It was a sea of red for global stocks last week as investors digested the idea of higher for longer rates following the Federal Reserve’s two-day meeting. For the ASX, it was the worst week of the year, falling 2.9% despite a strong recovery on Friday.

For some investors, this opens the door for a buying opportunity, particularly ahead of better seasonality in Q4, as investors look to a positive 2024 with the view of strong earnings growth and interest rate cuts.

In Australia, it’s a big week on the dividend front, with billions of dollars being paid out to shareholders from the likes of BHP, Coles, Telstra, Woodside Energy, Commonwealth Bank and many more.

3 things that happened last week:

1. Fed keeps rates on hold, signals higher for longer rates

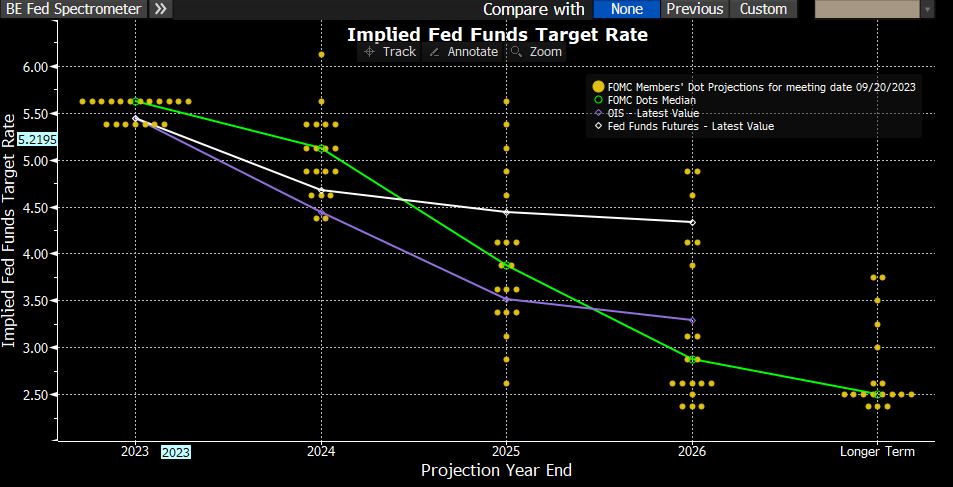

The Federal Reserve kept rates on hold again in September but left the door open to further hikes, maintaining its hawkish stance. Its updated dot plot shows FOMC members expect one more rate hike in 2023 and no rate cuts until mid or late 2024. This isn’t much of a surprise given how strong the economy is, but it did put markets on the back foot last week. The Fed now sees lower unemployment and a quicker path to 2% inflation, which would be the ideal scenario. There will be plenty of challenges ahead for Jerome Powell and the Fed over the months ahead, but for now, it seems they’re navigating the economy to a soft landing.

2. IPO fever warms back up

IPOs are once again the talk of Wall Street with the biggest wave of public offerings since 2021. Arm Holdings, Instacart and Klaviyo both made their trading debuts in the last week, all met with initial optimism from investors before fading through in last week’s sell-off. It doesn’t end there for investors, with Birkenstock and other Reddit flirting with a public listing. This raft of IPOs is a sign that corporate sentiment is improving, and the performance in early trade suggests there is a keen appetite from investors. IPOs give investors new choices in markets, and the good news for those investors is that there are likely more to come both in the US and Europe.

3. A winner and loser last week from the S&P/ASX200

There were few winners on the ASX200 last week, but Ramelius Resources stole the limelight up by 7.25%. It was the gold miners’ first week in the ASX200 after a reshuffle of the index.

With investors hitting sell on risk assets last week, Block was the biggest faller on the local market, dropping by -14.75%.

3 things to watch for the week ahead:

1. Australian CPI on Michelle Bullock’s radar

As Michelle Bullock settles into her first few weeks as the new Governor of the Reserve Bank, she’ll be hoping this week’s monthly CPI reading doesn’t throw a curveball. Monthly inflation has continued to decline meaningfully since peaking in December 2022 at 8.4%, with July showing a decline to 4.9%. However, that downtrend may stall this week with the expectation for inflation to pick back up marginally to over 5%. The RBA has remained on pause for the last three consecutive meetings, and if that were to change, it would likely be due to an upside surprise in inflation. The recent jump in oil prices may be a worry in the short term and poses a risk to the inflation outlook. This supports the RBA’s positioning on keeping the door ajar for further hikes if they deem necessary, should inflation pressures persist. Markets however, still believe that inflation is moving in the right direction, with markets pricing just a 50% chance of another hike by the RBA by year-end. The good news is that we think the current oil rally self-corrects as higher prices stoke conservation efforts whilst triggering global macro-driven demand slowdown fears.

2. Will Retail Sales show the Aussie consumer is still holding up?

This week, investors get a view of the state of the Australian consumer with incoming monthly retail sales data. Consumer sentiment surveys have recently shown that consumers are still pessimistic despite the RBA keeping rates on hold for three consecutive months. Clearly, the lagging impact of rate hikes and cost of living pressures are impacting consumer habits. Consumers are shelving the idea of buying big-ticket items, and other discretionary spending is being dampened by the jump in petrol prices in recent months. However, how consumers feel, and what they actually do, isn’t in sync. Last month, retail sales increased more than expected, jumping 0.5%, with spending continuing to remain near record levels. One factor impacting this figure is the strong jobs market with, consumers feeling confident in their job security, giving some freedom to spend. This week’s reading is expected to show another increase of 0.2%, but interest rates at decade highs may keep chipping away at the resilient consumer.

3. Liontown Resources – Full Year Accounts

Reporting season has concluded, but some companies are still updating investors across the Australian market. This week sees the ASX200’s best-performing stock, Liontown Resources, up more than 120% in 2023, announce its full-year accounts. The lithium miner has been on a tear since US lithium giant Albermarle proposed a takeover at $2.50 a share back in March, which Liontown rejected. Albermarle has since sweetened the deal with a ‘best and final’ offer at $3.00 a share, with the door still open for the takeover to be completed and shareholders to be rewarded – particularly those that bought shares in the 2018 IPO at $0.03 a share. Albermarle is looking to Liontown to expand its lithium production as the world’s appetite grows for electric vehicles, especially given Albermarle’s supply agreements with auto giants Ford and Tesla. Other lithium miners, Pilbara Minerals and IGO, announced record profits and mountains of cash in their full-year results, and Liontown investors will be hoping for the same positivity this week.

*All data accurate as of 25/09/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.