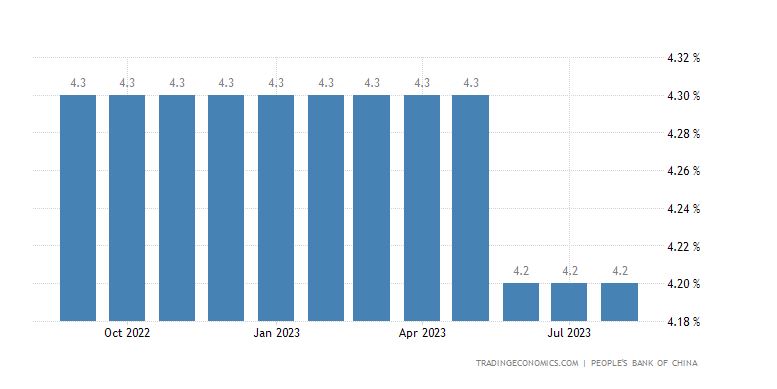

All eyes on China loan rates

On Friday, China’s one and five-year term loan rates are up for review. With regulators increasingly concerned by the nation’s fledgling post-COVID recovery, a cut to both rates is possible. Even so, a cut of anything less than 0.10 percentage points will almost certainly not be enough to keep up with the financial turmoil. Last month, the People’s Bank of China on Monday cut the one-year loan prime rate from 3.55 per cent to 3.45 per cent but left the five-year loan prime rate unchanged, stoking disappointment as the call for more decisive measures from the central bank and government grows louder. The triple threat of dwindling demand for Chinese goods, a narcoleptic property market and record low birth rates telegraphs a clear need for heavy policy intervention and while there has been some stabilisation compared to earlier this year, markets seem to be growing sick of a lack of firm rehabilitative action in the Chinese economy.

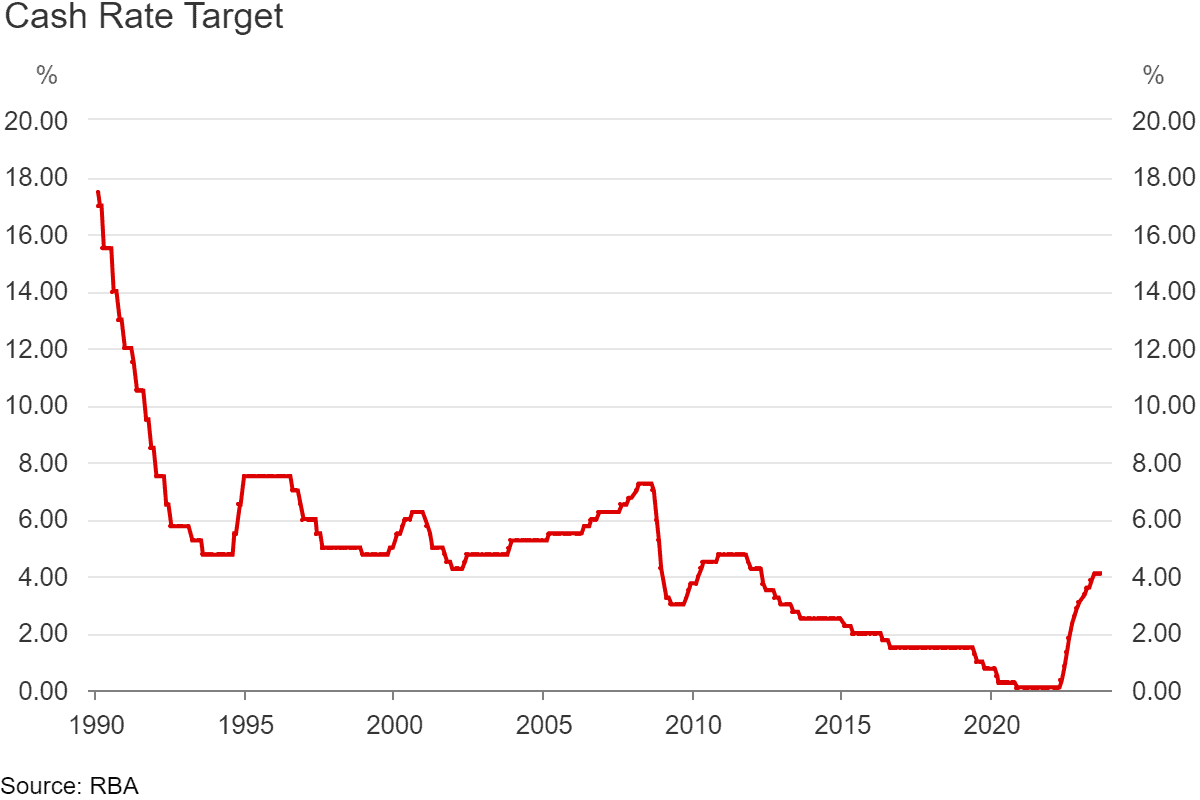

RBA Minutes

The release of the RBA’s quarterly bulletin on Thursday will be significant as Michelle Bullock officially steps into the role of Reserve Bank Governor. Markets will be watching closely to get a better picture of just how hawkish Bullock intends to be, with many analysts expecting at least one more hike in this cycle before the RBA calls time on its mission to facilitate a soft landing.

Following a middling earnings season across discretionary goods categories, it’s anticipated that the impact of this year’s rapid hiking cycle may be acknowledged by the Governor – but stubborn Australian unemployment figures and a surprising uptick in US consumer price data this week may serve as a warning to not ease off just yet.

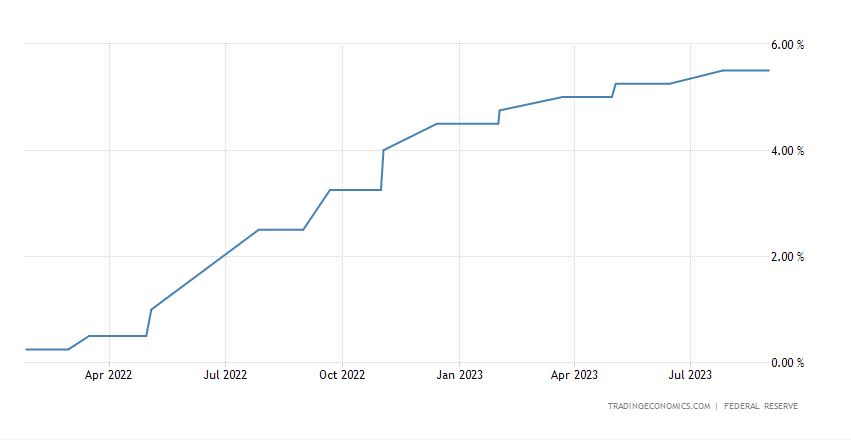

Fed Reserve to make a call on rates

In the US, the Federal Reserve is slated to make its monthly call on rates on Thursday. The meet is the third remaining scheduled rate meeting on the 2023 calendar (currently, nothing is set for October) and while markets are anticipating a pause on rates, it’s unlikely the Fed is altogether done with its hiking cycle as inflation continues to prove difficult to tame and the central bank remains firm on its 2% inflation target. As always, the call will come down to the data on hand and the subsequent release of the Federal Open Market Committee (FOMC) Economic Projections should give markets a clearer picture on how close the Fed is to acknowledging the peak of this current cycle.

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.