Unless you’ve been hiding under a rock for two years, you’ll be well aware of the transformative potential of Artificial Intelligence (AI) across just about every industry, with ChatGPT a key catalyst of mainstream adoption. Within that time, arguably the biggest beneficiary from the AI boom, Nvidia, has become the world’s largest stock, surpassing tech titans Microsoft and Apple, reaching a market cap of USD$3.3 trillion. After continuously delivering outstanding numbers, can the golden child of AI keep delivering? Let’s find out.

-

Nvidia’s stellar growth continued, with Q3 revenue surging 94% YoY, driven by relentless AI demand, despite market concerns over guidance.

-

The stock trades at a 32x forward P/E, lower than its 5-year average, but investors must ask if it deserves its premium valuation given its solid growth prospects.

-

Nvidia has 69 buy ratings, 7 holds, and 0 sells, with an average price target of USD$170.57, signalling a potential upside of 23.4% from its last closing price.

View NVIDIA CORP

The basics

Nvidia designs and sells graphics processing units (GPUs), a field it has been pioneering since the late 1990s, when it introduced the GPU for gaming applications. However, despite being known for gaming, AI is the company’s bread and butter. Now, the business makes the bulk of its revenue through its data centre business, generating 87% of revenue in Q3 early this month. Gaming now contributes 9% of revenue, a massive shift from three years ago when this segment was generating 45%. The other 4% of revenue in Q3 comprised Professional Visualisation, Automotive and OEM & Other.

