Despite a shorter week of trading, the ASX200 took a tumble down by 1.57%, led by Technology and Real Estate, both falling by 4% as rate cut expectations continue to be pushed back. That expectation was also felt in the US last week, with another blowout nonfarm payrolls report, as the US economy added 303k jobs. Fed Chair Jerome Powell repeated on Wednesday that he doesn’t expect “it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2%”, a comment that has slashed a Fed June rate cut to under 50%.

It’s a slightly quieter week on the macro front in Australia, but investors should watch for an update on Consumer Confidence on Tuesday alongside NAB’s business confidence survey and then Consumer Inflation Expectations on Thursday.

3 things that happened last week:

- Australian investors not giving up on lithium miners

It’s been a tough 12 months for lithium miners, with the spot price of lithium tumbling, driving most miners’ shares lower. However, eToro data shows that Australian investors continued to snap up these stocks, with Pilbara Minerals and Core Lithium in the top 10 of the biggest increase in ownership by investors. We’re in the midst of a lithium winter, with EV demand slowing, and lithium miners are at the whim of falling lithium prices that continue to fall, whilst inflation and high-interest rates elevate the cost of initiating new projects. However, short-term fluctuations aren’t deterring long-term investors from what seems to be the inevitable transition to Electric Vehicles. Instead, they’re seeing the drawdown in a business such as Pilbara Minerals which will have a huge hand in that transition, as an opportunity to own a quality business at a lower price for the long term.

