Reporting season stepped up a gear last week with BHP, Telstra and Wesfarmers all reporting. The RBA delivered their first rate cut in just over four years. That cut was met with hawkish commentary from Michele Bullock which signalled another cut won’t be right around the corner.

Friday saw US stocks fall due to new tariff threats and concerns around weakening consumer demand. The S&P 500 and Russell 2000 had their worst day since December, with all major indexes closing lower. All stocks in the “Magnificent Seven” group ended in negative territory, including Nvidia, which fell 4.1%.

This week, the biggest stock in the world reports its earnings, so what can we expect?

Nvidia Earnings

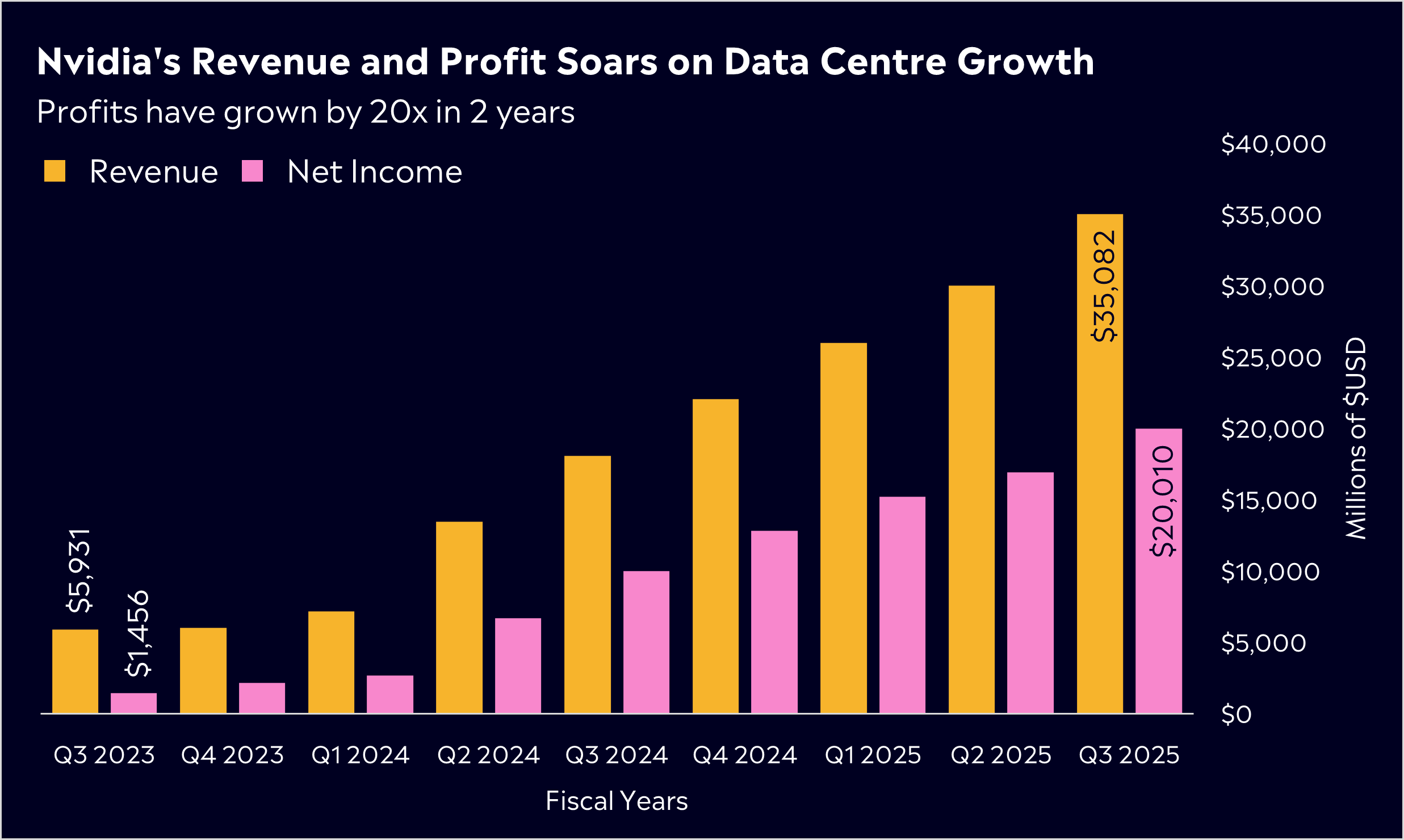

Nvidia reports its Q4 earnings Thursday morning in Australia. The chip manufacturer has continued its banner run, with shares up 100% in the last 12 months amidst the AI ‘gold rush’.

We are seeing major tech firms once again lift their capital expenditures. Amazon, Meta, Microsoft, and Alphabet are all increasing their spending on AI infrastructure by tens of billions of dollars. AI’s reliance on powerful chips means that Nvidia has held an enviable position in this race to the top; no matter who wins, Nvidia is reaping the rewards.

There is a downside for Nvidia in this contest – Chinese newcomer DeepSeek. Investors have had mixed emotions following the late-January DeepSeek route, which wiped US$600b of Nvidia’s market value in a single day. DeepSeek’s technology represents the potential that – in the near future, companies may not need pricy, high-end graphics processing units to run sophisticated AI models, which significantly undercuts Nvidia’s position.

DeepSeek isn’t the only dark cloud on Nvidia’s horizon. Demand outstripping supply has hurt its success in previous earnings and even though execs assured Wall Street that they expect to exceed “several billion dollars” in Blackwell revenue in the fourth quarter, there are caveats. We know the company is basically at its production capacity and is struggling to meet demand – and where there’s unfulfilled demand, there is potential for competitors.

