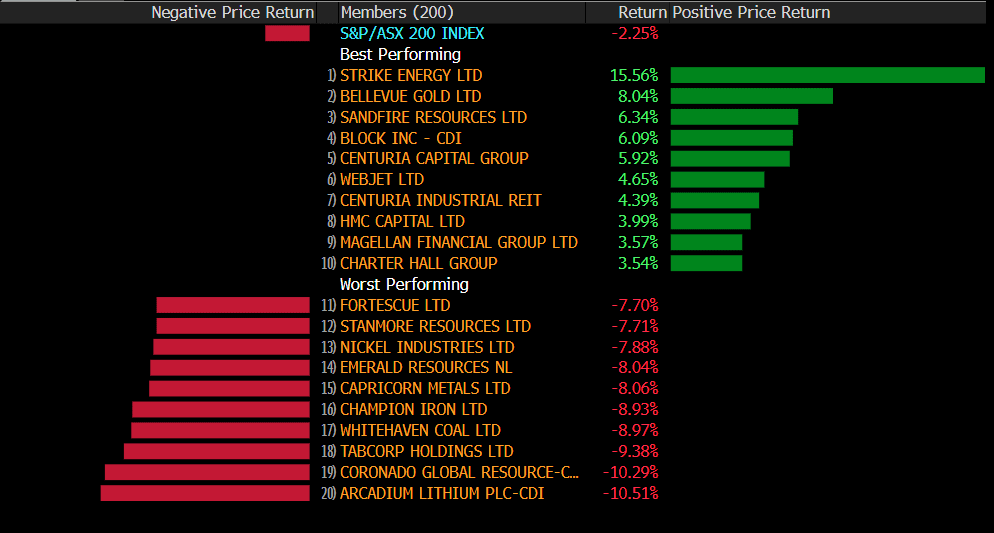

After two solid weeks of gains, the ASX200 suffered its worst weekly loss of the year last week, falling by 2.25%. Losses were led by Australia’s two heavily weighted sectors, materials and financials, both tumbling by more than 3%.

US stocks also fell, with the S&P500 down by 0.13% for the week. US Inflation came in slightly hotter than expected, shifting rate cut expectations slightly, with markets pushing back on three rate cuts in 2024.

Crypto assets suffered a sharp pullback over the weekend, with bitcoin falling to $65,000. It’s no surprise to see a retracement in these assets, with broad profit-taking after such a solid run to new record highs.

3 things that happened last week:

