Crypto assets stole the show last week with a rally across most major assets. Bitcoin and Ethereum have now gained more than 40% for the year, whilst meme-coins are also coming to the party, with Shiba Inu up 112% so far this year, and Dogecoin up 66%.

Risk assets continue to dominate financial markets, with the Nasdaq100 also hitting a fresh record high last week. Bulls remain firmly in charge, but the rally across global assets will have central bankers across the world on edge.

3 things that happened last week:

- Australian Inflation comes in weaker than expected

Australia’s monthly consumer price index rose to 3.4% in January, unchanged from December and coming in under market forecasts of 3.6%. The biggest contributors to the January consumer price index increase were housing (4.6 per cent), food and non-alcoholic beverages (4.4 per cent), alcohol and tobacco (6.7 per cent) and insurance and financial services (8.2 per cent). This number shows that inflation is easing quicker than the RBA anticipated and that a rate cut looks likely in August. The Reserve Bank won’t be celebrating a win on inflation just yet, with February’s figure likely to show a bounce in inflation with higher fuel prices having an impact.

- Global stocks hit new fresh highs

It was another green week for the global stock markets last week. The ASX200 hit a new fresh record high as it climbed to 7745 to close last week. The S&P500 wasn’t going to be left behind, making it 16 weeks of gains out of the last 18, hitting a new record high in the process. Tech stocks continue to do much of the heavy lifting, with Nvidia the clear winner of the year so far, gaining more than 65%, helping lift the S&P500 by more than 7%. The strong start to the year has also seen analysts lifting their price targets on the S&P500 as strong earnings growth and profit margin resilience show the rally has further legs. Many analysts have penned 5,400 as their target, from 5,137 at Friday’s close.

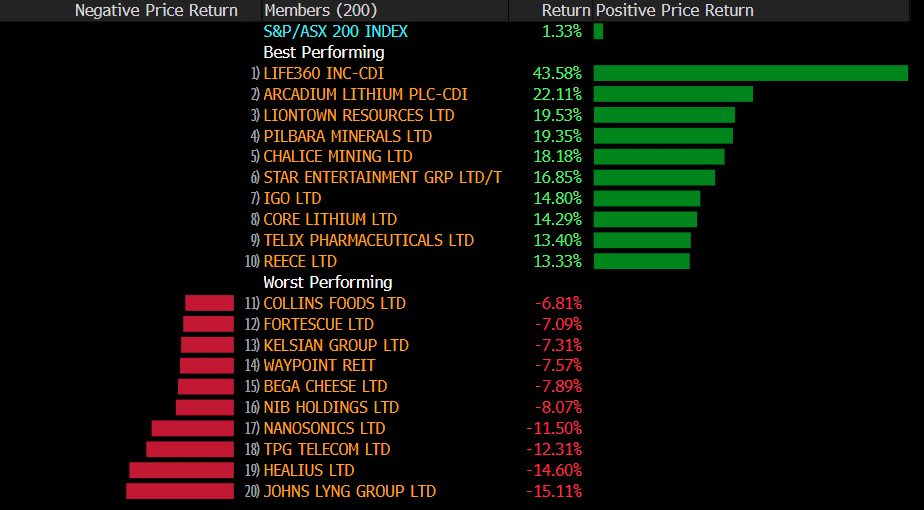

- A winner and loser last week from the S&P/ASX200

Life360 stole the show on the ASX200 last week, gaining 43.6%. The technology business saw shares rocket following better-than-expected earnings, with revenue jumping by 33% for FY2023.

It was a disappointing week for Johns Lyng Group following poor earnings results. The building services company saw sales revenue fall in the first half of FY24, and shares plummeted 15% for the week.

3 things to watch for the week ahead:

- Australian GDP

As we approach the Reserve Bank’s March rate decision on 18-19th March, investors’ eyes are on the upcoming announcement of Australia’s Q4 GDP for 2023. Predictions from the RBA indicate it’s likely to remain subdued, reflecting the continuing concerns around cost of living and interest rates.

Q3 revealed an unexpected cooling in the economy, with GDP growth at just 0.2%, falling short of anticipated 0.4% – 0.5% projections. This paints an annualised growth picture of 2.1%, modest by Australian standards. One point of concern was the dwindling household savings ratio, plummeting from 2.8% to 1.1%, the lowest since December 2007, which underscored the strain inflation can exert on households, as Q3 saw wage growth lag behind inflation.

Retail sales in the three months to end 2023 were the early signs that consumers were feeling the impacts of the RBA’s tightening cycle, which is likely to be a drag on GDP this week, alongside weaker residential construction. Slowing growth is likely to continue in the Australian economy as consumers continue to reign in spending, as witnessed by retail sales data last week.

- Chinese Inflation

Concerns are escalating about the potential for deflation in China as the nation reports its February CPI this week. January’s figures emphasised the country’s economic need for increased support and a surge in demand to avert a deflationary situation, suggesting a more aggressive policy stance is needed.

The Chinese economy has been grappling with the aftermath of the COVID-19 pandemic despite lifting restrictions in 2022, and has also been further impacted by the downturn in its heavily indebted property sector. This ultimately resulted in the liquidation order for Evergrande in late January, and while the move wasn’t unexpected, it nonetheless dampened market sentiment in China.