For now, though, the consensus estimate is that revenue will come in at US$38.2b, net income US$20.9b. The focus once again will be on more blockbuster numbers and its guidance being raised once again. The expectation from investors nowadays is nothing short of perfection.

Qantas 1H Results

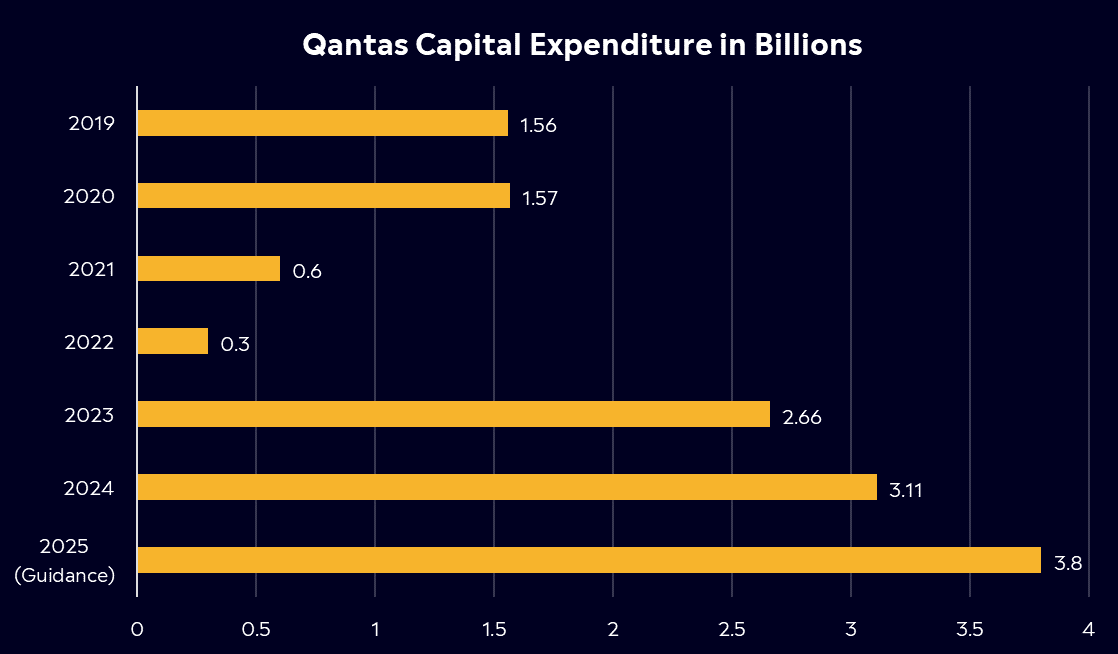

Qantas reports its H125 earnings on Thursday and the sentiment heading into it is that the carrier’s great big brand revival is working.

Since Vanessa Hudson was appointed CEO following Alan Joyce’s controversial departure, the leadership team’s focus on pulling the brand’s reputation out of a nosedive seems to be succeeding.

Qantas shares are up more than 60% over the last 12 months and the airline took the first place in YouGov’s ‘Biggest Brand Movers’ list for January, indicating a radical uptick in consumer perception.

Qantas’ broader goal seems to have been stability. Stability across services, pricing and customer experience. In the last year, this focused effort has hurt the business’ bottom line somewhat but the airline hasn’t changed its optimistic guidance since October last year, and I’d be very surprised if they don’t meet profit expectations in this update.

Once again, that comes with a caveat – and this is a big one. Virgin Australia has taken Qantas’ place as Australia’s largest and most reliable airline, according to the ACCC. Not only is this a concern in terms of market share, but it could signal that Virgin Australia may consider relisting on the ASX, which will only cause more headaches for Qantas as its team continues to work hard to restore the airline to its former reputation.

Bottom line: loyal investors have been rewarded for sticking with Australia’s flag carrier, but the airline needs to acknowledge and accommodate some pretty stiff competition if it hopes to stay on the good side of investors. A return of its dividend which many have continued to expect, may not be far around the corner.

Coles and Woolies 1H Results

This week, Aussie supermarket giants Coles and Woolworths are set to report their FY25 half-year results. The ACCC’s continued focus on both companies, and ongoing consumer frustration with the cost of living and grocery prices, means these results will be watched closely by investors, especially with the ACCC’s final report into both supermarkets set to be handed into the government by Friday.

Coles and Woolworths continue to face scrutiny from consumers, with the price of Easter chocolates at the supermarkets recently making headlines for their exorbitant prices. However, Coles has had a promising start to the year, with its share price hitting a new all-time high last week of $19.84 with investors optimistic about the company’s upcoming results.

Woolworths, on the other hand, has had a challenging start to the year, with shares down 9% over the past 12 months. Many analysts are expecting weaker results this week due to a 17-day strike that occurred at the end of last year. Woolworths anticipates additional impact on sales and earnings in Q2 as they work to restore stock levels following the strike by around 1,500 warehouse staff, which was centred around pay and working conditions. The strike resulted in an estimated $140 million in lost sales.

There is hope on the horizon for these supermarket giants, with both stocks likely to be aided by ongoing population growth, and the RBA’s latest interest rate decision, which is expected to boost consumer sentiment and increase spending. Any noticeable impact may not be felt for the next many months, but markets are forward-looking and could price in the positivity from future RBA rate cuts. The big takeaway from both of these names will be progress in e-commerce which is the key to ongoing growth.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.