Love may be in the air, but it’s coming with a hefty price tag for Australian consumers this year, with the pinch of inflation threatening the affordability of romantic celebrations. So, maybe this year it is time to give up extravagant gifts and look to give investing some commitment. Loyalty is just as crucial in investing as it is in romantic relationships, according to analysis for Valentine’s Day.

- With inflation continuing to hurt our wallets, traditional Valentine’s Day presents are set to cost more this year.

- Analysis from eToro shows how loyalty is as important in investing as it is in relationships.

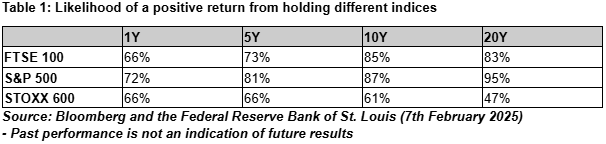

- Holding the S&P 500 for one year gives you a 72% chance of a positive return, rising to 95% over 20 years.

The high price of romance

The 14th of February is a day known for romance – but while love may be in the air, it’s coming with a hefty price tag for Australian consumers this year, with the pinch of inflation threatening the affordability of romantic celebrations. The RBA hasn’t delivered a rate cut for investors thus far, although that may be around the corner next week, and that means consumers will still be feeling the pinch on the 14th.

