It was another big week for the ASX200, setting record highs as inflation showed further signs of easing. The index rose more than 1.9% for the week, with all 11 sectors gaining. Six of the magnificent seven have reported their earnings with mixed results. Apple and Alphabet were last week’s disappointments, whilst Microsoft, Meta, and Amazon were the standouts. The Fed dampened expectations of rate cuts whilst keeping rates on hold last week. Markets now only see a 20% chance of a cut in March, significantly lower than the 70% markets were pricing just a few weeks ago.

3 things that happened last week:

1. The RBA’s hiking cycle is over

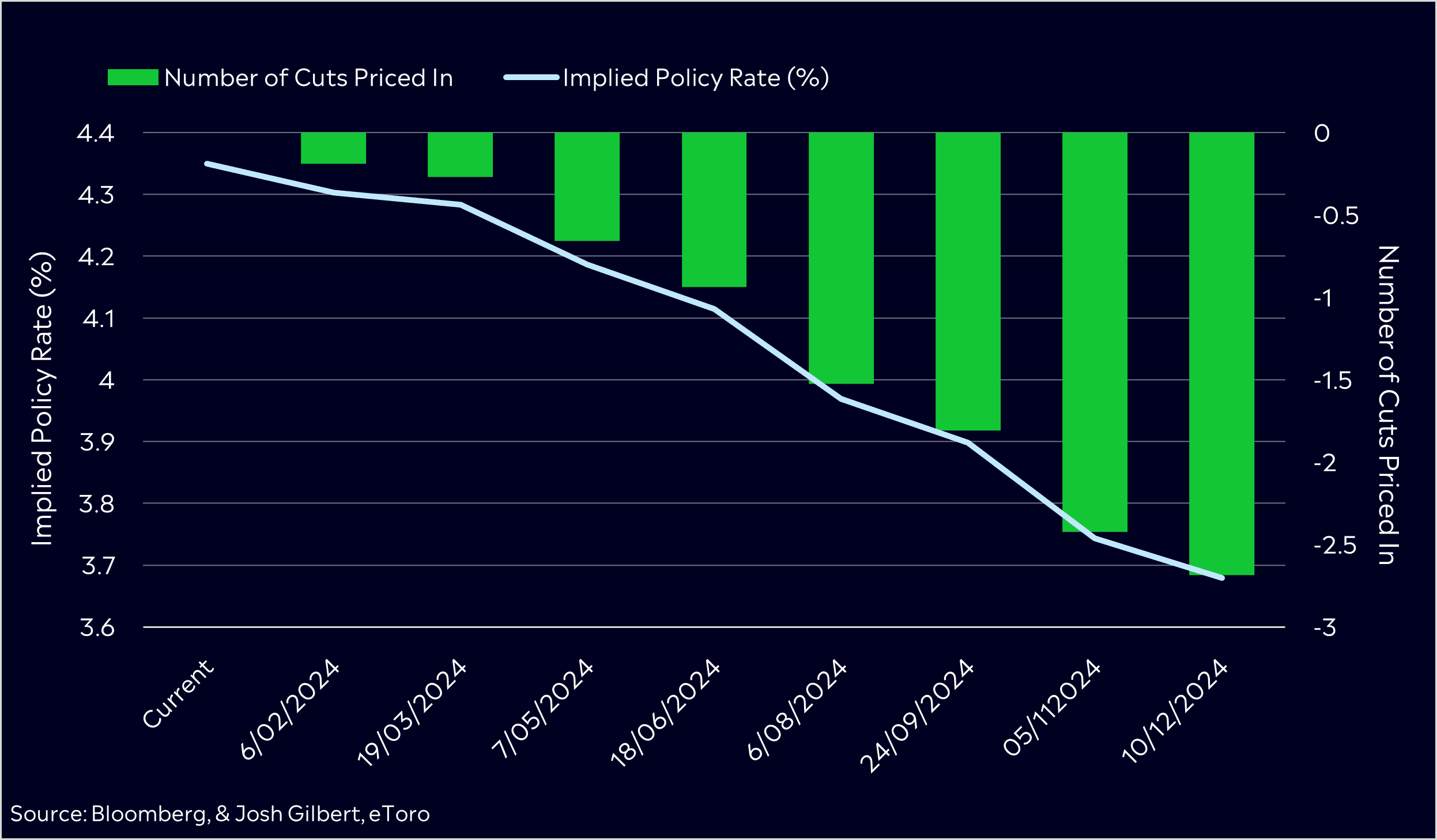

Last week’s downside surprise on inflation is more good news for the RBA, following the dismal retail sales print and slowing employment. This signals the end of the RBA’s tightening cycle and places rate cuts on the agenda as early as June.

