BHP is the world’s largest miner, and over the last ten years, they have provided excellent returns for investors, mainly thanks to their outstanding dividends, annualising over 12% returns with reinvested dividends. Now, BHP is looking to solidify itself as the heavyweight in mining, seeking to acquire Anglo American, known for its copper assets, with the metal recently hitting two-year highs. Could this be a stroke of genius from BHP and propel shares higher long term, or will it be a poor use of capital allocation? Let’s find out.

- If BHP’s acquisition of Anglo is accepted, it would significantly increase its copper production. Rising copper prices could aid BHP’s future profit growth.

- The acquisition seems strategically smart, with Copper a key commodity for the future. Still, risks lie with the execution risk of a complicated deal and BHP’s not-so-great track record of capital allocation, especially with future offers set to exceed AUD$65 billion.

- Shares have fallen more than 11% to start the year amid ongoing struggles in China, but recent weakness means analysts like it. The average price target from analysts via Bloomberg signals a 6.5% upside from current levels alongside its 5.4% dividend yield.

View BHP

The basics

BHP Group (BHP) is Australia’s biggest company on the Australian Stock Exchange, accounting for around 10% of the ASX200. The company employs more than 80,000 people worldwide and is a leading producer of iron ore, copper, coal, and nickel, with a recent move into potash. These are some of the essential resources needed to support global megatrends, such as decarbonisation.

