- Financial goals are soaring in 2024, with nearly half of Aussies (42%) setting financial resolutions, an 11 percentage point jump from last year.

- In 2023, financial goals were more important and maintained longer than any other resolution. Fitness resolutions were the hardest to maintain, with 65% maintaining their goal for less than three months.

Sydney, 19th December – More Aussies are committing to saving money and paying down debt in 2024, according to our latest research.

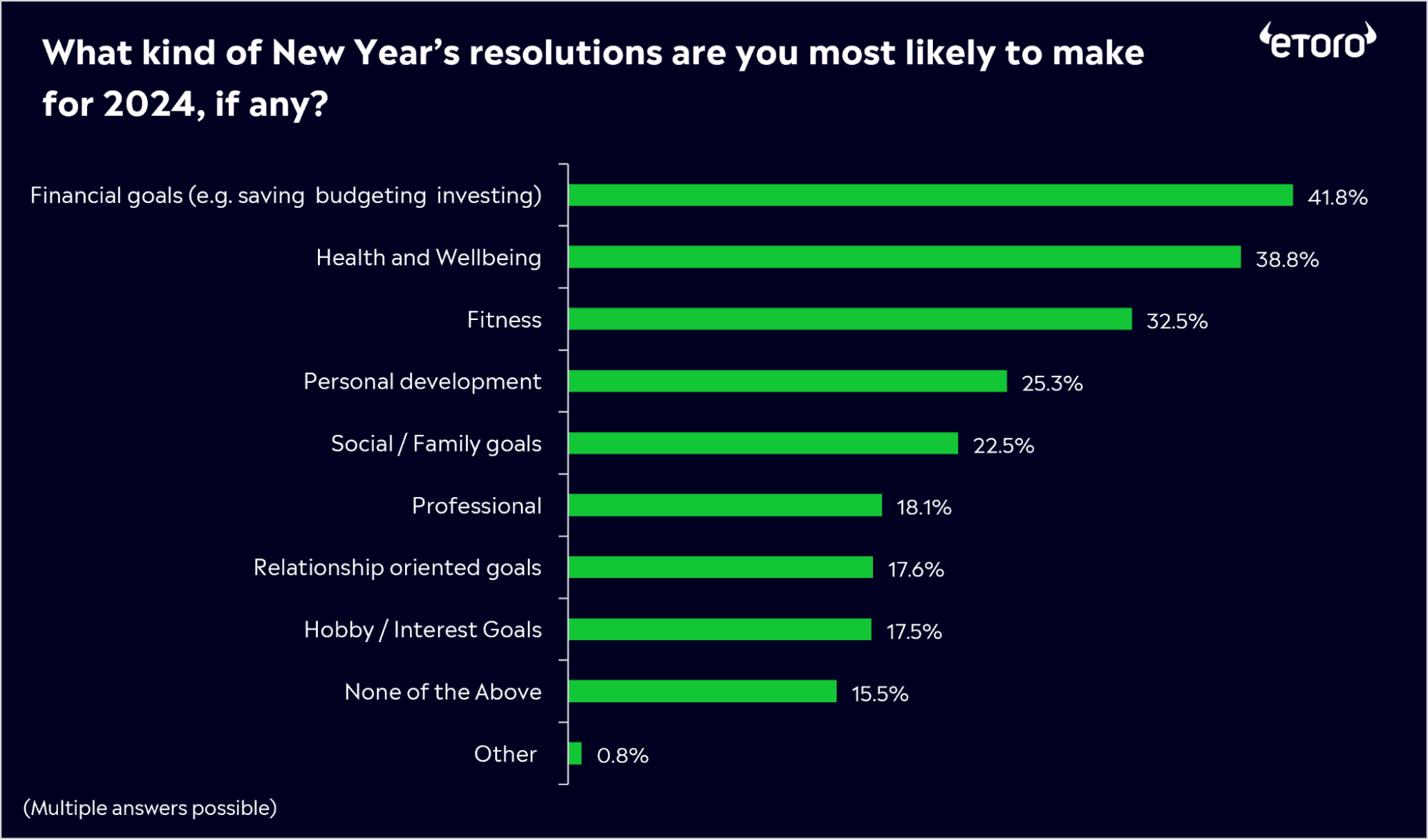

Through a survey of 1,000 Australian participants, it was discovered that the back pocket bite has Aussies worried about their incomes, with financial resolutions such as budgeting, investing, or saving being top of the list for 42% of Aussies in 2024, ahead of health and wellbeing (39%) and fitness (33%). This is an 11 percentage point jump compared to 2023, when 31% of people set a financial goal, coming in second to health & well-being resolutions at 35%.

Among those who made a financial resolution in 2023, 56% say they achieved their goals. This is the lowest success rate among all resolution types. Even those who did not achieve their goals still maintained their financial ambitions the longest out of all categories, with 37% of financial resolution respondents saying they kept their resolution for six months or longer.

