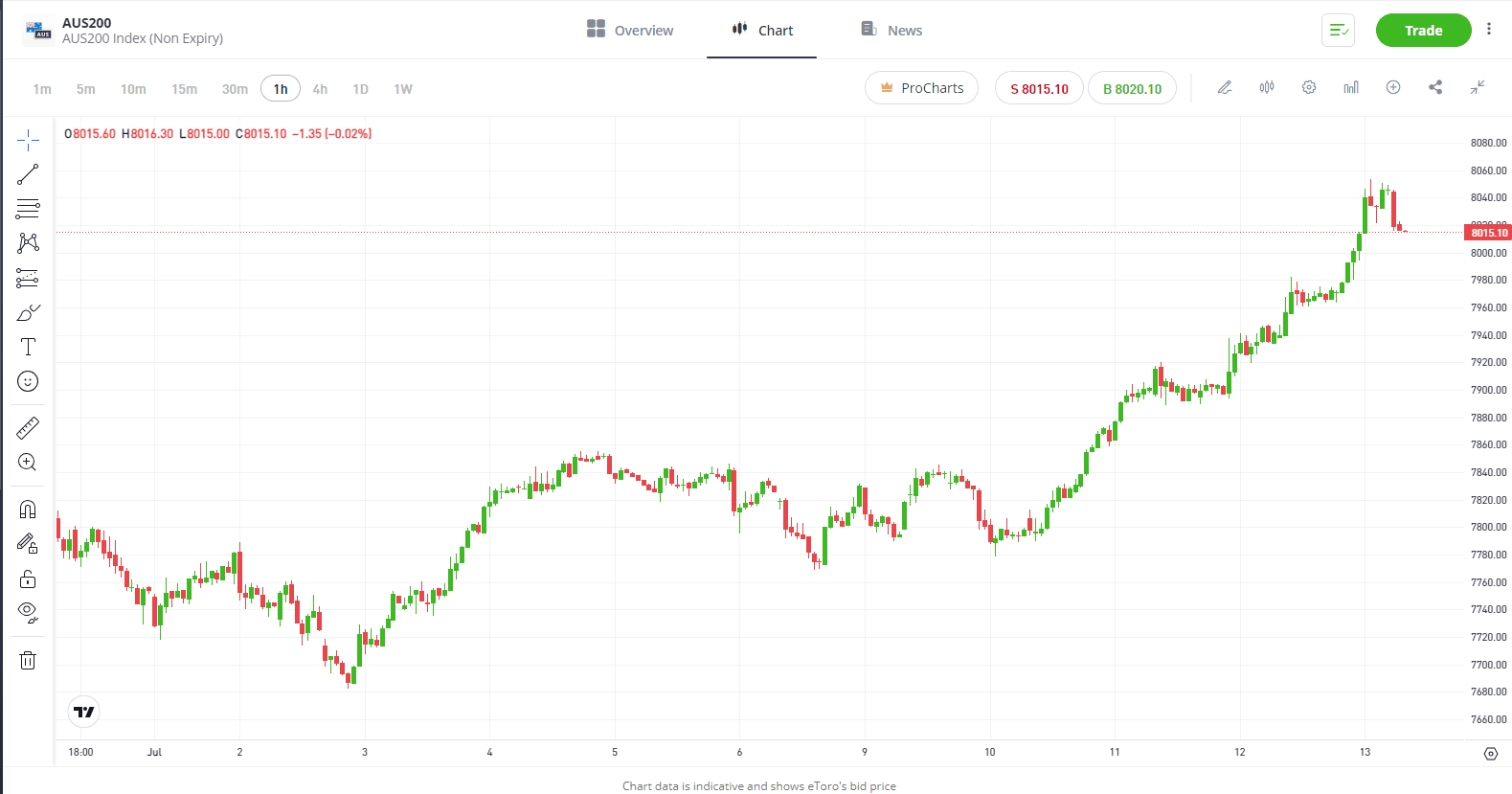

The ASX200 had a solid week last week, finishing up 1.75%, driven higher by the tailwind of US stocks. Futures point to a positive open for Australian stocks today. With a US rate cut in September looking highly likely after better-than-expected inflation data, small caps outperformed, with the Russell 2000 gaining 6% for the week.

The ASX was lifted by rate-sensitive sectors, with Consumer Discretionary, Real Estate, and Financials the week’s winners. US earnings season got off to a slightly sour start on Friday. Wells Fargo (WFC) fell 6% as higher-than-expected costs clouded its results. JPMorgan (JPM) missed on net interest income but posted a record profit, while Citigroup (C) said costs for the year are likely to be at the high end of the range previously provided. Netflix is the name to watch for the week, it reports on Friday Morning AEST.