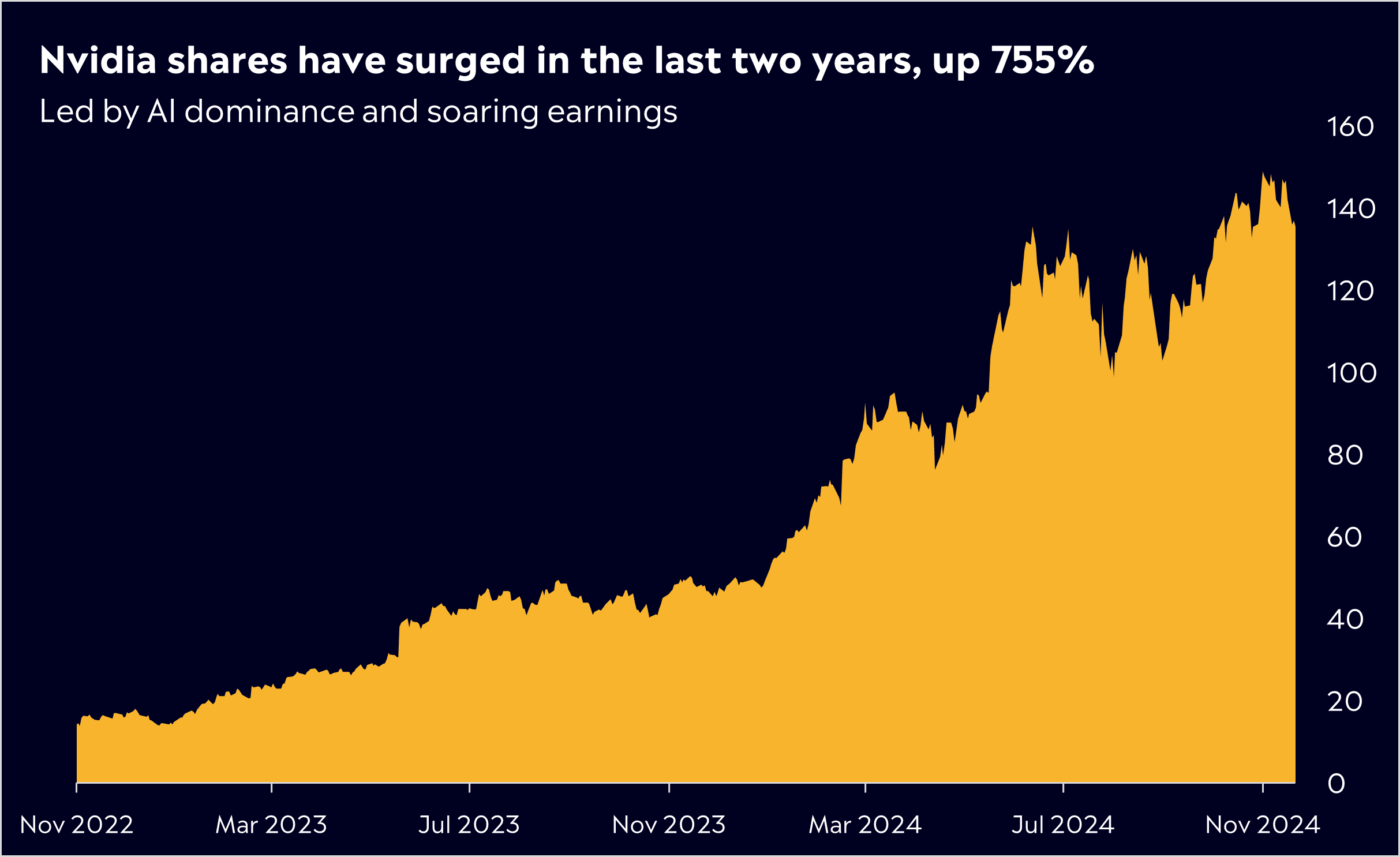

The catalyst for Nvidia’s eye-watering rise, in which shares have rallied 755% in the last two years, has been led by spending on AI infrastructure as enterprises globally began building data centres to support their growing need for high-performance computing. Once again, big tech stocks increased their capital expenditures this quarter, and that spending is going straight to Nvidia. This is a clear early sign that sales will remain robust as other tech giants race to increase their own profit from their growing AI investments.

Nvidia’s two most sought-after chips are Hopper and Blackwell. At Nvidia’s AI Conference, GTC, in March, CEO Jensen Huang said, “We have created a processor for the generative AI era,” as he announced the highly anticipated NVIDIA Blackwell chip. Designed to meet the demands of the most complex AI models and data-intensive workloads, Blackwell delivers a 2.5x performance boost over its previous-gen architecture, Nvidia Hopper. Set to start delivery in early 2025; its Blackwell chips represent the next big move for Nvidia.

Fun Fact: You might be surprised to know that CEO Jensen Huang has been focusing on AI for over a decade as he saw GPUs playing a more significant role in the adoption of machine learning technology. However, it wasn’t until two years ago that AI revenue overtook gaming.

Competitor Diagnosis

Nvidia is by far and wide the dominant force in the chip-making space. It has an estimated 90% share of the market for AI chips. However, competitors are ramping up efforts to challenge Nvidia’s supremacy, targeting under-served segments and innovating in adjacent technologies.

Its biggest rival is AMD. However, Nvidia’s revenue and cash flow far outweigh AMD’s, and Nvidia is growing at an even faster rate. Intel also competes with Nvidia but has lagged significantly in the last decade. However, AMD’s focus on competitive pricing and Intel’s potential re-entry with newer products could diversify consumer options in the future.

Microsoft, Meta, Amazon and Alphabet are running in the AI race. As long as they can, they will spend tens of billions of dollars per year on GPUs, which together account for 50% of NVIDIA’s turnover. To get their hands on Nvidia’s products, they are willing to pay almost any price, keeping Nvidia’s gross profit margin impressively high. Additionally, if their demand decreases, countless other customers will be queuing up to finally receive their order.

However, big customers could become competitors. Those tech giants are designing their own AI chips to reduce dependency on Nvidia. Although these solutions are used internally for now, they highlight the risk of hyperscalers reducing Nvidia orders over time.

Startups like Cerebras Systems, Graphcore and Chinese firms such as Biren Technology are also developing AI-specific chips that may provide alternatives to Nvidia in select workloads. While these firms currently lack Nvidia’s scale or ecosystem, their niche innovations could chip away at specific markets. While Nvidia’s position appears unassailable in the short term, competition will steadily grow.

Financial Health Check

Given what we’ve come to expect from Nvidia, it’s Q3 result in November wasn’t a blowout quarter, but it doesn’t change the long-term story in any way. Demand for its chips is phenomenal, AI is only getting started transforming industries, and Nvidia is in the best position to benefit from the wave of spending we’re seeing across enterprises.