Among the 44% who did not achieve their financial resolution this year, 78% attribute this to the rising cost of living, 65% said they had too many expenses to cover, and 50% said inflation was eating into their disposable income.

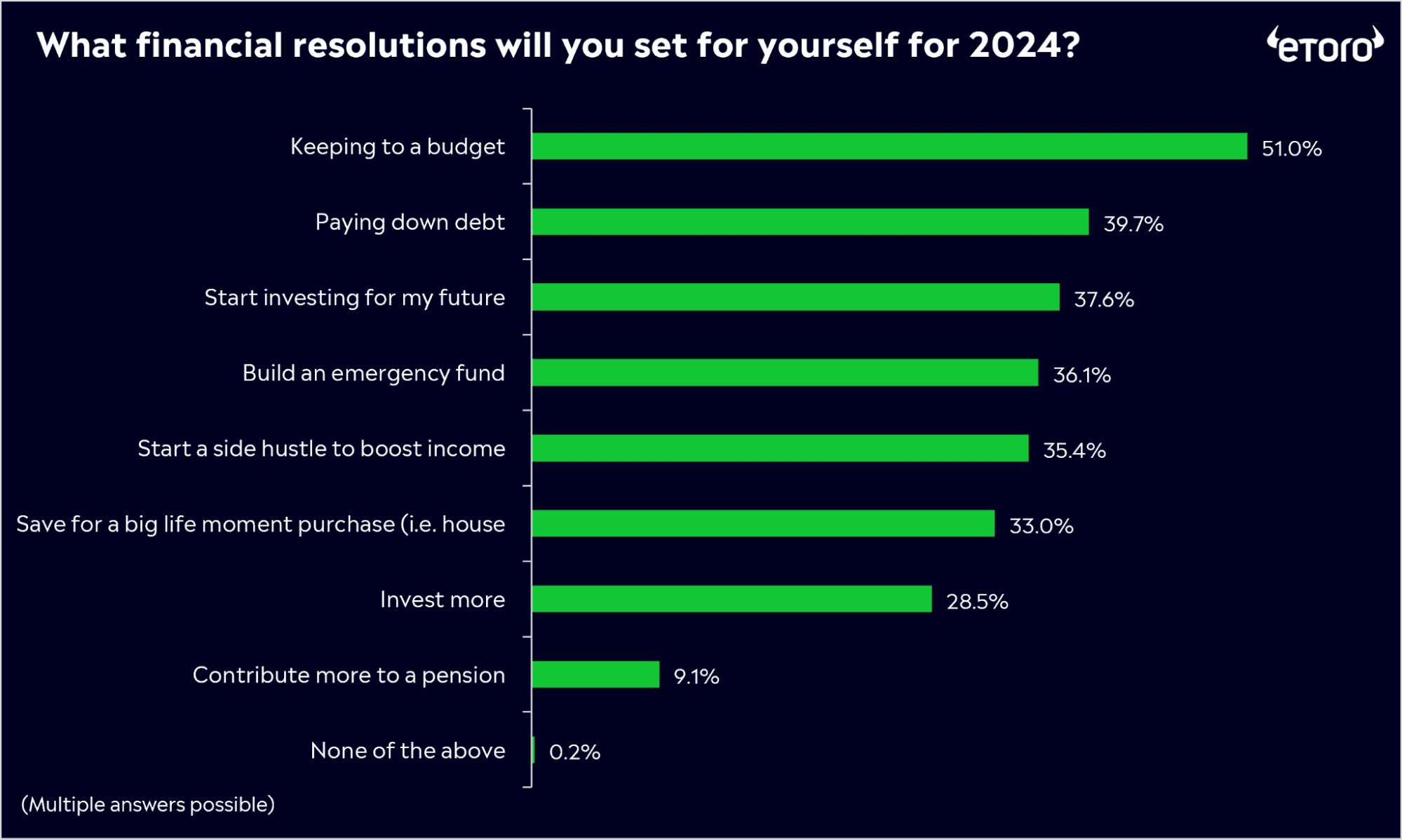

“As the cost of living continued to climb in Australia over the last year, consumers really prioritised immediate financial pressures over longer-term investments. For many, contributing to pensions and superannuation, or building a substantial investment portfolio, seems to have been seen as less of a priority compared to managing day-to-day expenses,” said Robert Francis, APAC CEO at eToro.

“While personal debt and rising supermarket prices remain concerns, there’s a growing sense of resilience and proactive planning among Australians and a positive shift towards effective budgeting and debt reduction, reflecting a strong commitment to financial health. The ASX’s early gains of nearly 4% this month, buoyed by encouraging global inflation data, suggest a potential soft landing in the near future. This evolving market landscape presents a promising opportunity for Aussies to align their new financial goals with the expected market conditions in the coming year.”

Start Investing

Disclaimer

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. eToro AUS Capital Limited(“eToro Australia”) is regulated by the Australian Securities & Investments Commission (“ASIC”) for the provision of financial services and products. Australian Financial Services Licence number: 491139.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.