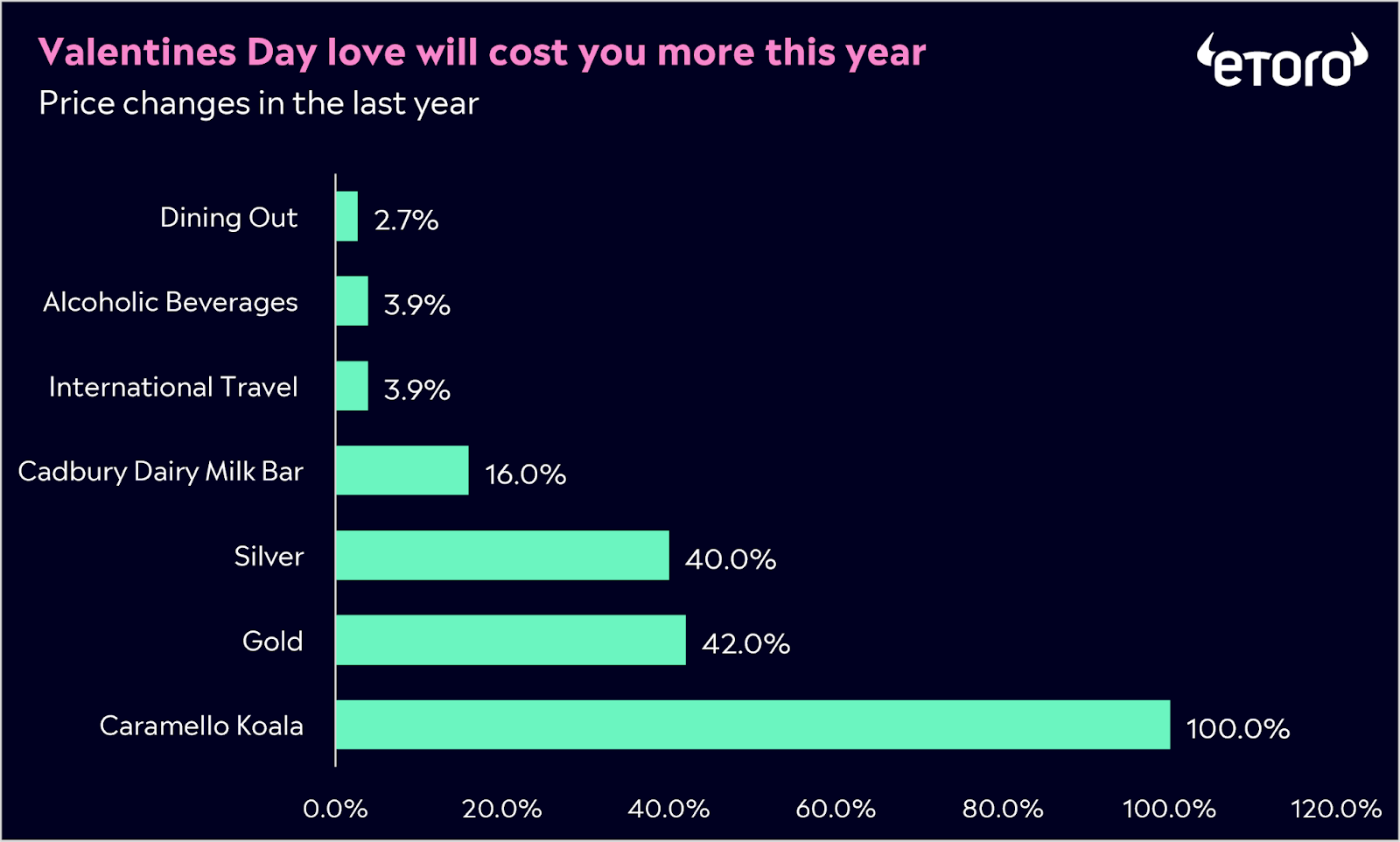

If you’re planning to give chocolate, hold on to your wallet! Cocoa prices have exploded, with futures up by over 190% in 2024. A poor harvest in Ivory Coast and Ghana – which account for over half of the world’s cocoa production – has limited supply. With major manufacturers now depleting their cheaper cocoa stockpiles, prices have been climbing fast, and shrinkflation is making it worse. Yes, that means your favourite chocolates are getting smaller, but the price tag isn’t. In November last year, Cadbury Australia increased the RRP of its 180-gram dairy milk block to $7, a 16% increase that was almost 6 times Australia’s inflation rate. It gets even worse, though: a Caramello Koala shockingly jumped in price by over 100%!

If you want to splash out on something a bit more luxurious, like jewellery, it will cost you a lot more this year. Gold and silver prices have both risen more than 40% in the last year, with gold recently hitting record highs, flirting with $3,000 an ounce. Investors have been turning to safe-haven assets such as gold amid rising geopolitical tensions, while central banks have continued to buy the asset at record levels.

If you want to celebrate Valentine’s Day without breaking the budget this year, your best bet might be dinner at a restaurant. Meals out rose 2.7% in Australia’s Q4 inflation data despite rising food prices. But beware of the drinks tab if you fancy a bottle of wine or a beer or two, as alcohol prices rose 3.4% in the quarter.

If you’re considering whisking your loved one away overseas for a romantic break in Fiji, that’s also rising more than standard inflation. The cost of international travel rose 3.9% in Q4 as airfares continued to rise, since travel remains a high priority for many consumers after the pandemic.

Unfortunately for consumers, this will be a costly Valentine’s – but with a number of RBA rate cuts expected this year, 2026 may wind up slightly less painful for the hopeless romantic. For now, love may be priceless, but celebrating it certainly isn’t cheap.

A love that lasts: Why patience pays in the market

While this Valentine’s Day may be more expensive than ever, the lesson of loyalty can extend beyond relationships and into investing, where long-term commitment can be just as rewarding. In fact, sticking with your investments through market ups and downs often leads to greater financial returns. As the saying goes, time in the market beats timing the market. That’s very clear from our new data and it goes to show why letting emotions take over in markets isn’t a smart idea. Let’s just say that selling at the first sign of a ‘red flag’ might not be the best choice when it comes to investing.

Based on historical data, the likelihood of a positive return from holding the S&P 500 for one single year is 72% (table 1). This figure rises to 87% if held for 10 years, and 95% if held for 20 years. Data from the FTSE 100 tells the same story, with the probability of a positive return rising from 66% for one year to 83% for a 20-year relationship. Nonetheless, not all relationships are meant to be forever. While holding the STOXX 600 will give you a 66% chance of a positive return, you would get the same result from holding for one year. In fact, this figure goes down as time goes on, dropping to 61% over 10 years and 47% over 20 years.

