In 2024, the ASX200 hit record highs, the RBA left rates at decade highs, supermarkets came under scrutiny, and retailers enjoyed a surprisingly good year. This combined made for a decent year for the local market, while overseas US stocks have seen some of their best years in history. Heading into 2025, investors face a new landscape shaped by macroeconomic factors, with inflation easing and rate cuts on the horizon. The next year offers both opportunities and uncertainties. This newsletter dives into the standout performances of 2024 and sets the stage for what investors should keep an eye on as we step into 2025.

- 2024 was a great year for global equities, with double-digit gains across the world. Shares were resilient and defied expectations throughout the year.

- There are always risks in equity markets, and ultimately, there is always something to be worried about. We break down the uncertainties and positives to watch.

- ASX200 companies are set to grow earnings by around 10% in 2025, which should help drive the local market.

Explore Australian Shares

A recap on 2024

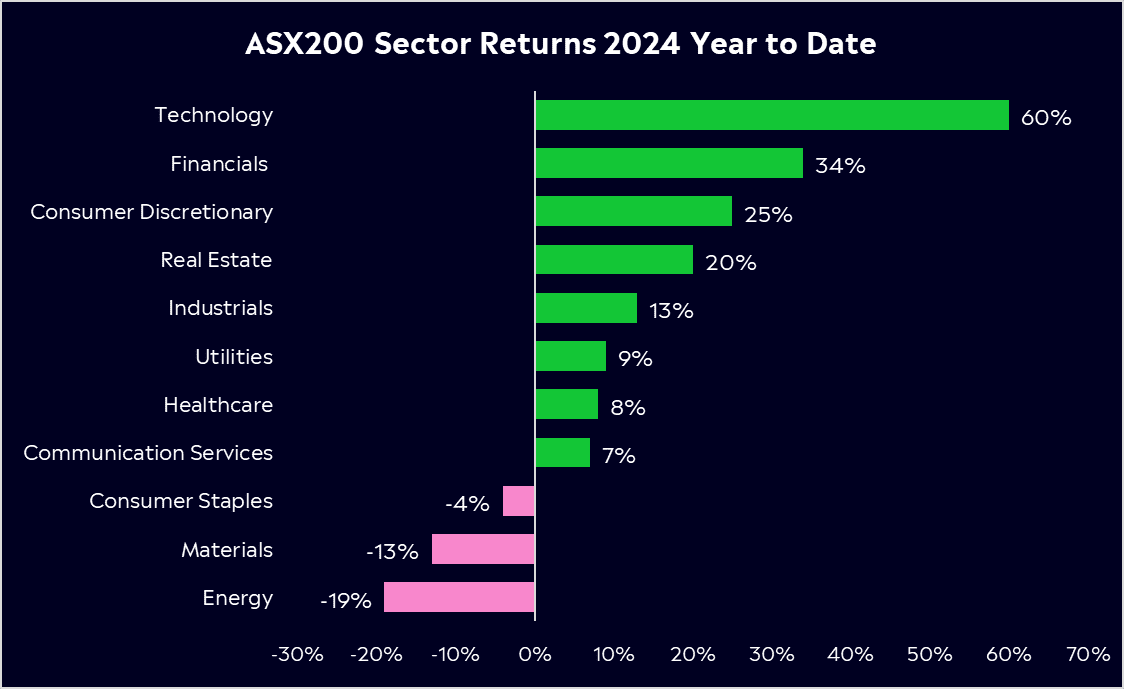

The ASX200 has had a solid year so far, up by 12%. However, that doesn’t tell the full story. A deeper dive into the top sectors shows that the two heavyweights of the index saw contrary returns, which we’ll touch on shortly. But, at the top end of the index, we have the technology sector, returning a huge 60%, following the gains we’ve seen from their US peers. Top performers include Life360, Technology One, Wisetech and Xero.

China’s tepid recovery and ailing property saw weaker demand for iron ore, sending miners including BHP, Rio Tinto and Forescue’s earnings lower. Falling lithium prices as the EV winter prolonged battered once-loved miners Pilbara Minerals and Liontown Resources, with their shares some of the worst performers on the index. Gold stocks, though were winners from the sector thanks to record high gold prices and renewed M&A activity.

Discretionary stocks were arguably the surprise of the year, particularly as consumers remained resilient despite interest rates staying at decade highs. JB Hi-Fi shares have climbed as much as 74% as their results impressed, while one of just a few new listings to the ASX in 2024, Guzman Y Gomez, jumped over 40% despite valuation concerns.

Elsewhere, Woolworths, Coles and Qantas all faced the limelight. If you weren’t aware of the ACCC before this year, you probably will be now. On the back of that, Woolworths shares have fallen 18%, with CEO Brad Banducci stepping down. Yet, under the lead of new CEO Vanessa Hudson, Qantas, who have focused on turning around their tarnished reputation, have seen shares hit a record high, up by more than 69% this year.