Inflation remains the most important number in markets and the easing of inflation locally, as well as globally, is a net good for investors.

The RBA is the outlier from major global central banks, with just two cuts expected this year compared to five from the Federal Reserve. However, the RBA will be more than pleased with last week’s result, coming in below their projections. If data continues to move in this way, a third-rate cut may be on the cards for 2024.

2. Microsoft remains magnificent

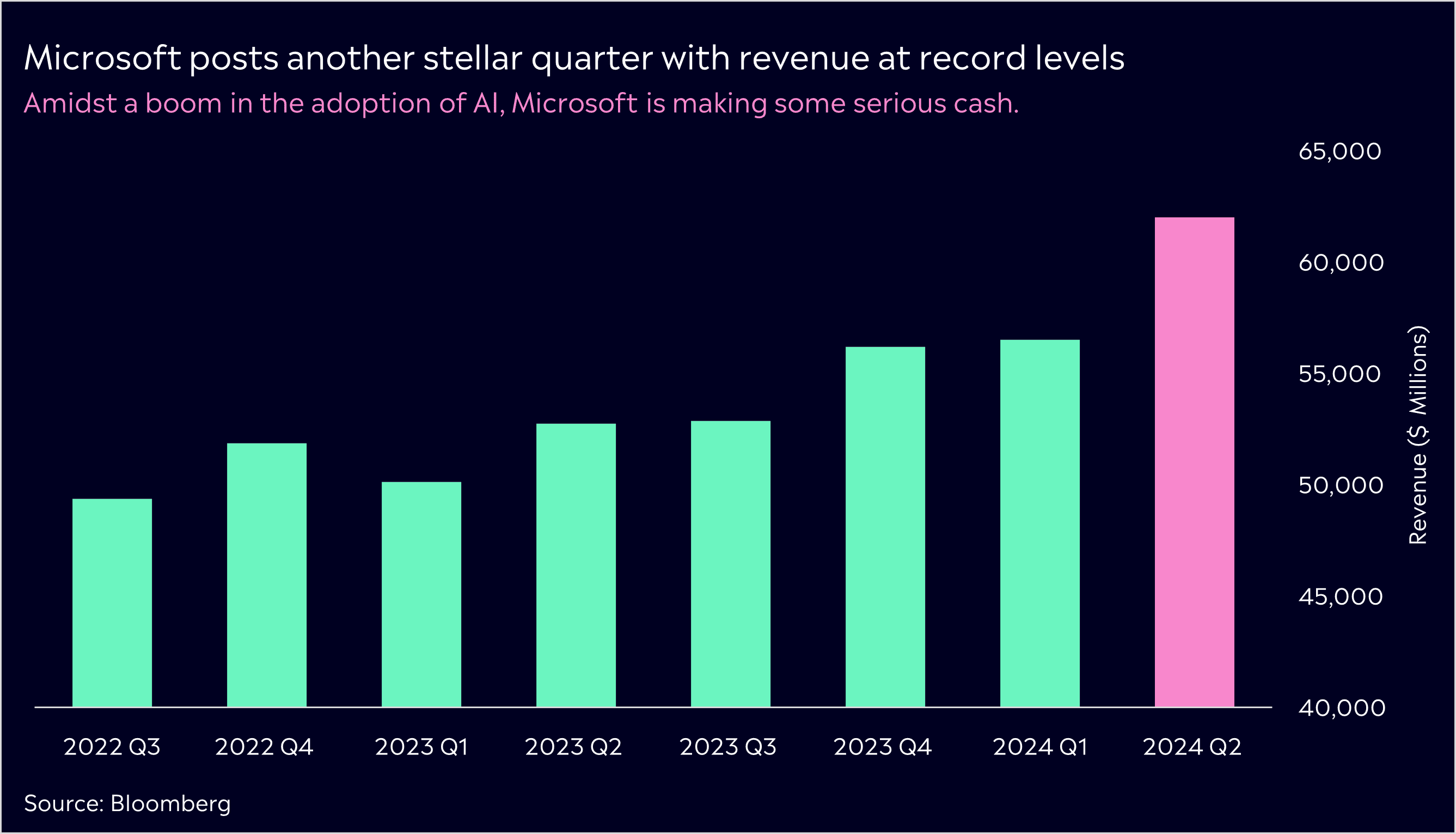

Microsoft delivered on earnings as it usually does, posting another stellar quarter with all revenue segments beating expectations. Revenue for its fiscal second-quarter rose by 18% to USD 62 billion whilst profit jumped by 33% marking one of its best quarters in history.

Amidst a boom in the adoption of OpenAI technologies, Microsoft’s early investment in AI continues to pay off and make the tech giant some serious cash. Azure, Microsoft’s cloud business, reported 30% growth and beat consensus, a result that will be well-received by Wall Street after four quarters of slower growth. With enterprise spending on cloud services on the rise, good times are set to continue for Microsoft and its investors who can be nothing but pleased with this report.

Microsoft has demonstrated why it’s the most valuable company on the planet, and shows no signs of slowing down. Satya Nadella and his team were early adopters of AI, made strategic investments, and are now blowing their competition out of the water.

3. A winner and loser last week from the S&P/ASX200

Megaport shares soared last week after the tech company reported better-than-expected quarterly results. Shares gained more than 33% for the week.

On the other end of the scale, AGL Energy had a more challenging week, with shares falling by 7%. The drop follows broker downgrades ahead of its half-year results.

3 things to watch for the week ahead:

1. Aussie Reporting Season

US Earnings season is garnering plenty of attention right now, with the bulk of ‘Magnificent Seven’ reporting their earnings last week. This week, though, Australia’s reporting season will step up a notch with big names such as AGL Energy, Mirvac and Transurban all releasing half-year results. Earnings growth for the ASX200 looks to be modest at around 3.4% for the first half of the financial year, and expectations will be high with the market sitting at record levels.

