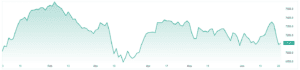

Australian shares had their worst week since March, with the ASX200 falling by more than 2%, and both Technology and Energy sectors losing 4%.

The ASX may see a shaky start to the week following a negative session on Wall Street on Friday alongside a wave of uncertainty from geopolitical tensions in Europe. It is unclear how the current geopolitical situation will play out, even if it seems a truce has been reached. The bottom line is that markets hate uncertainty, so we’re likely to see volatility increase this week– especially with the VIX at its lowest level in three years.

Fresh concerns of global conflict will add to the list of conditions investors are currently fretting over, such as inflation and higher interest rates. The uncertainty could see risk-off sentiment prevail, and investors may flock to safe havens, meaning assets like Gold and USD could catch a bid this week while investors seek a clearer picture of what’s ahead.

3 things that happened last week:

1. China cuts more rates, but optimism fades

The materials sector struggled again last week, falling by 3.8%, as optimism faded over China’s ability to ignite its economic recovery. Cuts of two key lending rates were a step forward following monetary tweakings earlier in the month, but investors were disappointed with no mention of stimulus in its State Council Meeting. China is clearly not in a rush to throw around blanket stimulus packages overnight; they are opening the taps, but it certainly won’t be a flood, and that will mean investors need some patience when it comes to China.

2. US Stocks cool with worst week since March

US markets have had a blinding start this year, with the Nasdaq having one of the best starts to the year in history – but we’re certainly due a slowdown in the pace of this rally, which was seen last week with the Nasdaq falling by more than 1%, ending eight straight weeks of gains. Hawkish comments from Jerome Powell were the key to investors taking profits last week, with the expectation of higher rates ahead. But, the rally so far has been fundamentally driven, with earnings growth forecasts rising, inflation falling, and US GDP on track to grow 2% this quarter. Sprinkle some AI optimism into the mix, and you can see why the S&P500 is up 15% and the Nasdaq up more than 30% this year. The rally is slowing, but it doesn’t mean it’s the end.

3. A winner and loser last week from the S&P/ASX200

AGL Energy (AGL) was a top performer last week, with shares rising more than 4%. Its strong week follows a recent upgrade to its profit guidance with energy prices expected to rise across Australia.

Lake Resources had a horrible week, with shares falling by 37.9%. The huge loss last week comes as the company handed down a disappointing update regarding its lithium project in Argentina, which has been set back until 2027.

3 things to watch for the week ahead:

1. Australia Monthly Inflation

It’s a huge week this week, with key inflation data coming that could lend vital insight into the RBA’s next move. Last month, Australian monthly inflation accelerated to 6.8%, driven by increases across rents and fuel. Phillip Lowe has made it clear that the RBA will do what is necessary to bring inflation under control, which has put the ASX200 under pressure so far this year due to markets pricing in further hikes from the central bank. The cash rate is currently at 4.1% but the consensus is that the RBA will keep its foot on the gas and raise rates to 4.6% over the next few months. The key factor preventing that rate from coming to fruition would be a sharp decline in inflation. Recent RBA minutes point towards ‘upside’ risks to inflation, and there are fears over services inflation, with rising electricity costs and soaring rents set to keep feeding inflation. The good news is that inflation is expected to decline to 6.2% for May, but a number below 6% would likely be needed to divert the RBA from raising rates at the start of July.

2. AU Retail Sales

Alongside inflation data this week, the RBA gets another key piece of data with retail sales. Last month’s data showed that the RBA’s extensive tightening cycle is having its desired effect on consumers, with sales flat for April. This is a situation where bad news is good news for the RBA. Retail sales were flat, but this means that consumption is slowing, a key ingredient in the fight against inflation. Retailers are now feeling the full pain of the RBA’s hiking cycle, with consumers tightening their belts. As the end of the financial year draws to a close in Australia, discounts are starting as retailers look to offload inventory. The idea of driving volume through markdowns can be useful but unfortunately, it means profit margins erode as a result. We’re already seeing that take shape, with many retailers downgrading their profit guidance with the full extent of the difficulties likely to be evident during reporting season. The expectation is for retail sales to gain marginally for May to 0.1%, but the next six months may see this number decline further as rates continue to rise and the lag of previous hikes takes full effect.

3. Can bitcoin’s rally continue after reaching a new 52-week high?

It was a big week for bitcoin, with the news that BlackRock filed an application for a bitcoin ETF. Bitcoin jumped above USD $30,000 for the first time in months but the key level to watch now is a sustained move above USD $31,000. The asset briefly traded above this level during the weekend, which signalled a new 52-week high. The good news for investors is that this is a tip of the hat from Wall Street to crypto, signalling institutions are clearly keen on this asset, even if it felt crypto had left the conversation for a few months. When it comes to ETF issuance, BlackRock knows a thing or two, with 575 accepted applications and one denial. A potential ETF approval, alongside clearer regulation and a bitcoin halving next year, are crucial catalysts for a solid second half of 2023 for bitcoin. However, there are still risks, from regulatory crackdowns to the potential for higher-for-longer interest rates that may spoil the party.

*All data accurate as of 26/06/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.