From a macro perspective, the RBA left rates unchanged all year despite the Federal Reserve and other major global central banks starting their easing cycles. Inflation accelerated in the middle of the year to a high of 4% but has since eased to 2.1% in October. The unemployment rate held firm, fluctuating throughout the year, but looks set to finish the year at 4.1%, exactly where we started 2024.

Fun Fact: The ASX200 rebalances every quarter, meaning stocks are added and removed. This year, we saw names like Audinate, GYG and Westgold Resources added to the index while Core Lithium, Nanosonics and Strike Energy were removed.

When will the RBA finally cut interest rates?

With headline inflation finally easing, many investors want to know when the RBA will begin its easing cycle. However, it’s important to remember that interest rates in Australia still sit below that of global peers. The RBA’s hawkish and cautious stance has been warranted, which is evident in recent inflation data showing trimmed mean inflation – the RBA’s primary concern right now – ticked slightly higher to 3.5%. If inflation begins to ease and unemployment gradually rises, the RBA will have room to begin its easing cycle. However, for now, that doesn’t look likely until May’s meeting. The unemployment rate, which has remained very low, has been one of the key reasons the RBA has refrained from cutting rates so far.

The most likely view is that we will begin to see unemployment rising and inflation moderating. However, there is the view that inflation will remain stubborn in Australia. That could push rate cuts further back and may see rate cut expectations adjusted significantly, particularly if global inflation rears its head once again. 2025 may see a sound growth period for the Australian economy with tailwinds from fiscal spending in the lead-up to the next Federal election, a strong employment market, and modest interest rate cuts from the RBA likely beginning in May.

What to watch: The rotation from financials to materials

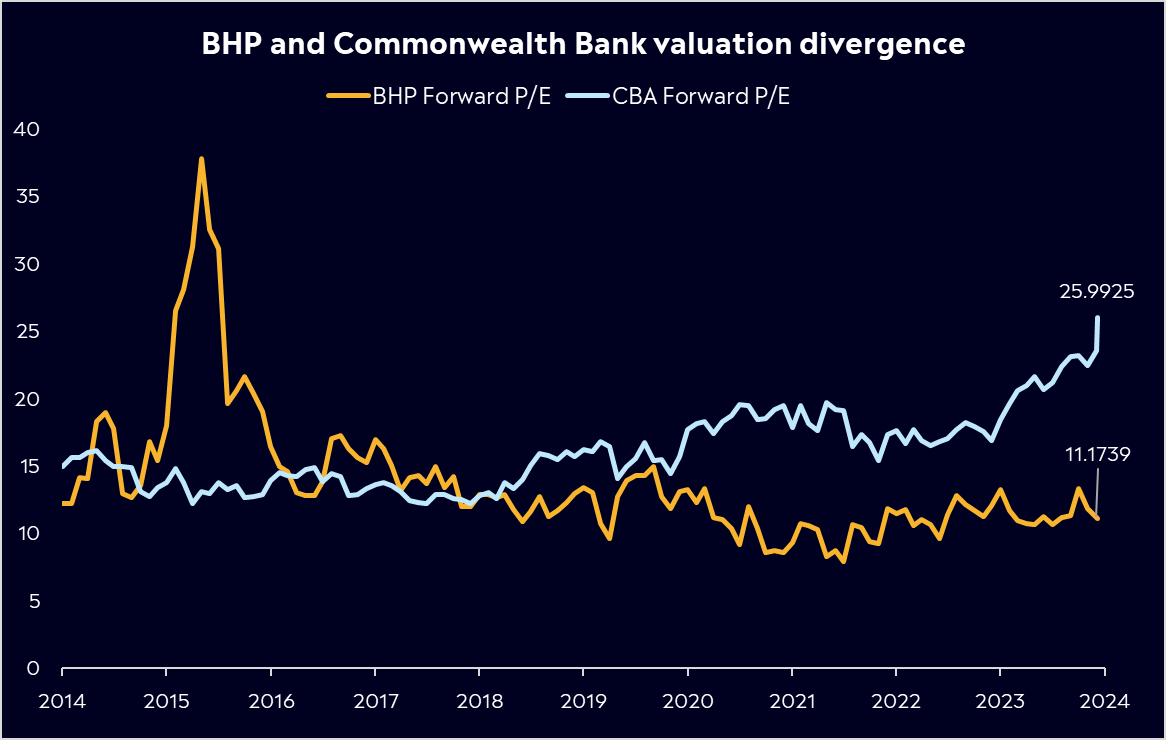

In 2024, the ASX200 was driven by the heavily weighted financial sector. So far this year, it’s jumped 34%, with Australia’s big four banks doing the heavy lifting. Westpac, the standout, has gained 46% this year thanks to improving earnings. In that time, Commonwealth Bank (CBA) went on to replace none other than BHP as Australia’s largest stock, with CBA now making up as much as 10% of the ASX equity value. It wasn’t just Commonwealth’s gains driving its new position, it was also BHP’s lacklustre performance alongside much of the ASX materials sector. Australia’s two biggest sectors have seen contrasting performances, with financials stealing the show and materials having a rocky year. So, will financials continue their performance into 2025? Well, the differentiating performance has seen two very differing valuations. CBA is currently trading at its highest valuation ever, 26x forward earnings, whereas BHP is trading at 11x forward earnings below its 10-year average.

