1. Consumer sentiment and business confidence

Westpac’s Consumer Sentiment is revealed this coming Tuesday. The index dipped in early August following a soft July rebound. With the RBA refusing to rule out additional rate rises in last Tuesday’s September rate meeting, consumers may continue to be cautious despite receiving a third month of consecutive rate pauses. With inflation proving to be a stubborn beast and homeowners unlikely to experience a cut to interest rates until at least this time next year, a significant positive shift in consumer sentiment would be a surprise.

Meanwhile, NAB’s business confidence report will also be delivered on Tuesday and the pairing of both insights will give analysts a good indicator of the overall health of the economy. Businesses seem to be staying more optimistic than consumers, attributable to a general belief within the business community that the RBA is wrapping up its hike cycle. However, diminished discretionary spending has led to an underwhelming earnings season in the past few weeks – especially across the category of homewares – and we may see this reflected in a less enthusiastic response from businesses this month.

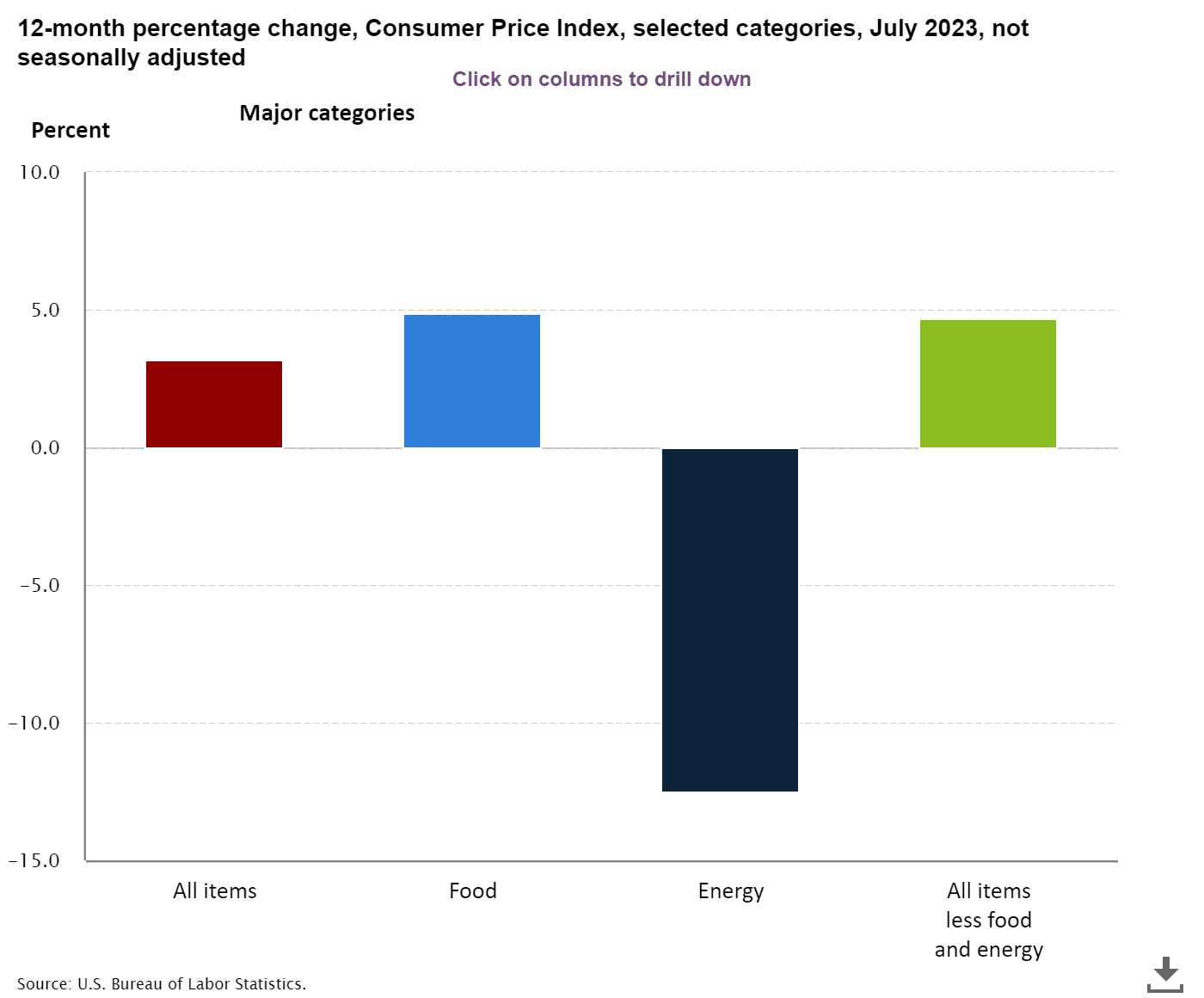

2. USA’s Big Inflation Brief

The US core inflation rate and the headline inflation rate will be revealed on Wednesday across both month-on-month and year-on-year categories. This is a significant data dump with many hoping that inflation will continue to slow so that the Fed may feel prompted to pull back on its hawkish stance. For those playing at home, headline inflation is typically a ‘default’ reading of the consumer price index, including household essentials. Meanwhile, core inflation subtracts food and energy prices – the belief being that this allows analysts to detect longer-term economic trends without the often influence of oft-volatile food and energy prices distorting key indicators.