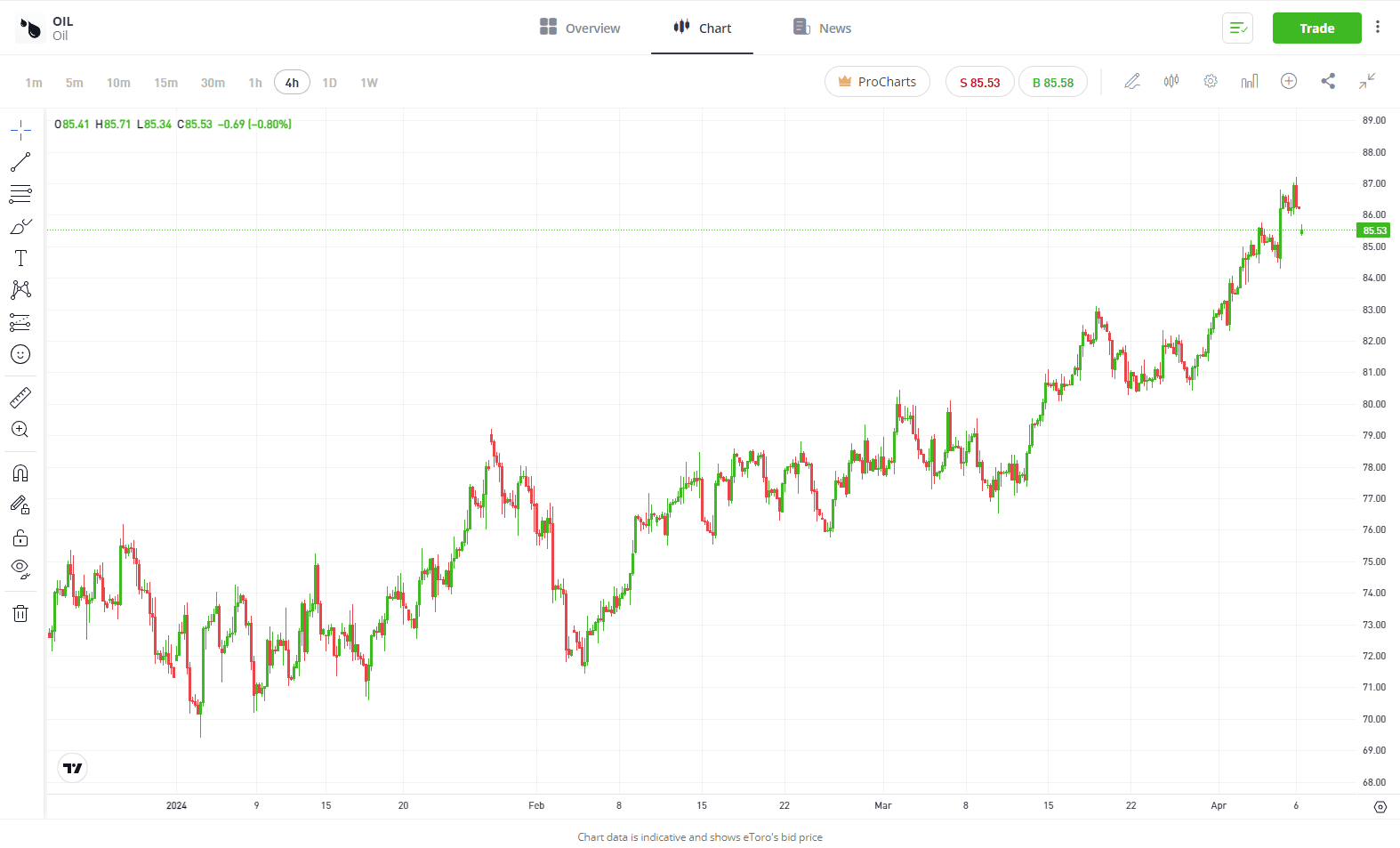

- Oil rises again, sparking inflation fears

Oil prices rose again last week, with WTI crude oil now gaining more than 20% so far in 2024. The move higher in oil this year stems from continued geopolitical tensions in key supply regions, and a recent move by Mexico to slash its crude exports, compounding a global squeeze, and forcing the US to consume more domestic barrels. The oil rally comes just ahead of the US summer driving season, which could put oil on the cusp of $100 a barrel for the first time in years. The worry for investors, however, is that this spike may stall the fight against inflation, making central banks’ deliberations over rate cuts that much harder. The ASX200 energy sector was one of the standout performers last week, and may continue to be a sector investors should watch over the weeks ahead should oil prices continue to move higher.

- A winner and loser last week from the S&P/ASX200

As Gold continues its mammoth start to 2024, miners are continuing to reap the rewards. West African Resources jumped 9.58% last week, making it one of the best performers on the ASX200.

On the other end of the index, Orora, the leading packaging solutions company, saw shares fall by -18.75%. The sharp fall comes amidst the company downgrading its earnings guidance for FY2024.

3 things to watch for the week ahead:

- US Inflation

After two hotter-than-expected inflation prints to start 2024, rate-cut expectations have shifted, with markets now eyeing July for when the Fed will begin to cut interest rates. This week’s CPI reading will hold significant weight on that decision, especially with the expectation for inflation to pick up once again. Consensus is for headline CPI to rise to 3.4% in March, from 3.2% in February, whilst core CPI is set to moderate to 3.7% from 3.8% in the prior month.

The final hurdle of bringing inflation down is proving to be tricky, which is why Jerome Powell expressed again last week that the Fed will wait for clearer signs of lower inflation before cutting rates. That said, if March’s inflation readings show signs of softening and are followed by further signs of easing in April, the Fed may put January and February’s readings down as a hiccup – putting a June rate cut firmly on the table. The recent jump in energy prices may dampen headline inflation, but slowing rent growth and falling used-car prices should help keep a cap on core inflation.

2. China Inflation

It’s another big week in China, where inflation is due on April 11th, and we’re likely to see deflationary pressures persist once again. This follows increased consumer activity over the Lunar New Year period, which saw the first positive push on prices since September, a turnaround from the sharpest drop in over 14 years in January. The worry for investors is that the holiday-driven demand won’t last, and those deflationary pressures will continue until we see further signs of a recovery in domestic demand.

China’s property market continues to paint a bleak picture. Historically a major economic driver in the country, major property developers are still struggling, and the likelihood of bank bailouts for fledgling big players is becoming an increased risk to the economy. Most recently, China Vanke suffered a credit rating downgrade and now teeters towards suffering the same fate as Evergrande and Country Garden.

There have been some positive signs in Q1 that the recovery is gaining some momentum, with stronger-than-expected PMIs in March showing activity was improving. However, this needs to be sustained, and it feels like we’ve had many false starts for this recovery over the last 12-18 months. The People’s National Congress hinted last month at its intention to provide more support for the economy, which will clearly be needed to get to its ambitious 5% growth target.

3. Q1 US Earnings Season

JP Morgan (JPM) and the biggest US banks kick off first-quarter earnings season on Friday, with earnings growth more important than ever. It remains a pillar of the current bull market we’re seeing in the US, and it becomes even more important given the second pillar of incoming rate cuts continues to be pushed back. The good news is that expectations are low, with 5% growth from the S&P 500, with communications, technology, and discretionary set to lead, growing earnings at an average of 22% in Q1.

However, this is a slowdown from the 38% these sectors saw last quarter. At the other end of the scale, energy and materials commodity sectors are set to see over 20% profit declines, whilst financials, which kick us off this week, are set to see slowing growth to 5%. Citigroup (C) is the best-performing big bank on the S&P500 this year, with shares rising by more than 18%, but Bank of America (BAC) may be the standout on the back of solid investment banking fees and trading revenues in the quarter. Check out eToro’s earnings calendar to stay up to date this earnings season.

*All data accurate as of 08/04/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.