A big trend will be on margins and cost control, with inflation continuing to ease in the first half of the fiscal year. Given China’s economy is still not playing ball, miners will be in focus throughout the reporting season, especially with lithium prices continuing to free fall and the materials sector‘s strong end to the year. The Real Estate sector will also be front of mind this February as the best performer in Q4 2023, with rate cuts driving these stocks high, expectations will be high and investors won’t want to be disappointed.

2. RBA Rate Decision

This Tuesday marks the RBA’s first cash rate decision for the year. The outcome is unlikely to be surprising, with markets fully pricing a pause thanks to sliding retail sales data, unemployment and Q4 CPI showing further signs of inflation returning to target faster than the RBA anticipated.

It’s all but guaranteed now that, barring a massive unforeseen economic event, the RBA is done with their hiking cycle. The possibility of cuts is still months away, but recent data now points towards the potential of seeing three cuts in 2024, up from the two anticipated at the start of the year and the first cut very much on the table in June.

The focus, instead, shifts towards Michelle Bullock, who will be holding a press conference at 3.30 pm following the decision and the statement following the decision. We’re unlikely to see the board sway from its hiking bias just yet, despite some background celebrations likely happening at Martin Place following the recent data. That data means that it may be difficult for Governor Bullock to sway away from sounding dovish. All of this is good news for the local market, with just one losing day in the last ten taking the ASX200 to record highs.

3. China CPI

China’s CPI fell 0.5 per cent in November – the sharpest decline in two years – and while Thursday’s CPI results aren’t likely to be as dramatic, markets are expecting the trend to continue falling for a fourth straight month with a 0.3% decline anticipated.

China continues to struggle as it increasingly decouples with the global economy. Real estate and construction remain among the most significant concerns, with development giant Evergrande ordered to liquidate by Hong Kong courts just last week, whilst demand remains anaemic and sentiment shattered.

More governmental reform seems all but guaranteed now but sluggish movement here, as well as a delay in scheduling the third promised economic plenum, means investors don’t have much to look forward to yet.

The nation’s post-pandemic recovery has been anything but effective, with growth slowing and its ripple effect will likely continue to harm Australia’s export industries.

*All data accurate as of 05/02/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.