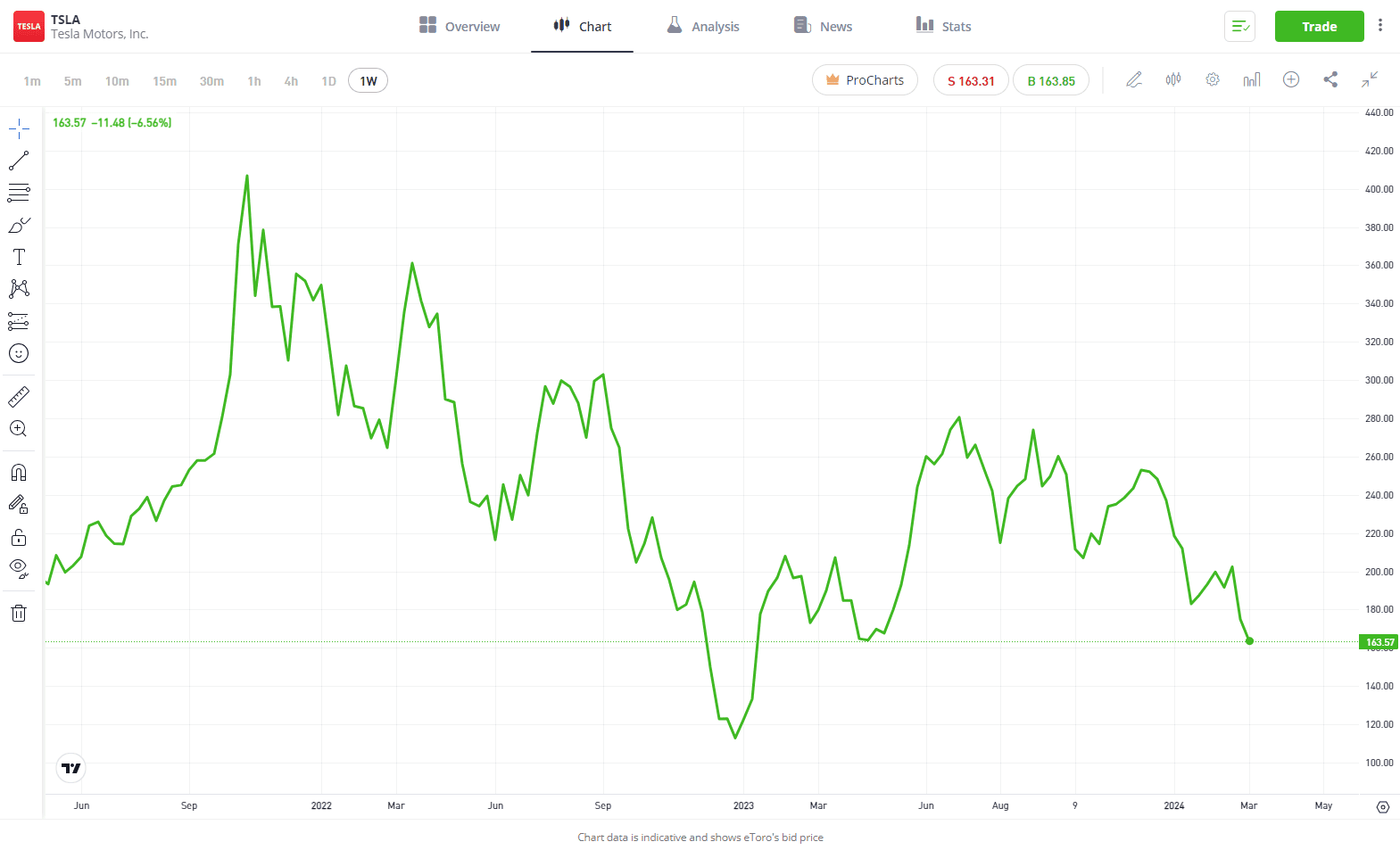

- Tesla suffers more pain through the EV winter

Tesla’s disappointing start to 2024 continued last week, bringing its year-to-date losses to over 34%, making it the worst performer on the S&P500 this year. Last week, Wells Fargo downgraded Tesla, with the bank worried that further price cuts could impact the EV giant’s bottom line. The stock has fallen 57% from its all-time high set back in November 2021, with Elon Musk and his team not doing enough to excite investors. However, in good news, the Biden Administration is set to roll out the toughest-ever limits on pollution, with the US transportation sector the most significant source of pollution in the US. However, a change at the White House may see EV policies reversed, which would spell more challenging times for EV manufacturers.

- Iron Ore prices fall as China worries continue

Local Australian Iron Ore miners came under pressure last week, with ore prices tumbling as demand disappoints and inventories grow. China’s National People’s Congress failed to generate much excitement from its recent meeting, which has dashed hopes that we would see a demand boost. While policymakers in China did affirm a GDP target of “around 5%”, property remains the key concern for the region. In the short term, investors will find it hard to be bullish on names such as BHP and Rio Tinto with so much exposure to Iron Ore and the persistent issues facing China’s ‘steel-focused’ real estate and manufacturing sectors.

- A winner and loser last week from the S&P/ASX200

Bellevue Gold had a great week last week, as Gold prices remained near record levels. The gold miner jumped by 8%, catching up after underperforming against spot prices in recent months.

It was a tough week for Arcadium Lithium, with shares falling by -10.5%. It follows an order from the Argentinian government to halt the construction of two of Arcadiums projects after a filing from the indigenous community.

3 things to watch for the week ahead:

1. RBA Rate Decision

This week, Australia’s Central Bank will meet for the second time this year, and they are once again expected to leave the cash rate unchanged at 4.35%. The data that the RBA has received this year, especially inflation data at the end of February, has reinforced that the board is done hiking. However, there may not be enough evidence just yet for Michele Bullock to pivot to an easing bias. Consumers and households are clearly struggling, but inflation remains the biggest fight for the RBA, and that’s why we’re likely to see the Governor keep a stern tone this week.

Markets still see June as the first meeting when the RBA is likely to cut interest rates for the first time in 2024. This meeting will be the last meeting until May, and before then, the RBA will receive a wealth of data, including February and March monthly inflation indicators, as well as the all-important Q1 figure. That pens May as the meeting where we may begin to hear some softening in the language from the RBA, given a cut may be just around the corner. The board’s hiking cycle is having evident effects on the Australian economy, and that’s why markets are penning June for the first cut.

2. US Rate Decision

Last week’s hotter inflation print tells us that January’s upside surprise was not an anomaly. However, investors looked past that number and were more focused on markets still pricing in the first Fed rate cut for June this year, sending US Stocks back to record highs. That’s because the reading showed good news on services inflation; an area of inflation Jerome Powell has fretted over in recent times.

However, the worry for investors will be that two higher-than-expected prints might trigger a “higher for longer” approach from the Fed. The ‘headline’ downtrend in inflation seems to be stalling for now, and the Fed would like to see it continue to move lower before easing rates. Given that rates are highly likely to stay on hold this week, the focus shifts to Jerome Powell’s comments, and I wouldn’t be surprised to see some pushback, which could put the US stock rally on ice.

The Fed will also update its U.S. economic growth projections this week, which include forecasts for gross domestic product growth, unemployment, interest rates and inflation.

3. AU Unemployment

Unemployment rose to a two-year high of 4.1% last month as capacity in Australia’s job market grows. Demand for workers is falling, with Australia’s ANZ-Indeed job advertisements report showing ads were down 12.4% year-over-year in February and down 2.8% from January 2024. This week, unemployment is set to stay at 4.1%, with the expectation that it will grow to 4.3% by Q4 2024. The growing unemployment rate remains one of the key drivers for the RBA to cut rates in the middle of the year. However, a jump in employment outside of the RBA’s projection of 4.3% may be a slight worry for the RBA and would be a huge dent in consumer confidence if it continues to move at the same speed.

Ultimately, the labour market is loosening in Australia, which is good news for rate cuts, and the RBA will want some evidence this week that new jobs are being added. The good news is that expectations this week are for a big jump in new employment which should help keep the balance on employment for now.

*All data accurate as of 18/03/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.