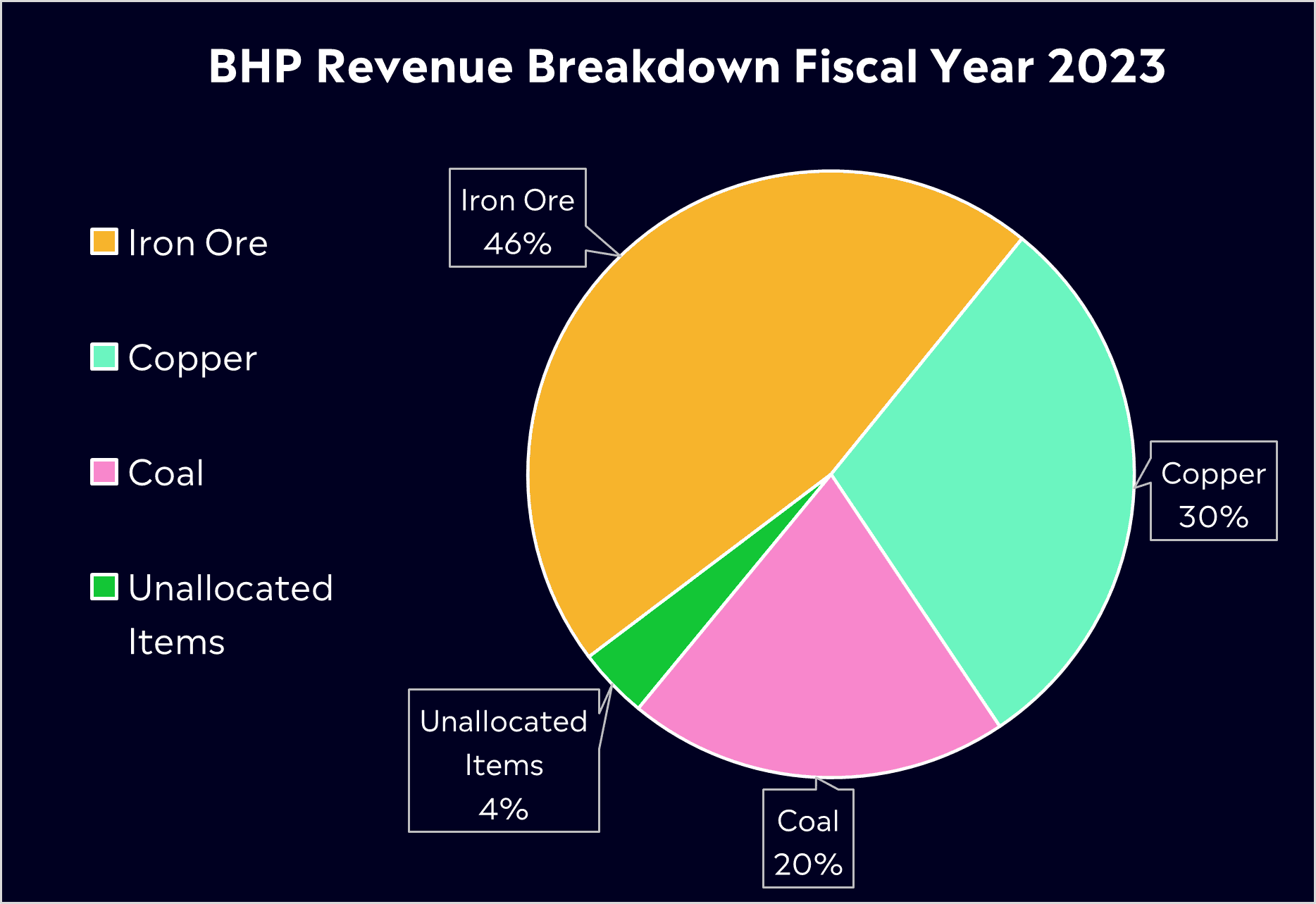

Iron ore, used to create steel for construction, is the biggest revenue driver, contributing over 46% of the USD$53 billion BHP generated in the fiscal year 2023. Copper is the business’ fastest-growing segment, with the commodity enabling the next generation of renewable infrastructure, set to see revenue growth of 10% in the fiscal year 2024.

Competitor Diagnosis

The mining industry is highly competitive, and often, the big guys look to acquire the little guys. Its about economies of scale, the ability to reduce costs and be the lowest-cost producer is key. BHP has a long history of M&A activity, and most recently, in 2023, paid AUD$9.6 billion to acquire Oz Minerals to strengthen its portfolio in Copper and Nickel.

Some of the big names competing alongside BHP and in the battle for Anglo American (AAL) include Rio Tinto (RIO) and Glencore (GLEN), all of whom are looking to increase their copper production. In short, it’s a critical metal for the electrification of the world, with higher usage of Electric Vehicles and Artificial Intelligence. The problem is a scramble for copper mines, with few new high-grade deposits being discovered and existing projects declining, striking the supply/demand imbalance. Copper prices have risen over 25% in the last year, with analysts expecting prices to keep increasing.

Anglo American has had a tough few years, with poor acquisitions, weaker commodity prices and operating failures. But, they have quality copper mines that the competition wants. If BHP hands down another offer that is accepted, it will be the largest industry deal in ten years and will make BHP the world’s largest copper producer, with over 10% of global production.