Historically, China’s real estate sector has been a substantial driver of the nation’s growth, and further distress could ignite fears of a slowdown in China’s economic growth. It’s evident that policymakers need to take more decisive actions as so far, the measures implemented have been substandard, and the lack of improvement in policy stance continues to further dent confidence and hold back spending.

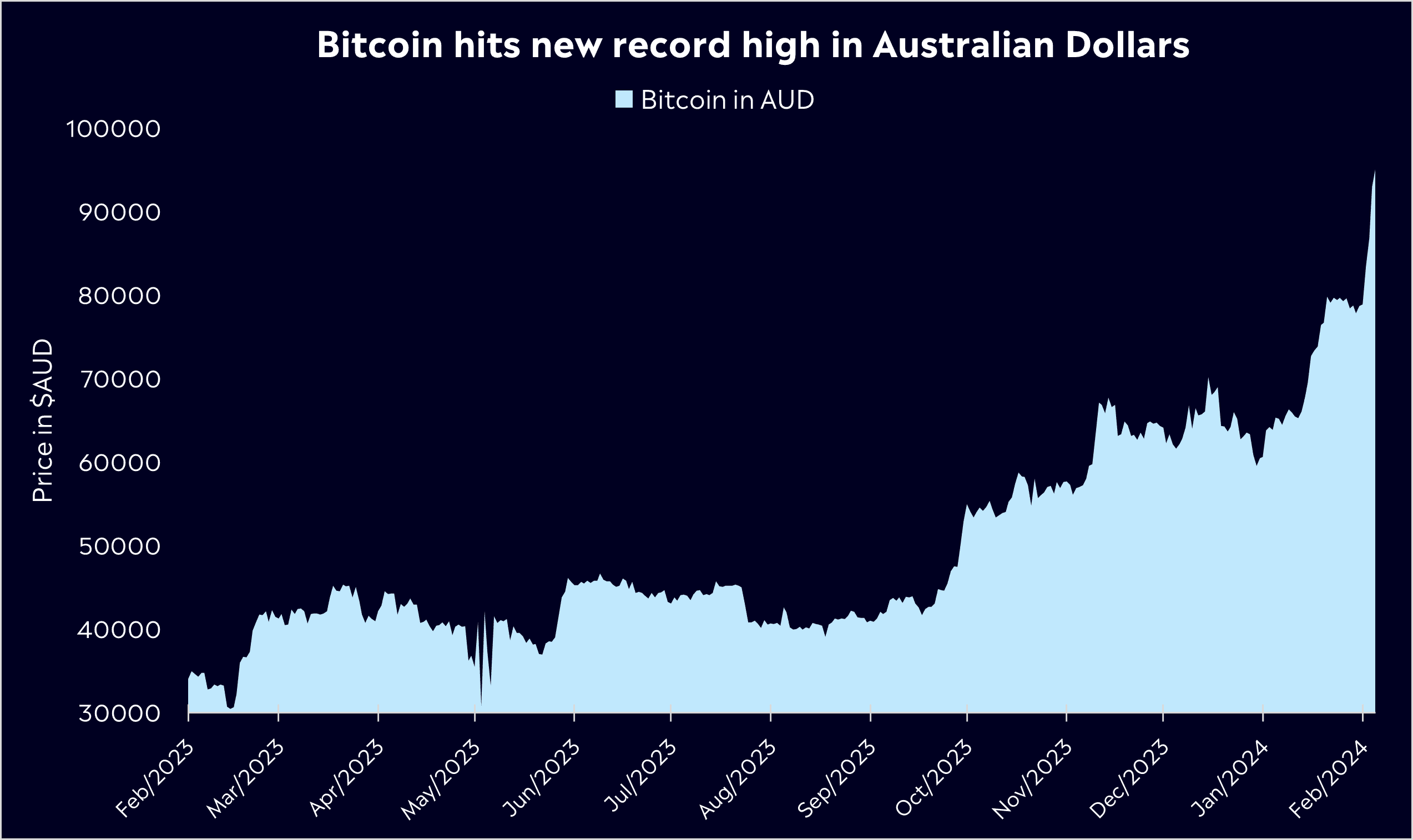

- Can BTC hit a new record high in USD?

Bitcoin, the reigning star of the crypto market, recently touched a new peak, reaching AU$98,000 as the crypto asset surged as high as US$64,000, just shy of the record-high $69,000 it hit in 2021. Interestingly, this doesn’t appear to be a cap, but rather an exciting new beginning for cryptoassets.

Bitcoin ETFs have piqued interest on a massive scale, with their substantial trading volumes and billions of dollars of inflows highlighting the increasing trend of institutional investors wanting exposure to bitcoin.

A supply squeeze accompanies the increase in demand, too. Investors continue to hold their bitcoin rather than spend, with 70% of all bitcoin in circulation currently not having moved in over a year, and the amount readily available for purchase on exchanges is at the lowest level since early 2018. The biggest financial institutions in the world, such as BlackRock and Fidelity, are not just observing this trend, but also actively participating, purchasing bitcoin in significant volumes.

Upcoming events like the bitcoin halving and mid-year rate cuts, continued inflows into ETFs, and revived retail interest could potentially propel the bull market into six-figure territory. In this scenario, it’s easy for investors to feel FOMO. However, it’s important to remember your risk profile and understand that bitcoin is still a volatile asset class that has a history of wild price fluctuations.

*All data accurate as of 04/03/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.