Our analysis of S&P and FTSE data shows that the chances of a profitable outcome increases dramatically as you stay committed for longer periods of time. It’s really important for investors to understand their time horizons, this can make a difference between flirting or finding that long-term connection. Flirting in financial markets comes with risks, but making that long-term commitment is more likely to be rewarding.

Short-term fling or long-term love?

While the data shows that staying committed to your investments can lead to greater returns over time, it’s not just about holding any stock. The key is choosing the right ‘relationship.’ Just like in love, not every connection is meant to last, and some short-term flings can leave you heartbroken. eToro’s data takes a deeper dive into how loyalty paid off for investors who stuck with certain companies—and how others who got swept up in the excitement of rapid rallies found themselves facing painful losses.

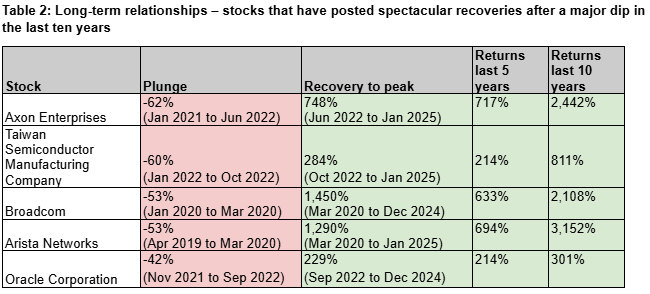

Investors who rode out the tough times with companies like Broadcom, Arista Networks and TSMC, staying strong through 50-60% dips, were eventually rewarded with massive gains (table 2). Broadcom, for example, saw its share price crash 53% from January to March 2020, but recovered 1,450% by the time of its all-time high in January 2025.

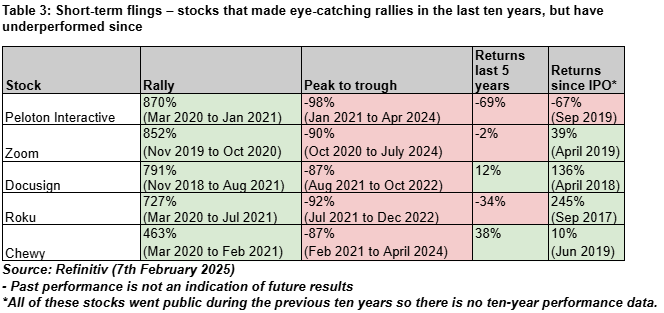

On the other hand, investors who were swept off their feet by eye-catching rallies posted by the likes of Zoom, Peloton, and Docusign were less lucky in love, as these stocks came crashing down soon after and continue to underperform the market (Table 3). Peloton saw the biggest rally at 870% but also the biggest plunge at 98%, and today, its share price is far from where it was at its IPO.

It’s important to note that it doesn’t always pay to fall in love with a stock. Just because there was an initial attraction doesn’t mean it will blossom into a long-term love story. The five stocks in our list of ‘short-term flings’ initially thrived during COVID, riding the rise of remote work, home workouts and pet ownership. Yet, that initial spark faded as lockdown measures eased. Although thematic investing can be a great strategy when investing, it’s important not to get too love-struck and remember to call it a day before things go sour.

By contrast, even companies with strong fundamentals, a competitive edge, and growth potential supported by long-term macro trends can experience rocky periods. Investors who stand by them through thick and thin may ultimately be rewarded for their patience and commitment.

Ultimately, whether it’s love or investing, the key to success lies in commitment and patience. Just as relationships require time to truly flourish, investing in strong companies with long-term potential also requires time. As we’ve seen, riding out the ups and downs can lead to substantial gains for those who remain loyal and make informed decisions. But, just as you watch for red flags in relationships, it’s also important to stay alert when it comes to stocks. Sometimes, initial excitement can fade, and recognising when to cut ties can save you from heartache. This year, whether navigating a costly Valentine’s or your investment strategy, remember that loyalty in both love and investing can lead to the best outcomes.

Invest In The Stocks You Love

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.