As Nvidia gears up to report its quarterly earnings, all eyes are on the tech giant to see if it can surpass sky-high expectations once again. With record-breaking growth, surging AI demand, and a $50 billion buyback program in the spotlight, this earnings season could shape Nvidia’s future—and the broader market—heading into 2025. Here’s what you need to know before the announcement.

Can Nvidia Beat Expectations Again?

The big question is, can the biggest company in the world beat expectations and raise Q4 guidance again? The answer is yes. Once again, this is the key driver of a potential price boost for the stock. The market now expects Nvidia to not only beat estimates but also raise its guidance significantly, building plenty of optimism for 2025.

Key Metrics and Growth Drivers

The market is guiding for earnings of USD$0.74 on revenue of USD$33.2 billion, which would see year-over-year growth of 84% across both metrics. Nvidia’s own revenue forecast for the quarter was USD$32.5 billion.

Highlights include:

- Data centre revenue: Expected to reach USD$29 billion, doubling from the same period last year.

- Free cash flow: Set to rise to USD$16.4 billion.

- Net income: Forecast at USD$18.5 billion.

These figures underscore the significant impact of Nvidia’s leadership in the AI and tech sectors.

Past performance is not an indication of future results

AI Spending Frenzy Drives Growth

Nvidia’s data centre revenue continues to see huge growth, driven by the AI spending frenzy from big tech companies. Increased capital expenditures from tech giants are going to the best in the business: Nvidia. This signals strong and sustained sales growth as other companies invest in AI to boost profitability.

The Role of Blackwell GPU Chips

The ramp-up of Nvidia’s Blackwell GPU chips is another key focus. CEO Jensen Huang described demand for Blackwell as ‘insane.’ Last month, Nvidia announced that these cutting-edge GPUs are sold out for the next 12 months. This long-term demand highlights their pivotal role in Nvidia’s growth trajectory.

$50 Billion Buyback Program

Nvidia’s $50 billion stock buyback program, announced last quarter and approved by its board, further signals confidence. Buybacks often indicate that a company believes its shares are undervalued, and Nvidia’s management appears optimistic about a strong 2025.

Explore Nvidia and other tech leaders with our Smart Portfolios.

Margins Under Pressure but Resilient

Gross margin is expected at 75%, slightly down from recent quarters. While margins may dip further next quarter, they remain comfortably above 73%. Early next year, margins are expected to grow again as Nvidia’s Blackwell chips begin their rollout, reinforcing its dominance in the sector.

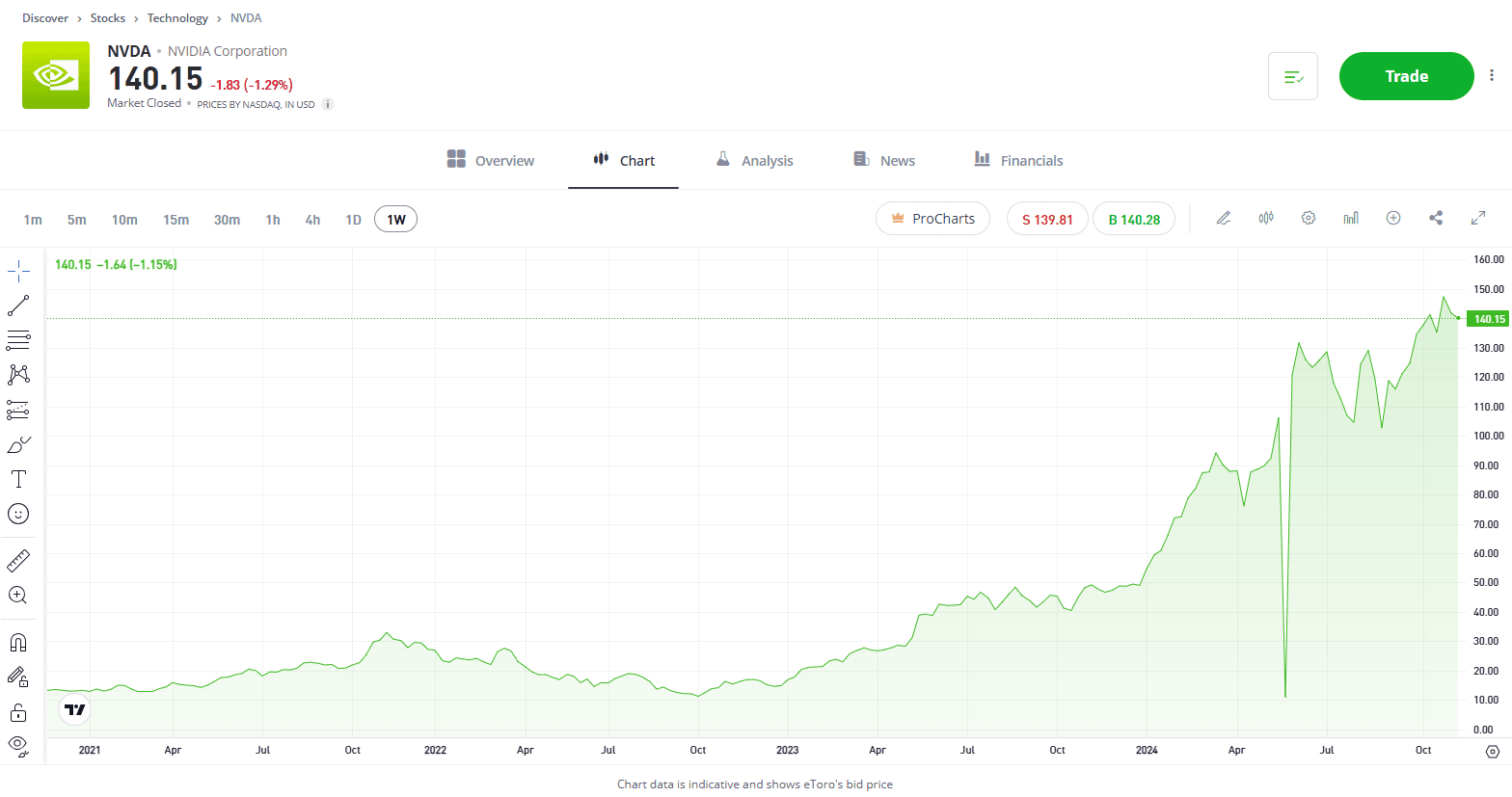

Stock Performance and Investor Outlook

Nvidia shares have surged 196% year-to-date, following a 238% gain in 2023. While expectations for this quarter are incredibly high, any perceived weakness could be seen as a buying opportunity, given the ongoing AI boom. Investors should also prepare for volatility. Options pricing suggests an 8% move either way following Nvidia’s earnings, underlining the anticipation surrounding the report.

View Nvidia

eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD.This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.