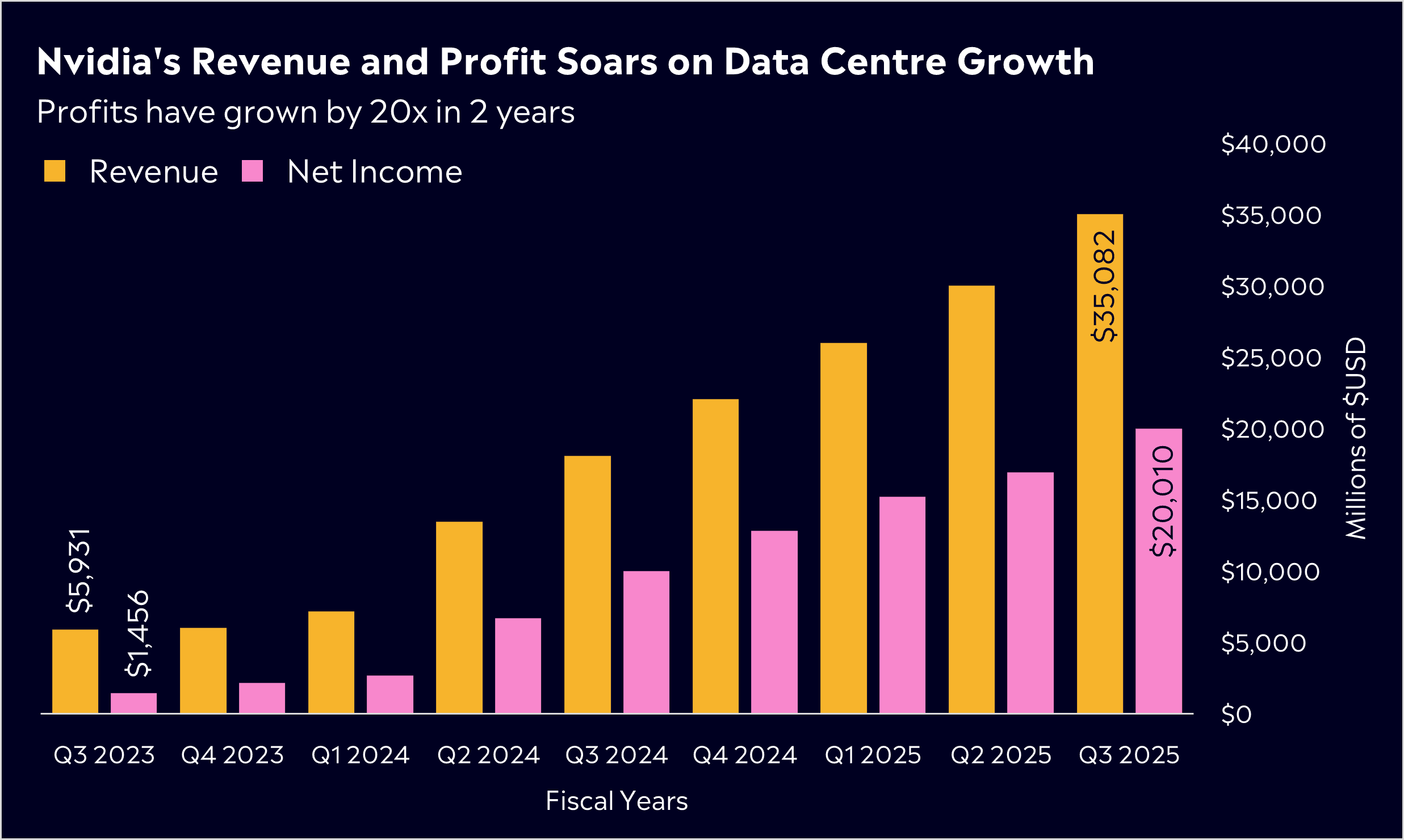

Nvidia delivered a USD$2 billion beat on revenue estimates, with $35 billion in sales. That number was 94% higher than the USD$18 billion in the same quarter a year ago and 17% higher than the USD$30 billion in the previous quarter.

Profit for the quarter reached USD$20 billion. To give some context for how strong that number is, Nvidia generated only USD$16.6 billion in revenue in 2021. That underscores the staggering pace of growth Nvidia has seen in recent years, and you’d be silly to bet against Jensen Huang and his team in the midst of this AI revolution.

As was the case last quarter, the market may be slightly disappointed with its guidance despite beating analysts’ forecasts, given that it didn’t meet the highest expectations. Nvidia sees Q4 revenue at USD$37.5 billion plus or minus 2%, which might be the headline the market dials in on. It’s only a small beat when investors have become accustomed to Nvidia raising its guidance in the billions. However, the demand for its new Blackwell chips, which are a heavy focus for the market, appears robust.

Buy, Hold or Sell?

Since high-quality data centres are part of the core infrastructure in every country, NVIDIA’s fairy tale can continue for years to come. However, it won’t all be one way for Nvidia. Competition will rise, especially given Nvidia is basically at capacity. Trade restrictions remain a worry, and if we see a slowdown in the AI boom, Nvidia’s dependency is high. Finally, due to the complexity in the supply chains, deliveries of the latest Blackwell chips, in particular, can sometimes take a little longer, which may be a worry for Wall Street.

Its valuation has become more attractive than it was a year ago, with a price-to-earnings multiple of 32x based on expected earnings over the next twelve months. That is lower than its 5-year average, given the sheer rise of its earnings. However, the S&P500 currently trades at 24x expected earnings, and Nvidia certainly deserves a premium to the other 499 companies. That doesn’t mean it’s cheap, but for investors, the question is, is it better to buy despite its meteoric rise and valuation than not to buy at all?

According to Bloomberg’s Analyst Recommendations, Nvidia has 69 buy ratings, 7 holds, and 0 sells, with an average price target of USD$170.57, signalling a potential upside of 23.4% from its last closing price.

Nvidia remains an industry leader, but maintaining its competitive edge and satisfying investors will depend on its innovation and ability to meet the growing demands of the market. When you’re branded as Magnificent, nothing but the best will do and for now, that’s exactly what Nvidia is delivering for investors.

View NVIDIA CORP

*Data Accurate as of 28/11/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD . This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.