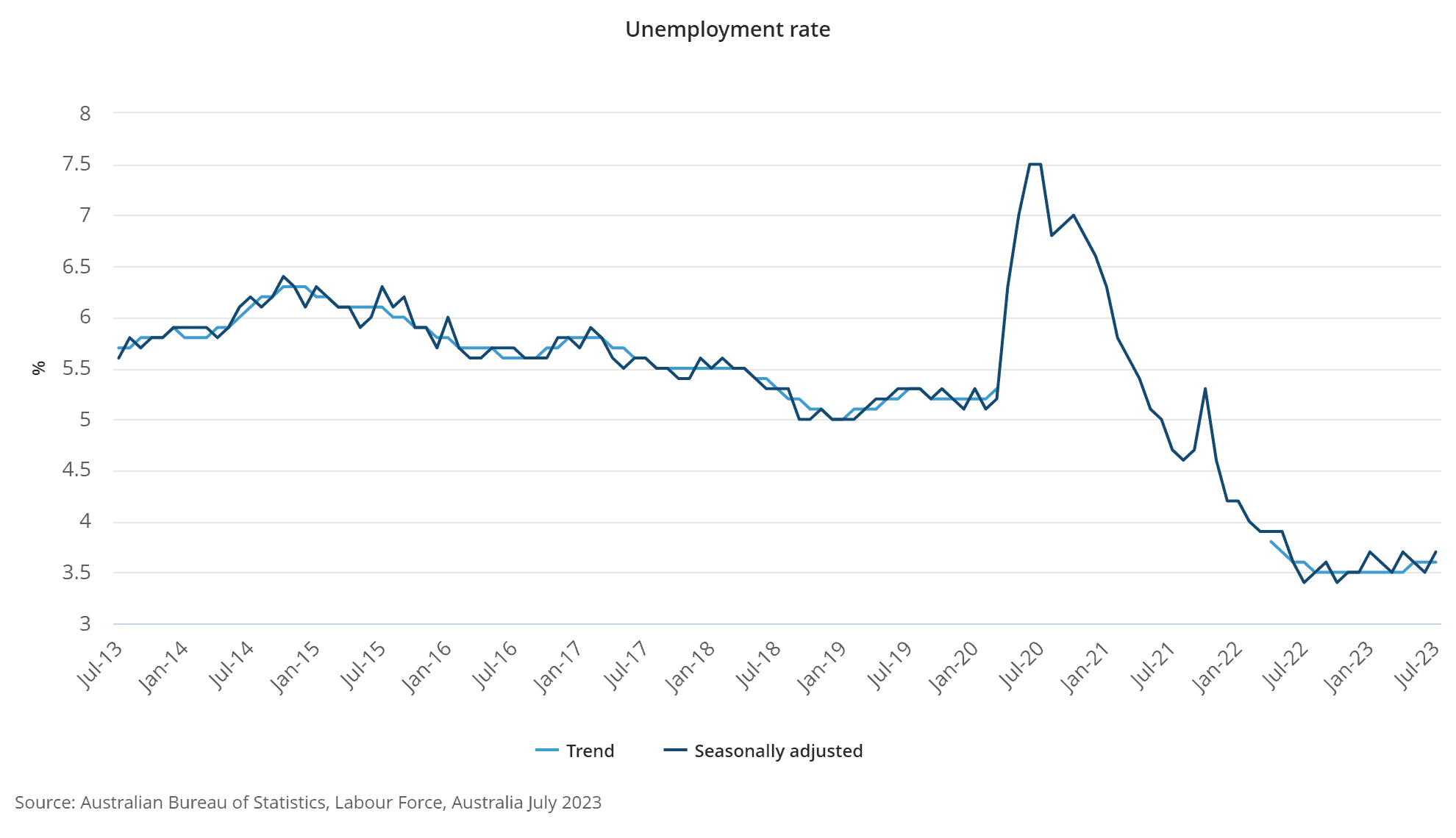

3. Aussie unemployment rate

August figures for Australia’s unemployment rate are due to come out end-of-week. With July’s rate just marginally higher than forecast, a steady or increased unemployment reading will likely push the RBA towards pausing rates again in October. The Federal Government and the Reserve Bank may still be hoping for the unemployment rate to break 4% in their pursuit of a soft landing (July’s reading was 3.7%) but economists are increasingly confident that keeping the number around the 3.75% region is sustainable, especially if inflation continues to slow – and ideally fall – without significant unemployment having to act as the catalyst. That said, the ripple effect of tightening household budgets and big businesses facing a holdover of inventory could lead to continuing redundancies among major workforces, even with the knowledge that the RBA is considering ending its tightening cycle.

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.