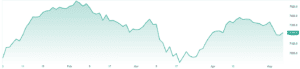

The ASX200 fell by 1.22% last week, with financials dragging the index lower for the week. The financial sector saw its biggest weekly loss since February, falling by 3.4%. Utilities was just one of two sectors to finish the week in the green, with AGL Energy (AGL) leading the way up by 7.1%.

US stocks came under pressure, with the S&P500 falling by 0.76% after further turmoil from regional banks, but Apple (APPL) helped to stem some of the bleeding with strong earnings seeing shares jump by almost 5% on Friday.

3 things that happened last week:

1. Central banks hike. Is the end of rate hikes here?

The Reserve Bank of Australia, The Federal Reserve and European Central Bank all handed down a 25bps hike last week. The hike was a surprise for Aussies, with the ASX200 falling 0.7% straight after the decision with the market pricing in another pause. However, the hike looks to be one final insurance hike from the RBA, with markets now forecasting rate cuts late in 2023. The Fed also dropped some hints that they were nearing the end of its hiking cycle but left the door open should inflation remain elevated. However, in Europe, it’s not the end. The ECB is dealing with stubbornly high 7% inflation and the consequences of starting its hiking cycle less than a year ago. So although the RBA and Fed are seemingly done with raising interest rates, the ECB still has more hikes to come.

2. Vanessa Hudson to replace Alan Joyce as Qantas CEO

Last week, Qantas (QAN) announced Alan Joyce would leave the airline after 15 years at the helm. Although his legacy may be up for debate between investors and customers, his leadership over the last few years will have left investors pleased, with Qantas posting a record half-yearly profit within the 2023 financial year in a significant turnaround for the airline. Any change in senior leadership will always result in some uncertainty for shareholders, particularly after Joyce’s long reign and recent success. However, his successor Vanessa Hudson, Qantas’ first-ever female CEO, has been with the business for almost 30 years. She has served as Qantas’ CFO since 2019, helping to navigate the COVID turnaround, which should reassure investors. The major task for Hudson will be to keep passengers happy while pleasing investors, which won’t be an easy feat.

3. A winner and loser last week from the S&P/ASX200

With Gold flirting with record highs last week, it was another strong week for local gold miners. Evolution Mining (EVN) jumped 11.2% for the week, taking its gains to over 30% for the year.

It was a tough week for National Australia Bank (NAB), with shares falling by -7.84% after the bank’s first-half earnings missed expectations and forecasted a difficult 2nd half of the year.

3 things to watch for the week ahead:

1. Consumer Confidence – Aussies set to be pessimistic as RBA delivers more pain

Last month, Australian Consumer Confidence surged by 9.4% to the highest level since June 2022 as the RBA left interest rates on hold. However, that confidence might be short-lived as the RBA increased its cash rate last week by another 25bps to 3.85%. This rate hike will squeeze household budgets even further, with retail sales already showing that consumers are spending less, which is the RBA’s aim. However, this hike will undoubtedly leave Aussies feeling more pessimistic. A saving grace for the index may be the increase in Australian house prices in April for the second month in a row, which may provide some relief to homeowners. Looking ahead, it seems that the RBA is now done with its hiking cycle, with rate cuts to occur in the 2nd half of the year, which should help to increase consumer confidence significantly.

2. US Inflation – Still the most important number in markets

Last week, the Federal Reserve handed down what looks set to be a final 25bps hike in its largest hiking cycle for decades. With inflation moving in the right direction and now falling faster thanks to the banking issues in the US, the central bank appeared to soften its tone on interest rates but reiterated that it would take time for inflation to return to target. Last month, data showed that headline inflation cooled to 5% whilst core CPI increased to 5.6%. Looking ahead to April’s reading, headline inflation is expected to fall again, but only slightly to 4.9%, with core inflation expected to stay unchanged at 5.6%. The main takeaway from this week’s reading will be if inflation remains high with further evidence of sticky core inflation, then there is still work to do to bring inflation back to target. US Inflation is driving recession risks and the Fed, so another sharp decline in inflation will bring some further relief to investors.

3. Chinese Inflation – An outlier to the rest of the world

It’s been a difficult period for Chinese equities since the 2023 peak in February, with the ‘reopening’ trade losing some steam and HSI Tech falling 21%. But as other global economies fight against soaring inflation, China is doing quite the opposite. Chinese CPI rose by 0.7% in March but fell from 1% in February, compared to 6.3% in Australia, 5% in the US and 10.1% in the UK. Prices in China are falling, and the People’s Bank of China are providing plenty of fiscal stimulus and cutting interest rates in order to boost the economy. The worry for the Chinese economy is now deflation; if goods and services continue to fall, consumers will delay spending, therefore increasing economic problems. However, for now, the economy is recovering, with pent-up demand driving 10% retail sales growth and a sharp recovery in GDP of 4.5%. China is set to be the only major economy to grow more this year than last. This week’s inflation print will be a key reading on what’s ahead for China, with expectations for inflation to decline once again.

*All data accurate as of 08/05/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.