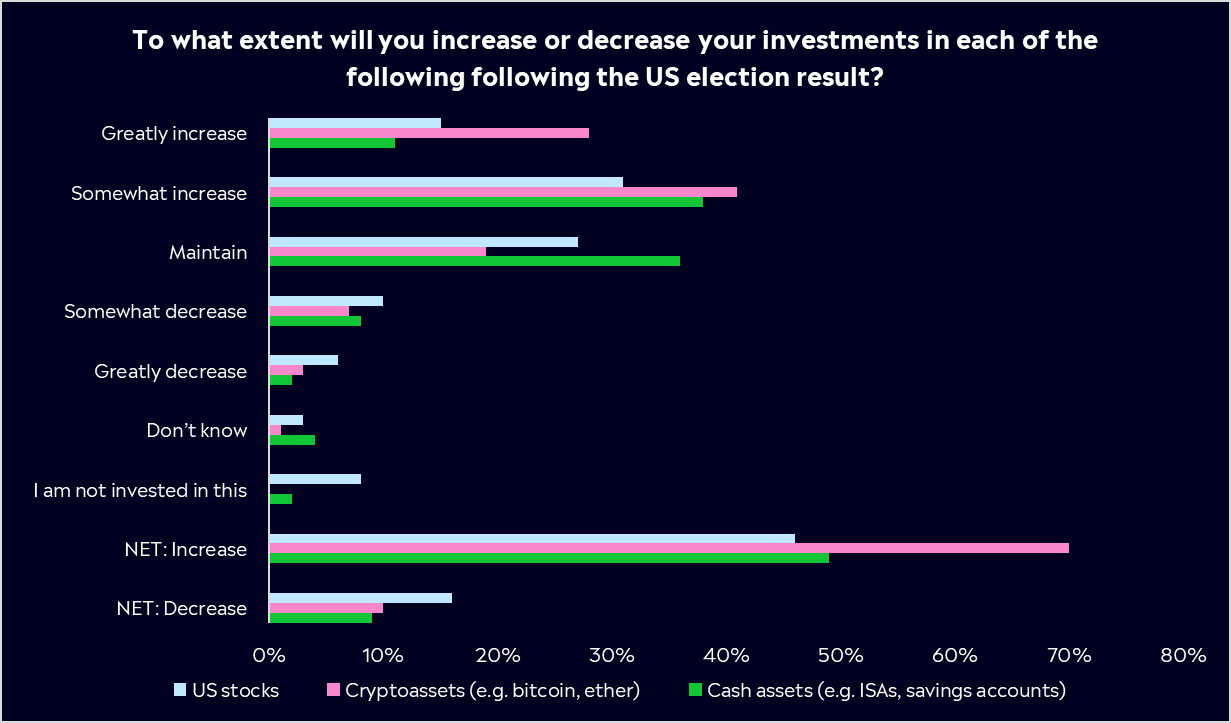

Following last year’s US election, almost one-third of Aussies (29 per cent) are planning to adapt their investment portfolio based on Trump’s victory, with a further 16 per cent having already adapted their portfolio. Of the Aussies who have already adapted or are planning to adapt their portfolio, 70 per cent intend to increase their investment in cryptoassets, likely as a result of President-elect Donald Trump’s pro-crypto stance. 46 per cent intend to increase their investments in US stocks, and almost half (49 per cent) intend to keep more cash assets.

Josh Gilbert adds: “Investors looking to adjust their portfolios as Trump’s inauguration day approaches makes a lot of sense. Although investors should focus on fundamentals and not politics, a Trump administration brings new challenges for investors, particularly inflation rearing its head again. On the other hand, a pro-crypto president and SEC chair set up a favourable environment for crypto assets in 2025 with clearer regulation that will likely encourage greater adoption of the asset class.”

TABLE 2: Australian Retail Investors’ investment plans following the US election result

Is the ‘Magnificent Seven’ hype starting to settle?

When asked which of the so-called ’Magnificent 7’ stocks they are most likely to increase their investment in for 2025, Australian investors ranked Tesla first, with 13 per cent selecting the EV giant, which has enjoyed a share price boost since the US election. Apple (12 per cent) followed closely, while Amazon (10 per cent), Nvidia (8 per cent), Alphabet (7 per cent), Microsoft (7 per cent), and Meta (3 per cent) rounded out the list.

Regarding how Aussies believe the ‘Magnificent 7’ stocks will perform compared to the broader market in 2025, 12 per cent of local retail investors said they will outperform significantly, while 32 per cent said they will only slightly outperform. 36 per cent expect them to perform in line, and 7 per cent tip underperformance.

“The Magnificent Seven will remain a prominent part of investors’ portfolios for years to come. These seven stocks as an index have outperformed the S&P 500 and ASX 200 in the last two years. They’re powerhouses of the US economy, are the key drivers of innovation in today’s society and will continue to dominate their industries for years to come,” concludes Josh Gilbert.

Explore Markets

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.