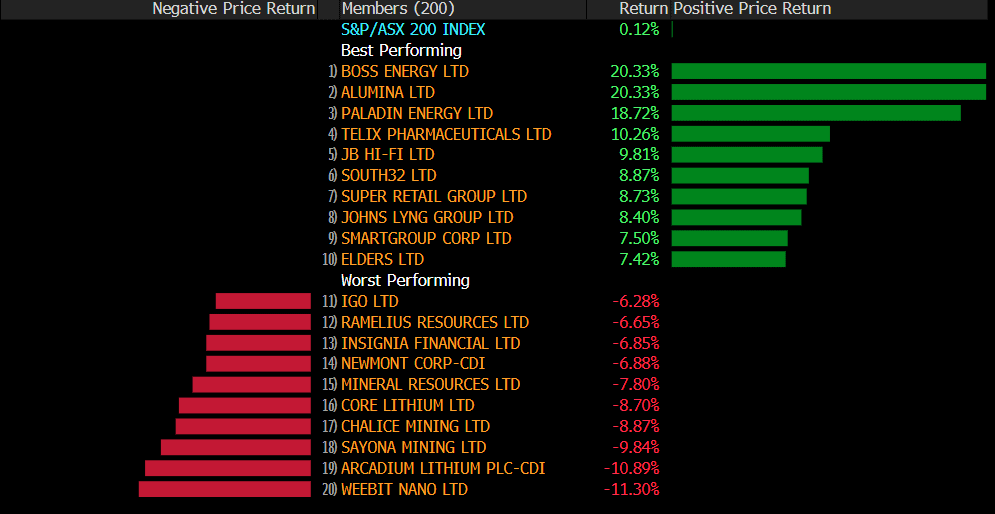

It was the first positive week of the year for the ASX last week, finishing up by 0.12%, led by technology stocks and consumer discretionary. Tech stocks had a strong lead from the US, with the Nasdaq gaining more than 3% from the week, a reminder of 2023’s stellar performance.