3 things that happened last week:

- Chinese Inflation

China’s CPI data came in below expectations last week, with inflation coming in at 0.2%, staying near Zero and deflation for a fifth straight month. The data is a clear sign that the Chinese economy is still dealing with deflationary pressures, despite the support provided so far, as the region’s recovery stutters along. Data in 2024 has been mixed, with some bright spots in manufacturing, but demand has remained weak with the real estate crisis still an overhang, while a job market is denting confidence. Consumption in the world’s second-largest economy will need to improve if the Chinese economy is to sustain a rebound. Today’s data is just another sign that although policymakers are drip-feeding support, more needs to be done. The next step should be more stimulus alongside an easing of monetary policy. We haven’t seen this yet because of the pressure it would cause the Yuan, which has remained weak this year.

- Jerome Powell inches closer to a rate cut

Last week, we heard from Jerome Powell, who said that more good data would strengthen confidence that inflation was moving toward the Fed’s 2% target. He got that later in the week when US inflation cooled in June to the slowest pace since 2021 on the back of a long-awaited slowdown in housing costs. The consumer price index dipped 0.1%, beating expectations for a 0.1% increase. The Governor also acknowledged that keeping rates too high for too long would jeopardise the economy and the labour market. Market pricing now sees almost a 100% chance of a rate cut in September, with another cut fully priced in by year-end.

- A winner and loser last week from the S&P/ASX200

Perseus Mining had a stellar week last week, climbing by 14.7%. It comes on the back of gold prices continuing to rally this year, with the metal up more than 16% YTD.

Alumina Ltd saw the biggest fall on the ASX200 last week, down by -7.9%. Last week’s weakness stemmed from a number of downgrades from analysts last week.

3 things to watch for the week ahead:

- AU Unemployment (Thursday)

Unemployment remains a strong focus in Australia’s battle against sticky inflation. While spending does not seem to be abating, the sentiment on the jobs front continues to follow a different narrative as the figure has floated around the 4% mark for months now.

The RBA will likely still want to see unemployment rise to somewhere between 4.25% and 4.75% before year’s end in order to quash this persistent period of inflation. Figures outside of the official unemployment statistics do seem to indicate that we are on track for increased joblessness nationwide. There is clearly a balancing act for the RBA to manage, and another hike may drive unemployment much higher than they would like, which is why for now, rates are likely to stay on hold rather than move higher.

For starters, the number of job ads on SEEK has slipped by 17.1% across the year to date, while the number of applicants per job ad has risen dramatically. You don’t have to be a statistician to figure out that this means we’re seeing Aussies out of work growing increasingly concerned in a tightening job market, as wages also slip below pre-pandemic levels.

eToro’s own data confirms the job market is softening more. According to our latest Retail Investor Beat, the average Australian’s confidence in job security has decreased since Q2, albeit minimally, slipping from 72% to 71%. Young investors (18-34), in particular, are having a significant job security confidence crisis, slipping from 77% confidence in Q1 to 70% in Q2.

It’s a tricky time for Australians managing a mortgage or trying to find work right now and based on current projections, there may be worse conditions to come before the central bank declares it’s put a stake through inflation.

- Production Updates from BHP & Rio

It’s been a difficult 2024 for the materials sector. It’s the worst-performing sector on the local market this year by far. Lithium miners have led the losses, but heavyweights Rio Tinto (RIO) and BHP (BHP) have dragged the sector lower with losses of 11% and 13%, respectively. This stems from a weaker iron ore price, which has tumbled this year following continued weakness in the Chinese economy and, specifically, the slump in the property market. Recent data showed that deflation is still a problem in the region, and more support would be needed. However, that weakness this year has sparked interest from contrarian investors. BHP shares saw a 24% increase in holders in Q2, the third largest increase of any stock on the eToro platform in Australia. Both these mining heavyweights will hand down production updates this week, and increased production across all segments of the business will be what investors want to see to offset lower iron ore prices. But, a focus will be on copper, with prices rising by more than 15% this year, and both looking to increase production over the years ahead, with BHP’s recent bid for Anglo-American a clear testament to that.

- Netflix Earnings

Netflix (NFLX) has had a pretty good start to 2024, with shares rising around 40%, well outperforming rival Disney (DIS). This week’s earnings look set to show more good news with subscribers still growing at a healthy pace, while revenue and earnings keep growing.

There were initial fears that the streaming service’s password-sharing crackdown could have dramatically hurt user volumes and brand identity when it came into effect last year, but it seems to have been a success. Netflix added 9.3 million new net subscribers in Q1, whilst revenues climbed 15% year-over-year to USD$9.4 billion. Although revenue is forecasted higher in Q2 at USD$9.5 billion, subscriber additions look set to be more modest at 4.8 million. Overall, this is a clear sign that its ad-supported plans are clearly having the desired effect.

Beyond these earnings, Netflix has already provided a middling outlook for the rest of the year and announced they would no longer be reporting subscriber numbers as of next year. This latter point is a significant concern for canny investors who must already grapple with a lack of visibility around Netflix’s equivalent to a ‘box office performance’.

Importantly, profitability is rising and at a solid click. Profits for the full year are anticipated to grow by over 40% to USD$8 billion, whilst earnings are set to rise 44% this quarter. Either way, expect some movement from Netflix shares following earnings, with markets anticipating an 8% move either way following the result.

*All data accurate as of 15/07/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.