This creates the view that we should begin to see profit-taking within the financial sector, mainly the big banks, with capital flowing into miners offering value after their drawdowns in 2024. The rotation would be supported by improving fundamentals that should drive the materials sector. Firstly, China is undoubtedly the key catalyst. We expect to see new stimulus measures rolled out in early 2025, not only to support the economy further but also as Beijing looks to mitigate the negative impact of the proposed US tariffs. This would be a massive boon for iron ore miners like BHP, Rio Tinto and Fortescue. A strong Chinese economy is good for growth around the world.

Secondly, the race to secure key commodities in the energy transition will continue. The move to decarbonisation will continue to drive value across the sector. Commodities such as copper will play a role in renewable energy, energy storage, and upgrading electrical grids worldwide, more so than ever with the rise of Artificial Intelligence and the energy it demands. BHP has a solid exposure to copper but may look to increase that through its interest in Anglo American. M&A activity will be key to watch in the materials space in 2025, and I expect to see further consolidation within the sector.

Finally, we have lithium. It’s a sector that boomed and then bust. Given the valuations of some of these beaten-down stocks, there may be opportunities, but there will also be plenty of challenges. There is no doubt that in the years ahead, EVs and energy storage advancements will see demand for lithium grow. However, in the short term, EV demand may stay subdued putting a dampener on prices, but Rio Tinto’s recent acquisition of Arcadium Lithium could signal value. However, the valuations also reflect the uncertainty of prices vs the cost of production.

The uncertainties to consider in 2025

When we entered 2024, there would have been a similar list of uncertainties. But, markets ultimately took this in their stride, with global equities seeing double-digit gains. However, on the back of two solid years for equity markets, it would be unreasonable not to think that we may see a breather at some point next year. Here are just a few potential risks in 2025:

- It would be naive not to mention the US under a new presidency and, of course, the Fed. The Federal Reserve’s decisions will ripple through global markets, affecting Australian equities. A bold prediction could be that if inflation rears its head under President Trump, we may not see a rate cut from the Fed in 2025.

- Valuations are less attractive given the move higher we’ve seen in equities.

- The risk of recession still lingers, particularly in Australia, if the RBA decides to leave rates high for too long.

- Geopolitical tensions could rattle markets. If we see escalations globally, it could have an impact. On a more political front, Aussies also have an election to face in the middle of the year.

The positives to consider in 2025

The above are all ‘possible’ uncertainties to look for, but for now, there is reason for investors to be optimistic. There are always risks in equity markets, and ultimately, there is always something to be worried about. But here are some of the reasons to be optimistic heading into 2025:

- Morgan Stanley believes ASX200 companies will grow earnings by around 10% in 2025, which should help drive the local market.

- Inflation is showing signs of abating, while labour markets are beginning to show signs of easing, which is good news for central banks.

- The above should mean incoming rate cuts from the RBA in the middle of the year, while markets expect 100bps of cuts from the Federal Reserve next year.

- Economies are in good shape, and growth should continue. The IMF forecasts global economic growth at 3.2% in 2025, while Australian growth forecasts sit at 1.8%.

- Early investments into AI bear fruit for enterprises, helping improve bottom lines and seeing margins improve.

- China rolls out targeted stimulus to boost its economy, helping to lift its ailing property market.

The Road Ahead

History shows that time in the market is better than trying to time the market. Missing the best market days can significantly impact long-term returns. A JPMorgan study found that missing the ten best market days between 2004 and 2024 would halve your investment returns. Seven of those best days occurred within 15 days of the ten worst days.

A simple strategy like dollar-cost averaging can be highly effective. It rewards consistency over timing, allowing you to protect against the unpredictable nature of markets by spreading out your investments over time, typically in even increments.

Those who consistently add to their long-term stock exposure tend to do well over time. As a result, longer-term investors should be pleased to see pullbacks, even when they get a bit scary. It can open the opportunity to buy high-quality assets at lower prices. What’s important is that markets have always gone higher throughout history, and we don’t believe that it’s done yet.

This is the last Investors Alpha of 2025. I hope you’ve enjoyed the insights throughout the year. Wishing you all a Merry Christmas and a Happy New Year. If you have any questions, please don’t hesitate to reach out.

View Aussie Economy Smart Portfolio

*Data Accurate as of 5/12/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.