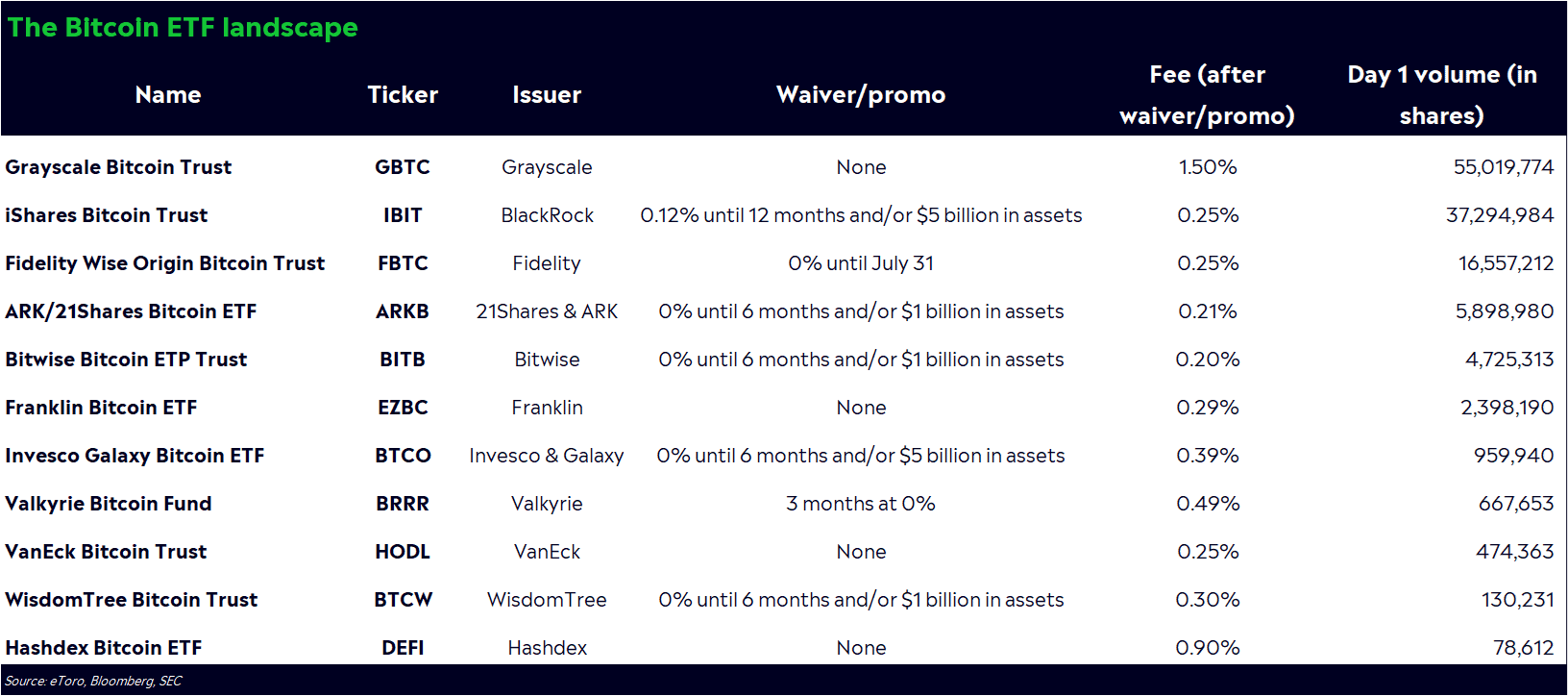

Bitcoin ETFs were finally approved in the US last week after ten years in the making, with 11 ETFs listing in the US. The acceptance came despite a hiccup earlier in the week, with a false approval from the SEC’s Twitter account rocking the crypto market. The most popular ETF was BlackRock’s iShares Bitcoin Trust, which saw the highest volume of trade on the first day.

3 things that happened last week:

1. Australian Inflation eases again

Australian monthly inflation eased to 4.3% from 4.9% in October, lifting expectations that the Reserve Bank is now finished with its rate-hiking cycle. The result was better than expected, with markets quickly bringing forward rate cut expectations, with a cut fully priced in by August. However, a rate cut may come sooner than August if economic data continues to move in the right direction. Automotive fuel eased further, declining to 2.8% for November from 8.6% in October, a welcome relief to the consumer. The next key test on inflation comes at the end of January when quarterly inflation data is handed down, just before the RBA’s first rate decision of the year.

2. US Inflation picks up, but markets still see a cut by March

Inflation in the US took a back step last week, picking up to 3.4% in December from 3.1% in November, showing the fight against inflation still isn’t over. The Federal Reserve has left rates on hold since the middle of last year, and hinted towards rate cuts this year, but this latest number could mean that we see a cut later than markets are pricing. For now, markets see more than a 75% chance the Fed will cut in March, likely thanks to the easing in core inflation, which excludes food and energy, declining to 3.9% from 4% in November. Rate cuts are coming in the US, and inflation may continue to dictate when they arrive in the US.

3. A winner and loser last week from the S&P/ASX200

Alumina (AWC) enjoyed a strong start to 2024, gaining more than 20% last week. This comes following positive broker upgrades on Aluminium and Copper for the full year on the back of stronger Chinese demand.

Sayona Mining (SYA) enjoyed a poor week, as did most of the lithium-related stocks on the ASX, falling by 10%. Lithium prices have remained in reverse in 2024, meaning bad news for lithium miners.

3 things to watch for the week ahead:

1. Bitcoin’s big leap forward

This week marked one of the most significant milestones in the history of bitcoin and crypto assets, taking decentralised finance mainstream onto Wall Street. The approval of the BTC ETF provides the on-ramp for institutional capital that bitcoin has longed for in recent years, providing good news for crypto markets and supporting the belief that bitcoin is an unstoppable technology.

This move has the potential to drive bitcoin’s price significantly higher in the years ahead, with the ETF opening the doors to trillions of dollars of capital. Last year’s performance is a reminder that crypto has a place in a diversified investment portfolio. Whatever time horizon you look at, risk-adjusted returns for bitcoin are dramatically higher than any other asset class and the ETF may be the option investors choose to take on. With many other catalysts ahead for bitcoin in 2024, it looks set to be a strong year for the asset.

With the RBA continuing active research into a CBDC this year, the ongoing legitimisation of crypto as an asset class bodes well for those hoping financial institutions continue to embrace the technology.

2. Australian Inflation

Last week delivered a promising outlook for the year in the form of YoY CPI, which has slowed faster than expected, arriving at 4.3% compared to a forecast 4.4%. With Aussies still concerned that additional rate hikes are still within the RBA’s scope, the arrival of the most significant decrease since January 2022 is welcome news.

On Tuesday, Westpac’s Consumer Confidence report will be released, along with Melbourne Institute’s inflation expectations, both of which hinge on a consumer outlook rather than pure economic indicators. Markets are now fully pricing in a rate cut from the RBA by August this year, but that may come sooner if economic data continues to move in the right direction. The first RBA monetary policy meeting of the year commences at the start of February, where the board is largely expected to keep rates on hold and that would more than likely mean the peak in interest rates.

3. Australian Unemployment

The other vital number in the battle against inflation is unemployment and on that front, this week marks the year’s first insights into the health of the job market.

In November, we saw job listings drop away and unemployment rise – bad news to anyone on the job hunt but good news for those hoping for a cooling economy.

It’s likely we’ll see a small rise in unemployment, with December unlikely to have been a key month for new hires. If the figure slips above 3.9% to 4% or higher, we will be well and truly on track to reach the Treasurer’s ‘sustainable unemployment’ target of 4.5%. While some economists believe it’s unnecessary for the rate to climb that high for the economy to recover, anything above 4.25% will give the RBA the confidence it needs to consider cutting rates sooner.

*All data accurate as of 15/01//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.