Financial Health Check

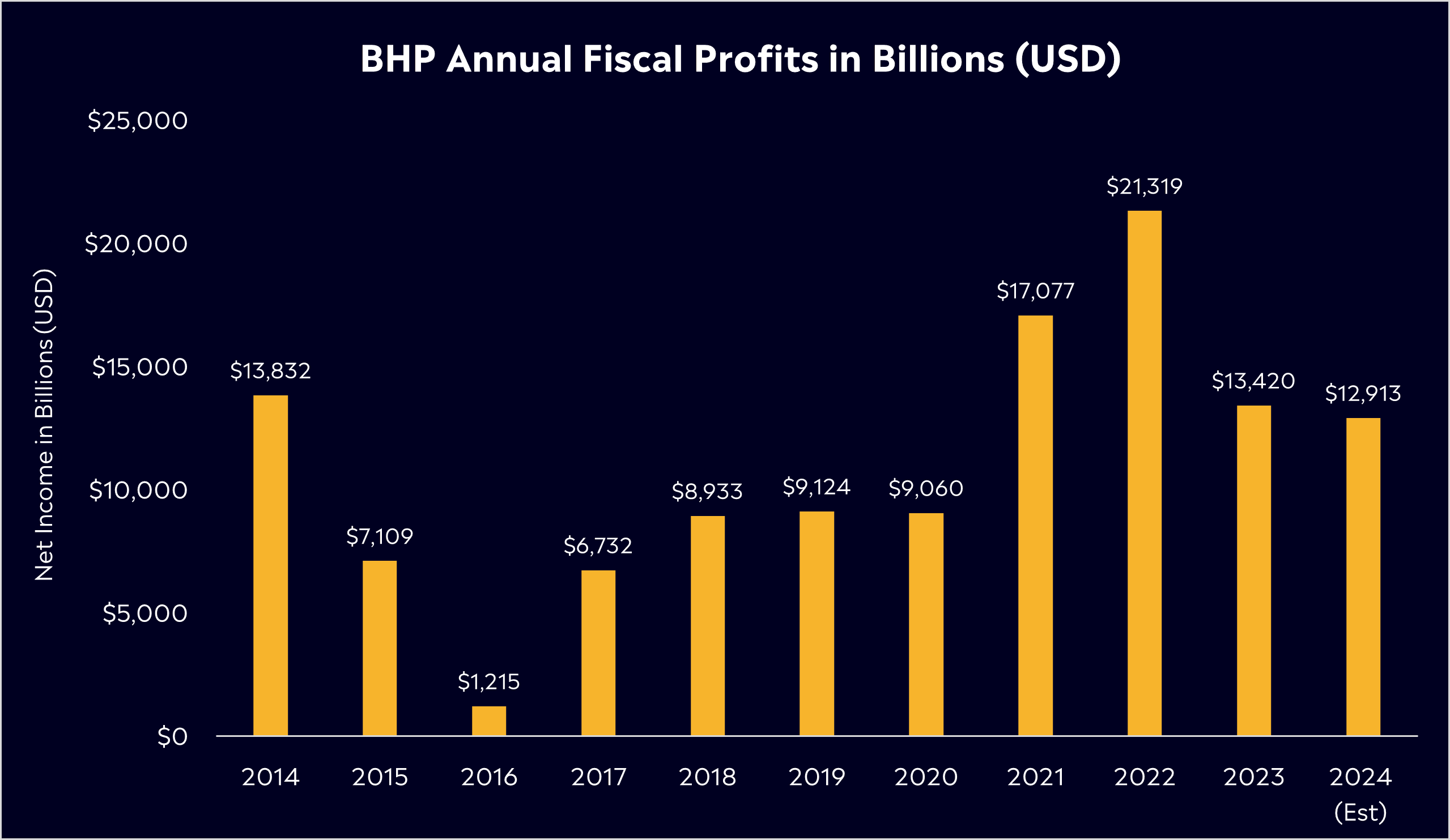

BHP saw a record year for the fiscal year 2022, reporting USD$60 billion in revenue, with a $21 billion profit paying out a huge USD$16.4 billion in dividends. Shares reached a new high of AUD$50.72 not long after the result. But, in fiscal year 2023, profits fell by 37% as China’s housing crisis sent the iron ore price tumbling. Production grew across iron ore and copper, but it wasn’t enough to offset falling prices.

BHP is reliant on commodity prices. Therefore, higher prices mean larger profits and vice versa, and BHP shares often move with these prices. However, margins are improving, and inflationary pressures are beginning to lighten the cost increase across BHP’s operations. Profits may also benefit from the ongoing recovery in China, with policymakers set to continue providing support for the ailing property market.

Buy, Hold or Sell?

Long-term shareholders will be scarred by poor capital allocation from BHP in years gone by, particularly its $20 billion shale investment, which is just one of the reasons its shares slipped by more than 4% on the news that BHP wanted to acquire Anglo. Although the move seems wise, it certainly comes with its risks, given the poor capital allocation in the past, especially if BHP overpay, with Anglo already rejecting two offers and Glencore and Rio Tinto in the mix.

According to Bloomberg’s Analyst Recommendations, BHP has 8 Buys, 11 Holds and 3 Sells. The average price target across those recommendations is $47.56, representing over 6.5% upside from current levels. BHP has an attractive dividend yield of 5.43% and is one of the world’s biggest dividend payers, taking the crown for the largest dividend payouts in 2021 and 2022. The business trades at 11x forward price to earnings, in line with its long-term average and lower than broader markets, showing that there isn’t a lot of optimism priced into shares right now.

The bottom line is that this acquisition still may not come to fruition. BHP needs to come to the table with a better offer. However, savvy investors will know that if copper prices keep rising, China’s housing crisis improves, and BHP can stay financially disciplined, the business will likely be in a better position years from now.

View BHP

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.